The views and opinions expressed here are solely those of authors/contributors and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

The cryptocurrency market data is provided by the exchange.

While a has proven to be beneficial to the early bitcoin investors, the late entrants have used the wild price swings to add to their bitcoin numbers. We can see from the charts in this article that the whales have increased their bitcoin holdings over the past couple of years.

In these price swings, an average trader buys at the highs and sells at the lows. We have been trying to help our readers avoid this pitfall. All along through this fall, we have refrained from suggesting aggressive long positions. But, do we find a short-term bottom now?

Let’s see.

BTC/USD

We were expecting to retest the lows after turning down from the trendline. But the bears could not break below the $8,000 mark.

If they succeed in breaking out of this zone, a quick rally to $12,000 might take place, where it will again face resistance from the 50-day SMA and the resistance line of the descending channel.

Therefore, the traders can wait for a breakout above $9,500 to buy. The stop loss for the trade should be kept at $7,800. The profit objective is a move to $12,000.

And what if the pair fails to break out of $9,500 and turns down once again?

In this case, traders should wait, resisting the urge to buy at lower levels because if the price breaks below $7,800, we might see it go down to the $7,000 point.

We always provide both the bullish and bearish scenarios because the traders should be aware of what to expect in both cases. It would be irresponsible to provide levels only in one turn of events.

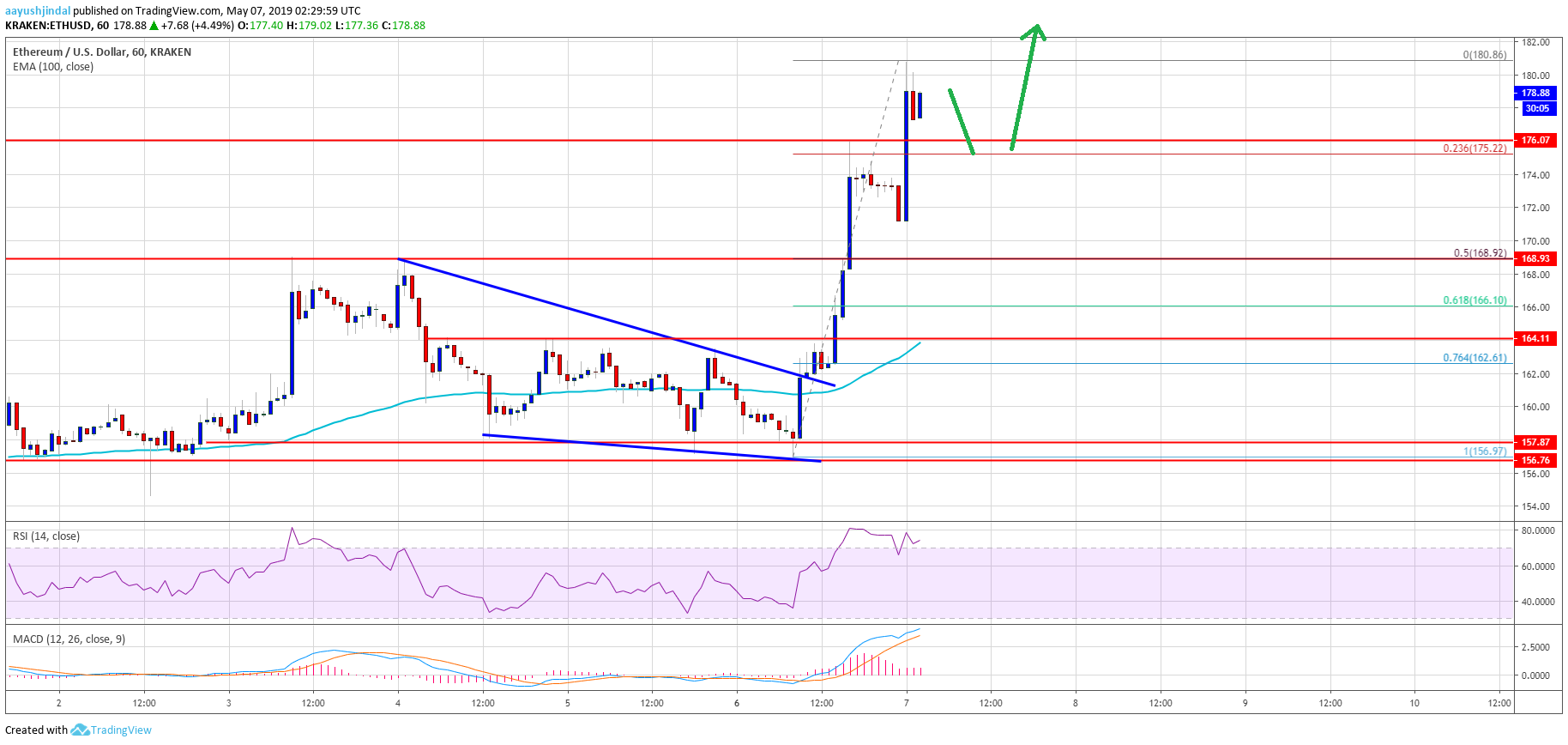

ETH/USD

After a two-day dip on Feb. 10 and Feb. 11, is also attempting to move up.

On the downside, $775 has strong support.

It doesn’t provide good risk to reward ratio, so we are not suggesting a trade on it.

BCH/USD

has been trading in a small range for the past four days. It might resolve with a large range day, either to the upside or downside.

But if the pair breaks out of the downtrend line and the 20-day EMA, it will signal a short-term bottom, which can be traded.

Therefore, we think a long position at $1,400 with a stop loss of $1,100 might be a smart move. The profit objective of this trade is a rally to the $1,925 – $2,000 levels.

XRP/USD

We about the possibility of a short-term bottom in . We have been waiting for a rally above the 20-day EMA to initiate long positions.

The traders can keep a stop loss at the $0.86 levels, which is just below the previous support. Ripple has been an underperformer in the current fall, hence, please trade with only 50 percent of the usual position size.

XLM/USD

has continued its range-bound trading action for the past few days. Attempts to rally have been facing strong resistance at the $0.41 levels.

On the downside, if the cryptocurrency breaks down of $0.3 on a closing basis (as per UTC), it can slide to the support line of the channel.

Therefore, we’d better wait for a breakout of the channel to initiate any long positions.

LTC/USD

We on long positions in if the breakout sustains above the $175 levels. However, for the past three days, the bulls have been struggling to clear the 20-day EMA hurdle.

We believe that this is a significant development. That’s we reiterate our recommendation to initiate long positions if the pair holds above the $178 levels for four hours.

The stop loss for the trade can be kept at $130.

On the upside, $200 is resistance. If the cryptocurrency struggles at this level, we should close the position or tighten the stops.

Once the bulls break out of $200, we might see a rally to $307.

ADA/BTC

continues to trade inside the descending triangle pattern. This is a bearish setup, and a breakdown of the support at 0.00004070 will complete the pattern.

Failure of a bearish pattern is a bullish sign. Therefore, if the cryptocurrency turns up and breaks out of the 20-day EMA, the downtrend line of the descending channel and the 50-day SMA, we need to reverse our position and go long.

Until then, consider staying away from it.

NEO/USD

In our analysis, we had recommended a long position on above $120 levels with a stop loss of $100.

On the downside, $93.53 again acted as strong support yesterday, Feb. 11.

The pair is stuck in a range of $93.5 on the downside and $120 on the upside. A breakout of this range is likely to propel the cryptocurrency towards the downtrend line of the descending triangle.

Traders can buy on a breakout above $121 if the price sustains the level for at least four hours. The initial stop loss should be kept at $93, which should be trailed higher if the bulls fail to break out of the triangle downtrend line.

But in case, if the NEO turns down from the moving averages and breaks down of the $93.53 levels, it might become negative.

EOS/USD

We had a short-term trade on at $9 with a target objective of $10 and $12. The cryptocurrency came very close to our target as it topped out at $9.9 on Feb. 10. Hope the traders trailed their stops higher and closed out the trade at least at breakeven prices.

On the downside, the $7.5 to $6.5 levels will act as strong support.

We don’t find any reliable trade setups at the current levels, so no suggestions on new trades with the pair.

The market data is provided by the exchange; the charts for the analysis are provided by .

Published at Mon, 12 Feb 2018 23:42:23 +0000

Altcoin