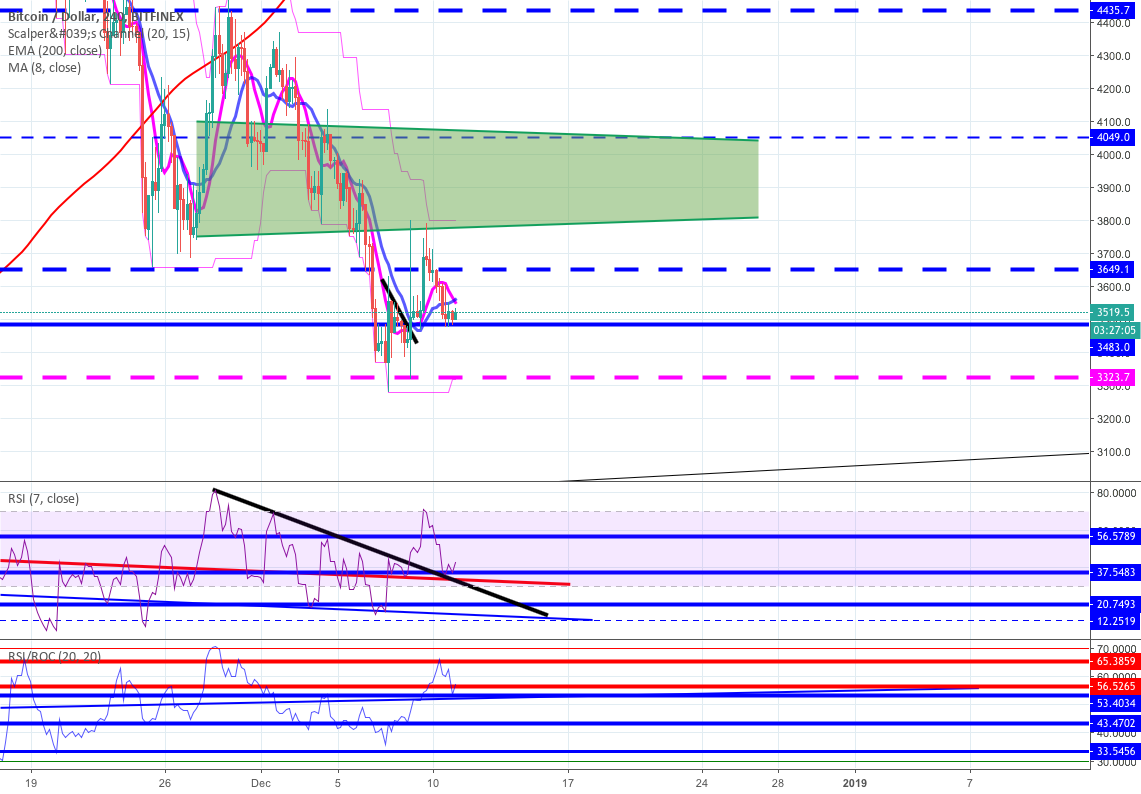

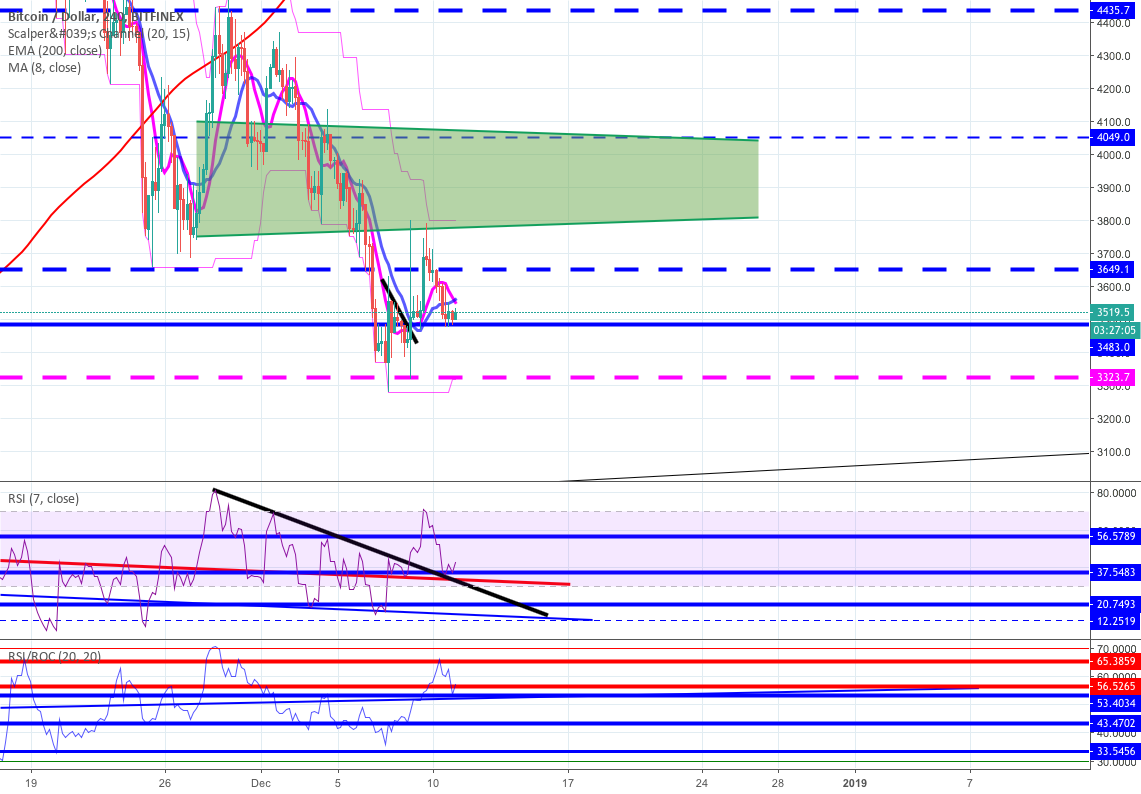

(finex) INTRA-DAY BREAKDOWN

Welcome to another episode of our favourite show – brought to you by FELIX!

** PREVIOUS RELATED IDEAS ARE LINKED BELOW **

1 HOUR BREAKDOWN

– We can see that 3480$ support has held up very well on since a rejection from the 3800$ level. Since testing highs of 3800$ MA’s have been used as resistance with a MA crossover occurring on the hourly charts. Moreover, we can see that 200 resistance lies currently just above 3650$. Thus, a break above this level will indicate huge momentum but I believe this will not occur – none the less, we need to be ready for all scenarios.

– Moreover, we can see that currently on hourly , there is support at the 37 level with previous (BLACK LINE) now being a .

– We can also see that on our RSI/ROC chart that 43 LEVEL its currently being used as support and I expect a retracement to the upside to the 53 level before runs out of momentum once again.

– This all supports the range activity we presumed in our weekly breakdown for .

4 HOURLY BREAKDOWN

– Again we can see that there are support zones evident on our momentum indicators on the 4 hourly with support at 37 level for and an expected increase to at least 56 level before next real price crash.

– For our RSI/ROC , support evident at the 53 level and I expect an increase to at least the 65 level on 4 hourly charts.

– This should correlate with a test of 3650-3700$.

DAILY BREAKDOWN

– Surprisingly, the are looking a LOT more in this instance. We can see that MA’s on the daily are being used as resistance.

– We can also see that we are currently at a resistance on both and RSI/ROC.

– This tells us that we can expect intra-day activity but on the whole things are still .

– DAILY INDICATING A DROP TO 2950$ IS NECESSARY IN MEDIUM RUN.

ENSURE TO FOLLOW OUR INSTAGRAM PAGE DOWN BELOW AND CLICK THE LINK IN THE BIO FOR OUR CHANNEL TO STAY UP TO DATE!

Published at Tue, 11 Dec 2018 04:32:58 +0000