By: John McAfee continues to trumpet a price that will hit $1 million by the end of the decade. He isn’t even afraid of on the same. Nonetheless, crypto bears keep coming back to spoil the party. One such doubter is UBS analyst Kevin Dennean.

UBS Analyst: bitcoin Price Faces a Long Road to Recovery

According to Forbes, Dennean recently :

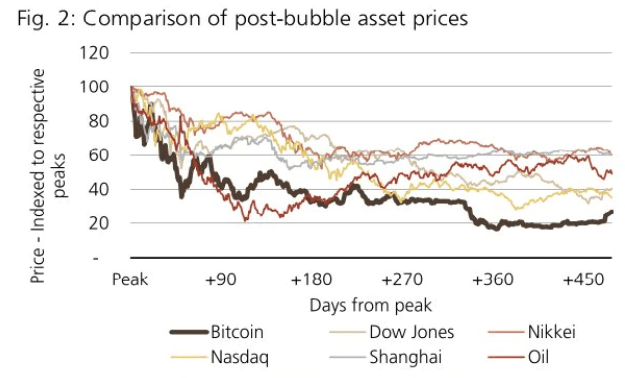

“We’re struck by how long it took other asset bubbles to recover their peak levels (as long as 22 years for the Dow Jones Industrials) and how pedestrian the annualized returns from trough to the recovery often are.”

Dennean went on to add that “crypto-bull contingents should consider what happens after the bubble–not every bubble that bursts recovers the old highs.”

The analyst believes that just like other asset classes, the price faces a slow and painful path to recovery. He likened the price “bubble” to the 1929 collapse, suggesting he thinks it might take slightly more than two decades for the to reach its highs of $20,000.

That’s a bold prediction to make considering the price has rallied this year and now sits at approximately $5,300.

The price vs. other asset bubbles. | Source: Business Insider, FactSet, CoinMarketCap and UBS

A Flawed Strategy that McAfee Would Disapprove

recently reminded his followers that is not a stock.

Come on people!!! It’s time to brush up your basic math skills and run some f*^#$ng numbers!!!! It is mathematically impossible for to be less than $1 mil by the end of 2020. is not an effing stock!!! You can’t apply stock paradigms or formulas and expect answers!

— John McAfee (@officialmcafee)

That’s why it is futile to value the in the same way as stocks.

is not a stock. At its heart, is a digital currency independent of any centralization. It’s designed to make peer-to-peer payments. So the mechanics of prices are completely different than that of a stock, which is why Dennean’s throwback to the Dow Jones crash isn’t an apples-to-apples comparison.

bitcoin’s Rally Is Here to Stay

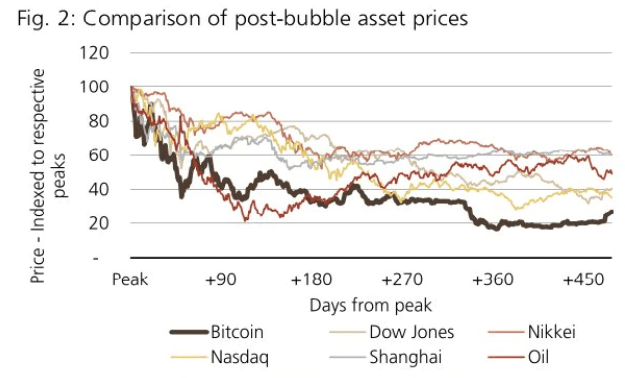

prices could keep soaring because both technicals and fundamentals are intact.

’s two-week moving average convergence divergence (MACD) indicates for the for the first time since May 2015. As it turns out, the price has not tested its lows for 123 days and could be gearing up for a sustained rally.

On the fundamental side, rising demand could fuel more gains. Of course, McAfee’s prediction for $1 million by 2020 seems like a huge stretch, but perhaps in the long run.

Wences Casares, a director at PayPal, is of the that ’s success as a decentralized currency will be the key to its growth. The lack of developed financial systems in certain economies could lead to an increase in the number of people holding .

is in African nations as it is turning out to be the preferred means of sending and receiving payments abroad in place of the U.S. dollar.

Critics sometimes miss the point that is not a stock but rather a digital currency whose aim is to enable peer-to-peer payments independent of any central authority. That’s why analysts should never value it using the mechanics of stock valuation or else they might have to eat their words and will look foolish in the long run.

Published at Sat, 20 Apr 2019 00:01:04 +0000

![Eroscoin clubcoin tezos (pre-launch) wincoin segwit2x [futures] santa coin bitcoin buy sell btc Eroscoin clubcoin tezos (pre-launch) wincoin segwit2x [futures] santa coin bitcoin buy sell btc](https://ohiobitcoin.com/storage/2018/01/yECAtx.jpg)