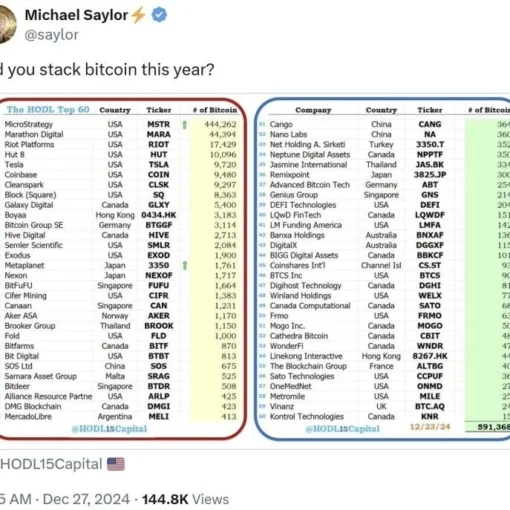

Track publicly traded companies around the world that are buying bitcoin as part of corporate treasury.

Bitcoin Holdings by Public Companies

bitcoin Holdings by Public Companies

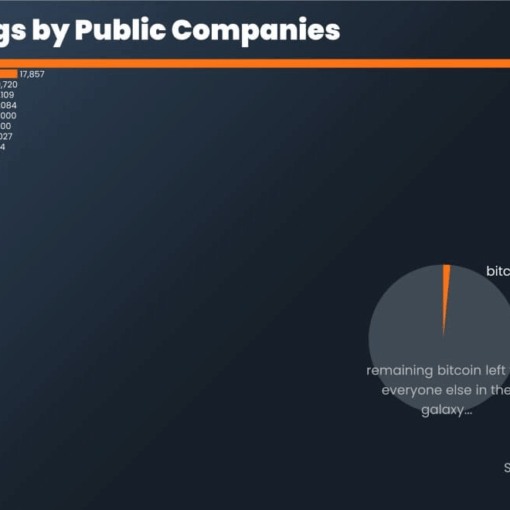

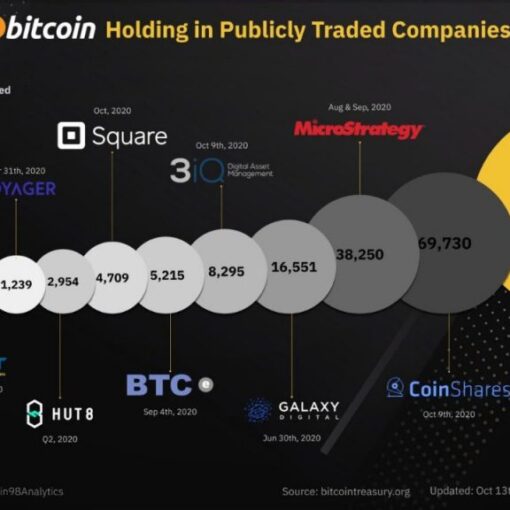

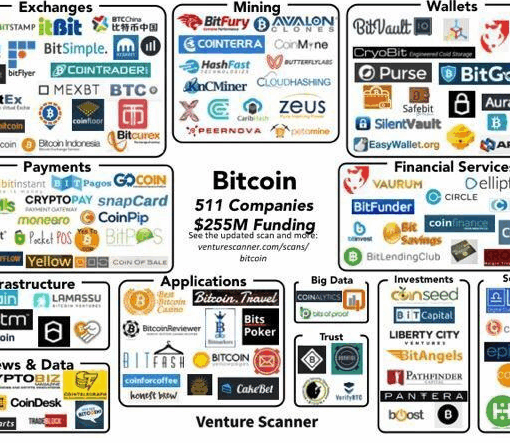

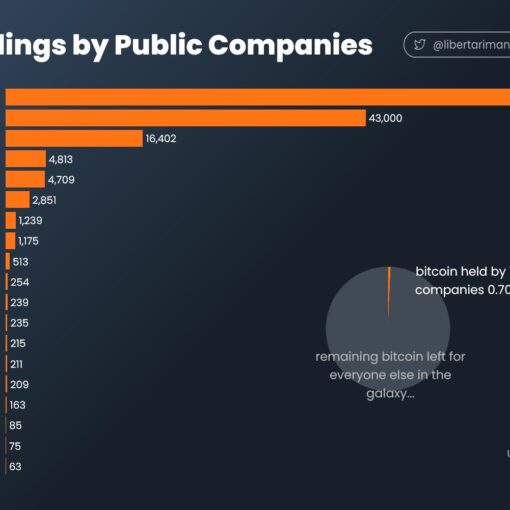

Lately, there has been a significant rise in the number of publicly traded companies worldwide that have started to allocate a portion of their corporate treasury to bitcoin holdings. This trend has gained significant attention in the financial world, as it reflects a growing acceptance and recognition of bitcoin as a legitimate asset class.

Will this trend continue?

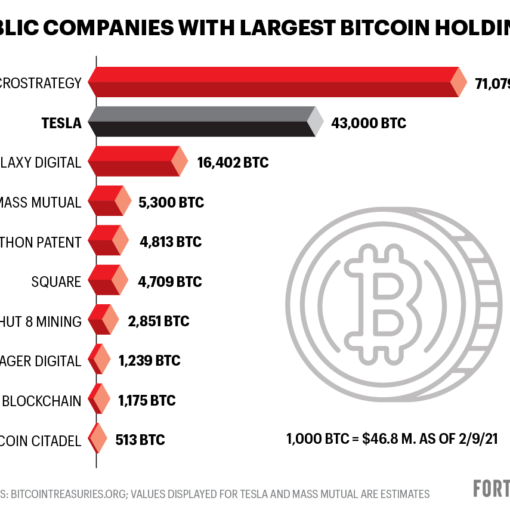

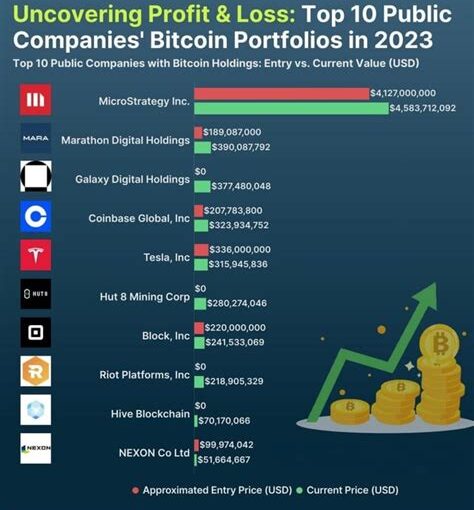

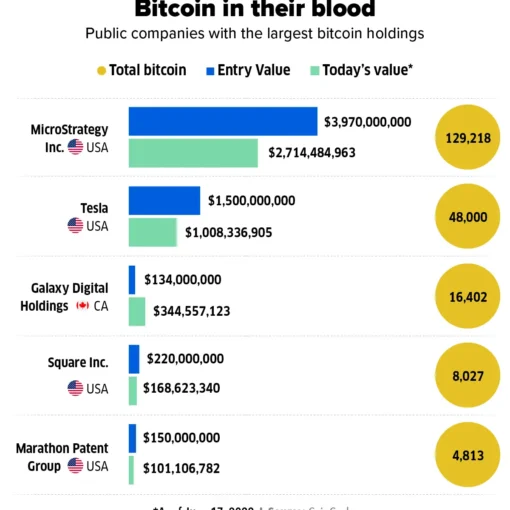

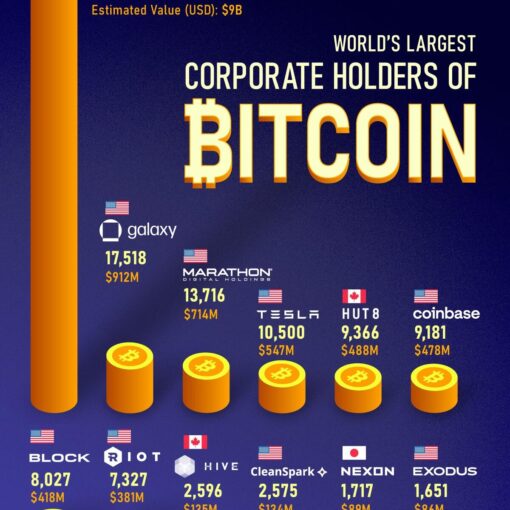

According to the latest data, numerous public companies have already made notable investments in bitcoin. For instance, , a multinational technology corporation, currently holds a multitude of bitcoin in its treasury. Similarly, other financial institutions, have accumulated a substantial amount of bitcoin and their current positions are detailed in the graphical charts above.

These companies are not alone in their embrace of bitcoin. Several other public companies, both within and outside the tech and finance sectors, have also entered the market and acquired significant bitcoin holdings. Corporations like Tesla and Coinbase are prominent examples of companies that hold bitcoin.

The increasing trend of public companies investing in bitcoin can be attributed to numerous factors, including the potential for long-term value appreciation, the diversification of traditional investment portfolios, and the desire to hedge against inflation risks. Moreover, bitcoin’s decentralized nature and limited supply make it an attractive store of value for companies seeking to preserve their wealth in turbulent economic times.

As this trend continues to evolve, it will be crucial to monitor the bitcoin holdings of public companies and analyze its impact on the wider financial landscape. The growing prevalence of bitcoin in corporate treasuries signifies a significant shift in traditional financial practices, presenting new opportunities and challenges for investors and stakeholders alike.

– Public companies worldwide are investing in bitcoin.

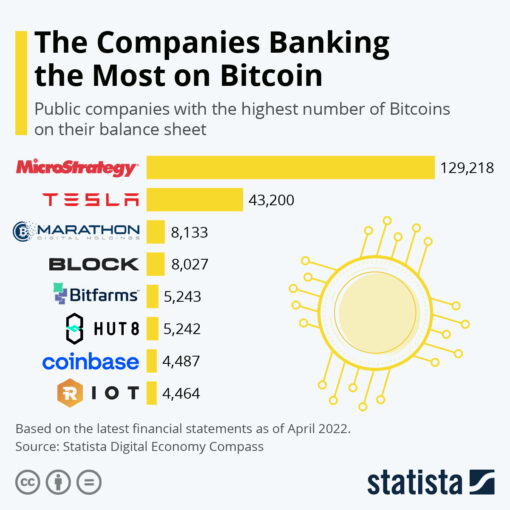

– Companies like Microstrategy hold a significant amount of bitcoin.

– Other financial institutions like BlackRock, Fidelity and Chase have also acquired substantial bitcoin holdings.

– Factors driving this trend include storage of value, long-term value appreciation, portfolio diversification, and hedging against inflation risks.

– bitcoin’s decentralized nature and limited supply make it attractive for preserving wealth.

– Monitoring public companies’ bitcoin holdings is important to understand its impact on the financial landscape.

– The growing prevalence of bitcoin in corporate treasuries represents a shift in traditional financial practices.

bitcoin Holdings by Public Companies: A Paradigm Shift in Corporate Treasury Management

In recent years, a remarkable trend has emerged within the corporate world, signaling a profound evolution in financial strategy and risk management. Traditionally viewed as a speculative asset or a niche investment, bitcoin has now firmly entrenched itself as a legitimate component of corporate treasury reserves for a growing number of public companies. This strategic pivot towards bitcoin holdings represents not just a hedging strategy against inflation or geopolitical risks, but a pivotal moment in the evolution of corporate finance.

The Rise of bitcoin in Corporate Treasuries

The journey of bitcoin from a whitepaper concept written by Satoshi Nakamoto to a globally recognized digital asset has been swift and, at times, tumultuous. Initially embraced by tech-savvy entrepreneurs and retail investors, bitcoin gradually attracted institutional interest, with hedge funds and asset managers allocating capital to this nascent asset class. However, the watershed moment came when visionary corporate leaders began to view bitcoin not just as a speculative investment, but as a reliable store of value akin to gold, albeit with the added advantages of divisibility, portability, and verifiable scarcity.

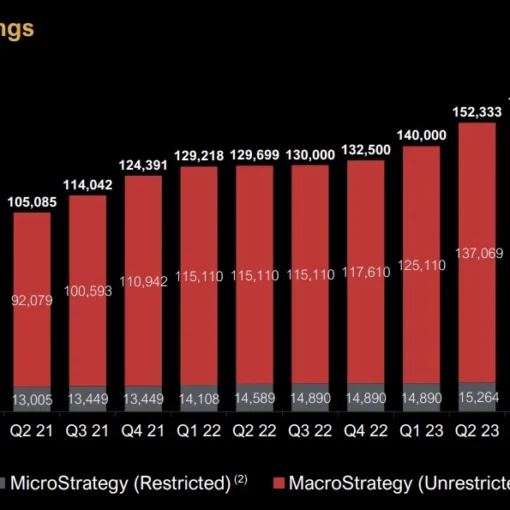

Tesla, under the stewardship of Elon Musk, arguably catalyzed this trend by announcing a $1.5 billion investment in bitcoin in early 2021. This move, followed by MicroStrategy’s pioneering strategy of converting a significant portion of its treasury reserves into bitcoin, marked a turning point. These bold decisions by high-profile companies served as a clarion call for other corporations to reevaluate their treasury management strategies in the context of a rapidly evolving economic landscape.

bitcoin as a Hedge Against Fiat Currency Depreciation

Central to the allure of bitcoin as a corporate treasury asset is its resistance to inflation and currency devaluation. As governments worldwide embark on unprecedented monetary expansionary policies in response to economic shocks, concerns about the long-term purchasing power of fiat currencies have intensified. bitcoin, with its fixed supply and decentralized nature, offers a compelling hedge against the erosion of fiat currency values over time. This inherent scarcity, encoded in its protocol, imbues bitcoin with properties akin to digital gold, making it an attractive diversification tool for corporate treasurers seeking to safeguard capital in an uncertain economic environment.

Challenges and Considerations

However, the integration of bitcoin into corporate treasuries is not without its challenges. Volatility remains a perennial concern, with bitcoin experiencing periodic price swings that can test the risk tolerance of even the most seasoned financial executives. Regulatory uncertainty also looms large, as policymakers grapple with how to classify and regulate digital assets within the existing financial framework.

Moreover, the operational complexities associated with securely custodying and managing bitcoin holdings necessitate robust infrastructure and adherence to stringent cybersecurity protocols. Nonetheless, these challenges have not deterred pioneering companies from exploring the potential benefits of bitcoin as a strategic asset allocation within their treasury portfolios.

The Future Trajectory of bitcoin Holdings by Public Companies

Looking ahead, the trajectory of bitcoin holdings by public companies appears poised for continued growth and diversification. As awareness of bitcoin’s value proposition as a store of value and inflation hedge continues to proliferate among corporate decision-makers, more companies are likely to follow in the footsteps of early adopters. This trend is further bolstered by the emergence of financial products and services tailored to institutional investors, including bitcoin exchange-traded funds (ETFs) and custodial solutions offered by established financial institutions.

Moreover, the maturation of regulatory frameworks governing digital assets is expected to provide greater clarity and confidence to corporate treasurers contemplating bitcoin investments. As a result, bitcoin’s integration into corporate treasury management strategies may become increasingly commonplace, contributing to a broader institutional adoption that could fundamentally reshape the financial landscape.

In conclusion, while bitcoin’s journey from the fringes of the financial ecosystem to the corporate mainstream has been swift, its ascent as a strategic asset within corporate treasuries represents a paradigm shift with far-reaching implications. By diversifying treasury reserves beyond traditional asset classes and embracing digital innovation, public companies are not only safeguarding their capital against inflationary pressures but also pioneering a new era of financial stewardship in an increasingly digital world.

As this trend continues to unfold, the role of bitcoin in corporate treasuries may evolve from a tactical investment to a cornerstone of resilient financial strategies, underscoring its transformative potential in the global economy.

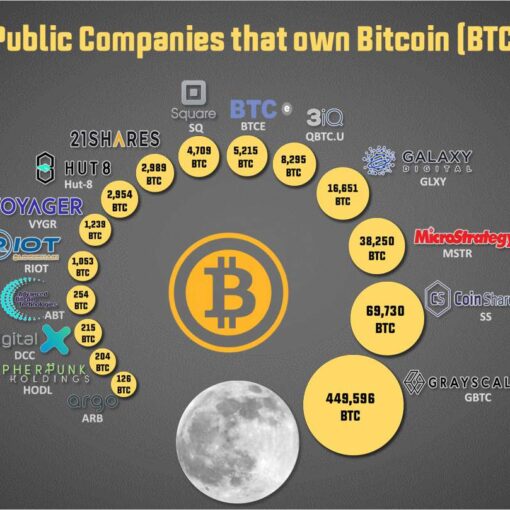

What public companies own the most bitcoin?

As of May 2025, several public companies have made significant investments in bitcoin, with Strategy (formerly MicroStrategy) leading the pack.()

Strategy (formerly MicroStrategy)

Strategy holds the largest corporate bitcoin reserve, totaling 568,840 BTC as of May 12, 2025. This substantial holding is valued at over $59 billion, acquired at an average purchase price of $66,384.56 per bitcoin . The company’s aggressive acquisition strategy underscores its commitment to bitcoin as a primary treasury asset.(, )

Tesla Inc.

Tesla maintains a significant bitcoin position, holding 11,509 BTC valued at approximately $1.05 billion . The company has retained this holding through the first quarter of 2025, reflecting its ongoing interest in cryptocurrency investments.(, )

Marathon Digital Holdings

Marathon Digital Holdings, a prominent bitcoin mining company, owns 46,255 BTC, making it the second-largest corporate holder of bitcoin after Strategy . This holding underscores the company’s integral role in the bitcoin mining ecosystem.(, )

Galaxy Digital Holdings

Galaxy Digital Holdings, a diversified financial services firm focused on digital assets, holds 13,704 BTC. The company’s substantial bitcoin holdings reflect its broader engagement with the cryptocurrency market .()

Coinbase Global Inc.

Coinbase, a leading cryptocurrency exchange, holds 9,267 BTC valued at approximately $961 million . The company’s bitcoin holdings are part of its broader strategy to support and invest in the crypto economy.()

These companies’ substantial bitcoin holdings highlight the growing trend of corporate investment in cryptocurrencies, signaling a shift in how businesses manage and diversify their treasury assets.

Who are the major public shareholders of bitcoin?

How much bitcoin do public companies hold?

As of May 2025, several public companies have made significant investments in bitcoin, positioning themselves as major shareholders in the cryptocurrency market.

Strategy (formerly MicroStrategy)

Leading the pack is Strategy, which holds approximately 568,840 BTC. This substantial holding underscores the company’s commitment to bitcoin as a primary treasury asset.

Tesla Inc.

Tesla maintains a significant bitcoin position, holding 11,509 BTC. The company has retained this holding through the first quarter of 2025, reflecting its ongoing interest in cryptocurrency investments.

MARA Holdings (formerly Marathon Digital Holdings)

MARA Holdings, a prominent bitcoin mining company, owns 46,374 BTC, making it one of the largest corporate holders of bitcoin. ()

Coinbase Global Inc.

Coinbase, a leading cryptocurrency exchange, holds 9,267 BTC. The company’s bitcoin holdings are part of its broader strategy to support and invest in the crypto economy.

These companies’ substantial bitcoin holdings highlight the growing trend of corporate investment in cryptocurrencies, signaling a shift in how businesses manage and diversify their treasury assets.

What public companies recently bought a lot of bitcoin?

What Public Companies Recently Bought a Lot of bitcoin?

May 2025 Update –

Several major public companies have made notable bitcoin purchases in recent months, signaling accelerating institutional adoption.

Strategy (formerly MicroStrategy) remains the undisputed leader in corporate bitcoin accumulation. In a bold move this May, Strategy announced the purchase of an additional 13,390 BTC for $1.34 billion. This brought its total holdings to an astounding 568,840 BTC—worth over $59 billion. The company continues to treat bitcoin as its primary treasury reserve asset, doubling down on a strategy that’s become a hallmark of its identity.

BlackRock, the world’s largest asset manager, has quietly become one of the largest bitcoin stakeholders. Through various investment vehicles and ETFs, BlackRock now holds over 625,000 BTC. The firm’s rapid accumulation reflects growing institutional conviction in bitcoin as a long-term macro asset.

Next Technology Holding (NXTT) made headlines after revealing it had acquired 5,833 BTC—5,000 of which were purchased just since the end of 2024. The company’s market cap surged following the news, signaling investor enthusiasm for bitcoin-aligned corporate strategies.

This wave of purchases isn’t isolated. In total, public firms have acquired nearly 200,000 BTC in the first few months of 2025 alone—more than the supply mined during the same period.

The pattern is clear: bitcoin is no longer just a speculative asset for tech visionaries. It’s becoming a balance sheet staple for forward-looking corporations in an era of fiat devaluation and monetary uncertainty.