INTRA-DAY BREAKDOWN – 20/03/19 (REDACTED BREAK DOWN FROM PRIORITY – OUR PREMIUM SERVICE)

We will do the top down style analysis that you should have become accustomed to by now to look at possible price direction.

WHAT CAN BE SEEN ON THE FOR XBT ?

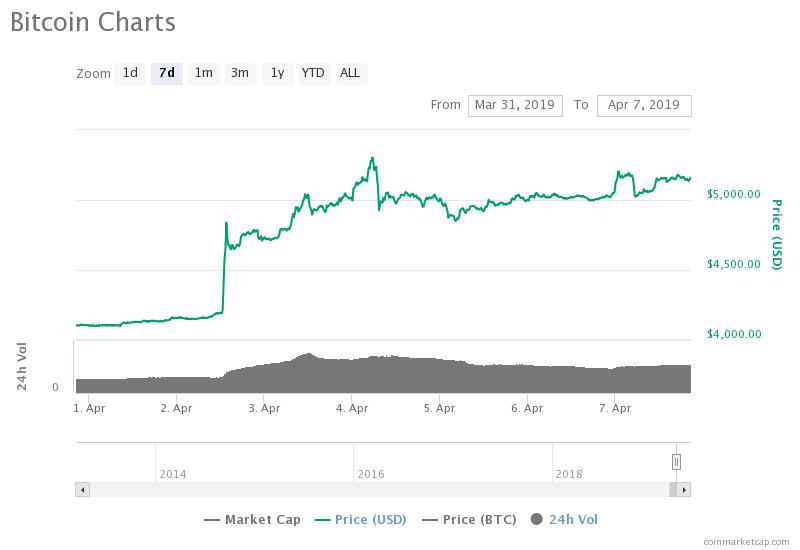

– Well, in the , which is more zoomed out, we can see our fan structure, which has dictated demand and supply zones for most of 2018 and 2019 thus far. We can see that we have officially broken the biggest resistance line to date in red. Moreover, with the lows at 3200$ thus far on BITFINEX, and 3060$ on Bitmex, we have tried the first of support at these levels – well, just nearly as we meet this support at 3060$ on BITFINEX. We can also see we are near the bottom now and the retest of resistance on the daily at 4720$ can not be ruled out in order to create a false breakout and a little bit more FOMO as we approach the bottom. IF on Bitfinex rises to highs of 4720$ then we can also expect XBT to test highs of 4500$! The actual bottom in reality is more closer to 2050-2200$ and as you can see on our zoomed out picture in order for you Guys to gain the bigger picture. Therefore, in any situation, there is still some downward activity to make up for but on an intra-day basis we could see some upward relief to highs of/and capped to 4720$ due to resistance laying at this price.

– On our daily chart, we can see that we have approached our first ceiling at 4120$ and we have consistently seen a rejection from this level for the past 5 days. We can also see on our chart that pressure has been declining and that the created are either becoming or very weak . None the less, its important to point out thus far we have successfully been creating higher lows every time. We can also see the resistance at just 4720$ and the downtrend line, at just below 5111$ – THESE TWO PRICE LIMITS ARE ABSOLUTE EXTREME CASE CEILINGS and will not come into play unless we see drastic behaviour. Therefor, for you guys, you should be really seeing these price targets as extreme case targets. Lastly, its important to note that MA’s are still being used as supports and that unless they break 3900$ to the downside and disrupt higher low formation completely, this may remain the same – but, a break of 3900$ MA support would also be the second validation for shorting this to 3480$ and 3650$ MAJOR SUPPORT ZONES.

WHAT CAN WE SEE ON OUR 4 HOURLY CHART FOR ?

– On our 4 hourly price chart, we can see that we have successfully made higher lows but activity is being blocked by the resistance wall at 4121$. We can also see that a break of 4080$ will signal to us a journey to our first in line with support on the 4 hourly at 3960$ and would also implicate the negation of MA support and it would instead start to act as a resistance. This would mean that on we would test support at 3850-70$ and even lows of 3800$.

WHAT CAN WE SEE ON OUR 1 HOURLY CHART FOR ?

– On our 1 hourly chart for we can see again rejection from ceiling. MA’s are also starting to do a crossover. We can also see that support currently lays at 4050$. We can see that price has been stagnant for quite sometime and that higher low formation may be broken soon.

TO CONCLUDE:

1. PRICE ACTION ON BITFINEX IS CAPPED TO 4720$ AND 5111$ RESPECTIVELY – both of these targets and resistance points are extreme case scenarios and will first be indicated by a break of 4121$ resistance and also finally 4223$ resistance on BITFINEX. We expect bitmex price to also make highs between 4380-4500$ and 4900$ in these two respective scenarios – our confirmation prices for FINEX are at 4125$ and 4225$ respectively, one being conservative (the latter).

2. NONE THE LESS, UNLESS WE BREAK 4121$, PRICE ACTION STILL IS HOLDING PRECEDENCE. This will first be indicated by the break of higher low formation and a break below 4080$. Thereafter, a break below support on the hourly at 4050$ and on the 4 hourly at 3960$. This would place XBT testing 3870-50$ support.

3. A break of 3960$ will indicate a break of all structure and therefore, we would be heading for 3480$ and 3650$ respectively – therefore this is our confirmation price for fines.

PLEASE SEE RELATED IDEAS DOWN BELOW 😉 & don’t forget to stay up to date with our calls by following our Instagram and telegram channels down below AND ON OUR TRADINGVIEW PAGE – CALL AFTER CALL CORRECT!

Published at Wed, 20 Mar 2019 18:24:08 +0000