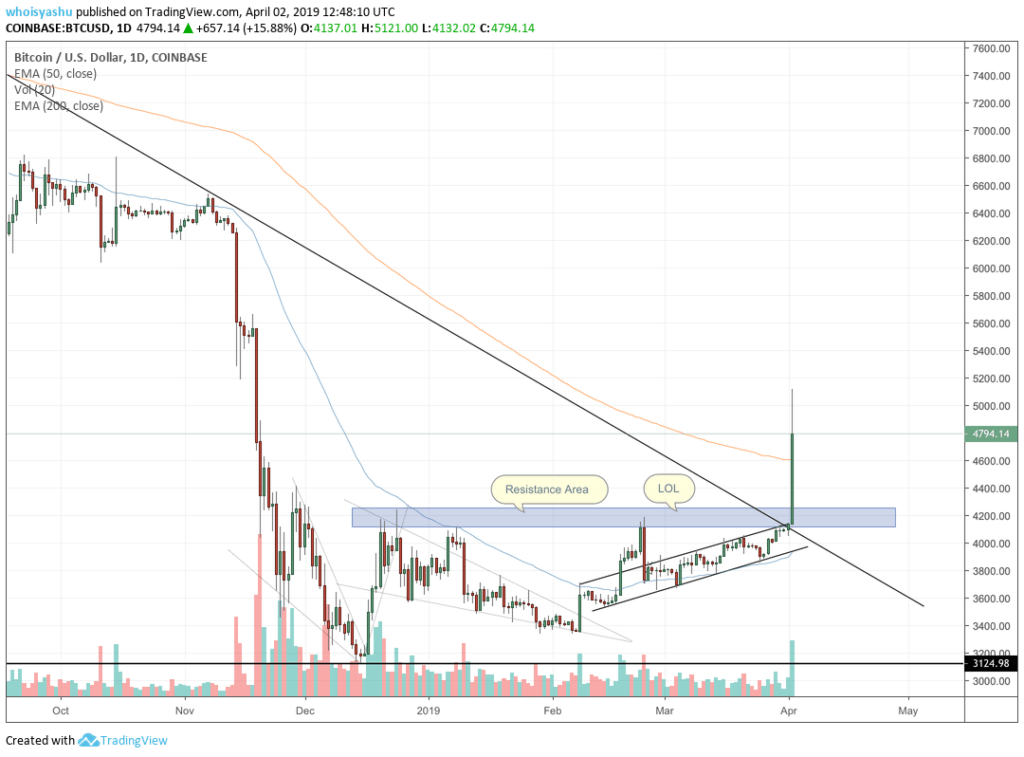

The finally broke above an extended resistance channel to establish a new yearly high above the psychologically-significant $5,000 mark.

data shows that /USD spiked during the early Asian session, surging almost 23 percent in just two hours to $5,120. The rally accompanied substantial volume, confirming a positive breakout scenario for the . It also negated some portion of the losses caused by the notorious , which prompted the previous crash in November last year.

PRICE JUMPS UP TO 23-PERCENT | SOURCE: COINMARKETCAP.COM

On the technical front, the latest crypto market rally pulled out of an overlong long bearish stretch below $4,414. It further rattled three strong bearish indicators, as discussed in our , that had prevented the from extending its upside momentum since November.

As of 12:25 UTC, the price was at $4,794, down 6.07 percent from its intraday high. At the same time, ’s market capitalization had surged from $73.85 billion to $84.21 billion.

The Bullish Case for a $6,000 bitcoin Price

There is no denying that the ongoing crypto market surge is almost too sudden. But unlike , a price rally in the market is historically more durable from an intraday perspective. The jump has certainly brought $6,000 back in the conversation of bulls.

The level supported the on multiple downside attempts until the November capitulation broke it. The fact that came hundreds of dollars closer to $6,000 could influence traders to keep one eye open towards it.

That’s pure fundamental talk. Let’s check the technical.

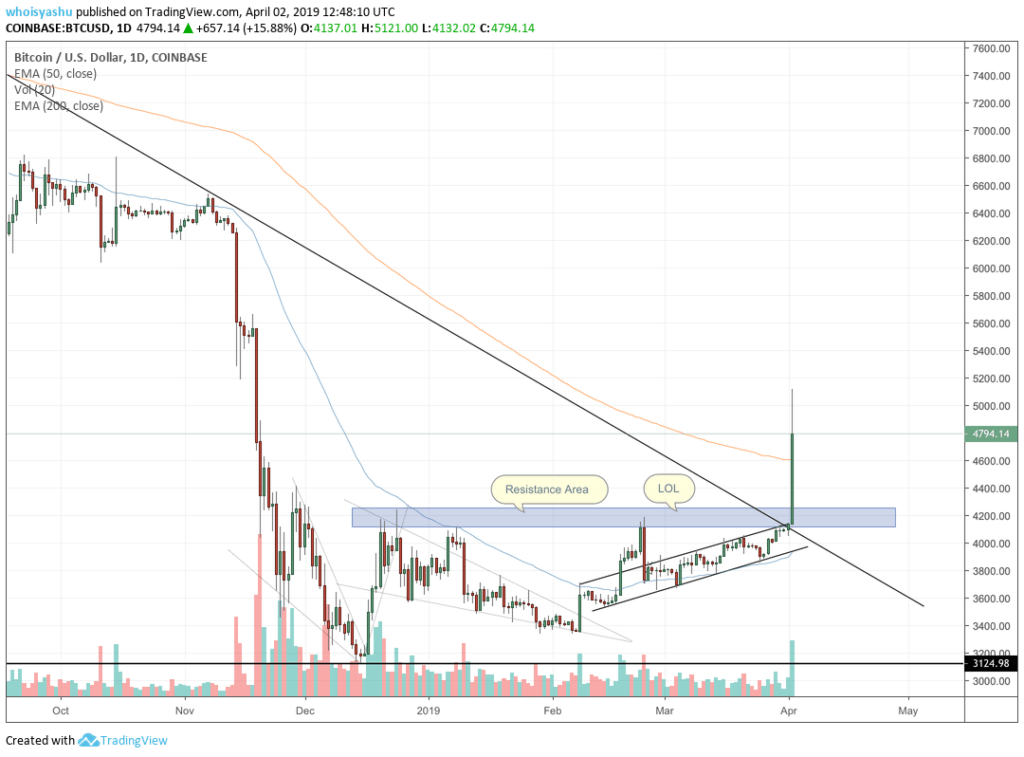

PRICE TESTING WEEKLY RSI TARGET | SOURCE: TRADINGVIEW.COM,

’s Relative Strength Index (RSI) on the weekly chart is finally attempting to push above a crucial borderline at 53.85. Historically, the market stayed on a bullish path when its weekly RSI was above 53.85. The early 2018 price action brought the RSI level below the said figure. With it, the price also entered one of its most extended bearish periods. It is the first time since February 2018 the RSI has touched 53.85.

A little above the RSI, one can also notice the 50-period EMA. The blue curve appears to be the only considerable resistance level as price extends its uptrend. Interestingly, breaking above the 50-period EMA will also push the RSI above 53.85 – towards an area that has not known any strong resistance in recent times. That’s one part of the bullish perspective that explains how the could reclaim $6,000.

Conversely, the price could pull back from the 50-period EMA and find support towards the rising trendline in blue.

Published at Tue, 02 Apr 2019 15:07:00 +0000