Für einen einzigen AntMiner der neuesten Generationen S11 und S15 muss man aktuell auf dem Markt zwischen 700 und 1000 US-Dollar berappen. Nimmt man diesen Preis zur Grundlage, plant Bitmain Investitionen im Volumen von mindestens 140 Millionen US-Dollar, sollte sich die Zahl von 200.000 neuen ASICs als wahr herausstellen. Darüber berichtete die US-Branchenplattform mit Bezug auf nicht genannte Quellen.

Zwar generiert Bitmain den Löwenanteil seiner Umsätze durch den Verkauf eigener Mining Hardware. Doch auch das Mining der großen Kryptowährungen gilt als wichtige Einnahmequelle des Pekinger Unternehmens.

Die Ankündigung kommt nach einer Reihe negativer Entwicklungen für das Unternehmen. Erst im Januar BTC-ECHO über umfangreiche Personaleinschnitte. Bemerkenswert dabei ist, dass die Entlassungen insbesondere die Mining-Sparte des Konzerns betrafen – also diejenige Unternehmensabteilung, in die jetzt investiert wird.

Günstiger Strom bei positivem Markttrend

Allen voran zwei Faktoren dürften die Entscheidung begünstigt haben: Die günstigen Strompreise in den Provinzen Sichuan und Yunnan, sowie eine positive Fundamentalentwicklung des Krypto-Marktes. So gelten die Stromkosten im Südwesten Chinas vor allem im Sommer als günstig.

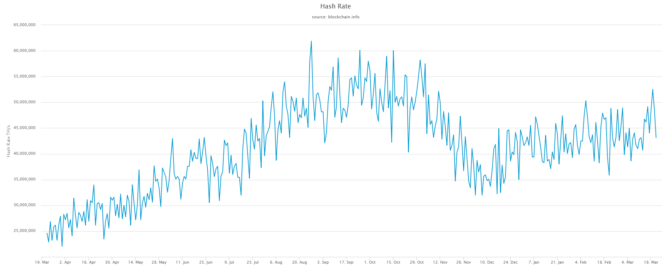

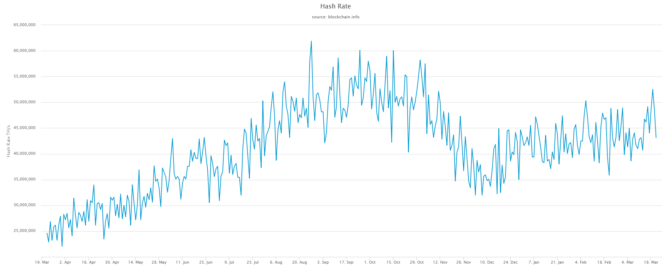

Gleichzeitig dürfte der Investitionsentscheidung positive Aussichten auf das baldige Erblühen des Krypto-Winters zugrunde liegen. Schließlich stimmen wie Hash Rate und bitcoin-Handelsvolumen auf den Exchanges optimistisch.

Zwar lassen sich aus vergangenen Performances des Krypto-Marktes keine zuverlässigen Kursprognosen bilden. Das baldige Coinbase Reward Halving dürfte sich aber so langsam einpreisen. Logisch, dass sich die Miner schon im Vorfeld gut am Markt positionieren wollen.

bitcoin & Altcoins kaufen: Kryptowährungen kaufen, verkaufen oder traden – wir haben die besten Broker, Börsen und Zertifikate zusammengestellt: | | | |

Published at Fri, 22 Mar 2019 17:10:31 +0000