BLOCKCHAIN TECHNOLOGY 2018

17TH JULY 2018

LONDON, UK

Overview

bitcoin. Ethereum. Hyperledger. With all the cryptocurrency buzzwords flying around, it is hard to get to the core of all of these technologies. The essential piece that serves as the underlying mechanism of all these technologies is blockchain. Blockchain is a decentralized, trustless, distributed ledger technology that was popularised by the bitcoin global cryptocurrency platform.

Blockchain technology carries a promise of great opportunity, e ciency, and fairness in business operations and governance for an entire struggling planet. Blockchain technology should be integrated broadly and uniformly across society and within as many existing institutions as possible. Blockchain development should not be the exclusive domain of a single sector, such as banking. Nor should Blockchain development re ect priorities of highest Return on Investment (ROI) from Venture Capital (VC) start-ups.

Indeed, the primary objective of Blockchain technology must be to reduce the cost of capital by decentralising risk, not necessarily money. Blockchain innovation can then be applied broadly, evenly, and intentionally across the economy. This makes sense because when building anything complex or important, one logical piece needs to go in front of the next logical piece regardless of its individual ROI, because collective ROI is the true basis of valuation.

Who Is The Course Suitable For?

Any of the following roles from Banks, Exchanges, Clearing Houses, Futures Commission Merchants, FinTech Firms, and Fund Managers:

•Fixed Income Members

•Interest Rate Risk Managers

•Rates Members

•Sales Executives

•Sell Side Bank Executives

•Technologists

•Technology Officers

•Business Owners

•Chief Executive Officers

•Chief Technology Officers

•Collateral Functions

•Credit Risk Managers

•Credit Trading Desks Members

•FinTech Executives

KEY BENEFITS

•Highly comprehensive training course materials (training manual, training materials, PowerPoint presentations, definitions booklet).

•Comprehensive and in-depth understanding of Blockchain technology, innovation in the capital markets, and strategic applications.

•Highly interactive sessions with the training course expert which can reflect the attendee’s business perspectives.

•Pre-course questionnaire to identify the attendee’s key course objectives.

•Post-course follow up to ensure all key course objectives have been met.

Day 1

MODULE 1: Introduction to Distributed Ledger

MODULE 2: Why Distributed Ledger Detractors are Missing the Point

MODULE 3: Innovation in Capital Markets

MODULE 4: Distributed Ledgers in Financial Markets

EXPERT TRAINER

Sol Steinberg is an over-the-counter (OTC) derivatives Markets Subject Matter Expert that specializes in Risk Management, Regulation, Market structure, Collateral, Valuation, Financial Technology Systems, and commercialisation efforts. Sol is the founding principle of his firm, OTC Partners. OTC Partners is a boutique value add firm based in New York that specializes in research, content, and business development. In 2014 OTC Partners developed numerous leading research reports on the global capital markets and has helped lead the China’s OTC market evolution in Beijing, Shenzhen, Jinan, as well as LATAM, and Europe. Before starting OTC Partners Sol was a senior executive at the world’s leading clearing house LCH. Clearnet. Sol also spent nine years on the buy side and Citi, performing product development, risk management, and valuation for the OTC markets. Sol has a wide-ranging network of asset managers, analytic providers, execution venues, regulatory, and government contacts. He used his eco system to successfully commercialise analytics, data, and other non-commercialised intellectual property. He brought to market several initiatives, including institutional and commercial risk engines such as SMART tool, Risk Explorer, Global Market Risk System for Citi: the largest VAR engine in the world from 2004 to 2006, as well as developing CCP2– a derivative education & certification program for leading consultancies. Sol also contributed to OTC industry’s clearing and default management policies for the cleared OTC swap markets as well as contributed to industry standard risk analytics in times of low market rates.

AWARDS AND HONOURS

Waters Magazine’s Award “Best Risk Analytics Initiative 2012”

Waters Magazine’s Award “Best Risk Analytics Initiative (Sell Side) 2013”

FTF’s award for “Most cutting edge risk contribution 2013” for developing the SMART Risk Analytics Tool.

Global Nominee in 2012 for “Best Practices in Global Financial Risk Management” from the Professional Risk Managers International Association (PRMIA).

Please find below reference links:

http://www.storm-7.com/blockchain-technology-2018/

starting on 2018-07-17 09:30:00

Address:

8 Fenchurch Place

EC3M 4PB City of London

United Kingdom Fever

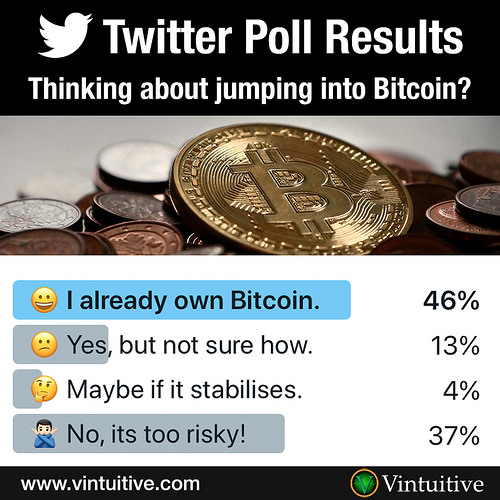

This week I asked how you felt about the recent spike in the value of bitcoin that generated global interest in the cryptocurrency over the past few days.

I asked specifically if this surge of activity and buzz in the news has got you thinking about getting in involved with bitcoin yourself.

1⃣ 😀 I already own bitcoin 46%

2⃣ 🙅♂ No, it’s too risky! 37%

3⃣ 😕 Yes, but not sure how. 13%

4⃣ 🤔 Maybe if it stabilises. 4%

Surprisingly, almost half of the respondents already owned some bitcoin and only 4% said they’d consider buying some bitcoin if the fluctuating value stabilised at some point.

Perhaps unsurprisingly, almost half of you said that you feel it is too risky to get involved with.

The remaining 13% said that they weren’t sure how to get started. So I supplied a few tips and pointers on how to start using bitcoin. There are essentially three simple steps:

1. Sign up for a bitcoin Wallet (free online service).

2. Connect it to your online bank account.

3. Transfer money to your bitcoin Wallet.

There was another group that I had overlooked. These are those who would like to buy some bitcoin but thought that it was too expensive and therefore couldn’t afford it. This misunderstanding is perhaps caused by the analogy to physical cash with the term “coin”, and that a single bitcoin must be the lowest denomination. As a single bitcoin is now worth around US$17 000 some may think that that is the entry point. The truth is that you don’t have to buy a whole bitcoin to get started, instead you can jump in with as little as $5, which will get you 0.000298 of a bitcoin.

Thanks to all who participated. Stay tuned for another poll next Monday morning!

By Vintuitive on 2017-12-15 06:34:53