Venezuela’s economic situation has been steadily declining in the past few years, bringing Venezuelans to turn to cryptocurrencies.

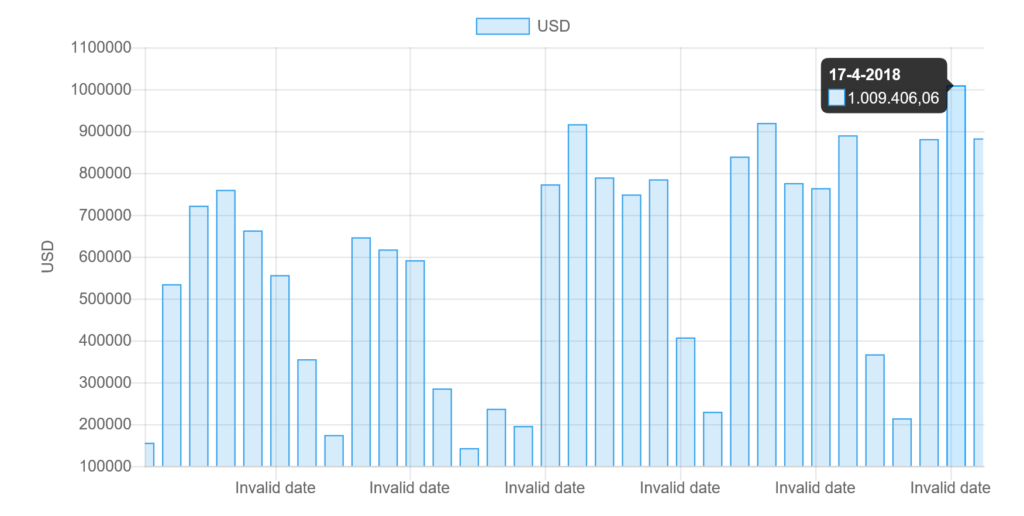

According to data, the bolivar-to-bitcoin market recently reached a new record, as the equivalent of $1.009 million in bolivars were exchanged for bitcoin on April 17.

VeneBloc tracks transactions made on peer-to-peer exchange LocalBitcoins on the South American nation. It currently posts a rate of over 800,000 bolivars per dollar. Venezuelans are turning to cryptocurrencies as the government has enforced strict foreign exchange controls back in 2003.

These controls see individuals and businesses who aren’t able to obtain government approval to purchase dollars at legal rates turn to the black market. Cryptocurrencies help Venezuelans access foreign goods, and effectively .

Last year Jorge Farias, the co-founder of Venezuelan-based cryptocurrency brokerage Cryptobuyer, which had over 10,000 users at the time, said:

“The transaction takes a few minutes, our commission is three to seven percent lower than the banks, and our exchange rate is regulated by supply and demand, making it more realistic than the official”

Venezuelans have limited access to official foreign exchange markets, which makes it hard to get a sense of what their fiat currency is worth. Cryptocurrency exchanges help them here, along with websites tracking the rate to dollar auctions, and WhatsApp groups.

Prices in Venezuela in the first quarter of this year, and a whopping 8,900 percent over the past 12 months. The hyperinflation has left the country on the brink of economic collapse, a problem that the government seemingly isn’t addressing.

Instead, Venezuela’s government is focusing on its oil-backed cryptocurrency the Petro (PTR), which recently received the from the Russian Cryptocurrency and Blockchain Association. The Petro, through its initial token sale, is said to have raised more than $5 billion from investors throughout the world.

While the country’s National Assembly and other entities bashed the Petro’s sale, some analysts it even exists. Meanwhile, the country has implied it may in it and ordered state-owned businesses to accept it, which could create demand.

As for its economy, the executive secretary of the country’s Blockchain Observatory, Daniel Peña, revealed he believes the oil-backed cryptocurrency will positively impact it within In an interview to the country’s Cuatro F newspaper, he said:

“There are many advantages, among them is that the inflationary scheme of the Venezuelan economy breaks down. Stolen or stolen tickets, because it is a digital currency that is safe to handle and has more functionality. The intermediaries will disappear, it will be a directional purchase. The waiting time for transactions will be reduced, because it will be faster than the banking system.”

Featured image from Shutterstock.

Follow us on .

Advertisement

Published at Thu, 19 Apr 2018 21:55:20 +0000

bitcoin Trading[wpr5_ebay kw=”bitcoin” num=”1″ ebcat=”” cid=”5338043562″ lang=”en-US” country=”0″ sort=”bestmatch”]