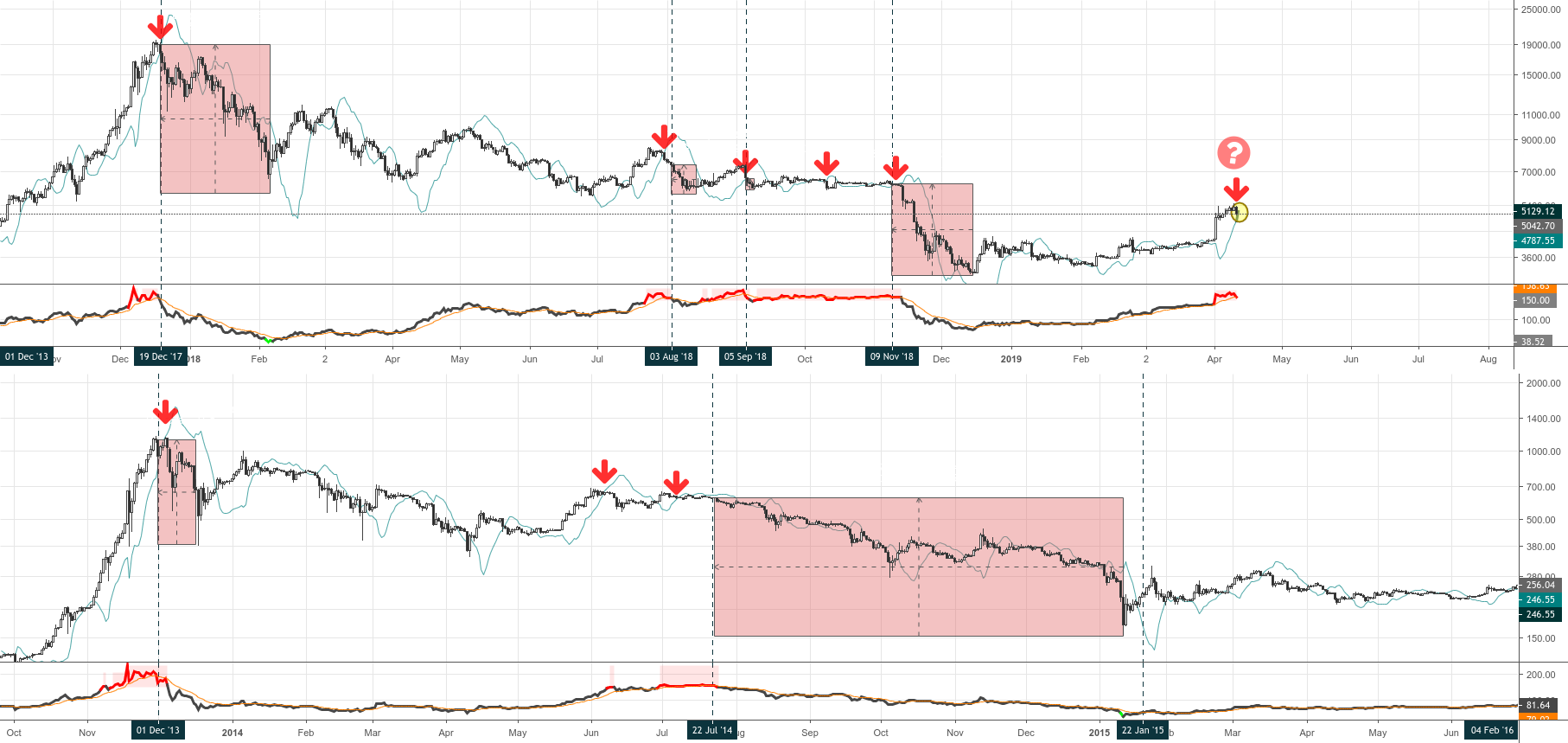

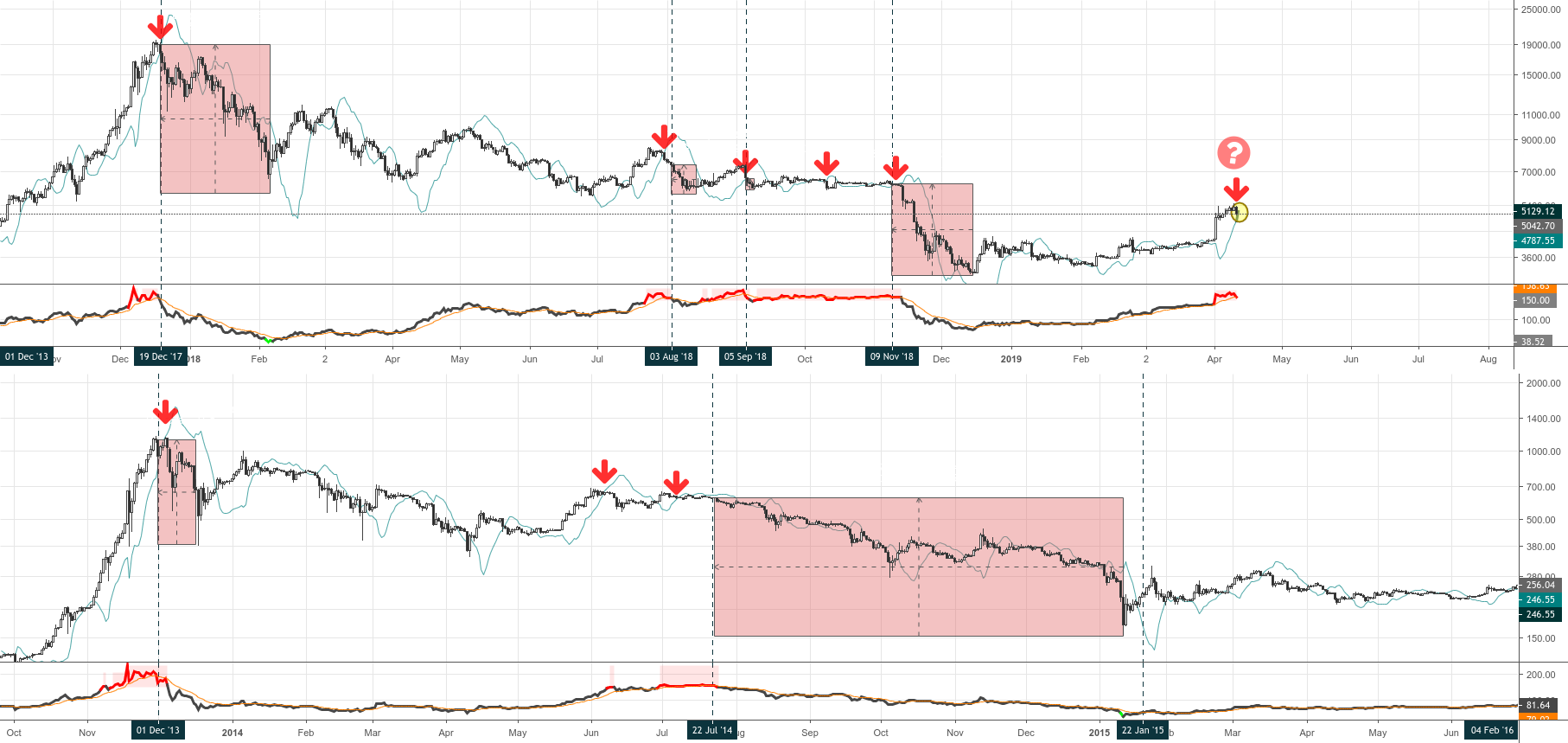

Now that the indicator is back in the red zone, I wanted to look back at the chart to spot potential topping patterns.

I am seeing a likely cross with its signal line by the end of the day (still unconfirmed).

And at the same time, I am plotting here the Dinapoli Momentum Switch indicator in search for key correlations.

And we can see two potential outcomes out of this event happening when the line was red:

a) The start of a significant down correction

b) A choppy consolidation period in front of us where would keep flashing red for some time… just to resolve in a significant down correction

Either way, the results look very consistent… not even a single time a bull trend has started right after these two factors were in confluence. I’d say it became quite the opposite. Is this time different?

Published at Thu, 11 Apr 2019 15:01:55 +0000