bitcoin (BTC) has pulled back from the 11-day highs, still, the short-term outlook remains bullish, the technical studies indicate.

The leading cryptocurrency looked overbought , as per short-duration indicators, having rallied to $6,681 on Bitfinex on Monday – the highest level since June 22.

Consequently, BTC fell back to $6,414 earlier today and was last seen trading at $6,530 – down 2.2 percent on a 24-hour basis.

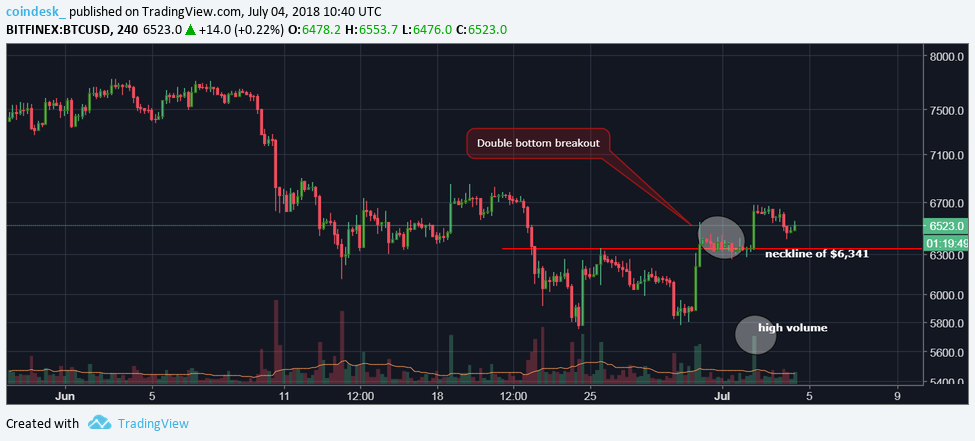

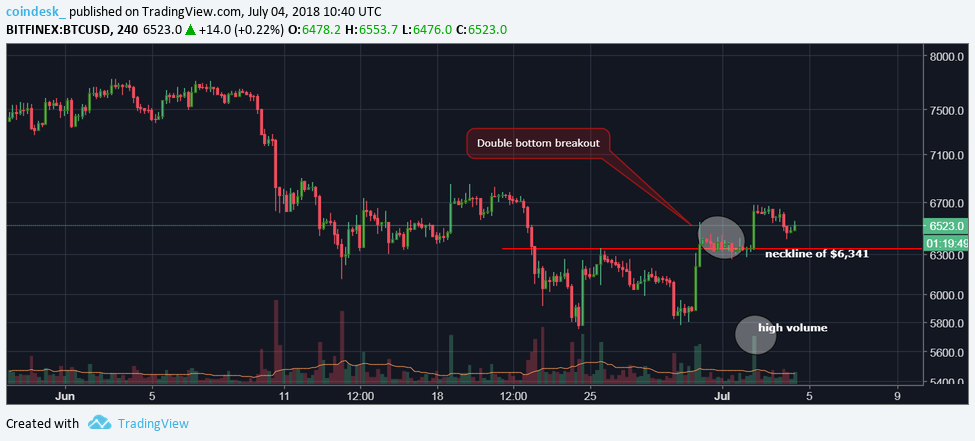

Clearly, the bullish momentum has waned in the last 24 hours, still, the technical charts are biased to the bulls and the probability of BTC rallying to $7,000 (psychological hurdle) remains high while prices are holding above the former resistance-turned-support of $6,341, as seen in the chart below.

4-hour chart

BTC breached the double bottom neckline resistance of $6,341 on Saturday, confirming a short-term bullish reversal and opening doors to $6,927 (target as per the measured height method). Further, it built a nice base (marked by a circle) around $6,341 before staging a high volume rally to $6,681 on Sunday.

Clearly, $6,341 is a strong support and only a break below that level would weaken the bull case.

Currently, BTC is trading well above the neckline support and is looking northwards as indicated by the double bottom breakout and .

Daily chart

The falling channel breakout and the bullish crossover between the 5-day and 10-day moving average (MA) indicate the rally from the June 24 low of $6,755 is likely to continue in the days ahead.

On the way higher, BTC may encounter resistance at (June 19 high), $6,880 (upper Bollinger Band), $7,067 (50-day MA).

View

- bitcoin is seen rising to $7,000 in the short-term and could rally further if its move toward the psychological hurdle is backed by a sharp rise in the trading volume

- A break below $6,341 (former resistance-turned-support) would weaken the bull case. However, only a daily close below $6,275 (Monday’s low) would abort the bullish view.

- A daily close below $5,755 (June 24 low) would signal a revival of the sell-off from the May high of $9,990 and would shift risk in favor of a drop to $5,400 (November 12 low).

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a . CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.

Published at Wed, 04 Jul 2018 11:00:22 +0000

Markets