The bitcoin price in the past 24 hours has undergone a much-needed bullish correction, rising about $500 since establishing an intraday low around $6,009.

In our , we were waiting for a bounce back from 6009-fiat to apply our intrarange strategy. As it did, our long position towards 6192-fiat made us a nominal profit. A near-term breakout followed later, upon which we placed another long position towards 6290-fiat and made another nominal return. Unfortunately, due to human constraints, we were unable to watch the rally towards 6494-fiat.

Today, we established 6500-ish area as a strong resistance level against the minor upside. The early Asian trading hour saw traders exiting their position around this area, while during the rest of the European trading session, the BTC/USD pair was consolidating sideways within a nominally wide range. Let’s see how the latest price action has rattled our technical indicators.

BTCUSD Technical Analysis

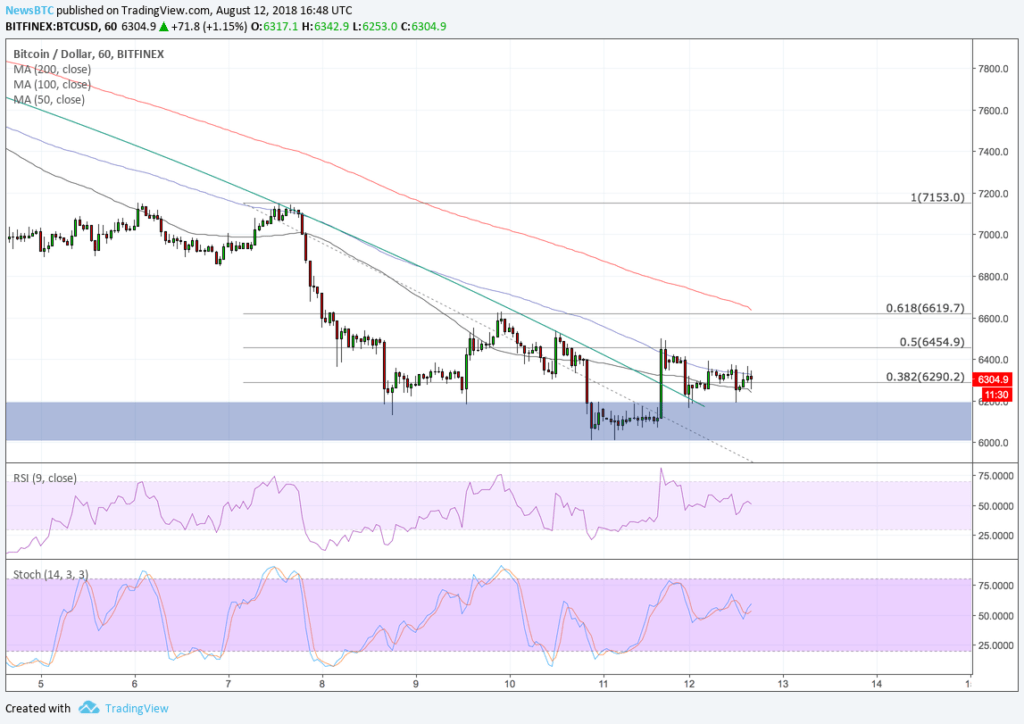

As discussed in our previous analysis, we had considered bitcoin to break above the bear trajectory (indicated in light blue) to bring medium-term upside targets in sight. And the digital currency eventually did, finally invalidating the curve and establish fresh intraday highs for our consideration. Nevertheless, we will still watch the trajectory in the event of an extended bearish momentum. We are still forming bearish pennants.

At the same time, the BTC/USD is now slightly above its 50H and 100H moving averages, while still far enough to test its 200H one. The RSI and Stochastic indicators have jumped from the oversold region, and are now treading sideways in a neutral area. This makes the near-term bias a little focused towards bulls.

BTCUSD Intraday Analysis

The latest price action has brought us inside a new range, defined by 6192-fiat as our interim support and 6454-fiat as our interim resistance, and 6500-fiat as our psychological one. It is a pretty wide range to apply put our intrarange strategy in place. With that said, we would be waiting for the price to bounce back from 6192-fiat to enable our long position towards 6500-fiat. Similarly, a pullback from 6454-6500 area will enable us to put a short position towards 6192-fiat.

If the invalidates either of the range levels, then we will switch to our breakout strategy for the day. Thus, a break below 6192-fiat will clear our short position towards 6009-fiat, our previous interim support level. Placing a stop loss three-pips above the entry position would help us reduce the overall risk of our trade.

Conversely, a break above 6454-fiat will allow us to put a long position towards 6550-fiat, our primary upside target. Our position can, of course, be beaten down at 6500-fiat. This is purely instinctive at this point in time. Anyway, we will keep our stops a 3-pips below the entry position should the bias reverses.

Featured Image from Shutterstock

Follow us on or subscribe to our newsletter .

•

•

•

Published at Sun, 12 Aug 2018 18:01:11 +0000

bitcoin Analysis[wpr5_ebay kw=”bitcoin” num=”1″ ebcat=”” cid=”5338043562″ lang=”en-US” country=”0″ sort=”bestmatch”]