This is my honest opinion of the market. The points I tried to make here require a lot longer than 20 minutes to really discuss, but they boil down to two major arguments:

- does not need a mining industry

- does not have any significant consumption-based demand (true demand)

This is important because both of these fundamentals are believed to underpin bitcoin’s speculative price by many analysts. Effectively, in the case of mining, there is no production based price floor, as the industry as we know is not a fundamental factor: a single can keep the entire network running, and there are many people mining for free! (Malware miners, electricity thieves etc.)

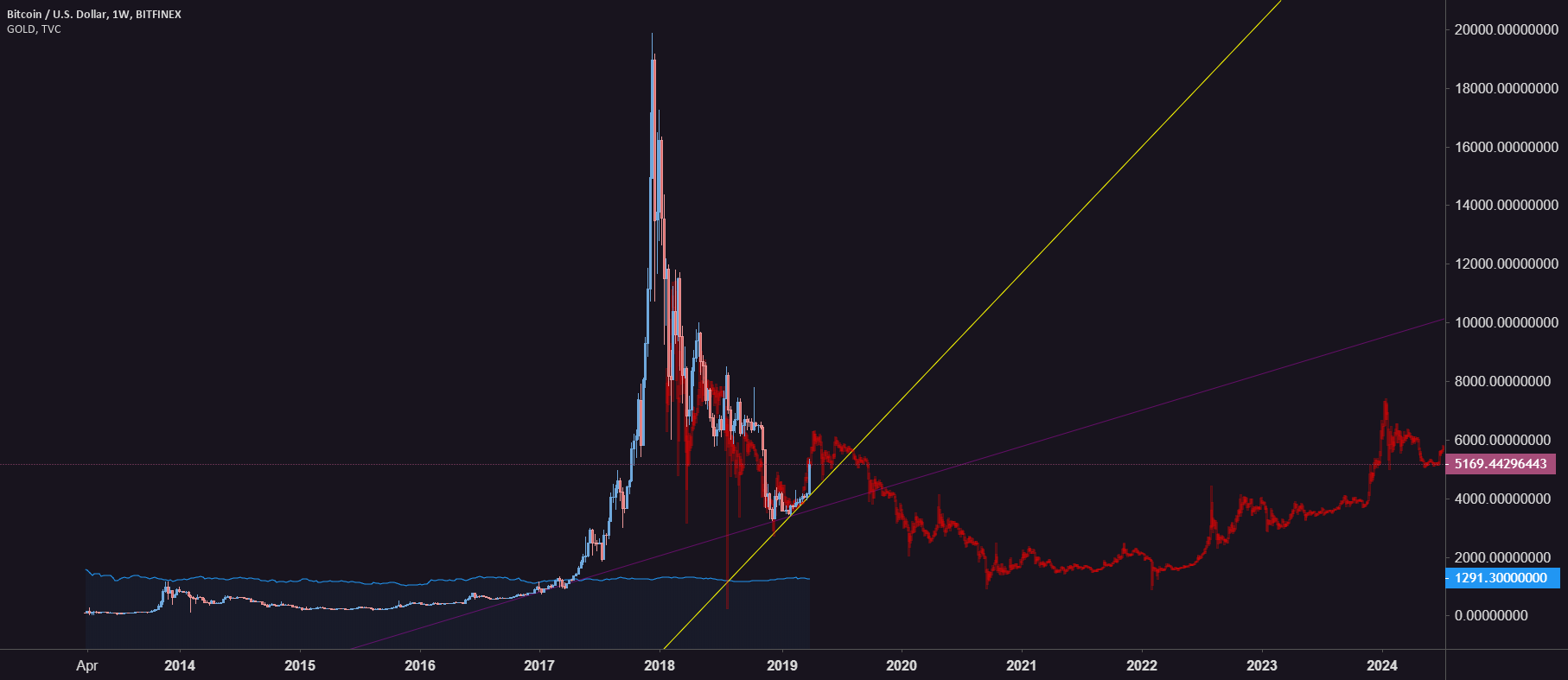

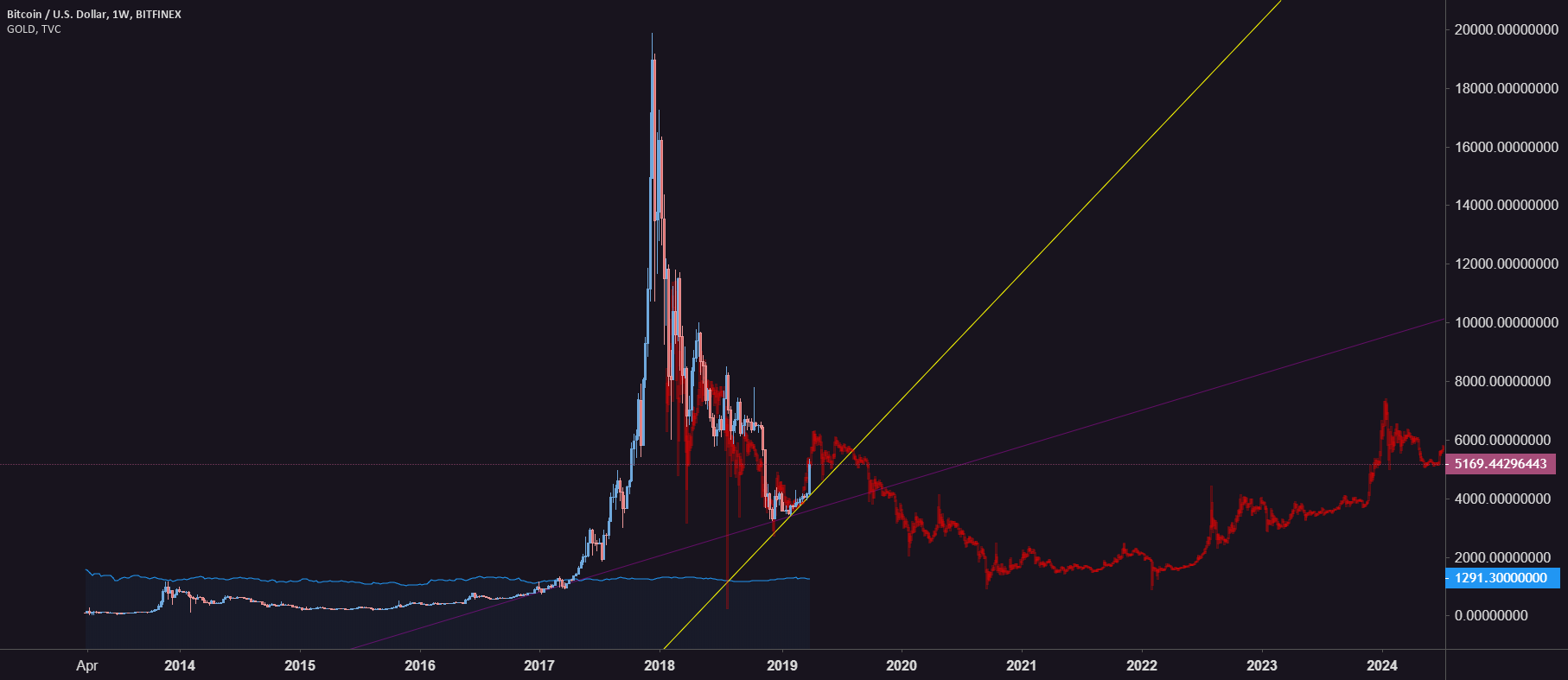

The second point is harder to contend. Let’s take as an established example. Gold’s “intrinsic value” (as espoused by goldbugs) lies predominantly in its utility and relative scarcity. But the truth is the industrial usecase makes up around 15% of the market, the rest is financial speculation and non-essential items. This is a recent change which took place within the last 50 years since the advent of and ETFs and this is why we see these massive inter-year price movements in the market now. Before this the price was fixed and before that (when utility was greatest) the price was flat for hundreds of years and changed very little over the millennia. (Yes, there are academics that work this stuff out.) Whatever happens within the speculative markets, the price returns to the supported by utility. This is what I call true demand. In this cycle seems to take decades.

Speculation is the heart of TA, it is effectively what most people chart. This type of supply/demand will eventually be overcome by fundamentals when you move to larger enough time frames. This analysis here, such that it is, takes a multi-decade approach.

Disclaimer: This is 100 % opinion, but it is genuinely what I believe.

Published at Sun, 07 Apr 2019 12:05:10 +0000