The has surged up to 4.85 percent this Tuesday, but there is still a strong case of an imminent pullback.

According to Crypto Michaël, an Amsterdam-based analyst, lacked adequate follow-up volume that could sustain the ongoing upside price action. The bearish interpretation followed the textbook volume-price relationship, in which a price move up on a declining activity signals a selling sentiment.

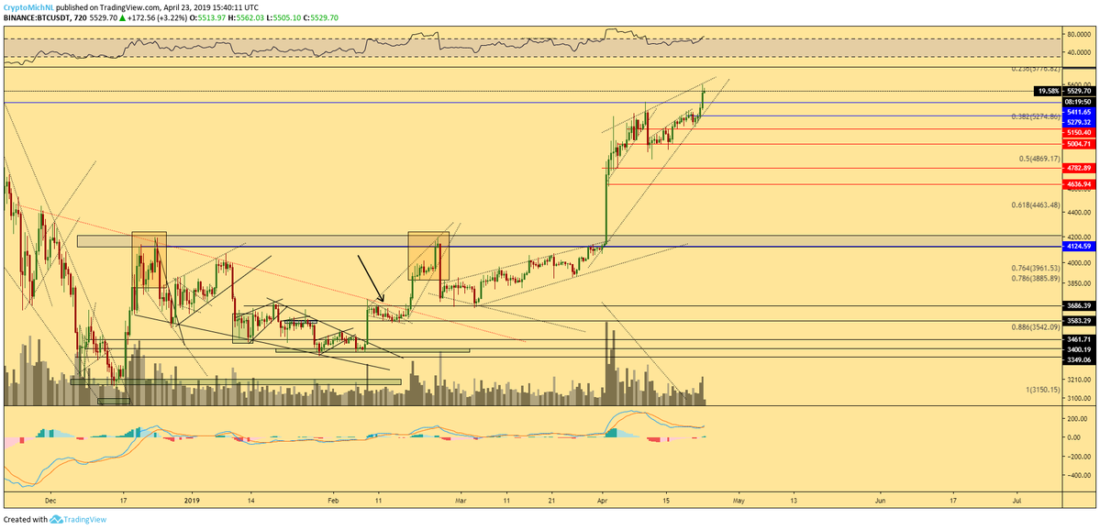

Michaël said if the price hangs near its newly established higher high for far too long, it could result in a pullback scenario, as shown below.

Price Inside a Rising Wedge | Source: Crypto Michaël

Michaël showcased the price trending inside a rising wedge pattern. Technically, it is a bearish pattern that begins wide at the bottom but starts contracting as the asset price moves upward. As the range narrows, the volume also starts declining. And, at the apex, the asset price breaks to the downside accompanied by a sudden surge in volumes. Michaël highlighted similar rising wedge formations via ’s recent price behaviors (boxes).

“The longer we keep on hanging here, the more meh it’s going to be,” the analyst stated. “I [really] want to see follow up volume. However, we’re making some [bear divergences] on higher timeframes already + hanging in resistance + bleeding hard. I’m remaining very cautious.”

The longer we keep on hanging here, the more meh it’s going to be.

I really want to see follow up volume, however we’re making some beardivs on higher timeframes already + hanging in resistance + bleeding hard.

I’m still remaining very cautious.

— Crypto Michaël (@CryptoMichNL)

Bull Trap

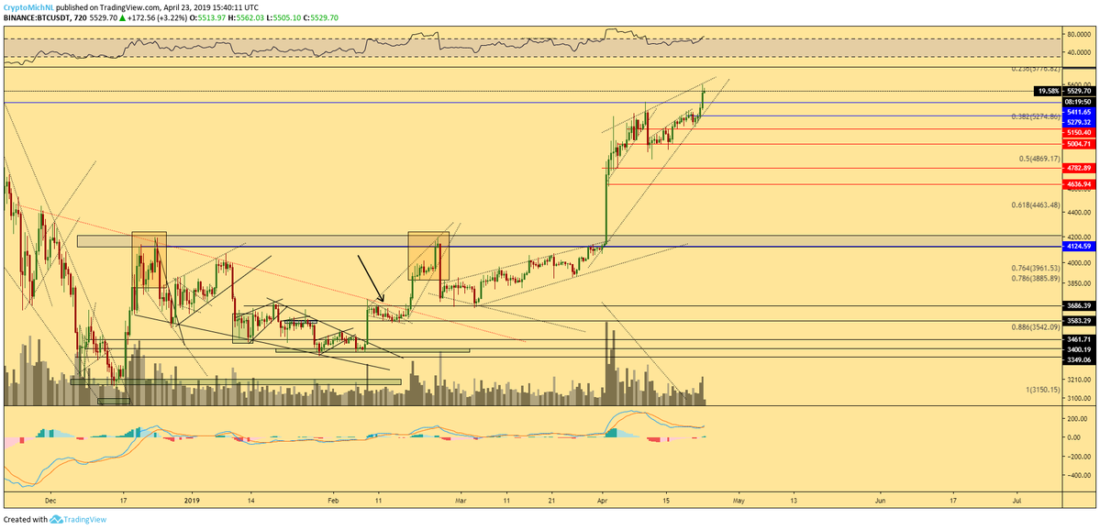

Michaël also a bull trap scenario, in which the price breaks above the rising wedge pattern, but may soon reverse direction. A potential bearish divergence indicator somewhat supported the bearish scenario. Technically, the ’s daily Relative Strength Index was moving downwards while its price was trending upward. Such a pattern typically ends up in a downward action for the asset.

Nevertheless, Michaël clarified that there were crucial resistance areas that could invalidate the entire bearish theory, as shown in the chart below.

Bull Trap | Source: Crypto Michaël

“I’m still neutral and not much changed overall,” he stated. “Pushing through orange block = [very good] sign.”

Double Bottom – Long Term Bull

Source: Stock Charts

Michaël said he was expending the price to perform a complete reversal and restest its bottom in May/June. Technically, it will be a double bottom scenario, which is a textbook bullish reversal pattern. In such a case, would pullback to the upside to retest the previous peak, accompanied by high volume, and followed by a breakout to turn the said peak resistance into new support.

“Personally, I’d sign for this: 1) Slight upwards/sideways continuation of till the end of April; 2) First altseason; 3) May/June downwards to bottom; 4) July – September sideways & major 5) After September beginning of uptrend bull market ,” said Michaël. “But, that’s me.”

Published at Wed, 24 Apr 2019 04:08:17 +0000