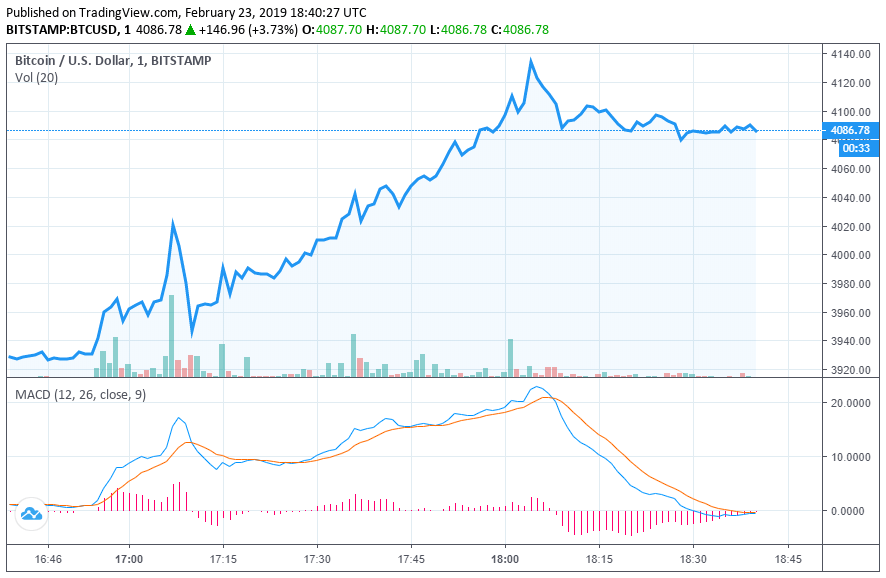

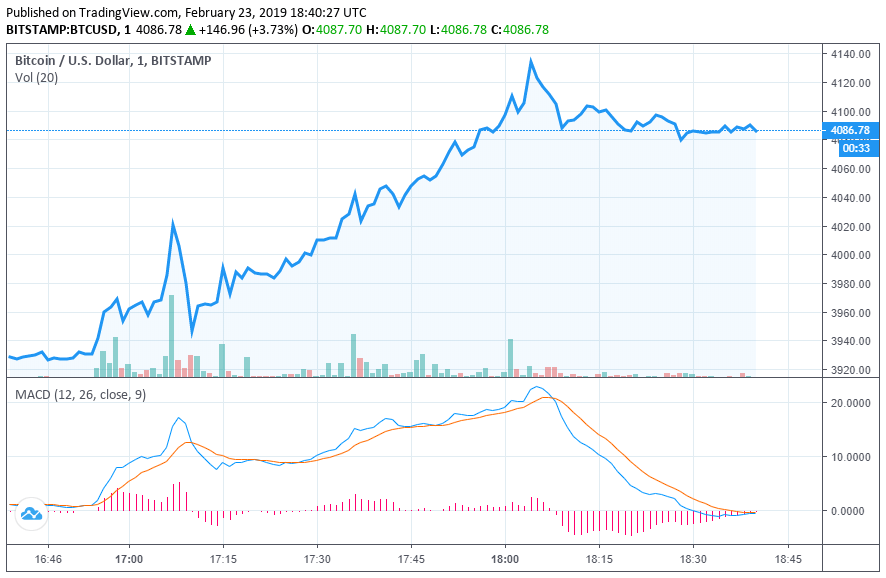

The price broke higher on Saturday, ripping past the psychological resistance at $4,000 and briefly stretching above $4,100.

The flagship had been hovering in the low $3,900s for most of the week after touching $4,000 on Feb. 18. volume had begun to decline, leading some analysts to question whether the market was going to consolidate before making another push higher.

The price made another run past $4,000 on Saturday.

However, overall market volume spiked back toward $27 billion on Saturday, enabling the price to launch as high as $4,137 on Bitstamp before settling back down to a present value of $4,090. Other top assets saw comparable gains, enabling the market cap to climb above $139 billion.

Assuming can hold above $4,000, the next important push would be toward $5,000, where the coin would face both psychological and technical resistance. According to eToro’s Mati Greenspan, a strong jump above $5,000 could signal that the 14-month crypto bear market has come to a close.

Click for a real-time price chart.

Featured Image from Shutterstock. Price Charts from .

Published at Sat, 23 Feb 2019 19:18:34 +0000