The bitcoin market on Wednesday attempted a decent bullish recovery, extending the recent marginal gains to an impressive 10% upside from the previous lows.

The Asian trading session witnessed an influx of buying orders in an attempt to pierce through $6,500-resistance. As we hiccuped through the European course, the bullish sentiment weakened and pulled the price almost $200 down. The US session, however, is attempting a bounce-back at the time of this writing, though with fragile bull support. We can notice a powerful selling sentiment around $6,500 – the price has reversed its uptrends before around there – owing to a robust bearish bias in medium-term.

BTCUSD Technical Analysis

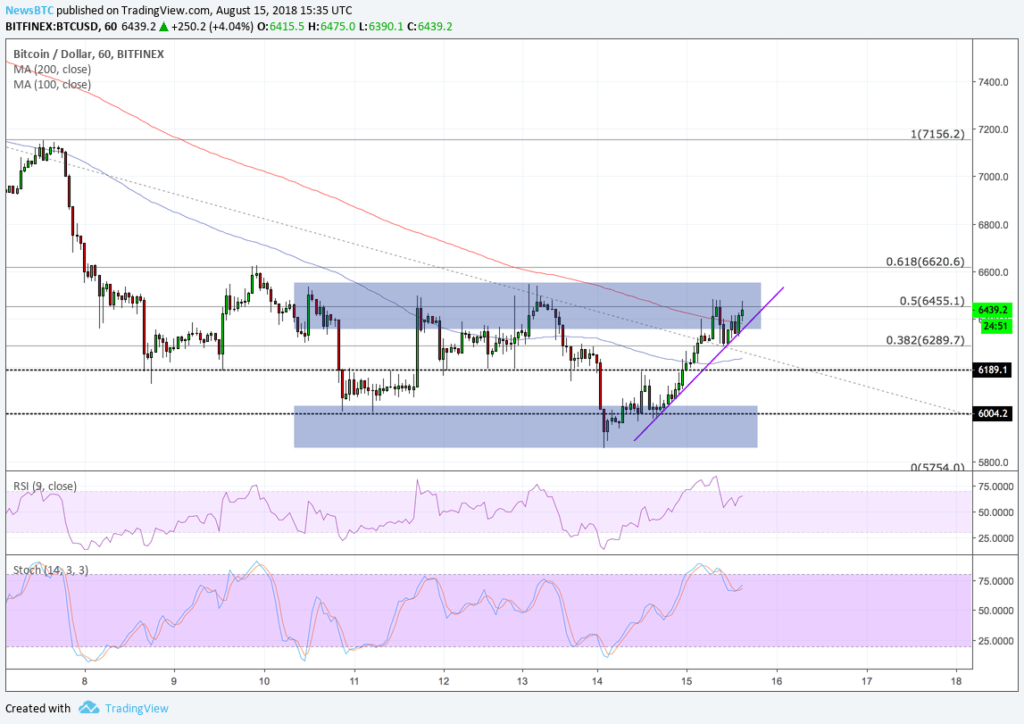

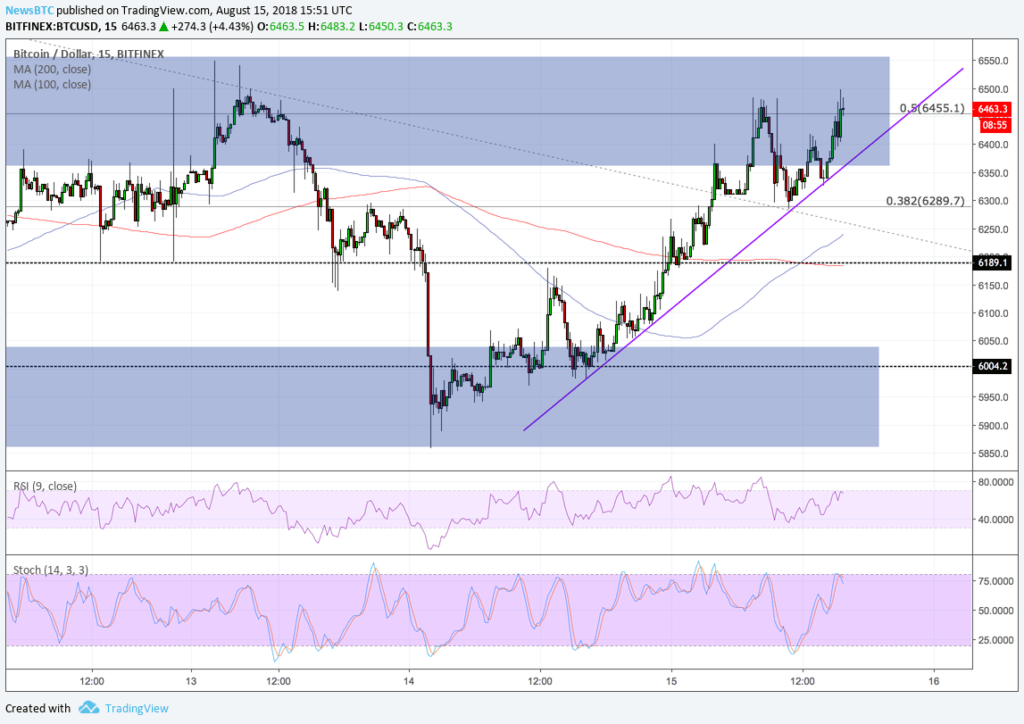

We can see the BTC/USD forming an accurate ascending trendline to indicate near-term support. The pair has already jumped above its 100 and 200H moving averages. The RSI and Stochastic indicators, at the same time, is hinting another move towards the overbought area. We also notice that BTC/USD is now inside a medium-term consolidation channel, indicated by two rectangular bars in the chart above. Both the support and resistance areas are proving to be much stronger than anticipated, pushing BTC/USD in a medium-term bias conflict.

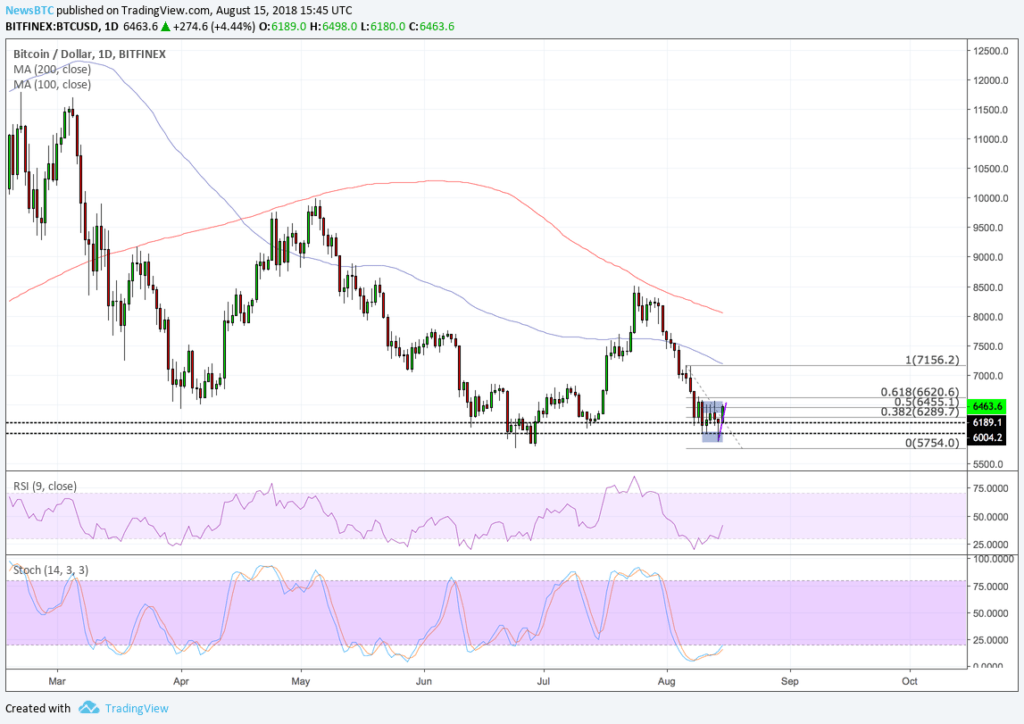

Nevertheless, on the daily chart, the current consolidation pattern is preceded by eight red candles. We are surely closer to testing 5754-fiat, the June’s low, again should the bearish momentum extend. There is also a potential Head and Shoulder pattern in the formation which, in the near-term, could push the bitcoin price towards 6850-fiat.

BTCUSD Intraday Analysis

Coming to our intraday analysis! The latest price action has brought us inside a new range, which is defined by 6500-fiat as our interim resistance and 6289-fiat as our interim support. This is the range we will be watching for the rest of the US trading session.

We are first waiting for a pullback (sorry, bulls!). The 6500-6500 resistance area has rejected previous upsides three times in a row. So, our near-term probability, coupled with the overall bearish bias of the market, prompt us first wait for a pullback from resistance and then put a short towards 6289-fiat, our support. Meanwhile, a stop loss 3-pips above the entry position will ensure we don’t lose much in case the upside recovery extends.

We won’t be putting a breakout position until the price breaks above 6550-fiat. Should it happen, our primary upside target will be towards 6620. Like always, a stop loss 2-pips below will protect us in case the bears wake up on an uptrend.

Coming back to our range support at 6289-fiat, we will be first waiting for the prevailing consolidation to validate itself. Should the price hint a bounce back, we’ll put a long position towards 6500-fiat while keeping a stop loss 2-pips below the entry point. In case of a breakout towards the south, we will put a short towards 6189-fiat while protecting our trade by keeping a stop 2-pips above the entry point.

Featured image from Shutterstock. Charts from .

Follow us on or subscribe to our newsletter .

•

•

•

Published at Wed, 15 Aug 2018 16:38:45 +0000

bitcoin Analysis