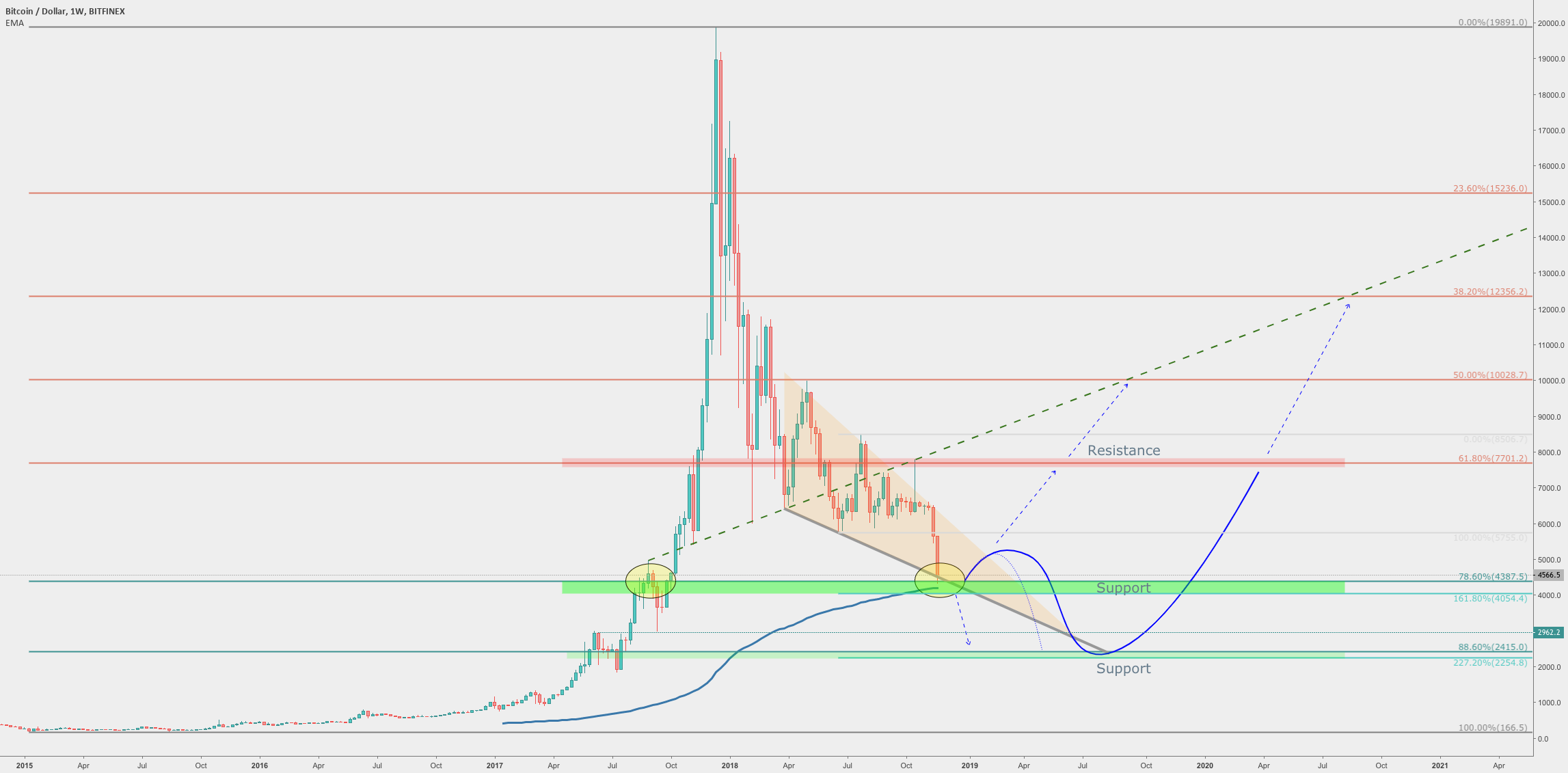

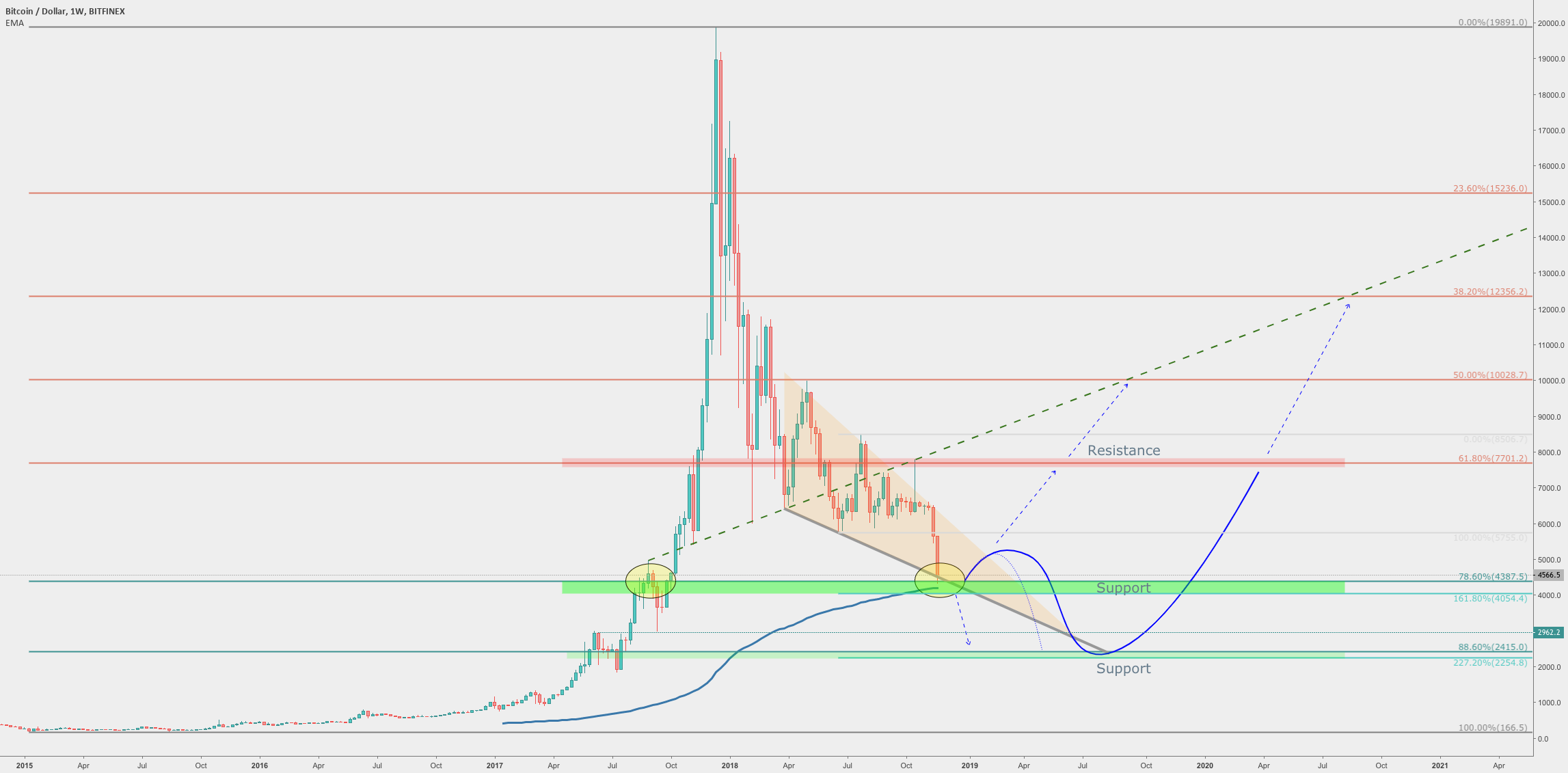

This week has reached the long-term support, that is 78.6% level at $4387. At the same time it reached the bottom of the , and almost tested the 200 Moving Average. Fibonacci, applied to the correctional wave up after breaking the uptrend , is pointing on the $4050 level, that is a 161.8% retracement.

This makes the area between the $4050 and $4400 a key long-term support, which might play a very important role in further price development. If support will be respected, BTC/USD upside correction could be expected, aiming at the upper of the .

However, downside risk remains and could drop further. It is not a high probability scenario, but definitely should be considered as one of the possible outcomes in the coming future. Weekly break and close below the $4050 most likely will send price down to the $2400-2250 , which is confirmed by 88.6% level.

It seems the very important factor is that on the weekly chart price has approached 200 Moving Average and Fibonacci support, Indeed it will not be ignored, but potentially already noticed by all market participants. Well, maybe this is the turning point for the all cryptocurrency market in general and in particular? In any way, even if that is a reversal phase, usually a consolidation period takes place prior to the reversal.

Lets summarize… while the huge has been reached, price is likely to reverse or consolidate. To claim that trend is reversing is far too early, especially while there are no confirmation of that. should be watched for break above or below, which might give more insights of further price direction.

Published at Thu, 22 Nov 2018 10:19:31 +0000