Like all digital assets, the bitcoin price is notoriously volatile, but a surprising pattern has emerged from that volatility which may have wider ramifications for the traditional finance markets as a whole.

The CBOE Volatility Index, or VIX, is an established measure of volatility in the overall marketplace long-used by traders to give them an impression of investor fear in the market.

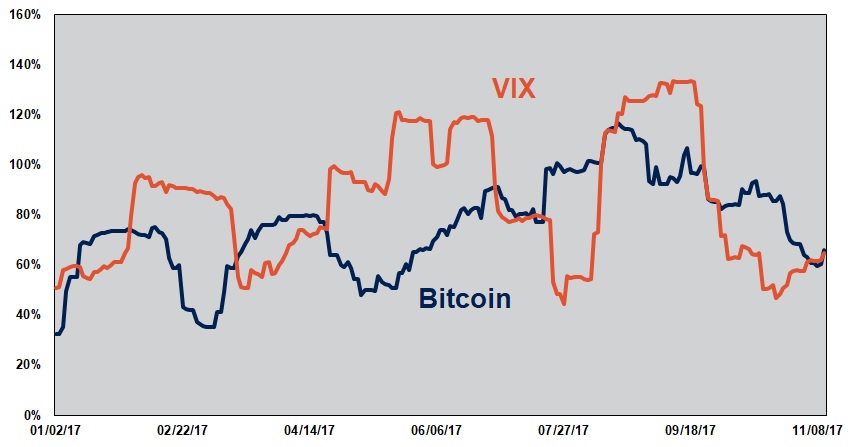

VIX analyst and President of Equity Armor Investments Brian Stutland — better known as the “The Fear Merchant” — believes that the is actually predicting the VIX one month in advance.

Speaking with , he said:

“There is huge correlation right now between VIX and bitcoin 30 days ago, 30 trading days ago, that is starting to measure out credit risk in the market. That’s what cryptocurrency is becoming. It’s becoming a way to sort of de-risk yourself from credit risk in the banking industry.”

Because cryptocurrencies are largely unregulated and allow investors to move their money off the balance sheets of banks and decrease credit risks, Stutland thinks they may be using bitcoin as a safe haven from the stock market despite the volatility of the former to avoid credit risks by putting their money in a more “off-grid” position.

“bitcoin is a way to for investors to basically move their money off the balance sheets of banks and into their own wallets,” he added. “Essentially storing their money under their pillow in the form of virtual currency.”

While bitcoin’s reputation as a volatile cryptocurrency may give the impression that stock traders would shun it in favor of a more stable haven, SEC Chairman Jay Clayton pointed out that these days , something that may come as a surprise to many.

“Just recently the volatility in bitcoin was not as great as the volatility we’ve seen in other securities, such as the VIX product,” said Clayton.

The benefits of avoiding credit risk plus the median stability provided by bitcoin compared to the stock market overall may have turned bitcoin into a leading indicator in the stock market.

If true, the implications are huge, meaning that the bitcoin price is actually a marker by which traders can predict stock market behavior. As credit risk increases, volatility in the marketplace does as well. Time will tell if the analysis is accurate, but if it is, the stock market is in for a bearish trend over the next few weeks.

Featured Image from Shutterstock

Follow us on .

Advertisement

Published at Wed, 30 May 2018 23:50:26 +0000

bitcoin Analysis