When Fundstrat Global speaks, the crypto world listens. In recent months it has been a steady font of good news for the ecosystem, with five figure price calls to predicting a very bright future, a crypto future. Resident guru Thomas Lee more-or-less foretold the current after tax season spike in prices when many others were decidedly bearish on the asset class. The firm recently surveyed a small group of institutional investors, and they appear to see cryptocurrencies poised for a breakout year. To help such investors make informed choices in that regard, the company also created five new crypto indices.

Also read:

Inflows of Big Money into Crypto

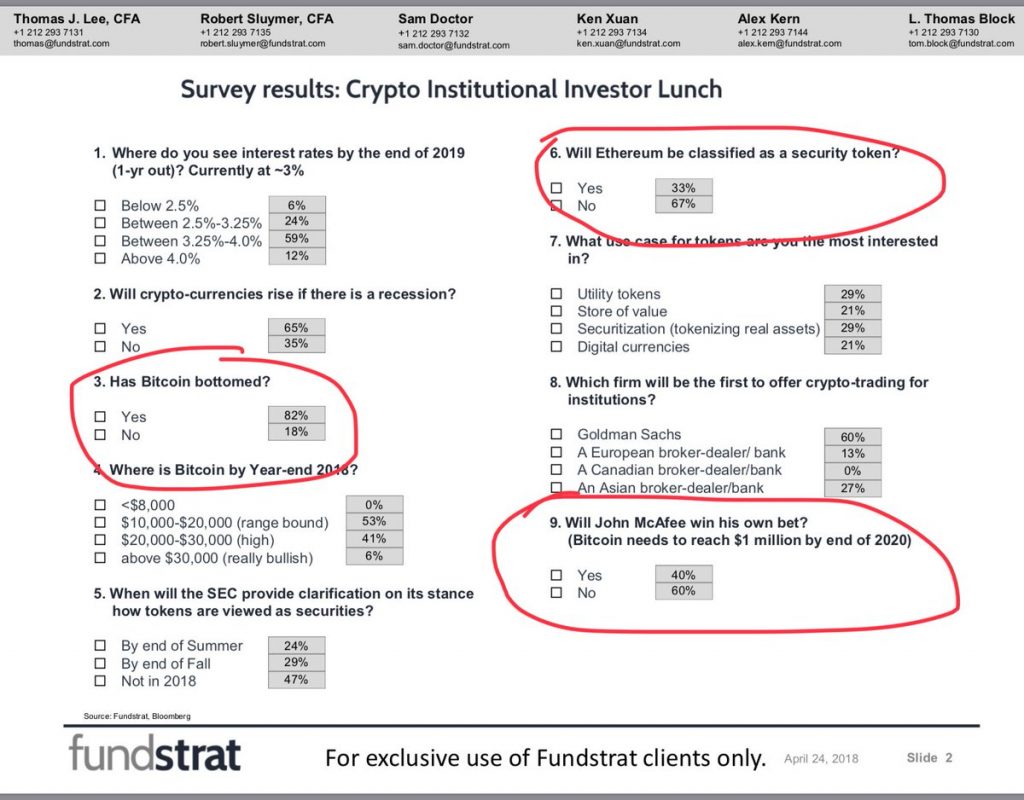

Fundstrat’s co-founder, , tweeted how his company “hosted a small group of institutional investors” recently. It was a “mix of crypto and traditional macro [hedge funds] long-only.” It was a chance to informally survey basic sentiment about the market shortly after the end of tax season for the United States.

Of the nine questions, they included: if cryptos will rise during a recession (65% Yes), if bitcoin core had bottomed (82% Yes), bitcoin core’s year-end price (vast majority believed it will be between $10K and $30K); most believed regulators will provide clarity sometime this year; they do not believe Ethereum will be classified as a security; a great number seem to be moving away from “store of value” concerns, toward an actual currency; and 60% believe Goldman Sachs will be the first to introduce institutional crypto trades. The key “takeaway,” Mr. Lee insists, is how “institutions believe [bitcoin core] bottomed. We see this as a leading indicator for inflows of big money into Crypto.”

Indeed, Fundstrat’s Mr. Lee has been something of a fortune teller for the digital asset class. It was he, and almost he alone, who urged investors to perhaps buy the Crypto Winter dip, believing bitcoin core would bounce back after capital gains and relevant tax penalties were paid. As of this writing, he appears to be correct.

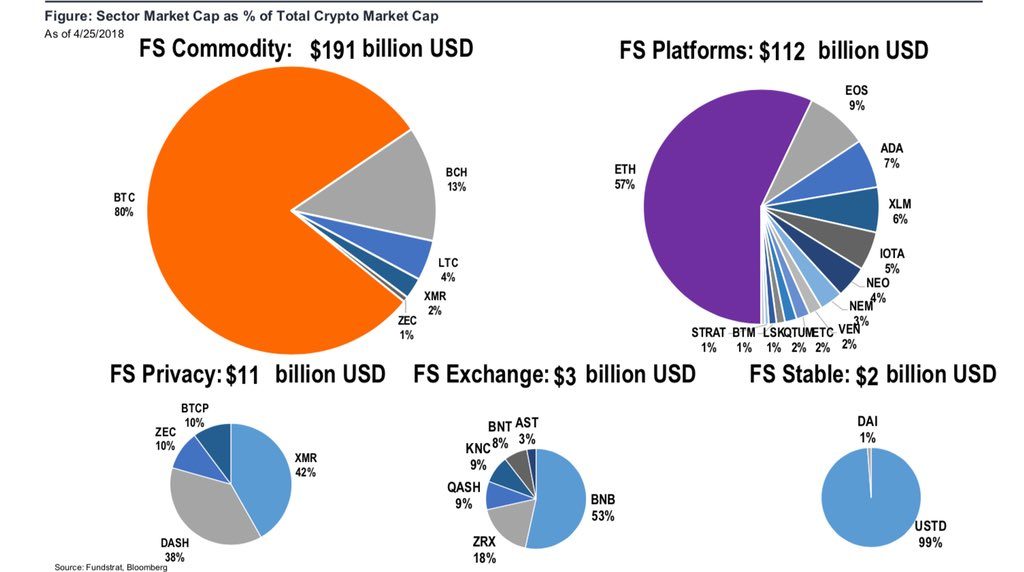

The future looks so bright for cryptocurrencies, Fundstrat also announced a set of new indices, five to be exact. “Commodity tokens,” wrote Mr. Lee, Sam Doctor, and Robert Sluymer, “in our view, are on-ramps for institutional inflows, given the expanding options for access (futures, etc.). And commodity tokens face less regulatory risk relative to other types of tokens at the moment.”

bitcoin Cash, bitcoin Core, Zcash, Monero, and Litecoin

Basing their choices on relative size, the five sectors comprising 75% of the sector’s cumulative market capitalization are Stablecoins, Privacy, Platforms, Exchanges, and Commodities (which take up nearly half of the index due to components bitcoin Cash, bitcoin Core, Zcash, Monero, and Litecoin).

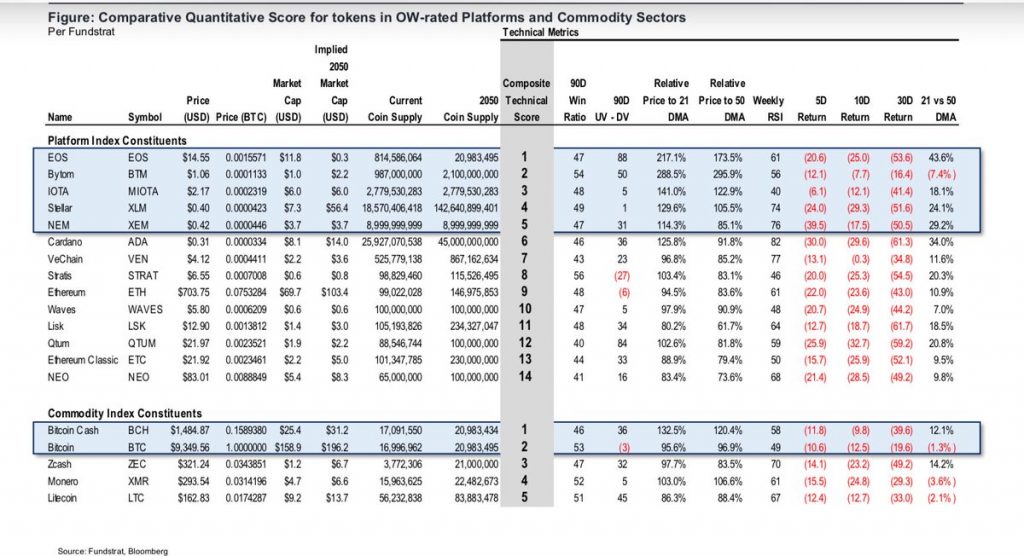

More recently, the firm held out seven coins as ones to watch: BCH, BTC, EOS, BYTOM, IOTA, XLM, and NEM.

Are you bullish on crypto this year? Let us know in the comments section below.

Images courtesy of Shutterstock, Twitter.

Need to calculate your bitcoin holdings? Check our section.

The post appeared first on .

The young cryptocurrency markets are anxiously awaiting the liquidity the big-monied investment banks, hedge funds, and pensions funds will bring to crypto exchanges, but current regulatory and compliance constraints are prohibiting their entrance. Nonetheless, 20 percent of institutional traders plan to start trading cryptocurrencies within 12 months, according to a recent Thomson Reuters survey of its clients.

A new institutional investor-compliant cryptocurrency trading terminal could be behind their optimism. (BCT) could be the biggest trading technology disrupter since Bloomberg put its electronic trading and real-time market pricing terminals on the desk of every trader in the 1980s.

“We aim to bridge the traditional asset management industry with the bourgeoning cryptocurrency community,” says Blockchain Terminal President Robert Bonomo. “Our consumers are institutional traders – either existing asset managers or crypto hedge fund managers – who need better controls and order trails,” he adds. “We are trying to bring stability, accountability and transparency to this new and exciting ecosystem and digital currency community.”

A Gateway to Institutional Grade Crypto Trading

The ‘bridge’ comprises two proprietary Blockchain systems as well as proprietary institutional-grade cryptocurrency trading software.

Bonomo, a former CIO with large investment management firms who has overseen three decades of rapid evolution in electronic trading technology and compliance, is also a true veteran of the Blockchain technology world—the digital ledger that serves as the operating platform for cryptocurrency trading — was an early adopter.

While working on technology solutions for hedge funds, pension funds, and bank trading desks, Bonomo recognized that any compliant solution would have to accommodate not only cryptocurrencies but also the coming convergence of crypto and fiat currency trading.

The compliance framework of the Blockchain Terminal (BCT) is powered by its compliance engine called , which provides secure encrypted transactions and real-time compliance monitoring. The terminal serves as both a regulatory compliance and trading risk management system with alerts, an audit system, and other safeguards.

Not coincidentally, Bonomo is involved in setting those standards for trading crypto assets in his role on the Digital Currency Council, which provides digital currency certification, and as Chair of the Technology Product Working Committee of the Wall Street Blockchain Alliance.

Test Driving the Blockchain Terminal

The Terminal is currently in beta testing stage on the trading desks of institutional investors, and 200 terminals are being ready to be distributed. The BCT streams market data from , as well as ICO, news, and social media updates.

A consolidated order book provides real-time bidding and ask prices across the multiple exchanges and thousands of currencies. By offering third-party developers the option of developing apps on the open source platform, BCT envisions becoming the Metatrader of the converging cryptocurrency and fiat currency worlds.

Institutional investors ready to step off the sidelines and trade this new asset class on a BCT institutional-grade trading terminal can buy the BCT token in the current (ICO) running until April 30, 2018.

The post appeared first on .