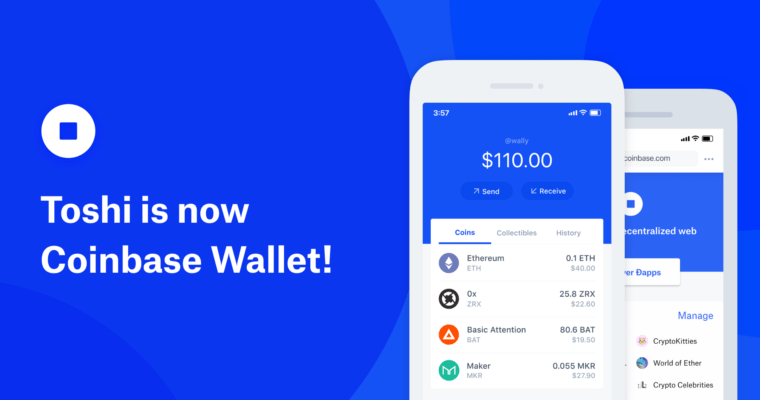

Toshi, the open source DApp browser and wallet designed by Coinbase will now be known as Coinbase Wallet.

In a Medium published on Wednesday, the company says the name change is beyond branding, and more of a “larger effort to invest in products” that will shape the future of the decentralized web.

Siddharth Coelho-Prabhu, Product Lead at Toshi while commenting on the development said the Toshi app would “upgrade to Coinbase Wallet” shortly and users can look forward to the “same great product” with an enhanced new look

Coinbase Wallet will feature some upgrade which is expected to serve as a home for “exploring the decentralized web” and the possibilities that comes with it. In addition to managing Ethereum and ERC-20 tokens, which was possible on Toshi, the new wallet will also support bitcoin, bitcoin Cash, and Litecoin. Users will also be able to receive ICO tokens, airdrops, store crypto collectibles and access leading decentralized exchanges from the wallet.

On security, Coinbase says the new wallet will be equipped with the “best-in-class secure storage” which would secure private keys using “your device’s Secure Enclave and biometric authentication technology.”

Coinbase plans to make the new Coinbase Wallet all-encompassing so users can “explore the full universe of third-party dapps” that makes everything possible from taking out loans to completing tasks in exchange for crypto payments. The company also believes the wallet can accelerate the adoption of cryptocurrencies and DApps around the world.

Toshi was last year, inspired by mobile money apps like WeChat that drives a large volume of digital payments in China. Built to be similar to a web browser that runs on your phone, Toshi allows you access an open financial network. The app comes with a built-in reputation system which makes it easier to rate other users and apps hosted on the software. At the time, the company said the app was built with the aim of providing “access to financial services” to a vast majority of the world’s population.

Featured image from Shutterstock.

Follow us on or subscribe to our newsletter .

•

•

•

Published at Thu, 16 Aug 2018 13:34:51 +0000

News