The crypto markets are showing no signs of recovery but instead have been gripped by a string bearish momentum wherein the overall market cap has slipped below $300 billion and bitcoin has gone way past tumbling down below $8000. As per the latest chart indicators, bitcoin seems to be heading towards what is famously known as a “Death Cross”.

This term is used to get a simultaneous view of the short-term 50-day and the long-term 200-day moving averages. More specifically, it is used to denote a strong bearish momentum of what is to come ahead and it illustrates the 50-day moving average going below the 200-day moving average.

On Wednesday, Jim Iuorio of TJM Institutional Services wrote to CNBC saying: “When we are talking about bitcoin, I think it’s important to remember that we don’t have much history to go off of to identify long-term trends. That being said, any time the 50-day crosses the 200-day, it should flash a warning…and when you couple that with the fact that bitcoin has been trending steadily lower since the launch of futures, I think that it is a major negative.”

However, many analysts don’t seem to be much worried about the death cross patterns on the bitcoin charts. Brian Kelly, a trader at Fast Money thinks that bitcoin is poised for a big uptrend similar to as seen after August 2017. While talking to CNBC, Kelly said: “bitcoin, just like the spot FX markets, follows technicals closely, therefore these support levels gain more importance. If these levels hold, then it will confirm the uptrend from August is still valid.”

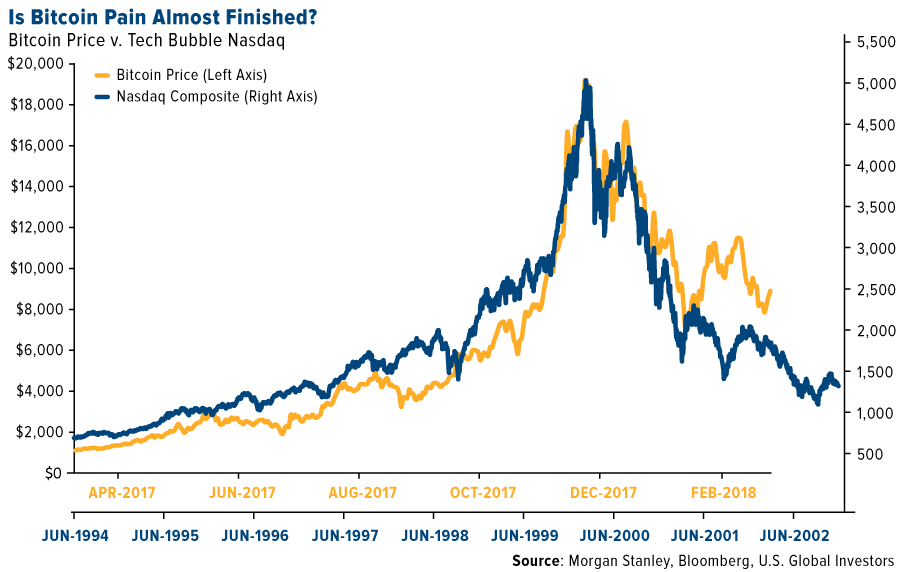

Another report from Morgan Stanley shows that the latest collapse in the bitcoin price resembles similarities of the Nasdaq tech bubble in 1990. However, Morgan Stanley still doesn’t find any reason to worry. The investment banking giant reasons this by saying that the main difference is that the bitcoin price erosion has happened at 15 times the rate of the tech bubble.

Hence, getting some positive news for the bitcoin bulls, Morgan Stanley says that 70% of the erosion is “nothing out of the ordinary,” and further that such corrections “have historically preceded rallies.” Just as Nasdaq gained in the subsequent years of the tech bubble, the agency believes that bitcoin could all be set for a similar recovery ahead.

Is bitcoin Pain Almost Finished? Image: U.S. Global Investor

Another New-York-based firm Fundstrat says that not only bitcoin but even other altcoins have already found a bottom. Fundstrat strategist Thomas Lee told to investors that even though the cryptocurrency bull run might not be in the near-term soon, the pain is “largely over”.

However, Thomas Lee has stated that even though crypto investors are looking out for other cryptocurrencies apart from bitcoin, they should largely stick to major large caps like Ethereum and Ripple.

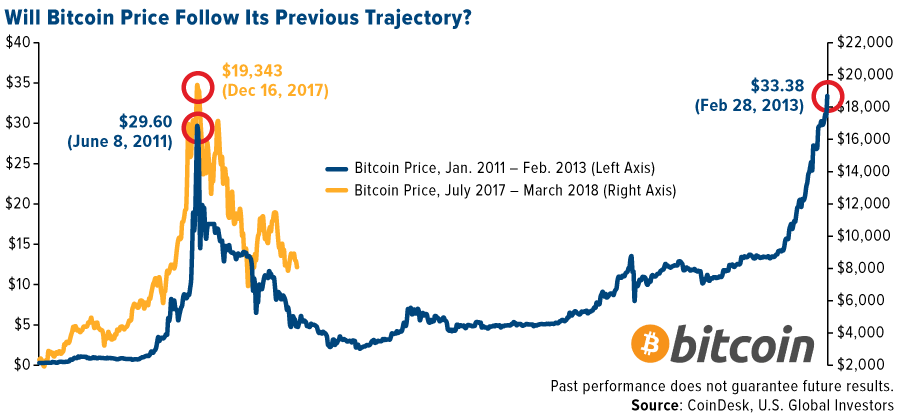

Will bitcoin Price Follow Its Previous Trajectory? Image: U.S. Global Investor

While taking a long-term view, Morgan Stanley also compared bitcoin current with the one from the past. Going back to June 2011, bitcoin touched a high of $30 and just in the next five months, it re-traced back to touch a low of $2.02. Later it took nearly 15 months from then onwards to again arrive at $30 levels. However, the one who bought it at the bottom levels made got a whopping price appreciation of 1,300 percent.

However, note that nothing can be said with surety about the future based on the past indicators and trends and moreover till now, we don’t even have a decade of data with bitcoin to identify some strong trends.

The post appeared first on .

Football Fans will be able to pay with bitcoin for their accommodation when they visit Russia for this year’s World Cup. Hotels in Kaliningrad, expecting guests from eight countries, are partnering with a local payment provider to offer the service. Booking a room for the day when England plays Belgium will cost approx. $300 in fiat.

Also read:

Kaliningrad Hotels Team Up with Free-Kassa

, the capital of Russia’s westernmost region, is one of the host cities for the . The mundial is scheduled to take place in the Russian Federation from June 14 to July 15. The city is expecting teams and supporters from Spain, Belgium, Serbia, England, Switzerland, Croatia, Morocco and Nigeria.

Hotel owners in the Russian have decided to offer their guests the opportunity to pay for their stay in bitcoin. According to local media, a hotel chain has already teamed up with a payment processor to provide the service. Anna Subbotina, manager of Apartments Malina, commented:

We are seeing increasing interest in cryptocurrencies. They will gradually come into use as a means of payment.

“We have decided that fans should be able to pay for our services with the help of this innovative technology”, Subbotina told Buying Business Travel Russia. She expects other hotels in the area to soon follow the example and offer cryptocurrency payment options.

Her company is partnering with one of Russia’s electronic payment providers, which supports cryptocurrency transactions, including bitcoin payments. “This is an interesting experience for us – we haven’t worked with hotels so far”, said Vitaliy Lavrov, Development Manager at Free-Kassa. “The is quite sensitive towards new trends”, he noted.

Accommodation rates in host cities have skyrocketed months before the championship. Kaliningrad is among the most expensive destinations, according to Yanis Dzenis, PR Director at Aviasales Travel. “Booking a room there on June 28, when England plays Belgium, will cost you ₽18,000 RUB (over $300)”, he told Interfax. That’s 10 times more than the regular fare, he added.

Mundial of Many Firsts

The World Cup matches will be played at 12 stadiums in 11 Russian cities. This is the first mundial to be held in Russia, in Eastern Europe, and on two continents – Europe and Asia. The video assistant referee will also be used for the first time. Most of the stadiums are newly built or renovated. Kaliningrad will host 4 games. 32 national teams will compete for the World Cup.

Two bills regulating different aspects of the crypto ecosphere have been introduced to Russia’s parliament this year. The one, the law “On Digital Financial Assets”, legalizes blockchain technologies, mining operations and initial coin offerings. The second draft, which was this week, amends Russia’s Civil Code to regulate the use for cryptocurrencies and protect investors’ rights. Both are expected to be adopted by the summer, possibly before the start of the World Cup.

Do you think the introduction of bitcoin payments in the hospitality industry will catalyze mainstream adoption of cryptocurrencies in Russia? Tell us in the comments section below.

Images courtesy of Shutterstock.

bitcoin News is growing fast. To reach our global audience, send us a news tip or submit a press release. Let’s work together to help inform the citizens of Earth (and beyond) about this new, important and amazing information network that is bitcoin.

The post appeared first on .

March 27, 2018 – Charlie Shrem, one of the world’s leading crypto entrepreneurs, has joined the advisors of Eligma. Shrem’s expertise in token economy and management will help further Eligma’s mission to draw on the advantages of artificial intelligence and blockchain technology to make commerce easier, faster and more transparent for buyers and vendors alike. The Eligma advisor team is convinced that this cognitive commerce platform aiming to revolutionize the world of shopping comes in at the right time to offer effective solutions to the current commerce challenges.

Crypto pioneer Charlie Shrem to enhance Eligma

Charlie Shrem has left a profound mark on the business world as a co-founder, manager and advisor of various entrepreneurial ventures with an innovative edge. He was one of the first to embrace bitcoin and is a founding member of the bitcoin Foundation, an organization with a mission to promote the standardization of bitcoin and its use for the benefit of users worldwide. He is also known for his business and community development role in Jaxx, a multi-platform cryptocurrency wallet that enables the management of digital assets, and currently furthers bringing cryptocurrencies into mainstream business through the CryptoIQ company.

Shrem’s interest in commerce and social economy goes hand in hand with Eligma, which aims to make high technology, cryptocurrency use and the transparency of blockchain transactions part of mainstream shopping. Its features include a highly effective AI-driven product search, cryptocurrency transactions at online and offline stores, and an automated inventory and resale listing solutions for one’s property. This will enable effective used product circulation and represent an important step towards sustainable commerce.

Shrem states: “Everyone who is part of the crypto world aspires toward building trust into digital currencies and using them as part of their daily consumer life. For this reason, Eligma stands for an exceptional revolution, not only in the shopping sense, but also in terms of making the general public aware of the practical advantages that cryptocurrencies offer. I am excited to collaborate on a set of commerce solutions that I am looking forward to using myself, so I hope Eligma enters the market as soon as possible.”

Impressive advisory board to support Eligma’s quest

Charlie Shrem is the latest to join the eminent line-up of Eligma’s advisors. Other names on the list include Andy Baynes, former Director of Environmental Technologies at Apple; Sunny Saini, a Commodity Manager at Google; and Peter Moricz, former Vice President at JP Morgan Private Bank in London, among others.

Dejan Roljic, Eligma founder and CEO, states: “It is a great honor for us that our vision of a powerful alternative in commerce has resounded with Charlie Shrem, one of the most renowned representatives of the crypto community. We are certain that our collaboration, along with the contributions of our other advisors, will result in a product that is far-reaching in its technology but easy and practical to use at the same time.”

Eligma has already yielded its first practical result: in mid-April, its cryptocurrency transaction system will start being tested at the BTC City shopping and business centre, where it will be implemented at a number of stores. This makes BTC City the first shopping centre in the world where cryptocurrency transactions will take place. In order to be able to advance its research and innovation, the Eligma project started a pre-sale of its tokens on 20 March, with the crowdsale to follow on 17 April.

Contact

For all media inquiries and more information about Eligma`s development process, please contact Sara Draskovic at media@eligma.com.

About Eligma

Eligma is set to change the way people discover, purchase, track and resell items online. With its unique features, it will offer users a “one-place” from which they can shop in all online stores anywhere in the world, check the value of the items in their inventory and learn the best time to sell them. Eligma will offer users a completely decentralized universal loyalty program and help transform every household into a business while are also bringing cryptocurrencies mainstream by offering crypto transactions at online stores even if those stores don’t offer them yet.