bitcoin is ending the week in much the same place it was trading Feb. 5 as sideways movement for much of the week sees prices hover .

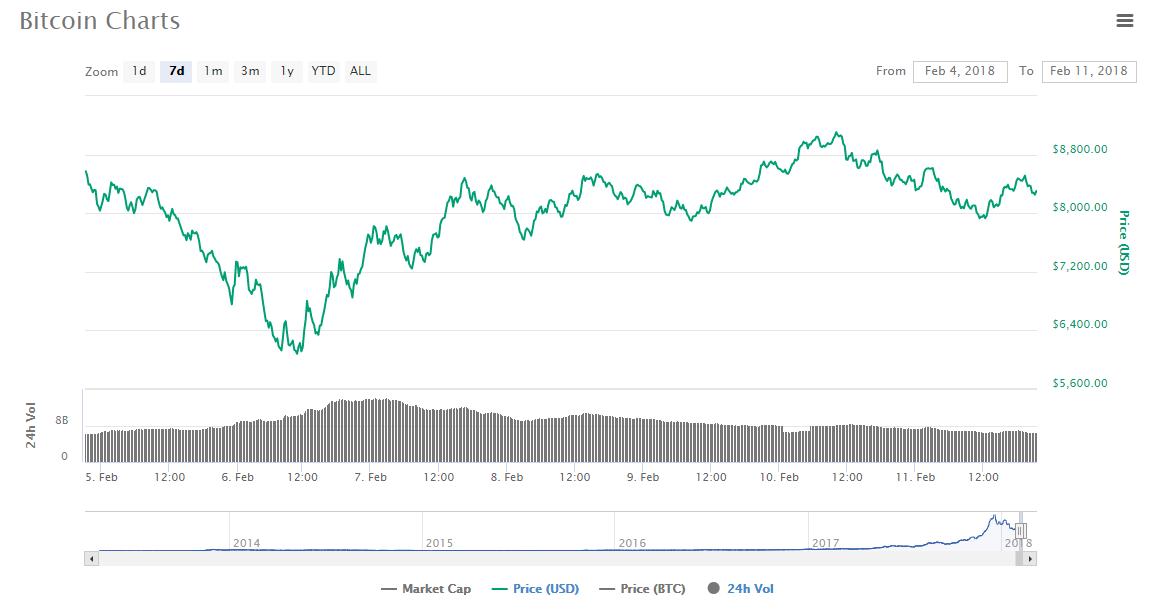

Cross-exchange data from Coinmarketcap shows bitcoin beginning and closing the past seven days at around $8300, having slid to a low of $6111 Feb. 6 before peaking at $9109 on Saturday, Feb. 10.

The market remains influenced by regulatory activity in major trading markets such as and the . Cointelegraph additionally throughout the week that press attention surrounding the Indian and US moves was contributing to the volatility.

On social media, traders and commentators had made calls for a in bitcoin’s fortunes, which began in earnest towards the weekend before support broke above $9000.

Forecasting next week’s activity, Tone Vays on Friday suggested that resistance around $10,000 “would be very hard to break.”

“We have to cross the 128 [day] moving average (around $10,300); the 128 has been great support, now it’s going to be resistance,” he added.

Hits $9,000, so is $6,000 gonna be the low for 2018 or is there still elements to be nervous about? Let’s look at the latest charts now that more data is in.

— Tone Vays [#bitcoin] (@ToneVays)

Altcoins have broadly moved in time with bitcoin so far in 2018, with only Ripple producing short-lived countermoves over the past week.

Sunday saw moderate losses across the top 50 assets tracked by Coinmarketcap, with only a curious entry by new altcoin , which spiked over 1000% in 24 hours to claim the number 33 spot by market cap at a capitalization of $645 mln, distorting the trend.

Published at Sun, 11 Feb 2018 18:37:35 +0000

Altcoin