It’s been a while since I posted a public video analysis. Glad to be back and share with you my opinion and analysis regarding this space. For those of you who don’t know me, my name is Amol and I’ve been a trader for 11 years. I started off my trading as a high school kid logging into my Dad’s account in 2008. Thinking I was hot sh*t, I made a couple of good trades but then financial crisis started kicking in and things got worse on that account. Long story short, I lost a bunch of my Dads money and felt horrible. I made it a point to learn how to trade, how to invest, read market sentiment, understand market data, structure, technicals, fundamentals etc. I became thirsty for knowledge in trading and investing. Fast forward, after years of equities trading, I started trading crypto in late 2016 and have been here since and I’m in it for the long-run. Anyway, I share my analysis with you every chance I get so here we go..

BTC/USD January 18 Analysis:

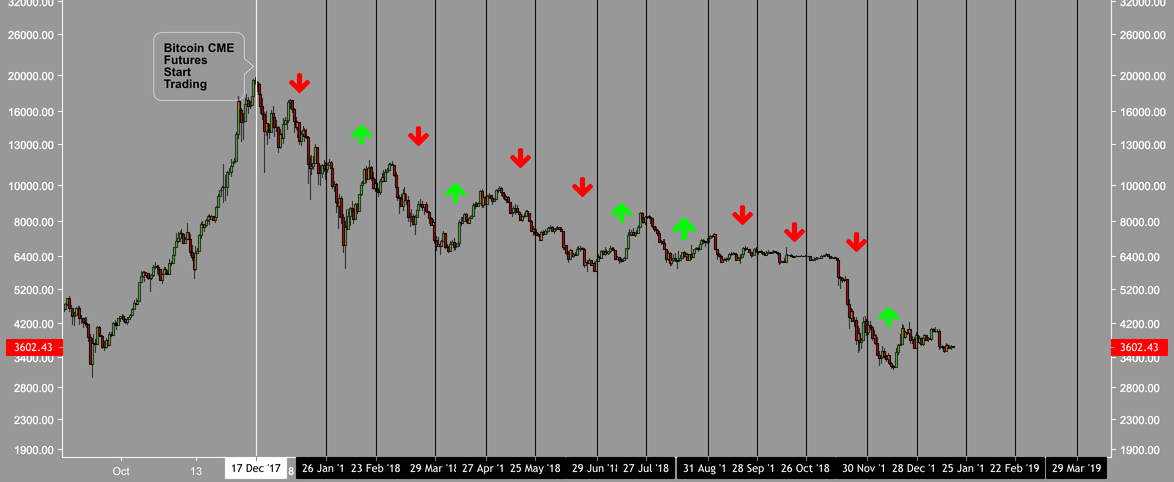

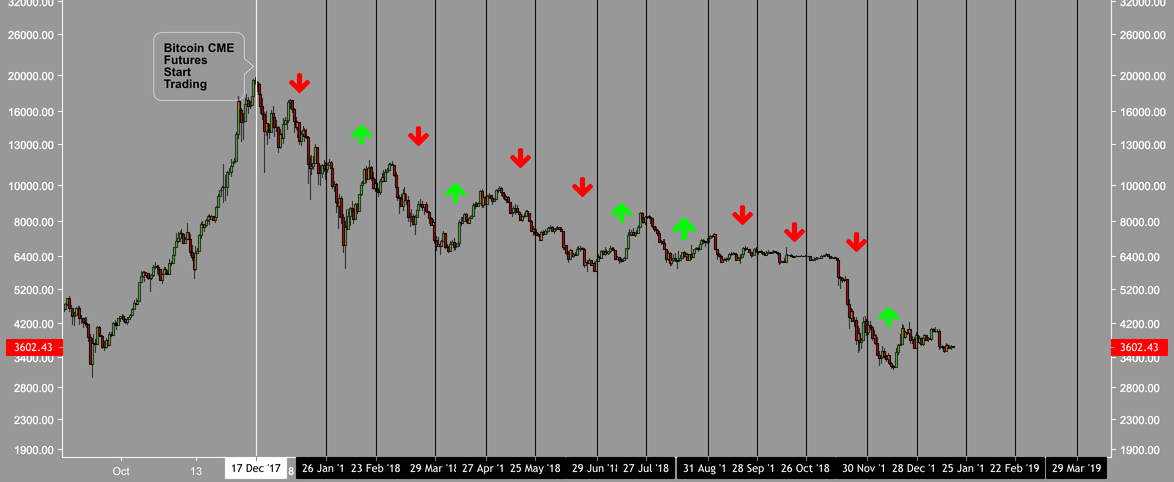

– The 128MA (daily) has been used heavily in the equity markets to gauge long-term trend shifts and possible areas of bounce/support. You can see on that it was used quite effectively. Even on the side of resistance it was used perfectly. However, the fact that we are so far extended away from 128MA and can’t come close to retrace when bouncing up shows severe weakness in the asset.

– And just like the 128MA the 382 fibs and the corrective wave shown in the video give you an idea that we have not had such a weak bounce in in all of 2018. Meaning when price fell from 6500 to 3100. We should have at least climbed into 4500-5000 range and then gotten rejected on the way down. Again- this shows the utter dominance from the bears driving the price down and disallowing it from coming up

– The Order Blocks shown are a great example to watch price be cripped. Staying under the 50% fib of the current OB is again a weak sign for .

All in all, unless climbs up toward $5000 over the next few days/week, it will undoubtedly have a higher probability of breaking down than up. Best case scenario is that $3100 was the bottom and we spend months in $3000 range for accumulation. But we won’t know this until we create higher lows and stay here for weeks/months.

See more updates below

Hope you enjoyed the analysis. Give me a thumbs up!

-Amol

Published at Fri, 18 Jan 2019 13:07:44 +0000