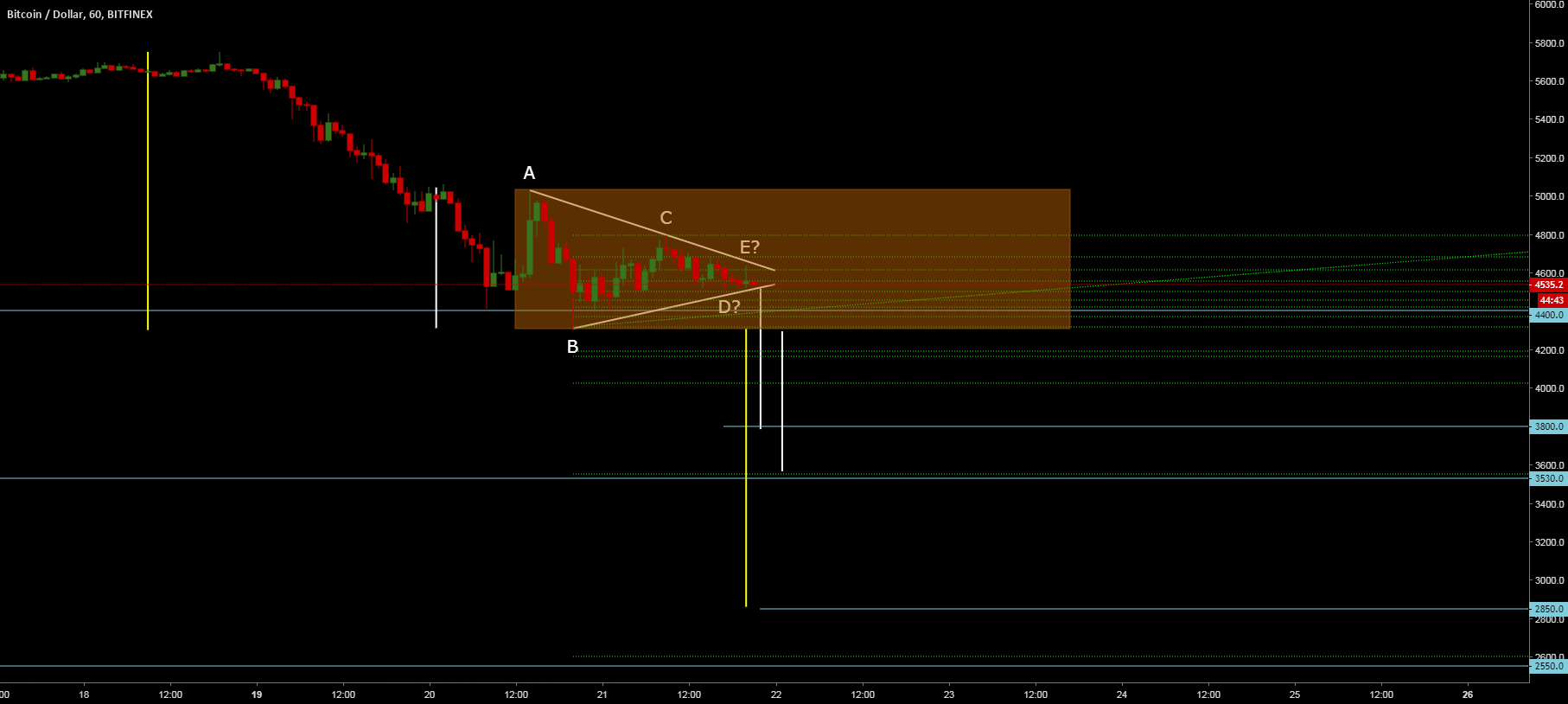

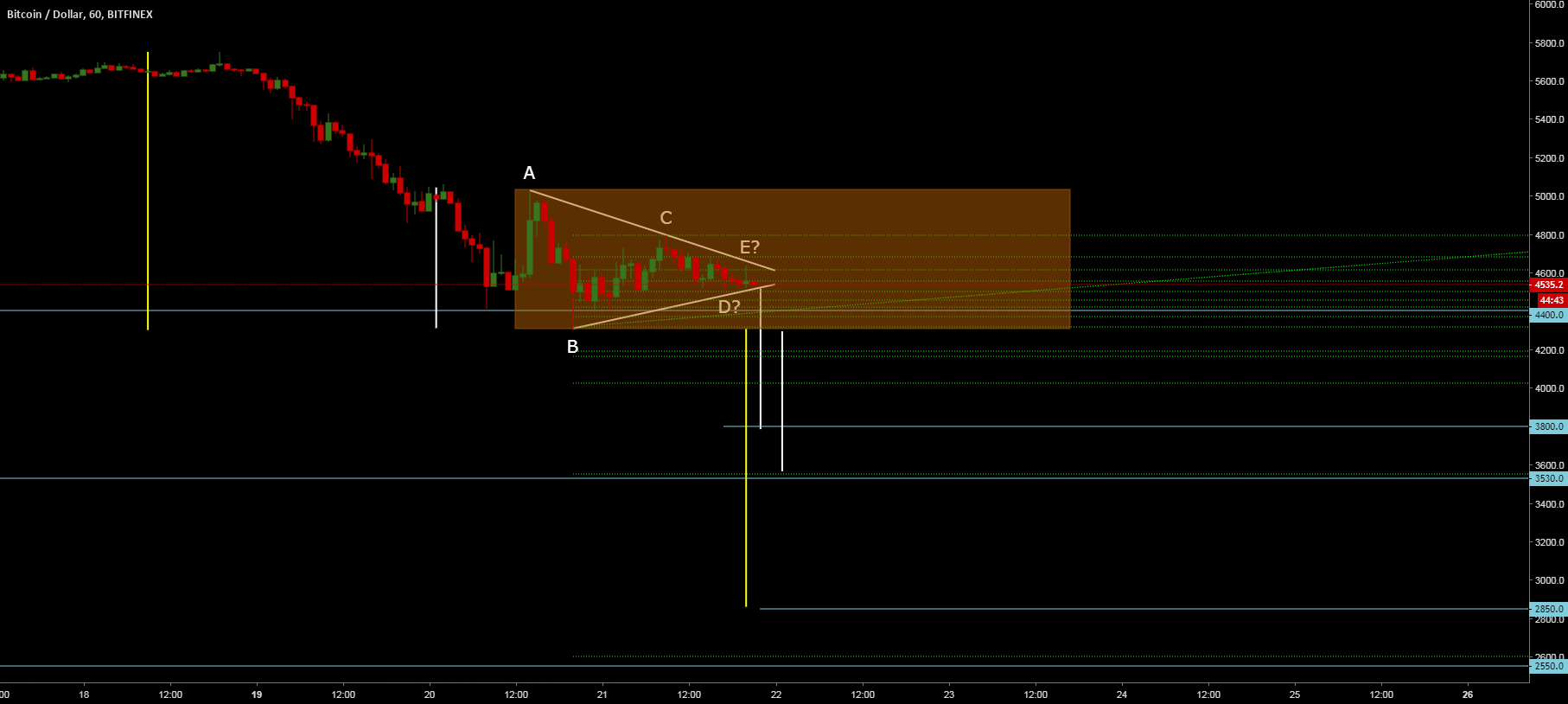

H1 chart, point us a PA exhaustion. But based on the analysis, we still have plenty of room for the side.

Even if this Symmetrical Triangle would be BO on top, would still be a corrective Pattern (Falling/Rising/Widening Triangle or ).

After a previous aggressive Impulse, we can expect a certain pressure from the Buyers (could be “whales”) and therefore a correction. But, , I don’t expect it to last or to be strong enough to cover a healthy of minimum 50%, ideal 61.8%, from the whole impulse. Which, technically means, a powerful NEW Impulse to be in place.

The white projection lines, represent Triangle or TP levels. And the big yellow one, represent the Inverted Flag TP.

Though it’s a Symmetrical Triangle (based on the and LHs), I don’t expect the event of a BO on top to last ( the pattern would become a , in development).

The ray horizontal lines represent minor Support live, where we should usually see a 38.2% . And on the Big we should expect ideal & healthy retracements of min 50% fib (confluence with added on the counter trend green fib, instead of using the Fib Extension tool).

And the whole Correction would become later on a (“W” letter ). So, I look for to Sell again, when any of these Correction will end.

Hope this helps.

Ice.

Published at Wed, 21 Nov 2018 21:15:19 +0000