bitcoin’s issuance is programmed to slow predictably over time, a design feature that reduces the flow of new coins entering circulation and gradually increases bitcoin’s scarcity. These scheduled reductions in miner rewards-commonly referred to as halving events-are enforced by the bitcoin protocol and are central to its fixed-supply monetary policy. As an open, peer-to-peer digital currency, bitcoin’s rules for issuance and validation are public and maintained collectively by the network rather than by any single authority . The protocol’s issuance schedule and the distributed verification of blocks mean that scarcity is an emergent property of both code and consensus,and the full blockchain that records this history is maintained by nodes that must download and store the ledger as it grows .

Understanding bitcoin Issuance Mechanics and the Role of Halving Events

bitcoin’s issuance follows a deterministic, algorithmic schedule encoded in its protocol: new coins enter circulation as block rewards awarded to miners who append valid blocks to the blockchain. This reward is cut at fixed intervals, reducing the rate of new supply and guiding the system toward its capped supply of 21 million coins. the predictable nature of this issuance – defined by the protocol and subject only to consensus changes – underpins bitcoin’s monetary design and long-term scarcity model .

Key mechanics that govern how issuance slows include:

- Block rewards: miners receive newly issued coins as part of each mined block.

- Halving events: the reward amount is halved at scheduled intervals (every 210,000 blocks, roughly every four years), directly lowering inflation.

- Fixed cap: total supply asymptotically approaches 21 million, so issuance trends toward zero over time.

- Miner incentives: as block rewards decline, transaction fees and network efficiency play a larger role in sustaining security and participation .

| Epoch | Reward (BTC) | Typical Effect |

|---|---|---|

| Genesis – 2012 | 50 → 25 | High issuance, early miner-driven growth |

| 2012 – 2016 | 25 → 12.5 | Inflation reduction, broader adoption |

| 2016 – 2024 | 12.5 → 6.25 → 3.125 | Scarcity increases, fee markets mature |

Implication: each halving tightens supply growth and amplifies scarcity pressures, forcing economic and technical adjustments across the network as miners, users, and fee markets respond to the changing reward landscape .

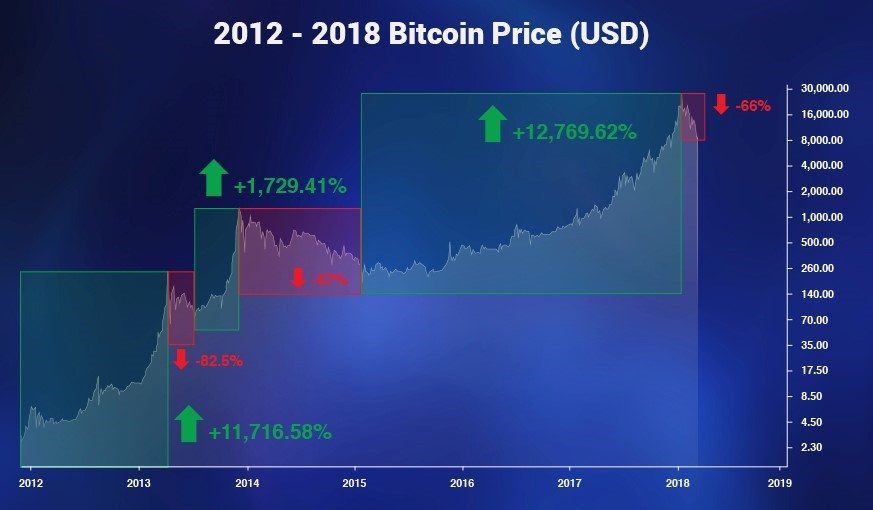

Historical Evidence of Slowing Supply Growth and Its Market Effects

bitcoin’s supply schedule is encoded in its protocol through a series of periodic reductions in miner rewards, a mechanism that has produced a demonstrable pattern of slowing supply growth as the network’s early years. These protocol-level rules are part of bitcoin’s open, peer-to-peer design, where issuance and validation are collectively maintained by the network rather than a central issuer . Over successive reduction events the annual inflation rate has compressed, creating a clear historical trend toward lower nominal issuance over time.

Markets have consistently responded to this tightening in supply dynamics with a mix of short-term volatility and longer-term price revelation. Observed market responses include:

- Pre-event speculation: increased buying and volatility in the months leading up to supply reduction events.

- Post-event reassessment: periods of consolidation as miners and investors adjust to new economics.

- Longer-term scarcity effects: reduced new issuance contributing to price appreciation when demand remains constant or grows.

These behaviors are rooted in bitcoin’s decentralized issuance model and broader economic incentives built into the protocol .

Below is a concise summary showing how successive issuance reductions compress new supply and alter yearly reward flows:

| Event | Approx. Year | Block Reward Change | Effect on New Supply |

|---|---|---|---|

| Genesis Era | 2009 | 50 BTC → baseline | High initial issuance |

| First Halving | 2012 | 50 → 25 BTC | ~50% cut in new issuance |

| Subsequent Halvings | 2016-2024 | 25 → 12.5 → 6.25 → … | Progressive decline in annual supply growth |

The protocol-driven reductions in new supply underpin the long-term scarcity profile that markets price in,a direct consequence of bitcoin’s peer-to-peer issuance rules .

How Reduced Issuance Amplifies Scarcity and Reinforces Store of Value dynamics

As the protocol systematically reduces the number of new coins entering circulation, the pace of supply growth slows and each unit of existing supply becomes comparatively rarer. this predictable tapering is enforced by consensus rules and executed by the network rather than any central authority, which anchors expectations about future scarcity and makes supply dynamics obvious to participants .

Over successive issuance epochs the marginal addition to total supply falls,concentrating value into a progressively smaller flow of new issuance and altering market incentives. A simple snapshot shows the effect of epochal reductions on nominal block rewards and the resulting supply growth pressure:

| Era | Example Block Reward | Supply Signal |

|---|---|---|

| Early | 50 BTC | High issuance |

| Intermediate | 6.25 BTC | Moderate issuance |

| Post-halving | 3.125 BTC | Low issuance |

This structural reduction shifts the balance between new supply and demand,reinforcing the view of the asset as a scarce,time-locked resource .

Reduced issuance produces measurable behavioral and economic effects: it lowers inflationary pressure, increases perceived scarcity, and encourages longer-term holding - all of which strengthen store-of-value dynamics. Key consequences include:

- lower nominal supply growth - fewer new coins dilute existing holders less over time.

- Stronger scarcity signaling – predictable issuance builds trust in long-term value preservation.

- Miner and market adaptation – rewards shift the emphasis toward fees and efficiency, a frequent topic among miners and operators in industry forums .

Together, these mechanisms convert a simple rule about issuance into a durable economic narrative supporting bitcoin’s role as a store of value.

Key On Chain metrics to Monitor as Issuance Declines and What They Reveal

Core supply and movement indicators – Track the changing share of newly issued coins captured by long-term holders versus those entering circulation, as well as the proportion of supply held in cold storage and exchange reserves. Key on-chain metrics to monitor include:

- Supply in cold wallets - concentration of coins removed from active circulation

- Exchange reserves – coins available for sale or withdrawal pressure

- UTXO age distribution - proportion of old vs. recently moved outputs

- Active supply – coins transacted within a specified window

these metrics clarify whether declining issuance is tightening available float or simply shifting coins between hands, reinforcing bitcoin’s fundamental design as a peer-to-peer monetary network .

Miner and fee dynamics – As block subsidy shrinks, miner compensation and network security signal crucial regime changes. Watch hash rate and difficulty to assess mining participation, and mempool/backlog plus median fees to understand market-clearing pressure. Practical indicators include:

- Hash rate / difficulty – miner commitment and security

- Transaction fees & fee-per-byte – market willingness to prioritize transactions

- Mempool size – temporary congestion and demand for block space

shifts in these metrics reveal whether declining issuance is shifting the burden to fees and how resilient mining economics are to lower subsidy levels, which is frequently discussed in mining communities and pool analyses .Also consider node and storage requirements when interpreting historical on-chain trends; full-chain size and sync behavior affect participation and data availability .

Signals and interpretations – Combine metrics to form concise, actionable signals. The table below maps simple metric observations to what they typically reveal about scarcity and market behavior:

| Metric | Typical signal |

|---|---|

| Rising cold-wallet share | Increasing effective scarcity |

| falling exchange reserves | Lower selling liquidity |

| Higher fees + stable hash rate | Demand outpacing supply, fee-market maturing |

| Large UTXO dormancy | Long-term holder conviction |

Interpreting these together – such as, falling exchange reserves plus rising cold storage and consistent mining security – signals genuine tightening of available supply and a stronger scarcity premium, while divergent signals warn of transient market dynamics rather than durable supply compression .

Macroeconomic Consequences of Lower bitcoin Supply Compared to Traditional Currencies

Issuance slows by design: bitcoin’s supply growth is governed by a transparent, algorithmic schedule that reduces new issuance over time, producing progressively greater scarcity relative to fiat currencies. this issuance and the validation of transactions are carried out collectively by the peer-to-peer network rather than a central authority, which makes supply predictable and resistant to discretionary expansion .

Macroeconomic effects manifest across several channels:

- Deflationary pressure: Slower supply growth can raise the real purchasing power of units over time, encouraging saving over consumption in some contexts and potentially reducing short-term aggregate demand.

- Credit and interest rates: A scarce monetary base can compress nominal lending capacity, pushing real interest rates higher unless velocity or alternative credit mechanisms adjust.

- Policy limits and market adjustment: With no central issuer to perform open-market operations, traditional monetary tools (rate cuts, quantitative easing) are ineffective, forcing economies to adapt via fiscal policy, private credit innovation, or asset-price adjustments.

- Distributional outcomes: Predictable scarcity can amplify wealth effects for early holders and reshape capital allocation toward assets expected to preserve value.

Comparative characteristics shape systemic responses:

| Characteristic | bitcoin | Traditional Currencies |

|---|---|---|

| Supply rule | Algorithmic,slowing | Discretionary,expandable |

| Policy adaptability | Limited | High |

| typical macro effect | Potential deflationary bias | Inflationary/managed stability |

Adaptation to these dynamics comes through market mechanisms-price signals,private credit innovation,and complementary assets-rather than central-bank issuance,a consequence rooted in bitcoin’s open,peer-to-peer design .

Security and Miner Viability Risks Arising from Lower block Rewards and Fee Reliance

As the block subsidy diminishes over successive halvings, miner revenue will increasingly depend on transaction fees rather than newly minted coins. This transition creates greater revenue volatility as fees fluctuate with user demand, mempool congestion, and broader market activity. Miners that cannot cover fixed costs (electricity, cooling, hardware depreciation) during low-fee periods may reduce hash power or exit the network, temporarily lowering the overall security margin that protects against large-scale attacks and reorgs.

Specific vulnerabilities emerge when mining economics shift toward fees:

- Concentration risk: Smaller operators may be forced out, increasing reliance on large pools and raising centralization concerns.

- 51% / reorg risk: Sustained drops in hash rate make coordinated attacks or deep chain reorgs more economically feasible.

- Fee volatility exposure: Sudden fee collapses or fee-market manipulation can create cascades of miner exits, further amplifying instability.

These risks interact: centralization amplifies attack surfaces, while fee unpredictability undermines long-term investment in resilient mining infrastructure.

Mitigations combine protocol-level design,market evolution,and operational adaptations. Layer-2 adoption and optimized fee markets can concentrate settlement on fewer on-chain transactions with higher-value fee capture, while miner diversification, dynamic cost management, and cooperative pool practices can preserve decentralization. The table below summarizes concise responses and time horizons for action.

| Risk | Short-term Mitigation | Long-term Solution |

|---|---|---|

| Hash-rate drop | Adaptive pool rewards, flexible scheduling | Robust fee market + Layer‑2 settlement |

| Centralization | Promote smaller pools, improve openness | Incentive design favoring decentralization |

| Fee volatility | Fee-bumping tools, mempool optimizers | Stable, predictable fee-market mechanisms |

Sources and practical guidance for miner economics and security considerations are discussed in mining resources and getting-started guides.

Investor Recommendations to Position Portfolios for Increasing Scarcity and Volatility

Allocate with scarcity in mind: Tilt a portion of liquid capital toward long-duration stores of value while keeping a core of cash and short-term bonds to meet near-term liabilities. For investors new to the asset, consider a conservative starting allocation (e.g., 1-3% of investable assets) and scale up as conviction and experience grow; informed community resources can definitely help refine entry and custody choices. Treat exposure as a distinct sleeve in the portfolio-set target ranges,pre-define rebalancing triggers,and document thesis-driven holding periods to avoid emotionally driven trades during high volatility.

Manage volatility through execution and custody: Prefer systematic programs such as dollar-cost averaging and staged buys to blunt timing risk; use limit orders and size ladders for larger entries. Prioritize secure custody and wallet selection-self-custody, reputable custodians, or diversified custody arrangements each have trade-offs-consult wallet guides when choosing an approach. If running full node infrastructure for added security or sovereignty, plan for bandwidth and storage requirements during initial synchronization and ongoing maintenance.

Practical allocation guide and checklist:

| Profile | Suggested BTC | rebalance |

|---|---|---|

| Conservative | 1-3% | Annual |

| Balanced | 3-8% | Semi-annual |

| Aggressive | 8-20% | Quarterly |

- Define risk limits: maximum drawdown tolerance and position size caps.

- Execution plan: DCA cadence, order sizing, and slippage allowances.

- Operational checks: custody method, wallet backups, and node/storage needs.

Operational Guidance for Miners, Exchanges, and Custodians to Adapt to a Low Issuance Environment

Miners should prioritize unit economics and reliability as issuance declines: reduce cost-per-hash through hardware refresh cycles, dynamic power sourcing, and tighter pool fee negotiations to maintain profitability. Maintain and monitor dedicated full-node infrastructure to independently validate supply and fee market signals-this preserves settlement integrity and helps avoid reliance on third-party block data . Coordinate on best practices, downtime scheduling, and software updates via community channels to reduce orphan risk and preserve collective hash security .

Exchanges must adapt treasury, matching-engine, and fee models to tighter nominal issuance and higher fee-driven incentives for miners. Recommended operational steps include:

- Liquidity forecasting: increase surveillance of mempool and fee trends to size order books and funding reserves appropriately.

- Fee pass-through and rebate flexibility: implement dynamic fee ladders to reflect real settlement costs during congestion.

- Independent verification: run validating full nodes and reconcile on-chain state regularly to prevent stale or false reporting.

These measures protect users from fee volatility and strengthen on-chain reconciliation workflows through standards shared in industry forums .

Custodians should formalize long-horizon reserve strategies, proof-of-reserves reporting, and recovery playbooks to address scarcity-driven valuation and operational risks. A concise operational checklist can guide governance decisions:

| Metric | Action |

|---|---|

| Reserve Ratio | Define target bands and rebalancing triggers |

| Proof-of-Reserves | Quarterly attestation + on-chain proofs |

| Key Management | Multi-sig + distributed HSM policy |

Transparent communication of those policies, combined with participation in developer and operator communities for software and consensus updates, reduces systemic counterparty risk as issuance dynamics evolve .

Policy and Regulatory Recommendations to Mitigate Systemic Risks While Encouraging innovation

Clear, principle-driven frameworks should anchor any regulatory approach to a diminishing-supply asset like bitcoin: rules must be transparent, proportionate, and designed to reduce systemic spillovers without stifling innovation. Core principles to guide rulemaking include:

- Transparency – open reporting for large custodians and market-makers;

- proportionality – calibrate requirements to the scale and role of each actor;

- Technology neutrality – avoid rules that favor legacy systems over novel protocols;

- Regulatory sandboxes - controlled environments to test new services;

- International coordination – align cross-border oversight to manage global liquidity risks.

These principles reflect how policy functions as an agreed plan to guide decisions and governance structures in organizations and markets .

Targeted regulatory tools can mitigate concentration and operational risks while preserving incentives for cryptoeconomic innovation. Key tools include enhanced market surveillance, custody standards, clearer classification of digital assets, and tailored AML/CFT measures for on/off ramps. A compact reference table summarizes practical pairings of tools and thier primary purposes:

| Tool | Primary Purpose |

|---|---|

| Custody standards | Reduce counterparty failure risk |

| Market Surveillance | Detect manipulation & flash events |

| Regulatory Sandbox | Test innovations under supervision |

regulations should be implemented with clear procedures and escalation paths so that enforcement and supervision follow agreed policy objectives .

Adaptive governance and stakeholder engagement are essential for managing long-term scarcity-driven dynamics. Regulators should commit to periodic review cycles,public-private working groups,and impact assessments to recalibrate rules as technology and markets evolve. Recommended operational steps include:

- Iterative reviews – scheduled evaluations tied to systemic indicators;

- Open consultations - include developers, exchanges, custodians, and consumer groups;

- Cross-border protocols – harmonize disclosure and resolution frameworks to limit fragmentation.

embedding these mechanisms ensures policy remains an actionable,living plan that balances systemic risk mitigation with continued innovation in a scarce-asset ecosystem .

Q&A

Q: What does “bitcoin’s issuance slows over time” mean?

A: bitcoin’s protocol releases new bitcoins to miners as block rewards, but the reward amount is programmed to decrease over time in discrete steps known as “halvings.” Each halving reduces the rate at which new bitcoins enter circulation, so the issuance rate progressively slows until no new bitcoins are created. this design intentionally reduces new supply over time to increase scarcity.Q: Why was bitcoin designed so issuance slows and supply is limited?

A: The protocol’s designer intended a predictable, capped supply to create scarcity and to contrast with fiat monetary systems that can be expanded by central banks. The limit and slowing issuance are meant to provide a known monetary policy and to make bitcoin a scarce digital asset.

Q: How does the halving mechanism work?

A: Approximately every 210,000 blocks (roughly every four years), the block reward given to miners for producing a block is cut in half. This reduces the number of new bitcoins minted per block, which lowers the annual issuance rate step by step.

Q: What is the maximum number of bitcoins that will ever exist?

A: The bitcoin protocol caps the total supply at 21 million bitcoins. Because issuance halves repeatedly and approaches zero, new supply asymptotically reaches that cap.

Q: When will the last bitcoin be mined?

A: Due to the halving schedule and the discrete block reward reductions, the final fraction of a bitcoin will be created over a long period.Estimates place the last whole satoshi being mined sometime around the year 2140, after which no new bitcoins will be issued.

Q: How does slower issuance increase scarcity?

A: As the rate of new supply falls while demand can grow or remain steady, fewer new units enter the market. This supply-side tightening-combined with a fixed maximum-means each existing unit becomes relatively more scarce compared with a scenario of continuous or expanding issuance.

Q: Does slower issuance affect bitcoin’s inflation rate?

A: Yes. Slower issuance reduces the inflation rate (the percentage increase in supply per year). Early on, bitcoin had a relatively high inflation rate because block rewards were large compared with the supply. Each halving reduces the annual inflation rate, eventually approaching zero as issuance ends.

Q: What are the implications for miners when issuance slows?

A: Block rewards are a major part of miners’ revenue. As rewards shrink, miners increasingly rely on transaction fees to cover operating costs. This economic shift can influence mining profitability, miner consolidation, and incentive structures in the long term. Discussions about mining hardware and pools, and how miners coordinate, are common in mining communities and forums.

Q: Will slower issuance make bitcoin more valuable?

A: Slower issuance alone does not guarantee higher prices-value depends on supply and demand.Scarcity is one supply-side factor that can support higher prices if demand is stable or rising.Market prices, though, are influenced by many factors including adoption, macroeconomics, regulation, and investor sentiment.

Q: Does slower issuance compromise network security?

A: The network’s security model depends on miners being economically incentivized to validate and secure blocks. As block rewards decline, transaction fees are expected to play a larger role in miner compensation.The transition raises questions about long-term incentives and security; though, bitcoin’s decentralized design and ongoing network activity help sustain security. Running a full node also requires bandwidth and storage to maintain the blockchain-a practical consideration for participants operating nodes.

Q: How does the slowing issuance interact with transaction fees?

A: As issuance falls, miners will increasingly rely on transaction fees as compensation. This could make fee markets more important during periods of high demand; users may choose to pay higher fees for priority confirmation, while lower-fee transactions may take longer to confirm.Q: are there misconceptions about bitcoin scarcity and issuance?

A: Common misconceptions include: (1) thinking no new bitcoins are created today (they are,but at a reduced rate); (2) confusing halvings with immediate price guarantees (halvings reduce supply growth but do not ensure price increases); and (3) assuming the cap can be changed easily-altering the 21 million cap would require consensus from the network and is extremely unlikely.

Q: How can a regular user verify bitcoin’s rules and behavior?

A: bitcoin’s rules are implemented in open-source software clients and visible on the blockchain. Users can run full nodes to independently verify transactions and consensus rules-though an initial sync requires bandwidth and storage to download the full chain, as documented on client download pages.

Q: What should readers take away about issuance slowing and scarcity?

A: The programmed slowdown of bitcoin issuance and the fixed 21 million cap are core monetary design features intended to create a scarce digital asset.these mechanics reduce inflation over time and shift economic incentives within the network, with important implications for miners, fee markets, and long-term valuation-though market outcomes remain driven by supply and demand dynamics and also broader economic and technical factors.

The Way forward

bitcoin’s programmed issuance schedule reduces the flow of new coins over time, producing a predictable, disinflationary supply curve that increases bitcoin’s scarcity as fewer new units are created with each halving cycle . That scarcity is a core aspect of bitcoin’s monetary design and shapes discussions about its potential role as a long‑term store of value, even as demand, network security, and market dynamics determine realized outcomes. Ongoing development and community debate continue to refine technical and economic understanding, while practical matters-such as how users secure and access their holdings-remain central to adoption and use .