Friday, May 10 — () has seen today, having surged above the $6,300 price mark and hit market dominance records from December 2017, according to data from .

The major is seeing the biggest gains out of the top 20 coins by , up 4.4% over the past 24 hours at press time, while the rest of the top 20 list are seeing mixed signals. coin () is down 4.3%, while cosmos () is down 5.6% at press time.

is also seeing the biggest gains over the past 7 days, holding around gains at press time.

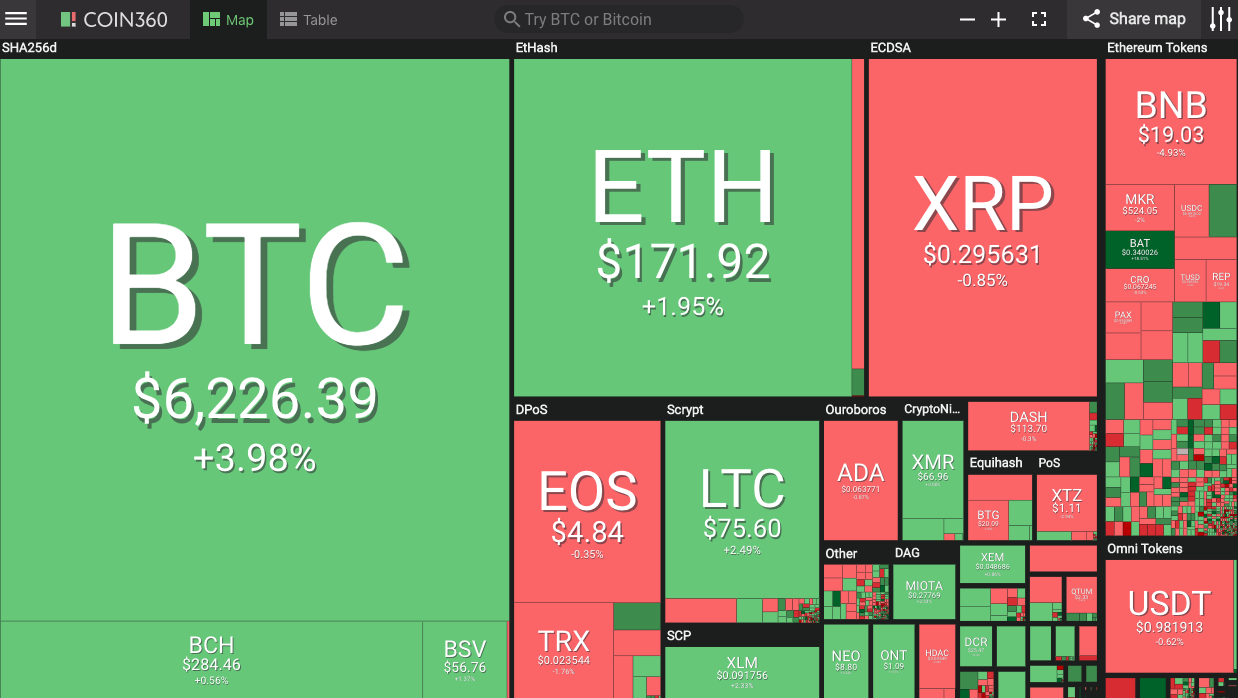

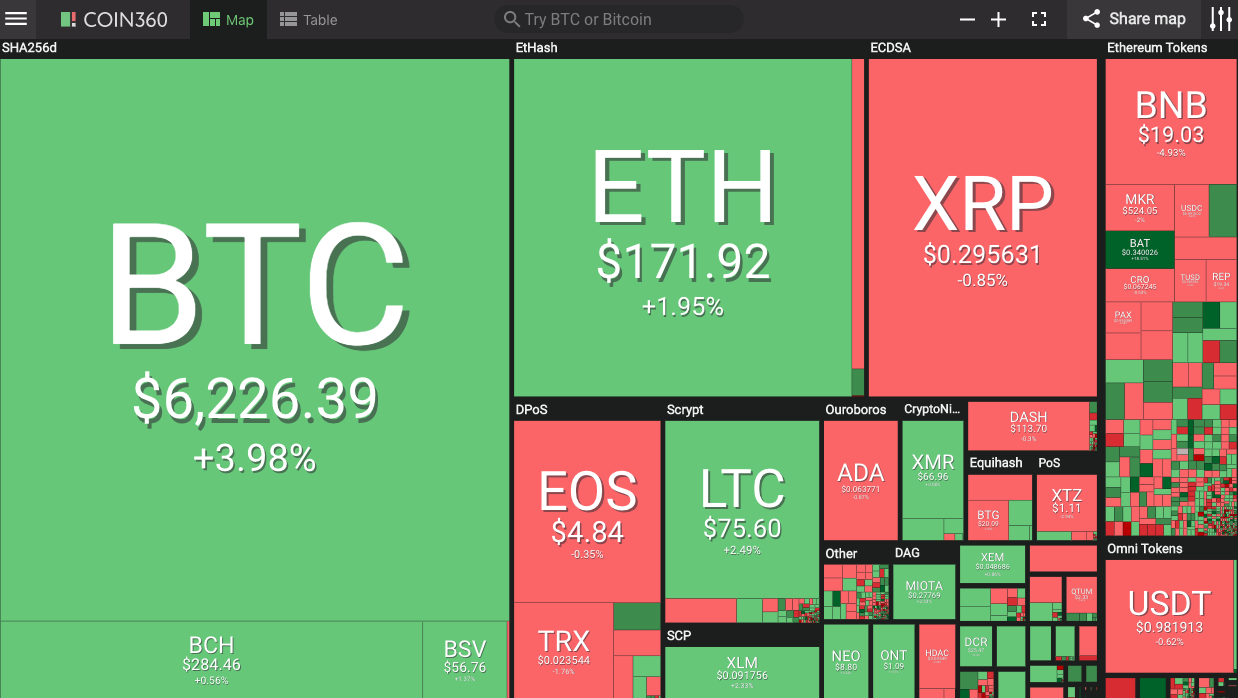

Market visualization from

has continued hitting new 2019 records this week, having surged to as high as $6,353 earlier in the day. At press time, the biggest is at $6,304 with a market cap of $111 billion. This is the highest share of the market since December 2017, when was approaching its of $20,000.

1-year price chart. Source:

At press time, ’s dominance rate accounts for 58% of the overall crypto market.

Percentage of total market cap (dominance). Source:

Ether (), the second-largest by market cap, is up 2.1% to trade at $172 as of press time, seeing almost equal gains over the past 7 days, up 2.7%.

Ether 7-day price chart. Source:

, the third-top by market cap, is slightly up 0.1% to trade at $0.298 at press time. However, the second-top is down around 3.3% over the past 7 days.

XRP 7-day price chart. Source:

Total has surged to the volumes of mid-November 2018, accounting for $192 billion at press time. Daily trade volume amounts to $56 billion.

Total market capitalization 7-day chart. Source:

Yesterday, Galaxy Digital CEO that will break new all-time-highs within 18 months, adding that the $6,000 threshold is likely to be a stall point, while the next price point will be $10,000.

On the other hand, famous crypto sceptic recently his negative stance on , claiming that “crypto is the mother and father of all bubbles.”

Meanwhile, the government of Liechtenstein recently new and crypto-related in order to improve investor protection and establish more clarity in the industry.

While crypto markets have seen a major bullish move this week, global stock markets have seen a massive sell-off, with investors having withdrawn over $20.5 billion from global equities in the past week amid tensions between the United States and , reports. At press time, the Dow Jones Industrial Average () is down 0.3%, while S&P 500 () and () Composite are both down around 0.2%.

prices are seeing mixed signals at press time, with West Texas Intermediate (WTI) crude oil down 0.3% on the day, while Brent crude is slightly up around 0.1%, according to . The OPEC basket dropped 0.8% as of press time.

prices have seen mild gains today, with having edged up 0.1% to $1,285 per ounce at press time, while also gained around 0.1% to $1,287.

Published at Sat, 11 May 2019 05:51:24 +0000