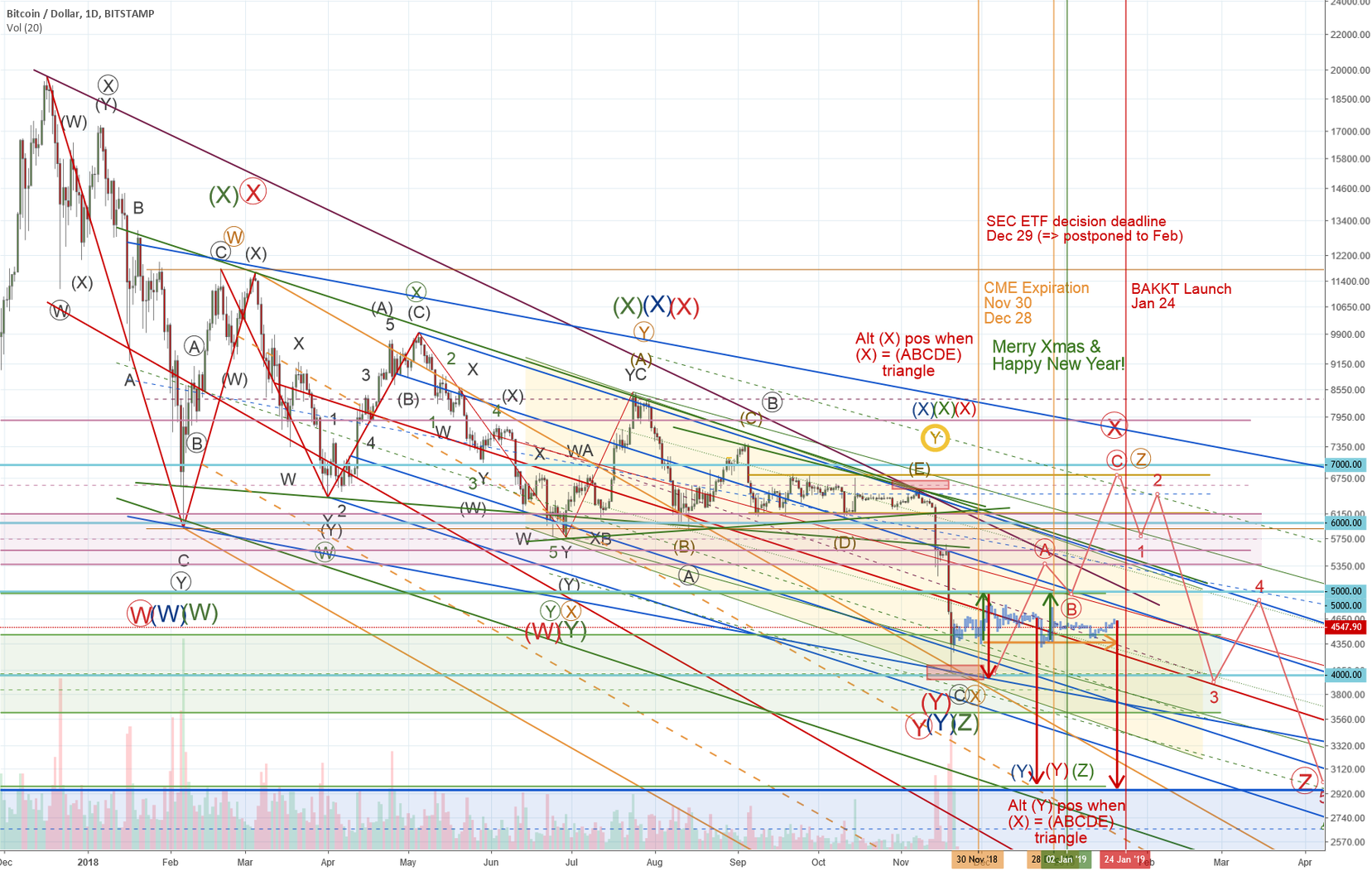

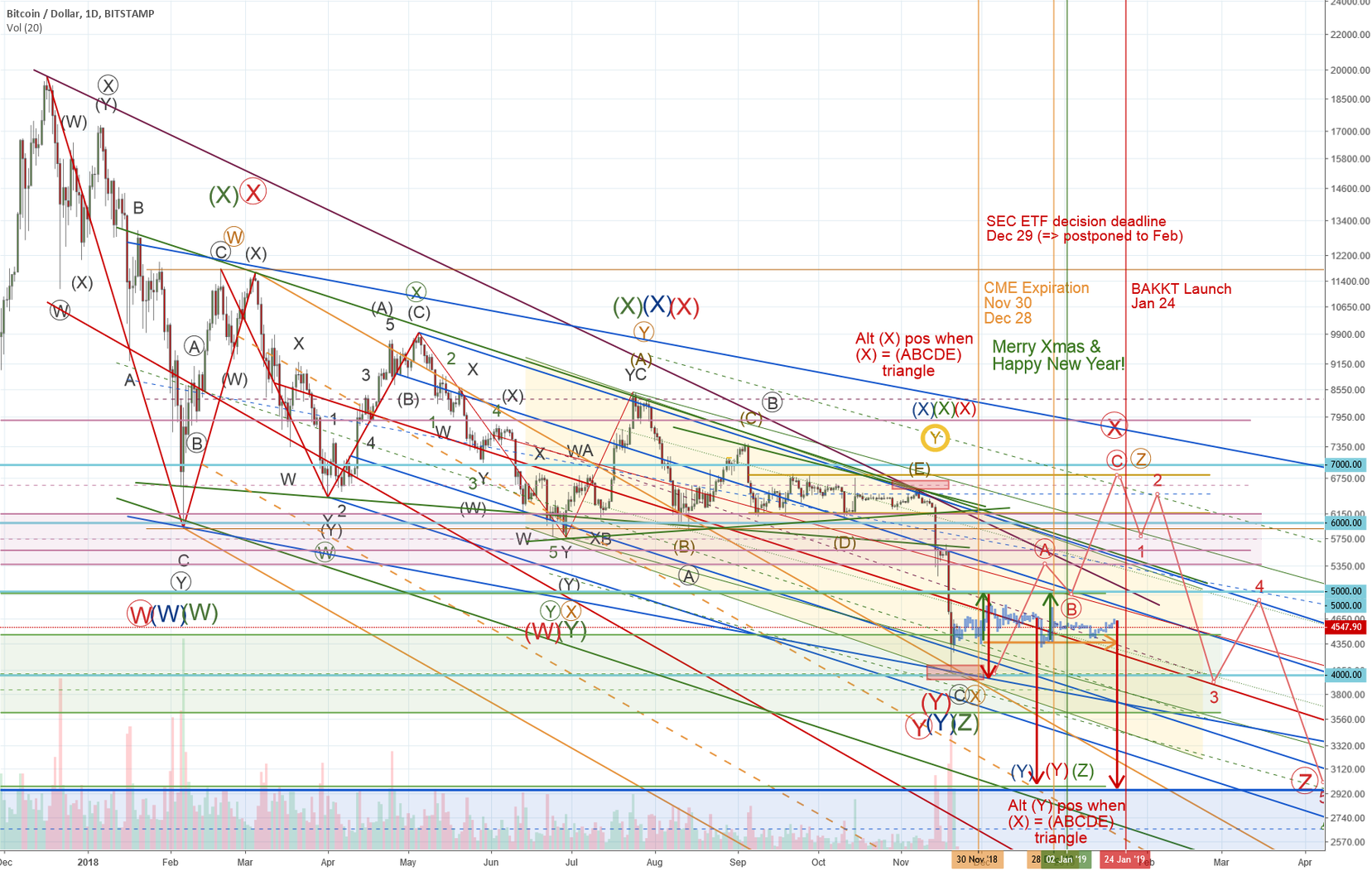

Here’s another macro look at .

– We have dropped to the 4200 level on Coinbase as predicted in one of the scenarios of the previous macro analysis.

– We also had a spike fakeout upwards on expiration day due to Tether FUD – described as a possible violent move in the previous analysis.

A Recap of key recent events:

– Tether FUD (dropped to 0.85$) caused a major fakeout spike on

– The 6K Wall has fallen as expected. RIP King Leonidas and the 300 brave whales that fought alongside him, all presumed dead heroes. Praise the King!

– BAKKT launch is moved from Dec 12 to Jan 24 2019

– SEC deadline for VanEck decision is now Dec 29 but will likely be postponed till Feb 2019

– BCH fork and civil war of the and chains have caused a major drop

– World’s First ( , physically backed by ) is approved: $HODL, will begin trading on Switzerland’s Six Swiss Exchange beginning next week

the index includes: , ETH, XRP, LTC and BCH and is managed by VanEck subsidiary

On a chart there are:

– 3 EW counts: red, green, blue, and a 4th orange subwave count. Black subwave count is common for all.

– 3 down channels: yellow, green and blue

– 3 pitchforks: green, blue and orange

– 3 major support/demand zones: pink, green and blue

was moving sideways on top of a major pink and has dropped because of a confluence:

– ADCDE triangle (yellow) top side breakout failure (E)

– touched/failed to break the Blue Pitchfork’s top band

– on the news of a BCH hard fork and upcoming civil war of the chains

– on expiration date

Price has stopped at 4200 because of a confluence:

– top of a major green with a quick dip to its and bounce back to top

– Orange Pitchfork’s top band

– fib level confluence

– BCH fork has won

– major

Notes:

1. NO Bull Run This Year (till Spring 2019):

– both the BAKKT launch and the approval are postponed.

There are no fundamental reasons for the price to go up unless some unexpected major event happens (i.e. surprise early approval).

The institutions will not buy an asset without proper security, ensurance and regulation with clear established rules.

The average investors either HODL or expect the price to go down and won’t buy.

There will be price manipulations, of course, but not a bull run.

– professional traders take profit and exit before Thanksgiving/Christmas. Expect a low sideways market or further decline/drop to new .

– We’ll see how the Switzerland performs next week but don’t expect a lot – they are just testing .

2. We have dropped to unimaginable 6 on D1. And there was no substantial bounce! We also had a major divergence on H4.

The indicators are broken/useless in these market conditions. Shorts >> Longs. Still no squeeze. Nothing. No liquidity, no sellers.

_______________________________

There are 3 scenarios:

1. a ranging sideways market between 4-5K

2. a drop to 3K (next major top, green bottom, pitchfork’s support line, fib confluence)

3. a grinding uptrend to max 5500 this year and then 6800 at BAKKT launch, decline afterwards

Also expect:

– violent moves on the expiration dates.

– more Tether FUD related fakeout spikes in . They can’t pump, they can only drop Tether even more to get some shorts liquidated.

is in a yellow , just bounced from its bottom. It will move sideways for a while but when it touches/fails to break:

– 5K psychological level

–

– supply line (purple)

– 5500 bottom of the pink (now supply resistance)

– top band of the yellow channel

the price will bounce down and drop into a larger green , make a new bottom if 4K support doesn’t hold.

And this new green channel has a bottom band crossing at 3K.

Blue demand channel is defined by 2 bottoms and 1 top. It needs readjustment for the top band if the current bottom doesn’t hold and price drops further.

Yellow/Green supply channels are defined by 2 tops and 1 bottom. They don’t need readjustment.

If the current 4200 bottom holds, we will continue in a blue channel with a max price for the year 7900 (blue channel crossing the larger pink top) but chances of reaching that price are slim, that’s why I predict only max 5500.

There are 4 counts:

1) (WXYXZ) (red) ( , then )

This count has 2nd X at 6800 and Z at 3K. Then a bull run should start.

a drop to 3K is possible before X starts

triangle in Z and the end of correction – both and

– – we may go up and retest 11000 (thin will soon allow that) in 12345 up trend

– – WXYXZ can transform into a larger WXY and become only its first W wave, with whatever wave X up follows being just an upwards correction

2) (WXY) (blue) ( , then )

a (WXY) variation of (WXYXZ) (red) with first X further down the channel, still implies 2nd X upwards correction.

results in a 2nd X upwards correction or a down trend continuation in wave Y with a drop to 3K before 2nd X starts

3) (WXYXZ) (green) ( )

this count implies that the 2018 bear market correction is over and a bull run/correction upwards should start now. But it won’t happen due to fundamental reasons.

That’s why I’m moving 12345 up trend to spring

4) (WXYXZ) (orange)

this is basically an inverted upwards WXYXZ subwave inside a long X after the first W with Z ending at 6800 or blue channel top, with another decline afterwards.

depending on ABCDE triangle there are also 2 subcounts for each count:

– in type1 subcount ABCDE is not a triangle but an inside Y or Z or each count

– in type2 subcount ABCDE is a triangle inside wave X with a higher probabiliy drop to 3K, so

all corresponding 2nd Xs move to their alt (E) and

all Ys to their corresponding alt at 3K

in EW 2nd X and last Y/Z can be a triangle

So, basically all counts are the same: sideways, then drop to 3K. Or upwards correction to 6800, then drop. Or just ranging sideways for 1-2 months

Good Luck! Please, don’t trade based only on my analysis, confirm/disprove using other sources.

Published at Thu, 22 Nov 2018 02:29:47 +0000