Thursday, August 2: (BTC) and (ETH) are trading around levels, while other top 20 coins are seeing notable losses, according to data from .

Market visualization from

bitcoin (BTC) is up around 0.3 percent over the past 24 hours and trading at $7,579 at press time after testing a slight rebound today. The top keeps trading sideways, with an intraday low of $7,451, according to the Cointelegraph . As Cointelegraph in a previous market analysis, if bitcoin breaks $7,750 resistance, the move can extend to further to $8,400.

bitcoin 24 hours price chart. Source: Cointelegraph

(ETH) is down 1.03 percent, trading at $411 at press time. The major has climbed to an intraday high of $423 before seeing a gradual decline.

Crypto markets analyst Trading Room on Twitter that if Ethereum dips delow $350, it would cause a further downtrend across other altcoins. However, bitcoin would allegedly be “detached from the mayhem.”

Ethereum 24 hours price chart. Source: Cointelegraph

Total market capitalization is standing its ground around $267 billion, seeing a slight decline within the day after peaking at $275 billion.

Total market capitalization 24 hours chart. Source:

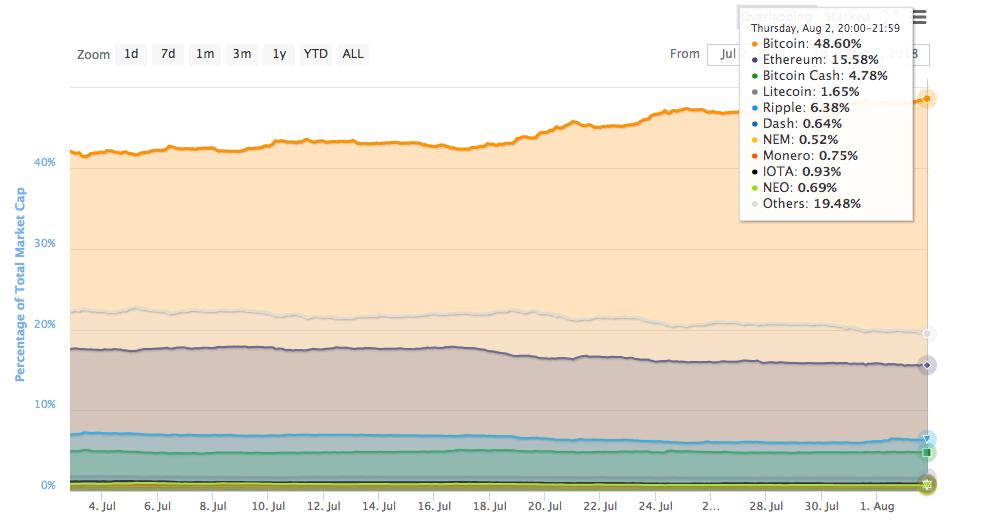

bitcoin is steadily displacing altcoins from the market, reaching over 48 percent of total market cap dominance.

Percentage of Total Market Cap (Dominance). Source:

(VEN) has suffered the most losses over the past 24 hours among the top 20 coins following the recent launch of its own and . The coin has lost almost 11 percent and is trading at at press time, down almost 23 percent over the past week.

(XTZ) is seeing slightly less losses, down 6.65 percent and trading at today.

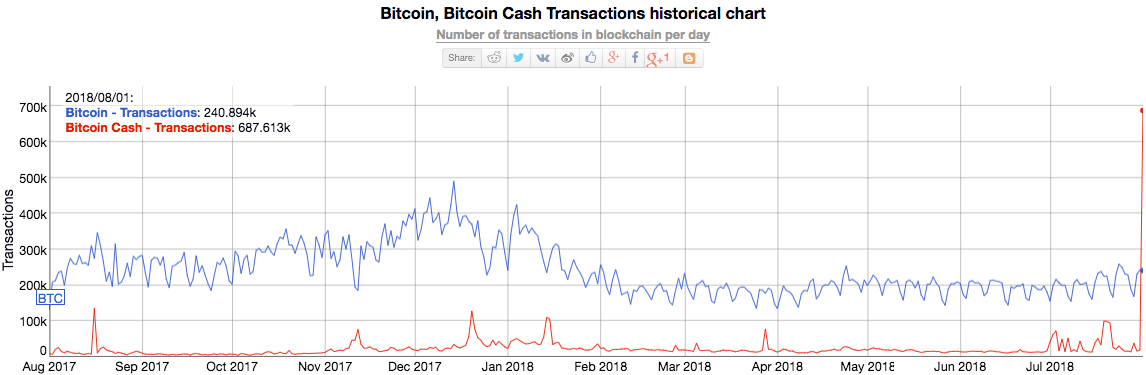

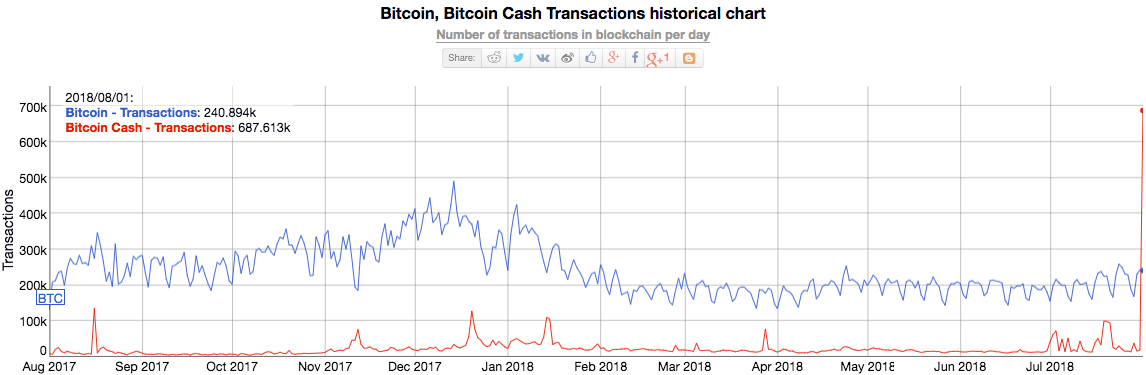

While (BCH) is seeing losses around 2.5 percent today, the number of BCH transactions has surpassed the amount of bitcoin transactions for the first time. Yesterday, BCH its first birthday, following a from bitcoin’s blockchain on last year.

bitcoin and bitcoin Cash Transactions Historical Chart (Dominance). Source:

Earlier today, payments service Square over $70 million in bitcoin revenues in the first half of 2018. The firm’s revenues from crypto have grown by $37 million in Q2 2018 compared to $34 million in the first quarter. bitcoin trading on its app in November 2017.

On July 31, financial conglomerate announced it will a 12 percent stake in U.S.-based electronic trading platform operator Clear Markets in a move to introduce a crypto derivative trading platform.

Published at Thu, 02 Aug 2018 21:39:00 +0000