The total lost more than $5 billion of its value for the past seven-day period and declined to $131.3. By the time of writing (BTC) is trading at $3,827, while (ETH) stands at $136. Ripple is at $0.312.

BTC/USD

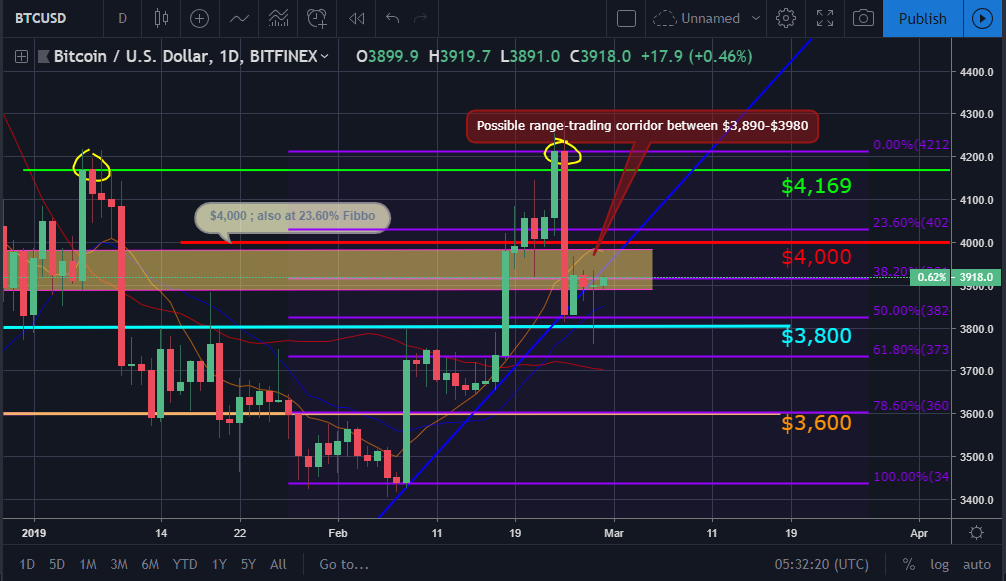

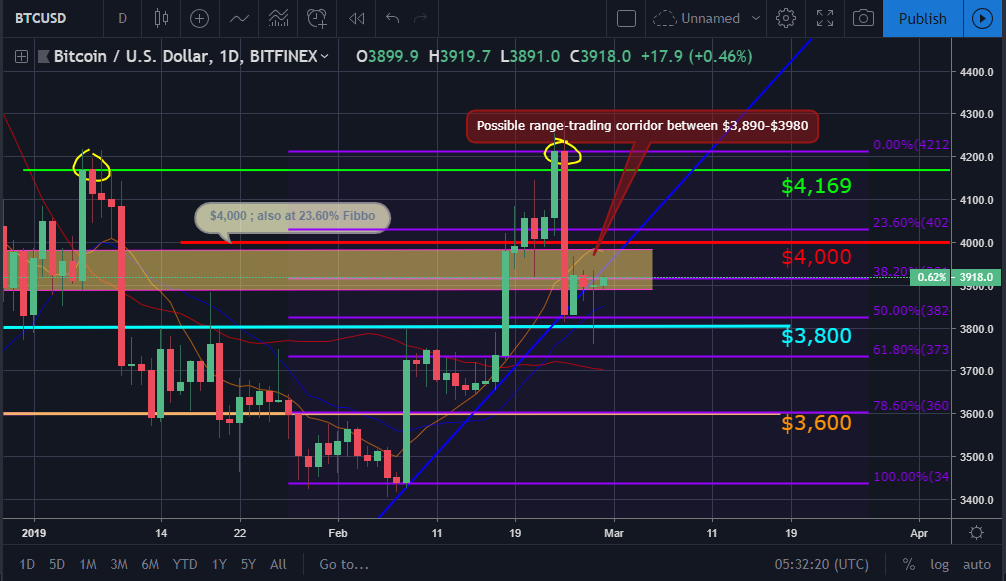

After six consecutive days of gains, bitcoin closed the trading session on with a red candle on the daily chart. The pair dropped to $4,007 still above the psychological level of $4,000.

Trading volumes broke their 2019 records on both the spot and futures markets, which fueled the short-term bull run.

When it comes to futures trading, last week one of the two regulated bitcoin markets in the U.S., the Chicago Mercantile Exchange Group (), its daily all-time high number. Over 18,000 contracts ($360 million in value) were traded on the platform on February 19.

On , bitcoin bulls managed to erase the losses from the previous day entirely and pushed the price back up to $4,058. The most popular cryptocurrency registered a 3.5 percent increase on February 23 and successfully broke above the 2019 high of $4,169, stopping at $4,211.

The last day of the week brought only pain to bull traders as bitcoin deleted nine percent of its value or the equivalent of the gains from the previous six days. It closed the trading session at $3,833, 2.5 percent lower than where it stood a week earlier.

Thailand’s National Legislative Assembly took another step towards embracing by allowing issuance of tokenized securities as by the local news outlet, The Bangkok Post on February 22. The amendment to the Securities and Exchange Act means that once it comes into effect, securities such as stocks and bonds could be officially issued and traded on the blockchain. As per the Thai Securities and Exchange Commission () deputy secretary-general Tipsuda Thavaramar, “the implementation of the tokenization platform is expected to become effective this year. The SEC has amended the act to serve the tokenization.”

As BTCManager reported on , the South Korean IT giant Samsung unveiled its long-anticipated Galaxy S10 mobile phone featuring a new hardware security feature called Samsung Knox. Now, to Asia Crypto Today, the device will offer a built-in cryptocurrency wallet provided by the Korean company . A screenshot posted by Tworld, Korea’s second-largest telecom company, the Enjin Wallet screen showing ether (), Enjin Coin () and Basic Attention Tokens () balances. The application also supports BTC, LTC, and all tokens as per the official webpage.

The BTC/USD trading pair started the new week with a green candle to $3,922 hoping to re-test the newly conquered high at $4,211. The pair traded in the $3,862 to $3,932 range on February 26, but could not close with a second green day in a row, ending the session at $3,895 or 0.7 percent lower for the 24-hour period.

The coin was trading in the $3,763 to $3,943 range on and closed with a $4 gain at $3,900.

ETH/USD

Ether closed with a red candle to $148 after trading at $156 during the day session. ETH buyers, however, were already eyeing the 2019 high at $161 and reacted fast, pushing the price above the psychological level of $150 on .

The upcoming hard fork (scheduled to happen at block number , estimated to occur on February 28) was likely driving the pair up as many traders we accumulating the coin hoping for a long-term bull run after the chain upgrade.

On February 23, ether closed at $162 finally surpassing the peak as mentioned above, setting a new three-month high. Last time commentators saw ETH/USD above this level was on November 18, 2018, when it closed at $179.

On February 24, however, ETH lost 16 percent of its value and dropped to $135, closing the seven days with almost no change.

On February 25, one of the leading altcoins once again moved North, this time to $141, to maintain the overall bullish sentiment. On February 26, however, it made a drop to $139 after trading as low as $136 during the day.

Ether fell even lower on closing the session at $137.

XRP/USD

The company token could not close above the mid-January high at $0.34 and made a slight correction to $0.326 on . The 3.2 percent drop was the first red candle on the Bitfinex daily chart since February 16 when XRP/USD was at $0.305.

Trading volumes continued to decline after they reached a 60-day high at $1.33 billion on . On , the pair traded as low as $0.32 during the day session, but bulls were able to turn the tide and closed in green, at $0.328.

The weekend of February 23 to 24 started with a 3.6 percent jump to $0.34 on February 23. The price mark was right above the Fibonacci 50 percent level and the earlier mentioned mid-January high.

The XRP coin lost ten percent of its value on February 24 as all the top cryptocurrencies were experiencing major price corrections. It was almost flat for the seven-day period.

The biggest news of the week came when U.S.-based cryptocurrency exchange Coinbase announced on February 25 it would offering XRP on its Coinbase Pro trading platform.

The company began accepting inbound transfers of XRP to Coinbase Pro on the same day, 12 hours before enabling full trading for the XRP/USD, XRP/EUR, and XRP/BTC pairs. According to the official blog :

“XRP trading will initially be accessible for Coinbase Pro users in the US (excluding NY), UK, supported European Union member nations, Canada, Singapore, and Australia.”

The Ripple currency was flying high on the same day gaining more than ten percent to close the session at $0.335. It was not enough for it to re-gain positions above $0.34 though as bears were already knocking on the door. On February 26, XRP/USD dropped to $0.323 losing 3.5 percent of its value.

Commentators saw another red candle on February 27 when the pair almost fell below $0.305. It managed to avoid severe losses, however, ending the session at $0.317.

Published at Thu, 28 Feb 2019 09:30:34 +0000