Hello guys , xuanhaimmoer is here for help and support all you

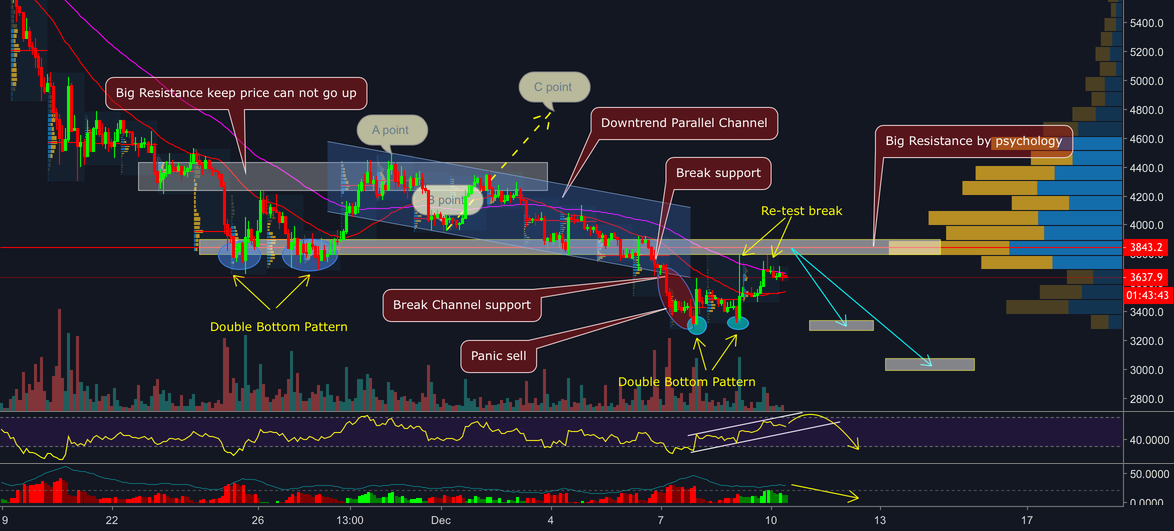

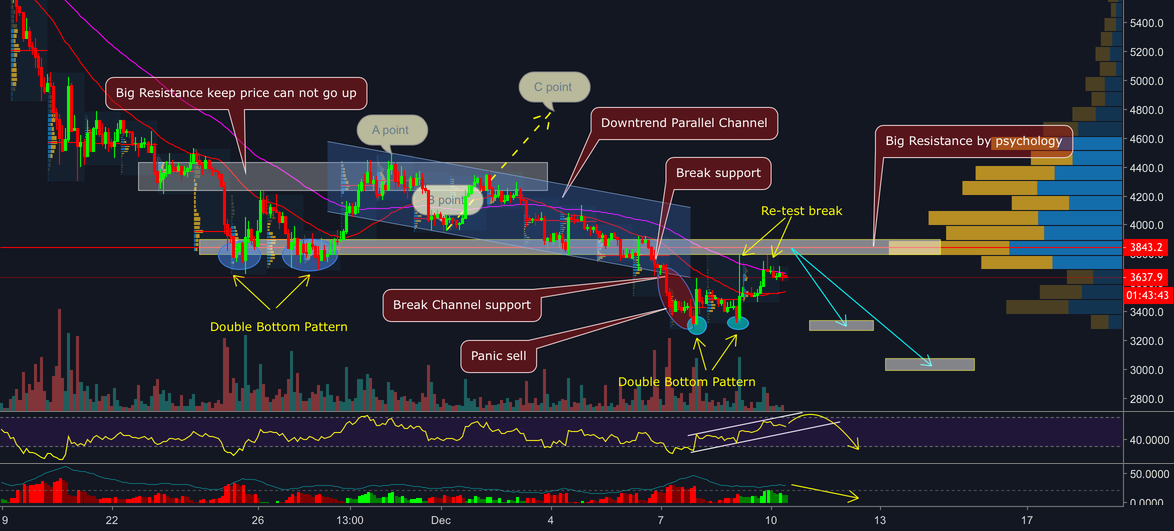

Just like habit in everyday so today I make this chart also an update for new actions of but more important I willing to declare for all you WHY IT IS HARD FOR BREAK UP 3700 – 3900$ ???

Trading is my job and I watch market very hours in day by day, you know ? Each action of market has all meaning of that. Which mean blue and red candle occur in this time ? Why is big in that candle ? Why break up or why break down ? Which meaning in that break and what happen after that ? And very important thing that which meaning market want to show for us in next step of moving by looking in candles ?

Do you want to know about the action of market in recent time via my viewpoint ? Yes ? So keep read in below.

BUT BEFORE READING HELP ME LIKE THIS POST FOR SUPPORT ME !

Okay so now we will solve and understanding about each signal in this chart I make for all you.

We just consider about the price from 25 November up to now guys.

Look at 25 Nov – 27 Nov, what you see in here ? Pattern ? Clearly for buy ? Why you did not buy ?

When the market bounce up from many people think that this is really a signal for middle – term bounce back because we have not any official bounce back from the crazy crash when we break down 57xx$. But what happen after that ? The price can not break up neck line of this pattern in A point. The price correction down to B point.

And in here at that day I predict it has went up to 45xx$ -47xx$ ( C point as predict ) but what happen ? We can not break up by the stronger of bear and fear psychology.

From here we have Downtrend . In Dec , we officially break down the major support 36xx$ and very fast after that we also break down with panic zone of selling from market.

We can not break up neck line which is normal way but why did not ? And also has recent panic sell so what do you think about the market right now ? Bear is clearly so do you believe that can break up 3600 – 3900$ ? With me that is hard for us.

Take some criteria in here for next.

After Panic sell we also have Pattern and put the price go up but look at the ? It is lower than before so do you think it is good for going up ? We will see bear soon.

Also look at Visible Range of we all see the in 3600 – 3900$ is big so many investor they buy in high so they will sell when the price come here.

For more detail, research about Session of each time period that we all see high for accumulation before dump very strong. Also clearly with some big red column of will give you evidence market.

DMI 4C show for us is weaker

in Pattern so we just go up for little before reached overbuy zone and next bear will come!

So what about the target. That is my prediction – not recommend for buy and sell so remember !

The target for next term is 33xx$ ( the last Double bottome zone ) or 2800 – 3000$ is bottom zone as LEGENDARY ANALYSIS.

Thank for reading and hope all you can get some helpful information in here !

LIKE & SHARE for support me !

Published at Mon, 10 Dec 2018 04:16:23 +0000