Shortly after a sharp drop from the mid $14,000 to the lower $9,000s, bitcoin saw a strong bounce to the upper $11,000s. At the time of this article, bitcoin appears to be consolidating and is ready to make its next move:

Figure 1: BTC-USD, 1 Day Candles, Macro View

In the , we discussed the distribution trading range the market fell out of as it reached for lower support boundaries. Ultimately, it found support on the macro 50% retracement values near $10,000. Once it broke south of the trading range, the price fell sharply and with high volume:

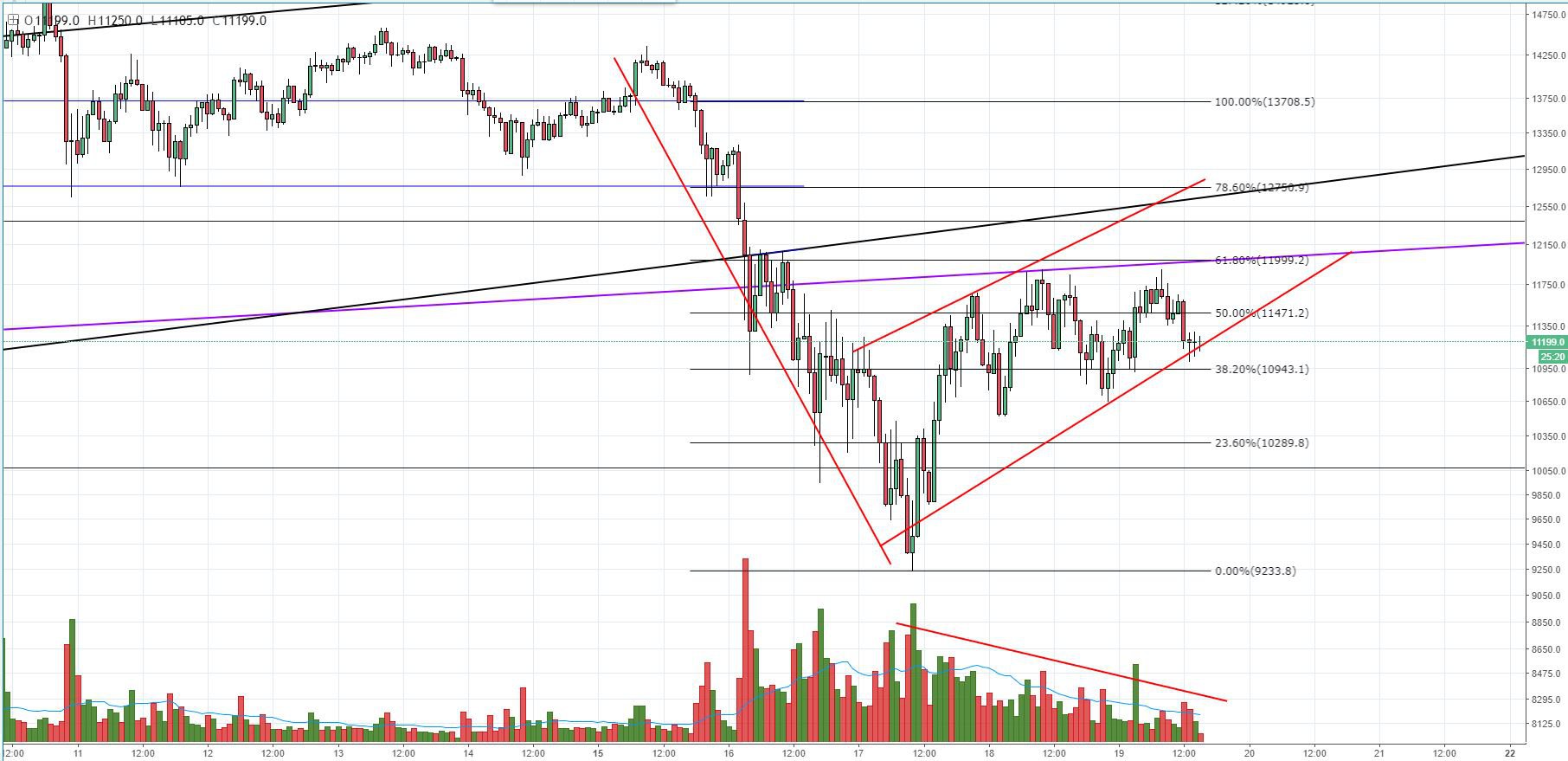

Figure 2: BTC-USD, 15 Minute Candles, Current Support and Resistance Levels

After bouncing off the macro 50% values, the market rallied and ultimately tested the linear trendline shown in Figure 1. Now, after several failed attempts to break the linear trendline’s resistance, the market finds itself in a consolidation pattern where it decides where it will move next.

Figure 3: BTC-USD, 60 Minute Candles, Potential Bear Flag

One possibility to keep a close eye on is this potential, strong bear flag. After finding support on the macro 50%, the subsequent rally saw decreasing volume throughout the length of the movement. This sort of price action could potentially lead to a bearish continuation with a measure move between $4000 and $5000 — a price target of approximately $6,000 – $7,000. If a drop of this magnitude continues the downtrend, we can expect to find support on the 61% macro Fibonacci retracement values shown in Figure 1.

It’s important to note that bitcoin has a penchant for breaking upwards when all signs say “down,” so tread lightly and wait for confirmation of the move. Confirmation of the bear flag breakout would show a pretty obvious outlier in volume, combined with wide price spread.

Summary:

- bitcoin recently saw a steep drop in price where it ultimately found a local bottom in the low $9,000s.

- Since it bottomed out, it has seen a rally on decreasing volume which leaves the door open for a bearish continuation.

- If the bearish continuation continues, expect support on the 61% macro retracement values.

Trading and investing in digital assets like bitcoin and ether is highly speculative and comes with many risks. This analysis is for informational purposes and should not be considered investment advice. Statements and financial information on bitcoin Magazine and BTC Media related sites do not necessarily reflect the opinion of BTC Media and should not be construed as an endorsement or recommendation to buy, sell or hold. Past performance is not necessarily indicative of future results.

Published at Sat, 20 Jan 2018 07:00:06 +0000