From 2015 to 2017, the price surged from around $150 to $20,000 in a parabolic movement, demonstrating a staggering gain of 13,233 percent within a two-year period.

Big question re: analog year comparison is whether 10a rally will lead to 10b retest similar to 2013-2015

— Peter Brandt (@PeterLBrandt)

In the next several years, according to the analysis published by respected trader Peter Brandt, the price could potentially recover quickly from the current level at $5,000 to over $50,000 if it continues to show strong momentum.

Why Big Predictions For bitcoin is Emerging Once Again

As reported by , on Saturday, Brandt laid out strong technical reasons to support the potential of to rebound beyond the $20,000 all-time high to a range between $50,000 to $72,000.

Brandt told Yahoo that “analogs” are holding well and that the market is in an ideal position to jump back into a parabolic bull market.

“I think the analogs are holding remarkably well and based on those analog studies, I think cryptos now will go back into a parabolic bull market. The only question I have is do we rally here some and then sometime in late summer check the late 2018 lows or not? There is a chance that it does, there’s a chance that it doesn’t,” he said.

In the past four months, as soon as tested key resistance levels above $4,200, the dominant showed a fairly large retracement, falling back to the $3,000 region.

Following its impressive 20 percent rally from $4,200 to over $5,000, it dropped shortly below $5,000 but recovered fairly well since.

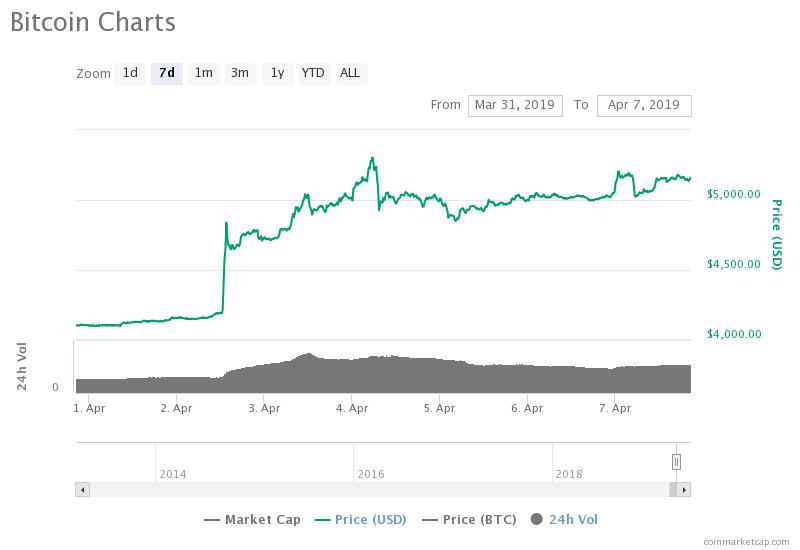

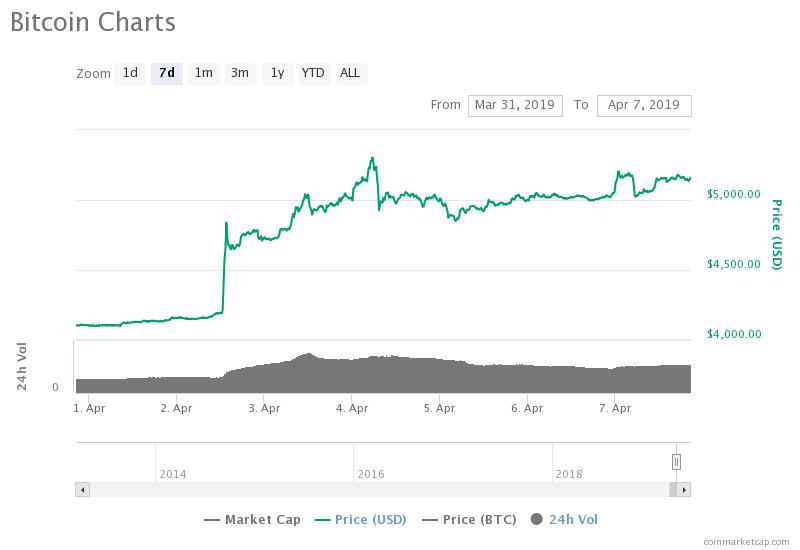

The price has been on an upward trend throughout the past week (source; coinmarketcap.com)

In the last 24 hours, the valuation of the crypto market has recovered by $4 billion while the price rebounded from around $4,900 to $5,169, by more than 3 percent.

Both fundamental and technical indicators point toward a strong near-term price trend of , especially if the asset can sustain its momentum in the weeks to come.

Thomas Lee, the head of research at Fundstrat Global Advisors, said:

We see fewer reasons to question the recent recovery [in] prices—the best quarter since 2017. While the key technical price hurdle is closing above its 200D (currently ~$4,600 and falling by $15 per day), we see 2019 as positive risk/reward.

bitcoin Not in All-Clear Yet

The projection of the price by Brandt and other technical analysts in the space primarily depends on the short-term performance of , specifically whether the asset will be able to remain above crucial resistance levels.

But, alternative and other major crypto assets in the likes of , , and Coin have recorded large gains in the past several weeks, showing that the overall sentiment around the sector remains positive.

Published at Sun, 07 Apr 2019 14:18:39 +0000