So the bears turned the market one more time as expected. Sometimes I wonder what´s the point of publishing a chart just showing how it could go up and how it could go down, or even worse, being a permabull because “long” ideas get more likes than “short” ideas. The answer is that all those “experts” making that charts are not traders, those just make money by selling cheap courses that you can found in the internet for free. I don´t think that´s fair for newbies which just entered this market, or even people with more time in this market but don´t have the time to analyse. Me as a trader I´m always looking for trading opportunities with a safe set up, combined with a money management strategy that suit my trading style. The users in my telegram group are already inside a short trade with a huge potential return, just by entering at the right time with a properly set up.

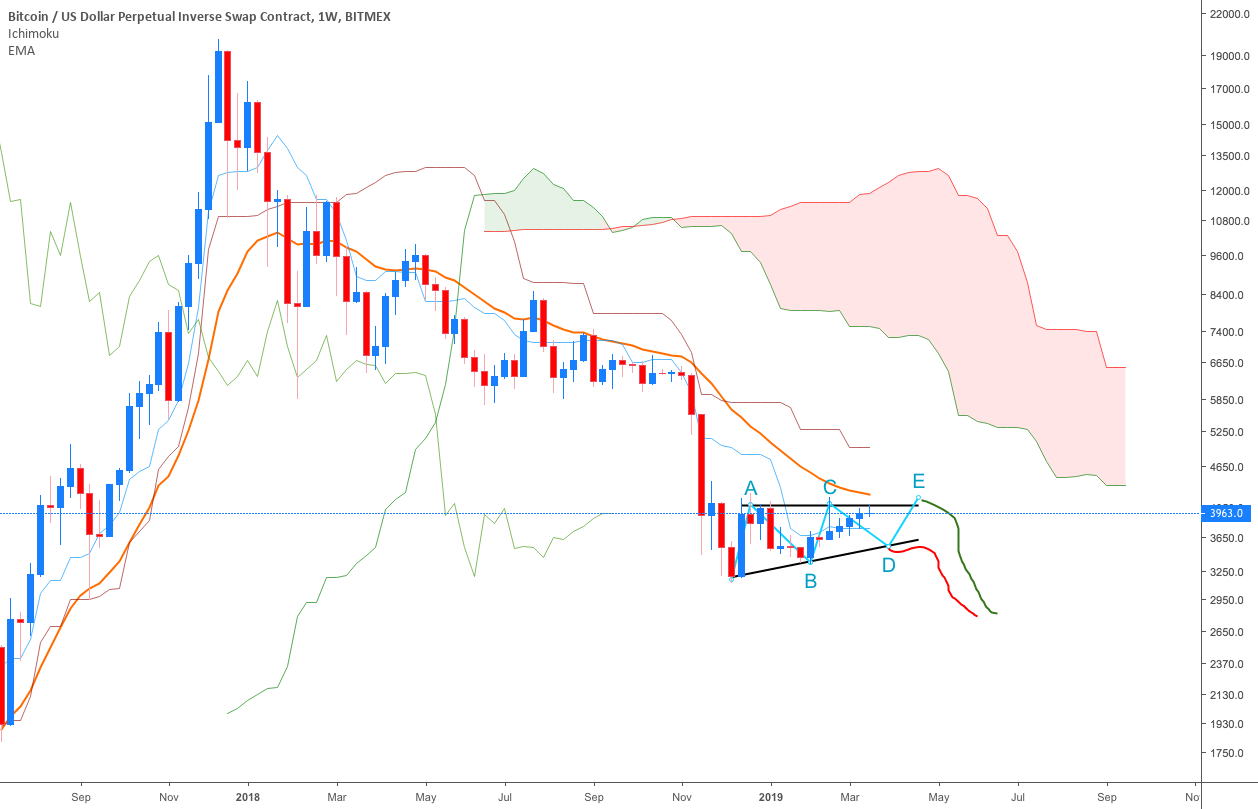

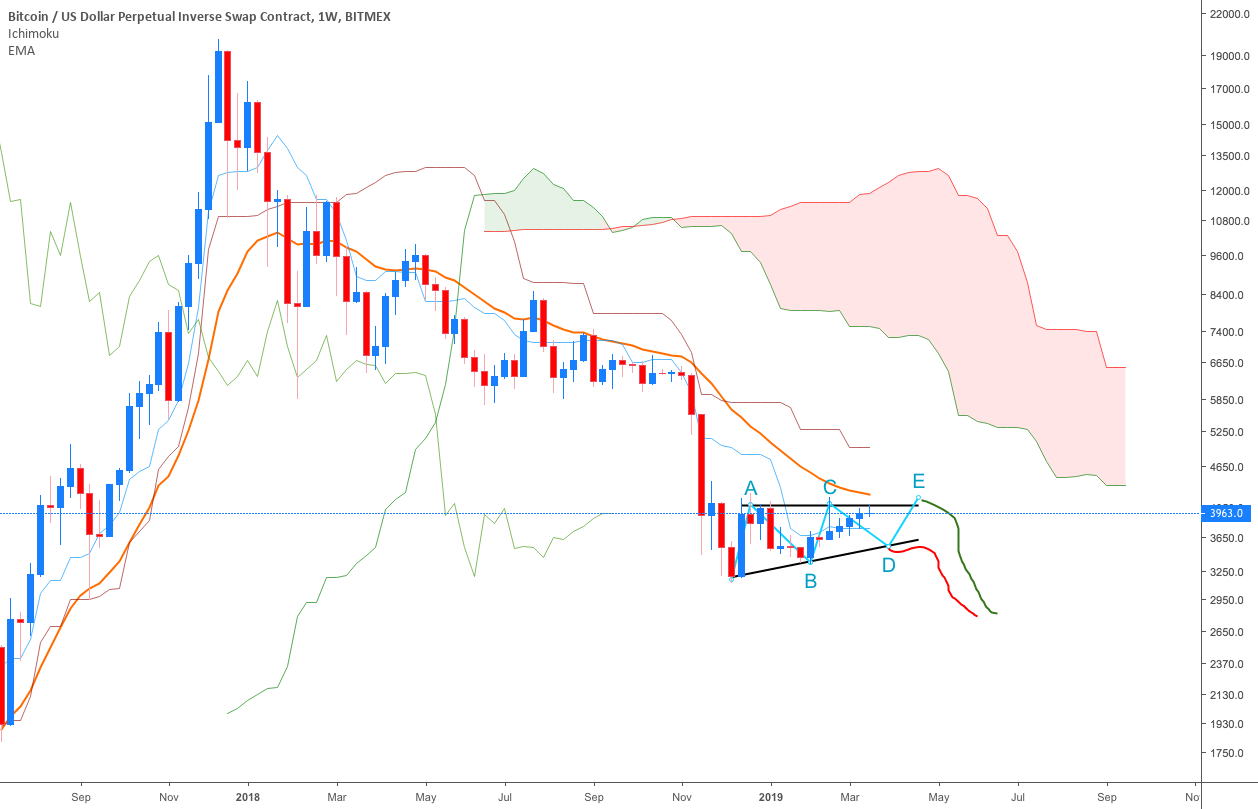

I maintain the overall vision that I´m publishing since weeks ago. That´s not meaning that I couldn´t send a “long” signal in my group whenever I consider that have a good potential, but the overall scenario guys is . Why going again a market that have probed during more than one year that is fully depressed? This is the opportunities that one have to get advantage of, once the market gives signals of recovery I´ll be the fattest bull, but until that happens I know very well what to do and how to do it.

Things are still the same, there is no clarity wether we are going up again from around 3600 or this just the beginning of the first impulsive wave that will finally send this market way below 3k. It will depend pretty much on what the react at 3500/3600, and what the price printed in the chart.

As always I´ll keep you updated, thanks for watching.

IF YOU FIND THIS INFORMATION USEFUL, PLEASE HIT THE LIKE BUTTON AND FOLLOW ME.

Public Telegram channel

Open your account in Bitmex and get a 10% discount on your trade fees

Open your account in Binance

Published at Thu, 21 Mar 2019 17:56:09 +0000