Hi guys,

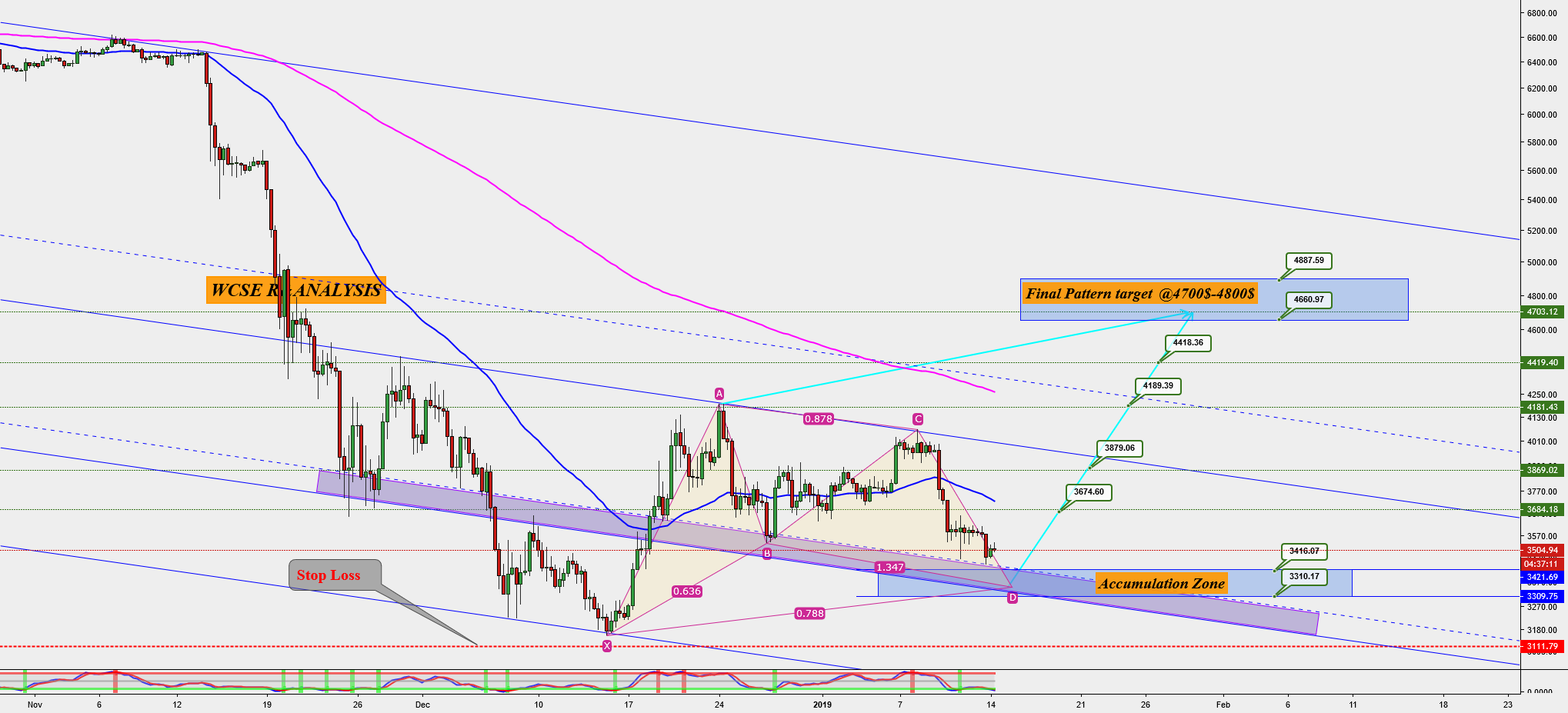

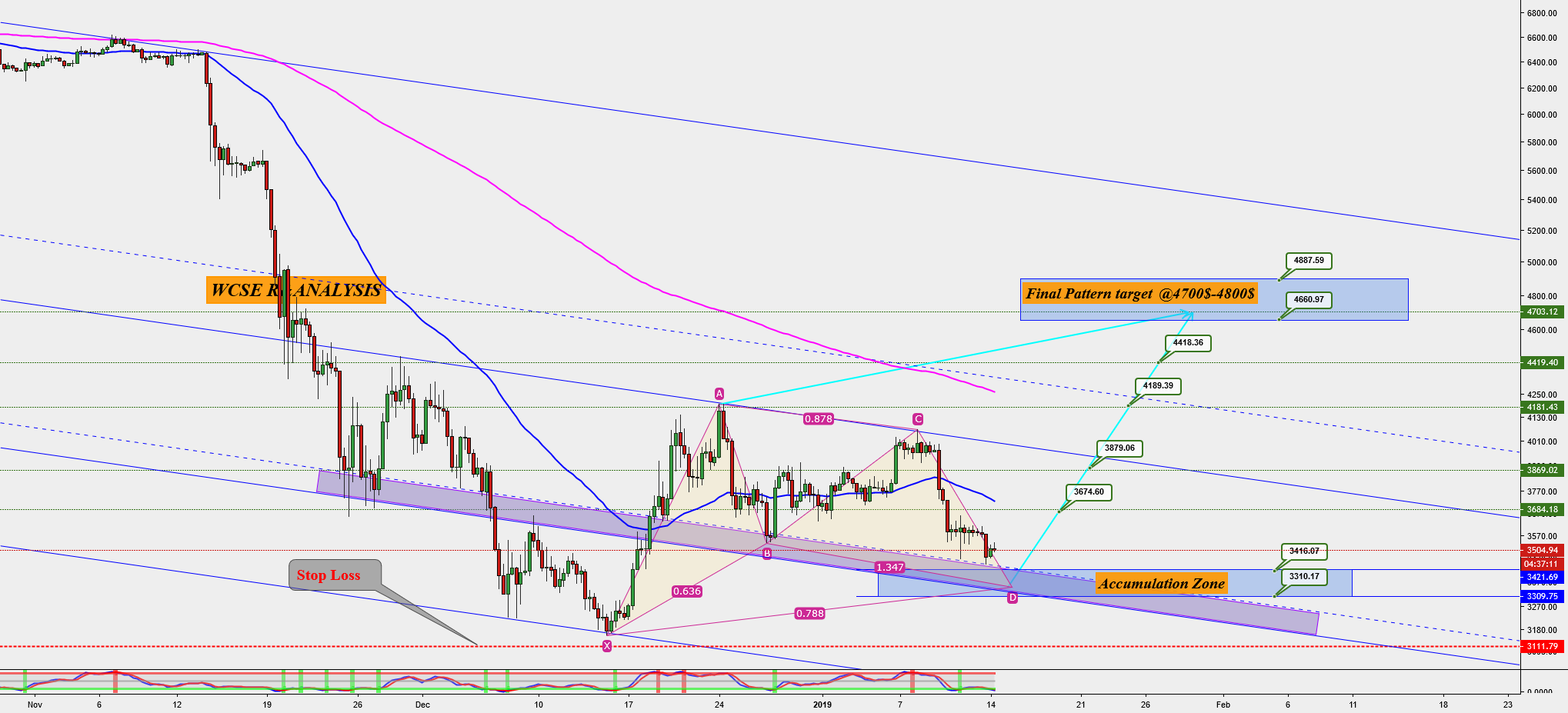

Discovered another pattern on which is in nature called PATTERN. is basically an appearing during a or and it indicates the possibilities that the correction of the ongoing trend may be over and the initial trend may resume.

In simple words the patterns can be summarized as follows:

XA: The XA move could be any price activity on the chart. There are no specific requirements in relation to the XA price move of the chart formation.

AB: The AB move should be approximately 61.8% of the XA size. So, if the XA move is , then the AB move should reverse the price action and should reach the 61.8% of XA.

BC: The move should then reverse the AB move. At the same time, the move should finish either on the 38.2% Fibonacci level, or on the 88.6% Fibonacci level of the prior AB leg.

CD: The CD should be a reversal of the move. Then if is 38.2% of AB, then CD should respond to the 127.2% extension of . If is 88.6% of AB, then CD should be the 161.8% extension of .

AD: Then there is the last rule for the . When the CD move is complete, you should measure the AD move. A valid on the chart will show an AD move, which takes a of the XA move.

From the above above general rules, looking at the current chart we can see serious correlation that made me believe we might be onto gartely pattern.

Suggested buy zone is given inform of accumulation zone where we pick our Long trade across the drop towards the last leg D of the pattern.

Level to watch are: 3309-3421$. Spread the Long orders in between the range, I will also start the long laddering from current price as the price may tend not to drop far more in other not to miss out of the real move.

Pattern stop loss is the close below the point X.

Possible Entry and exit targets are clearly stated on the chart.

BLUE: POSSIBLE ENTRY ZONE

RED: Possible

GREEN: SELL TARGETS

Join our discussion room for more about our trading ideas.

Please share your thoughts about it and support my post with your LIKES.

Thanks

Note:

It will be good to always understand risk involve in trading. Always trade with stop Loss in place.

Set up an entry/exit strategy for every trade, with good risk/reward ratio.

Published at Mon, 14 Jan 2019 11:23:11 +0000