Hello Lads and Ladies,

Welcome back to TJ’s TA sessions.- The Daily Update

What happened in the last 24h?

Finally, one of our lower orders are starting to fill and we are getting ready for the short squeeze. By now, it is only a matter of time when short are going to get trapped and liquidated.

We saw a wonderful low dump. Nothing interesting happened there in my opinion. We liquidated around 10 million Longs and had two market shorts of each above 5 million at the very bottom around 3714$ (how to get trapped 101). Nevertheless, a reason that I am elaborating on for this dump is a the very steep decrease in the Funding Rate. Which is again increasing by a lot and we are seeing a small movement upwards.

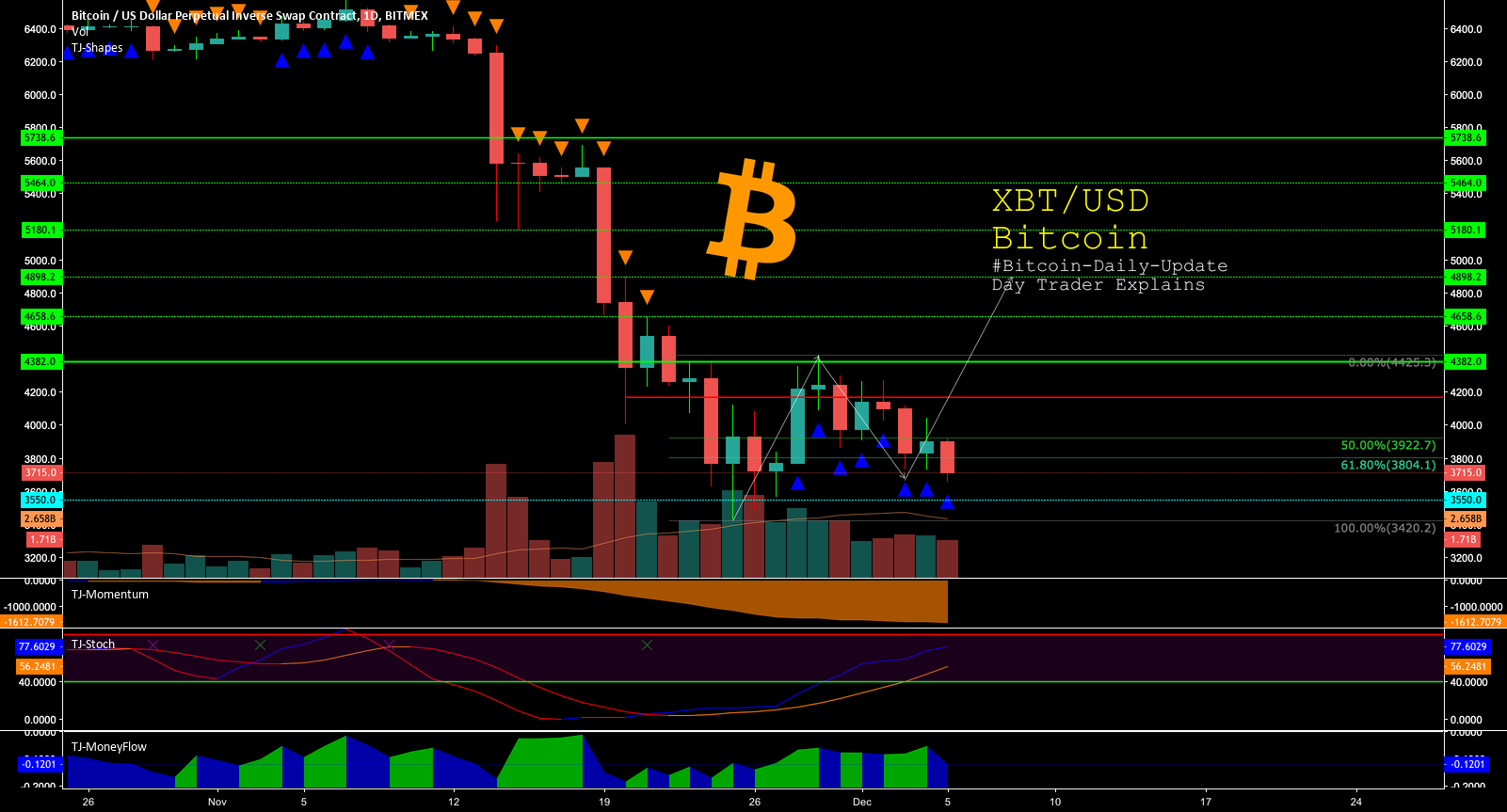

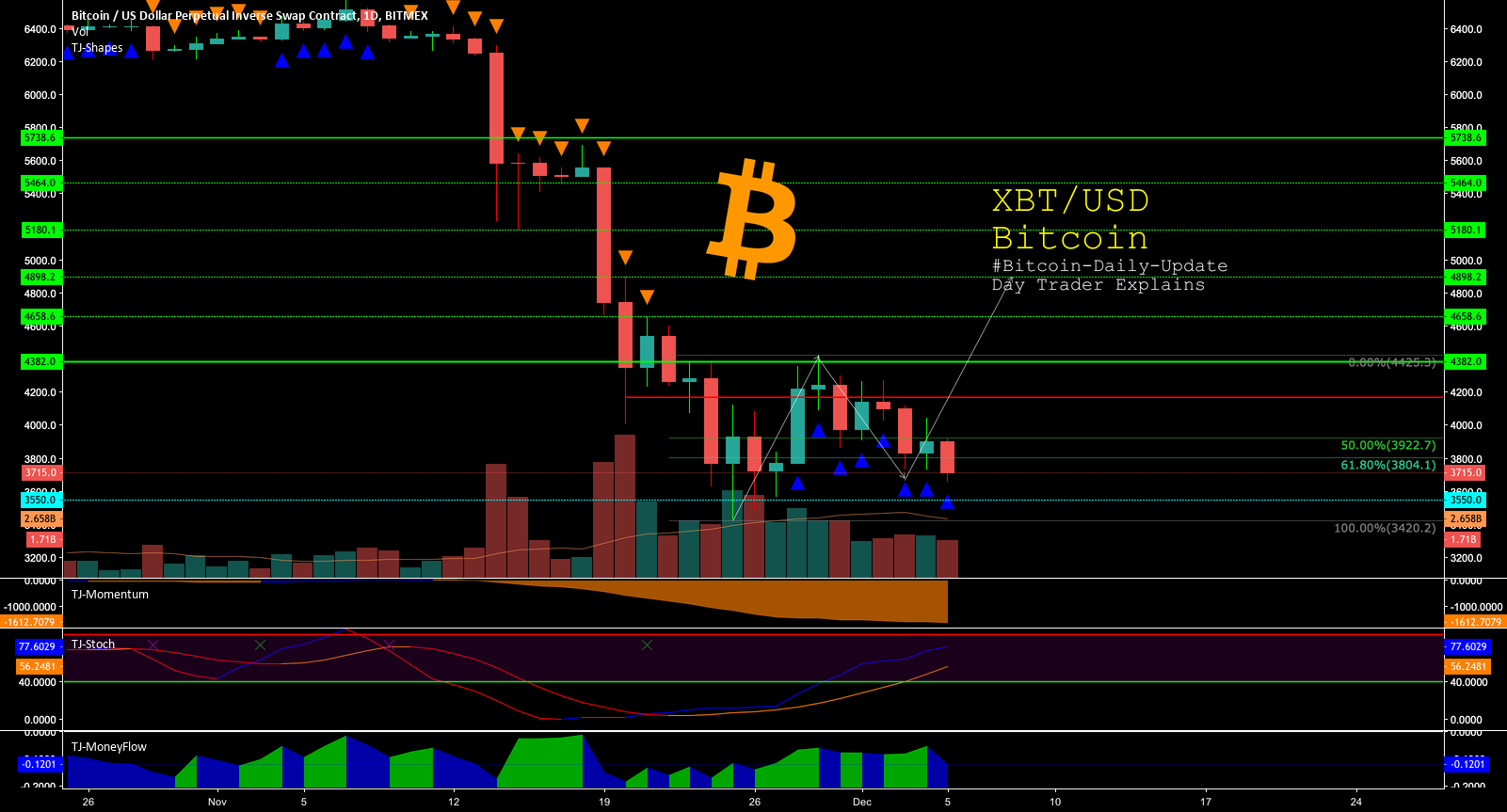

Most important S/R right now?

3434 3550 3666 3730 3820 3950 4077 4123 4169 4382 4658

Gained lost %?

Since the opening of the new daily, we wicked down -6.41%, but gained 0.25%

MarketCap?

Total MarektCap is 121 Billion – lost 6 –

Of wich is 65 Billion – lost 3 –

With a Dominance of 54.2%

– Today’s dump seems to have downed more alt coins than just –

Volatility?

The 30d is 5.53%

– +0.01 –

Shorts/Longs?

Shorts – 35.7k (danger-zone)

Longs – 26.9k (solid)

– S +1.2 / L +0.1 –

Funding?

The last 3 funding rates added -> -0.05%

– -0.21 -> lost a lot –

Momentum?

The TJ-Momentum is still red but very low. As soon as we see it green, it will be a rising momentum and it will be a sign for . Until then we need to keep a tighter Stop Loss and lower leverage as well as margin.

Volume?

We are STILL waiting for a big breakout. Today, as mentioned low dump. We are forming a n-formation, which is very divergent to our chart and price.

TJ-MF/StochRSI levels?

TJ-MoneyFlow -We are still below the 0 line. Yet the is heading down. This is again not favouring the direction that we are going towards right now. Once more shoring us a divergence.

StochRSI (still trending up)

K(blue) – 77

D(orange) – 56

Divergences?

I am still seeing the going sideways bit the price going down. The same with the price going down and the TJ-Stoch going up as well as the TJ-MoneyFlow continuing up. A big move is still indicators are rather showing us the possiblity for a move upwards to test the resistance at 4.4k.

Market Structure?

Right now we are on lower timeframes in a , with decreasing and decreasing price. With a high chance we will see the breakout upwards. We are still heading for that , which would ultimately align all starts in one line.

Overall?

We are definitely in a bear market and definitely have to fight the very strong sentiment in the market. Moreover, we see a lot of dumps and breaking horizontal supports and a negative momentum, which is why we are saving us with a protective stop loss at this moment. Nevertheless, we are seeing a lot signs that are pointing up. We have so many shorts and from what I see right now, every time we get into that 35k region, next day the are getting liquidated, lets see if tomorrow we will see a nice push, with the increased funding rate and the low dump. As you see I am still definitely keeping my long position. I will not be the one shorting a possible bottom below 4k.

Please note: I am still having orders below and am following a proper risk management with a low margin and low leverage. I am basically happy when we move down.

What do we want?

We want to stay above and close the daily above 61.8%, once again heading to close above it would be really nice. This time it would be 3800$. This might give us a bull and a pretty nice indication for a solid long.

Position?

Keeping the Long position. Still not convinced of a short position. STILL READY for a possible test of 3400$, without panicking.

Entry at 3.8k is ok

Entry at 3.7 is good

Entry below 3.6 is very good

Let me know in the comments and leave a like if you like the infos and want to see it daily.

Like and Follow me and you will find this page interesting because I am a TA expert and professional day trader in crypto since 2012 that does daily updates and new posts about the hottest and most discussed coins.

This is as always a delayed post, if you are interested in first hand news, feel free to join our group,

Cheers, TJ

Published at Wed, 05 Dec 2018 23:25:26 +0000