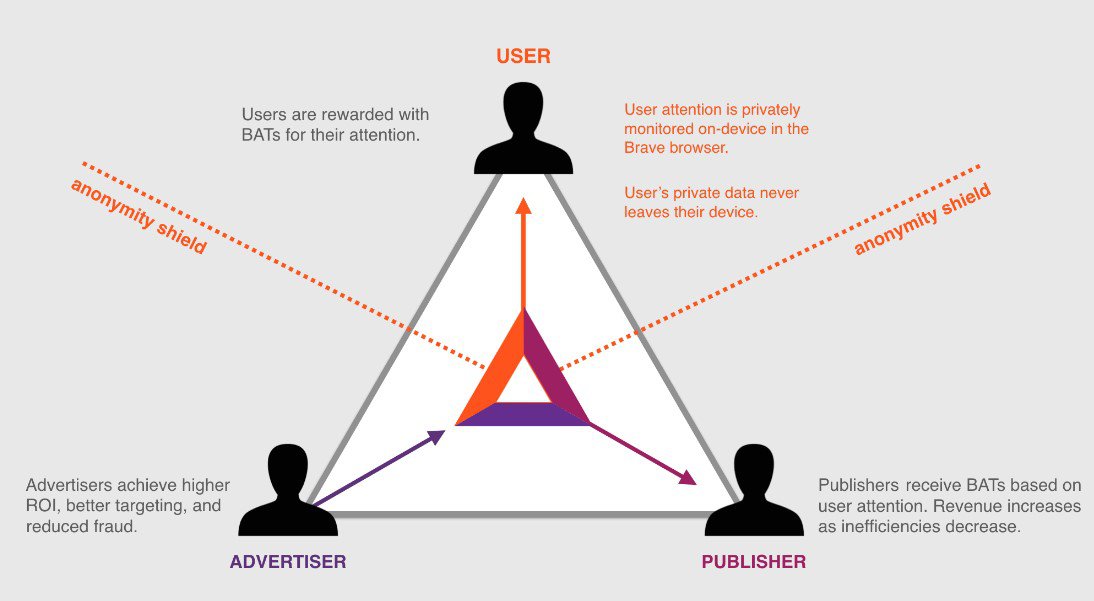

Since the launch of bitcoin in 2009, blockchain technology has evolved from a peer‑to‑peer electronic cash system into a foundation for programmable money and decentralized applications. bitcoin, originally designed as a secure, censorship‑resistant digital currency, enables users to send value directly without a central authority, using cryptography and a public ledger of transactions known as the blockchain . Ethereum,introduced later,extended this concept by embedding a more expressive programming habitat directly into its blockchain,allowing developers to deploy complex smart contracts and decentralized applications.

This divergence in design has led to an ongoing debate: how do bitcoin’s more constrained smart contract capabilities compare to Ethereum’s flexible, general‑purpose approach? bitcoin’s scripting system was intentionally kept limited to reduce attack surfaces and prioritize security, reliability, and monetary soundness . ethereum, by contrast, was built around a Turing‑complete virtual machine, explicitly optimizing for flexibility and rapid innovation in use cases beyond simple payments.

This article examines the trade‑offs between bitcoin’s conservative, security‑first smart contract model and Ethereum’s broader programmability. It will outline how each network’s architecture shapes what can be built, discuss the implications for security, scalability, and decentralization, and explore how emerging technologies are pushing bitcoin toward greater functionality while Ethereum continues to refine and secure its flexible environment.

Understanding the foundations How bitcoin and Ethereum implement smart contracts at the protocol level

At the lowest level, bitcoin and Ethereum embed contract logic directly into their consensus rules, but they take radically different paths. bitcoin relies on a deliberately constrained, stack-based scripting language baked into each transaction output. A transaction spends coins only if the unlocking script (scriptSig or witness data) satisfies the locking script (scriptPubKey), enabling simple yet powerful conditions such as multisignature schemes, timelocks, and hash locks. This design keeps validation predictable and minimizes attack surface, reinforcing bitcoin’s role as a secure, censorship‑resistant settlement layer rather than a general-purpose computation platform .

Ethereum, by contrast, introduces a fully programmable virtual machine (EVM) that runs on every node and executes bytecode stored on-chain as part of contract accounts. Rather of encoding conditions in individual outputs, Ethereum treats smart contracts as long‑lived stateful programs with their own storage, balance, and code. Each operation in the EVM consumes gas, a metering unit paid in ETH that both incentivizes validators and bounds computation.This architecture allows developers to implement complex decentralized applications, but it also means every state transition must be carefully priced and validated across the entire network, increasing systemic complexity compared to bitcoin’s UTXO-centric model .

These protocol-level choices lead to very different smart contract patterns and trade‑offs:

- bitcoin: stateless scripts bound to individual UTXOs, focused on security, auditability, and predictable behavior.

- Ethereum: stateful contracts with internal storage and logic, optimized for flexibility and rapid dApp advancement.

- Security model: bitcoin minimizes complexity; Ethereum embraces expressiveness, accepting a broader attack surface.

- Resource accounting: bitcoin limits opcodes and script size; ethereum uses gas pricing and block gas limits.

| Aspect | bitcoin | Ethereum |

|---|---|---|

| Core model | UTXO + scripts | Accounts + EVM |

| Contract form | Spend conditions | On-chain programs |

| Design goal | Robust settlement | General computation |

Security trade offs Script simplicity in bitcoin versus Turing completeness in Ethereum

bitcoin’s intentionally limited scripting language offers a narrow attack surface: scripts are mostly stack-based, non-Turing complete, and exclude features like loops, which sharply reduces the risk of unexpected behaviors and denial-of-service vectors on the base layer . This minimalism supports bitcoin’s core design goal as a robust, censorship-resistant settlement network and “hard money” asset, where predictability and auditability of transaction rules outweigh expressiveness. In practice,many potential vulnerabilities are pre-emptively ruled out simply because the language cannot express them,and this simplicity helps full nodes validate blocks deterministically and efficiently across a globally distributed network of peers .

Ethereum, by contrast, embraces Turing completeness at the virtual machine level, enabling arbitrarily complex smart contracts and decentralized applications running beyond simple peer‑to‑peer value transfers . This power introduces a broader attack surface: reentrancy bugs, mispriced gas usage, logic errors, and unexpected state interactions all become realistic risks. The protocol mitigates some of this with gas as a metering mechanism to cap execution and discourage infinite loops, but complexity inevitably increases the burden on auditors, developers, and users who must understand contract behavior under many execution paths. Consequently, formal verification, rigorous code review, and battle‑tested libraries are not optional niceties but core security requirements in the Ethereum ecosystem.

From a security engineering outlook, the trade‑off can be summarized as constrained but sturdy versus flexible but fragile without discipline. bitcoin’s model favors simple, composable primitives (multi‑sig, timelocks, hashlocks) that can be layered into higher‑level protocols, while Ethereum internalizes much of that logic on‑chain, where bugs are costly and public. Developers weigh these differences when choosing a platform, frequently enough deciding whether to accept bitcoin’s scripting constraints in exchange for strong base‑layer assurances, or to leverage Ethereum’s expressiveness with the understanding that every additional line of contract code is a potential liability.The contrast is clear in how each network is used today: bitcoin as a secure, value-dense settlement layer ,and Ethereum as a programmable environment where security is an ongoing,active practice embedded in the development lifecycle.

Programming models A comparison of bitcoin Script Miniscript and Solidity for developers

bitcoin’s base-layer contracts are written in bitcoin Script,a low-level,stack-based,non-Turing-complete language that executes deterministically across the peer-to-peer network maintaining the ledger.It exposes a minimal set of opcodes for signature checks, timelocks, and basic logical operations, with no loops or dynamic memory, drastically reducing attack surface at the cost of expressiveness. Miniscript sits on top of Script as a structured,composable language that constrains how Script fragments are written and combined,allowing developers to reason about spending conditions,analyze safety properties,and automatically generate standard scripts. This makes complex policies-like multi-party escrows and time-based recovery paths-auditable and tool-amiable without changing bitcoin’s consensus rules.

By contrast, Ethereum smart contracts are primarily authored in Solidity, a high-level, contract-oriented and Turing-complete language designed for stateful applications and rich on-chain logic. Developers can define custom data structures, inheritance hierarchies, and complex control flow, while interacting with a global shared state maintained collectively by network nodes, similar in spirit to how bitcoin nodes synchronize the blockchain. This flexibility enables DeFi protocols, NFTs, and DAOs in a single contract account, but also introduces surface area for reentrancy, integer overflows, and gas-related vulnerabilities that simply do not exist in the constrained bitcoin Script environment. In practice,Solidity projects rely on extensive testing,audits,and patterns such as checks-effects-interactions to keep complexity in check.

From a developer’s perspective, choosing between these models is a decision about guarantees versus freedom. bitcoin Script and Miniscript emphasize policy clarity, static analysis, and predictable execution, making them well-suited for custody rules, vaults, and layered constructions that push arbitrary logic off-chain and use the blockchain as a final settlement arbiter. Solidity, in turn, favors expressive, on-chain programmability, ideal for applications where business logic must be obvious and self-contained on the ledger itself. Key trade-offs can be summarized as:

- Safety-first vs. feature-rich: Script/Miniscript minimize footguns; Solidity exposes a full programming model.

- UTXO contracts vs. account state: bitcoin uses contract-like locking conditions on outputs; Ethereum manages mutable contract state directly.

- On-chain logic vs. off-chain coordination: Miniscript often pairs with off-chain protocols; Solidity tends to encode more behavior on-chain.

| Aspect | bitcoin Script / Miniscript | Solidity |

|---|---|---|

| Language type | Stack-based, non-Turing-complete | High-level, Turing-complete |

| Typical use | Spending policies, multisig, vaults | DeFi, NFTs, DAOs, complex dApps |

| Risk profile | Smaller surface, strict constraints | Broader surface, richer behavior |

| tooling focus | Static policy analysis, templates | Testing, formal verification, audits |

Scalability and fees How network design impacts contract complexity and transaction costs

Network architecture directly shapes how complex smart contracts can be before fees become prohibitive. bitcoin’s relatively small block size and conservative scripting system encourage contracts that are compact, linear, and predictable, helping keep verification overhead low on a global, permissionless network where every full node independently validates the full history of transactions. Ethereum, by contrast, prices every computational step in gas, allowing arbitrary logic but making contract authors responsible for optimizing code paths, storage usage and execution patterns to avoid runaway costs during periods of congestion.As a result, developers on both chains are forced into different design philosophies, with bitcoin favoring minimalism and Ethereum favoring expressiveness with explicit cost accounting.

| Aspect | bitcoin | Ethereum |

|---|---|---|

| Contract style | Script-based, constrained | Turing-complete, flexible |

| Fee metric | Bytes in transaction | Gas per operation |

| Scalability pressure | Block space competition | Execution + storage load |

These structural differences ripple into real-world costs for end-users. On bitcoin, contract designers frequently enough rely on simple multi-signature flows, time-locks and covenant-like patterns that minimize on-chain complexity and defer rich behavior to off-chain protocols, such as payment channels, sidechains or batched settlements. Ethereum’s dApp ecosystems frequently embrace more intricate on-chain logic-automated market makers, multi-step DeFi strategies, and composable protocols-but users can face volatile gas prices when the network is saturated. To navigate this landscape, developers typically:

- Favor state-minimal designs that reduce storage-heavy operations.

- Use layer-2 solutions and rollups to amortize contract execution costs across many users.

- Adopt fee-aware UX, such as batching actions and allowing flexible gas settings.

Use case suitability when to choose bitcoin smart contracts over Ethereum based on business needs

bitcoin’s scripting capabilities are intentionally limited, but this constraint can be an advantage when your business values predictability, security, and monetary finality above expressive logic.As bitcoin is primarily designed as a decentralized digital currency with a robust, battle-tested consensus layer, it is well suited for use cases where the contract logic is relatively simple yet must secure high-value transfers over long time horizons. Typical scenarios include long-term treasury management, escrow arrangements, time-locked payouts, and multi-signature corporate controls that prioritize resistance to change over rapid innovation. In such contexts,the reduced attack surface of bitcoin scripts can align better with conservative risk policies than Ethereum’s more complex virtual machine.

Organizations may also prefer bitcoin-based smart contracts when they want alignment with bitcoin’s macro narrative as “hard money” and its liquidity profile in global markets. Such as, asset managers, payment processors, and international remittance providers building programmatic flows around BTC settlements can benefit from having contract logic that lives as close as possible to the underlying settlement asset. Consider choosing bitcoin when your request:

- Involves simple conditional payments (e.g., HTLCs, time locks, multi-sig).

- Needs maximum censorship resistance and long-term settlement assurances.

- Focuses on value transfer and custody,not complex stateful applications.

- Operates in a high-regulation, low-change corporate environment.

In contrast, Ethereum’s more flexible smart contract model tends to dominate for complex, stateful dApps such as DeFi protocols, NFTs, and on-chain governance systems that require frequent upgrades and intricate business logic. When your product roadmap depends on rapid iteration, composability with a broad ecosystem of protocols, and programmable interactions beyond simple spending conditions, Ethereum generally offers a better fit. A concise comparison can help clarify where bitcoin smart contracts are most suitable from a business standpoint:

| Business Priority | Better Fit: bitcoin | Better Fit: Ethereum |

|---|---|---|

| High-value, long-term settlement | Yes | Possible, but secondary |

| Complex, evolving logic | Limited | Core strength |

| Conservative risk posture | Aligned | Requires stricter governance |

| Ecosystem composability | Niche, emerging | Extensive |

Tooling and developer ecosystem Evaluating wallets libraries IDEs and infrastructure support

On bitcoin, the tooling landscape has historically revolved around secure value transfer rather than rich application logic, and that is reflected in its wallets and libraries. Core-focused wallets and full-node clients prioritize robustness, self-custody and network validation, with many implementations aiming to help users fully verify transactions and blocks without trusting third-party infrastructure. Developer libraries tend to be low-level and protocol-centric, exposing primitives for transaction construction, scripting and multi-signature, while higher-level smart contract frameworks (e.g., for Taproot or covenants) remain comparatively niche. This conservative stack slows rapid experimentation but offers a mature, security-hardened foundation for contracts tightly coupled to payments.

Ethereum, in contrast, offers a vertically integrated stack tailored for dApp builders. From browser-based IDEs like Remix, to plugin-rich environments for VS Code, frameworks such as Hardhat and Foundry, and widely adopted libraries like ethers.js and web3.js, the ecosystem encourages fast iteration and reusable patterns. Wallets commonly act as dApp gateways rather than just coin vaults,with browser extensions and mobile clients embedding direct support for contract calls,event subscriptions and network switching. This creates a feedback loop where infrastructure providers, explorers and testing tools continually adapt to new token standards and DeFi primitives, reinforcing Ethereum’s position as a general-purpose smart contract platform.

When evaluating where to build, teams must look beyond language design and compare the surrounding infrastructure: node services, monitoring, deployment pipelines and wallet integration paths. bitcoin’s ecosystem offers battle-tested full nodes and mobile wallets focused on decentralization and zero-trust principles, making it attractive for contracts that demand maximum resilience and monetary finality. Ethereum’s broader choice of managed RPC providers, indexing layers and analytics tools, however, makes it easier to instrument complex application logic and user flows. Key decision points typically include:

- Wallet integration: UX for signing, fee estimation and network switching.

- Library maturity: Availability of audited, composable components.

- IDE and tooling: Debuggers, simulators and testing frameworks.

- Infrastructure depth: Nodes, indexers, monitoring and DevOps support.

| Aspect | bitcoin | Ethereum |

|---|---|---|

| Primary tooling focus | Security & validation | dApp development speed |

| Wallet role | Store & verify funds | Interact with contracts |

| Library layer | Low-level protocol APIs | High-level contract SDKs |

| Infra richness | Stable, conservative | Diverse, fast-evolving |

Cross chain innovation Examining Layer 2 sidechains and bridges for extended contract flexibility

As bitcoin experiments with Layer 2 designs and sidechains, its conservative base layer is increasingly augmented by environments that feel closer to Ethereum’s contract model. Systems like the Lightning Network, Rootstock (RSK), Liquid, and emerging rollup-style constructions aim to preserve bitcoin’s settlement assurances while enabling more expressive logic off-chain. In practice, this means that complex contract flows-from multi-step swaps to wrapped synthetic assets-can be executed away from the main chain, with final settlement anchored back to bitcoin. The trade-off is architectural complexity: every additional layer adds new trust assumptions,liquidity fragmentation,and potential attack surfaces that must be weighed against the gains in programmability.

Cross-chain bridges further expand this design space by allowing bitcoin value to flow into Ethereum-style environments and back again,turning BTC into a programmable asset without altering bitcoin’s base protocol. These mechanisms typically rely on:

- Lock-and-mint models where BTC is locked on bitcoin and a representation is minted on another chain.

- Federated or multi-signature custodians that collectively control locked funds.

- Light client or zk-based bridges that verify foreign chain state with minimal trust.

Each model balances decentralization, speed, and security differently. While Ethereum’s native contracts can compose seamlessly within a single state machine, bitcoin-backed assets on foreign chains depend on the correctness and integrity of bridge logic and off-chain validators, adding layers of systemic risk that must be transparently understood by users and developers.

| Approach | Contract Flexibility | Security Anchor | Trust Model |

|---|---|---|---|

| bitcoin L2 sidechain | High, EVM-like or custom VMs | bitcoin finality & peg rules | Federated or pegged, protocol-defined |

| Ethereum-native BTC bridge | Very high, full Solidity stack | Ethereum consensus & bridge contract | Custodial, oracle or light-client based |

| Pure Ethereum dApp | Very high, rich composability | ethereum L1/L2 | On-chain, protocol-native |

From a design perspective, bitcoin-oriented solutions emphasize sound settlement and minimal base-layer change, offloading experimentation to ancillary layers and sidechains. Ethereum, by contrast, integrates flexibility directly into its core execution environment, with L2s focused more on scaling than compensating for missing opcodes. The emerging cross-chain stack therefore looks asymmetric: bitcoin leans on layered innovation to approximate Ethereum-like contracts, while Ethereum increasingly becomes the programmable hub that absorbs and mobilizes bitcoin liquidity via bridges and wrapped representations.

Regulatory and risk considerations Compliance attack surfaces and long term maintainability

From a regulatory perspective, bitcoin’s comparatively constrained smart contract capabilities can be an advantage as well as a limitation. Because bitcoin focuses on simple, script-based conditions around value transfer rather than full application logic, its compliance attack surface is generally narrower: there are fewer protocol-level features that can inadvertently create new categories of financial instruments or opaque on‑chain behaviors .Ethereum’s highly expressive environment, by contrast, enables complex DeFi primitives, derivatives-like structures, and composable financial products at scale, which can invite deeper scrutiny from securities, derivatives, and consumer protection regulators. This does not make bitcoin “regulation-proof,” but it means that many compliance conversations focus on endpoints-exchanges, custodians, and payment processors-rather than on the protocol’s contract layer itself.

When mapping attack surfaces, Ethereum’s flexibility introduces multiple layers of risk beyond the base protocol. Vulnerabilities can emerge from contract logic, upgrade mechanisms, governance tokens, and cross‑protocol integrations, leading to cascading failures when a single contract is exploited.bitcoin smart contracts, by virtue of limited opcodes and a UTXO‑based model, tend to have smaller, more auditable code paths for critical value flows, which can be easier to reason about and formally verify . In practice, this means builders on Ethereum must maintain robust security practices around:

- Formal verification and third‑party audits of complex contract systems

- Upgrade controls and transparent governance over admin keys

- Dependency management across oracles, bridges, and external libraries

- Operational monitoring for real‑time anomaly detection

| Aspect | bitcoin Contracts | Ethereum Contracts |

|---|---|---|

| Regulatory posture | Value-transfer centric | Application and product centric |

| Compliance surface | Fewer protocol features | Many financial primitives |

| Code complexity | Minimal, script-based | High, Turing-complete |

| Long-term maintenance | Slow-changing base layer | frequent contract and tooling updates |

Long‑term maintainability is also shaped by how each ecosystem evolves. bitcoin prioritizes stability and backward compatibility; changes to its scripting capabilities are rare and conservative, which can simplify the lifecycle management of contracts anchored to the chain over many years . Ethereum, conversely, embraces iterative innovation-upgrades to the virtual machine, fee markets, and consensus layer have already altered how contracts behave and are deployed. For developers and compliance teams, this means budgeting for ongoing refactors, migrations, and documentation updates, but also gaining access to increasingly powerful primitives. Over time,organizations must weigh: (a) the predictability and low churn of bitcoin-based logic versus (b) the agility and higher maintenance burden of Ethereum’s evolving smart contract stack,aligning technical choices with internal risk appetite and external regulatory expectations.

Practical recommendations Building a decision framework for selecting bitcoin or Ethereum smart contracts

Start by mapping your project’s core constraints before choosing a platform. Define what you need in terms of security guarantees, expressive logic, and regulatory or organizational requirements. bitcoin’s scripting is intentionally limited and optimized for secure, transparent value transfer on a peer‑to‑peer network that has proven resilience and censorship resistance over time. Ethereum, by contrast, offers a Turing-complete environment for more complex stateful applications such as DeFi, NFTs, and DAOs. Translate these characteristics into explicit criteria, such as “minimal attack surface vs. maximum programmability” and “settlement layer vs. application execution layer”, so stakeholders can see trade‑offs instead of debating preferences.

| Decision lens | Favors bitcoin | Favors Ethereum |

|---|---|---|

| Contract complexity | Simple, rule-based spending | Rich, stateful logic |

| Security posture | Smaller surface, slow changes | Audits needed, rapid evolution |

| Ecosystem tools | Limited, UTXO-focused | Mature defi / dApp stack |

| Primary goal | Robust settlement | Programmable applications |

Next, codify these lenses into a repeatable framework your team can apply across use cases. A practical approach is to score each option against a small set of weighted criteria and document the rationale behind the score. Consider aspects like:

- Threat model: Who are your adversaries, and how critical is the underlying settlement assurance provided by a long‑lived, decentralized network?

- Upgrade cadence: Are you agreeable with slower protocol changes (bitcoin) or do you need rapid iteration and new primitives (Ethereum)?

- Operational complexity: Do you have the in‑house expertise for advanced EVM contracts, or is a more constrained scripting environment preferable?

- Interoperability: Will you bridge assets, or can you minimize risk by anchoring critical logic on one chain and using off‑chain or side‑chain components?

Finalize the decision by aligning technical conclusions with business realities: total cost of ownership, regulatory posture, and long‑term governance. Use structured checklists, threat‑model workshops, and external audits to validate that your chosen platform and contract design match the project’s risk tolerance.For highly sensitive flows-such as treasury controls,long‑term escrows,or institutional settlement-favor simpler,battle‑tested constructs on a maximally secure base layer,even if that means sacrificing feature richness. For exploratory products or innovation‑driven roadmaps,prioritize ecosystems and tooling where composability,on‑chain data availability,and developer velocity give you room to iterate without repeatedly revisiting the foundational platform choice.

Q&A

Q1: What is bitcoin, and how does it currently support smart contracts?

bitcoin is a decentralized digital currency that relies on a peer‑to‑peer network of nodes, each maintaining its own copy of a public, distributed ledger called the blockchain. This ledger records all transactions without central oversight, using consensus among nodes to validate and order them . bitcoin’s scripting system is intentionally limited: it supports simple, stack‑based scripts (“bitcoin Script”) that enable basic smart‑contract‑like conditions such as multi‑signature wallets, time‑locks, and conditional spending, but it is not Turing‑complete.

Q2: What is Ethereum, and why is it often considered more flexible than bitcoin?

Ethereum is a blockchain platform designed from the ground up for general‑purpose programmability. It introduced the Ethereum Virtual Machine (EVM), which allows developers to write and deploy Turing‑complete smart contracts in high‑level languages (e.g., Solidity). These contracts can encode complex logic for decentralized applications (dApps), decentralized finance (DeFi), non‑fungible tokens (NFTs), and more. Relative to bitcoin’s constrained scripting, Ethereum’s environment is much more expressive and flexible for on‑chain computation.

Q3: How do bitcoin smart contracts work at a technical level?

bitcoin smart contracts are built with bitcoin Script, a non‑Turing‑complete, stack‑based language. Key characteristics:

- No loops: This removes the risk of unbounded execution and makes resource usage more predictable.

- Conditionals and checks: Scripts can require multiple signatures, enforce “n‑of‑m” spending rules, or lock coins until a certain time or block height.

- Taproot and script upgrades: Recent upgrades (e.g.,Taproot) make complex spending conditions more private and efficient by allowing multiple spending paths,only revealing the path used at spend time.

These scripts are mainly focused on expressing conditions for unlocking funds rather than implementing arbitrarily complex applications.

Q4: How do Ethereum smart contracts work at a technical level?

Ethereum smart contracts are programs deployed to the Ethereum blockchain and executed by the EVM. Key aspects:

- Turing‑complete: Supports loops, recursion, and complex control structures.

- Stateful: Contracts can maintain internal state across transactions (e.g., balances, configuration, order books).

- Gas model: Every operation consumes “gas,” paid in ether, which limits resource use and mitigates denial‑of‑service attacks.

- Composability: Contracts can call other contracts, enabling layered, modular dApp ecosystems.

This design is aimed at supporting a broad range of applications, from DeFi protocols to gaming and identity systems.

Q5: Why is bitcoin’s smart contract capability intentionally limited?

bitcoin’s design prioritizes:

- Security: A restricted scripting language reduces the attack surface and makes formal reasoning about scripts easier.

- Simplicity and robustness: By keeping the base layer minimal, bitcoin aims to be a stable, long‑term store of value and settlement layer.

- Predictability: Non‑Turing‑complete scripts avoid complex execution paths and resource unpredictability.

This conservative approach reflects bitcoin’s role as a monetary protocol first and a contract platform second .

Q6: What are the main advantages of bitcoin’s approach to smart contracts?

- High security and predictability: The constrained language lowers the risk of subtle programming errors and unexpected behaviors.

- Robust monetary focus: The protocol is optimized for secure, censorship‑resistant value transfer and long‑term settlement.

- privacy improvements with Taproot: Complex conditions can be hidden unless exercised, improving privacy and efficiency.

- Easier validation for nodes: Nodes in the peer‑to‑peer network can validate scripts deterministically with bounded resource use .

Q7: What are the main advantages of Ethereum’s flexible smart contracts?

- Expressive programmability: Developers can encode complex financial logic, governance mechanisms, nfts, and more.

- Rapid innovation and composability: Projects can build on and integrate with existing contracts, creating rich DeFi and dApp ecosystems.

- Stateful applications: Contracts retain internal state, enabling features like lending markets, automated market makers, and DAOs.

- Broader use cases: beyond currency transfers, Ethereum is suited to tokenization, gaming, identity, and enterprise logic.

Q8: What limitations or risks are associated with bitcoin’s smart contracts?

- Limited expressivity: Certain complex applications that are straightforward on Ethereum are difficult or unachievable purely on bitcoin’s base layer.

- More off‑chain or layered solutions: Many advanced use cases require sidechains, layer‑2s, or external protocols, adding architectural complexity.

- Developer tooling and ecosystem: Compared with ethereum’s dApp ecosystem, bitcoin has fewer generalized smart‑contract frameworks.

Q9: What limitations or risks are associated with Ethereum’s flexible model?

- Greater attack surface: Turing‑complete contracts and composability increase the risk of bugs, exploits, and economic attacks.

- Complexity for auditors and users: Ensuring correctness of complex contracts is challenging; failures can lead to permanent loss of funds.

- Execution costs and congestion: Contract execution can become expensive during periods of high network demand.

- State bloat: Storing rich application state on‑chain can increase node requirements over time.

Q10: How do bitcoin and Ethereum differ in decentralization and validation requirements?

Both use decentralized networks of nodes, but their design goals differ:

- bitcoin: Emphasizes minimal, predictable validation so that a wider range of participants can run full nodes and verify the entire history .

- Ethereum: Accepts more complexity at the protocol and contract level to enable richer applications, which can make validation more resource‑intensive compared with bitcoin.

Q11: Can bitcoin gain more flexible smart contracts without changing its base layer philosophy?

Yes, to a degree:

- Layer‑2 solutions (e.g., payment channels, off‑chain computation) can move complex logic off the main chain while using bitcoin for settlement.

- Sidechains and federated systems can host more expressive contract environments pegged to bitcoin.

- Script upgrades like Taproot expand what is possible while preserving the core constraints.

Though, these approaches deliberately avoid turning bitcoin’s base layer into a general‑purpose computing platform.

Q12: How does each platform align with different types of use cases?

- bitcoin smart contracts are well‑suited for:

- Secure custody schemes (multi‑sig, time‑locked vaults)

- Payment channels and basic financial instruments

- high‑assurance, low‑complexity conditions on value transfer

- Ethereum smart contracts are well‑suited for:

- Complex financial protocols (DEXs, lending, derivatives)

- Tokenization (fungible and non‑fungible tokens)

- Governance systems and DAOs

- Interactive dApps (games, social, identity)

Q13: How do market and macro‑economic factors affect the use of smart contracts on bitcoin and Ethereum?

Macro conditions-such as monetary policy, interest rates, and central bank balance‑sheet changes-can influence overall market liquidity and risk appetite, affecting both bitcoin and Ethereum ecosystems . in practice:

- bitcoin often functions as a macro‑driven store‑of‑value asset; smart‑contract usage tends to be more conservative and tied to custody and payments.

- Ethereum usage is closely linked to on‑chain activity volumes; DeFi and dApp usage rise and fall with risk sentiment and liquidity.

Q14: How should developers and users choose between bitcoin smart contracts and Ethereum?

- Choose bitcoin if:

- Your primary objective is secure, long‑term value storage and simple, high‑assurance spending conditions.

- You value maximum protocol stability and minimal on‑chain complexity.

- Choose Ethereum if:

- You need rich application logic, complex financial products, or composability with an existing dApp ecosystem.

- You are building applications where programmability and feature breadth outweigh the desire for minimal base‑layer complexity.

In practice, many participants use both: bitcoin as a foundational monetary asset and Ethereum (or similar platforms) for application‑layer innovation.

In Summary

In closing, the contrast between bitcoin’s smart contract capabilities and Ethereum’s flexible execution environment reflects two fundamentally different design philosophies in blockchain technology.

bitcoin was conceived primarily as a peer‑to‑peer electronic cash system and store of value,emphasizing security,predictability,and resistance to change above all else. Its scripting language remains intentionally limited, enabling relatively simple, highly auditable smart contracts that minimize attack surface and align with its role as a robust monetary layer. Enhancements such as multisignature transactions and Taproot-based constructs extend functionality, but always within a conservative framework.

Ethereum,by contrast,was designed from the outset as a general‑purpose,Turing‑complete smart contract platform. This flexibility supports a broad range of decentralized applications, from DeFi protocols to NFTs and DAOs, at the cost of greater complexity, a larger attack surface, and a faster pace of protocol evolution.

Neither approach is universally “better”; each optimizes for different priorities. bitcoin tends toward hardened, narrow functionality anchored in monetary reliability, while Ethereum prioritizes programmability and rapid innovation. For developers, users, and institutions, the choice between building on or interacting with bitcoin smart contracts versus Ethereum’s flexible environment ultimately depends on their tolerance for risk, need for expressiveness, and long‑term objectives in the broader blockchain ecosystem.