bitcoin is a decentralized, peer‑to‑peer electronic payment system that lets individuals hold, send and recieve value without relying on traditional banking intermediaries, using cryptographic keys and a public ledger to record transactions. By placing control of private keys directly in users’ hands and relying on a distributed network of validators rather than a central authority, bitcoin enables people to custody their own funds, transact across borders at any time, and verify the integrity of the ledger independently. This model expands financial autonomy and access, while also shifting responsibility for security, backup and key management to the individual.

Understanding How bitcoin Empowers Individuals to Act as Their Own Bank

At its core, this system replaces the need for a centralized gatekeeper by giving individuals direct control over their value through cryptographic keys and a decentralized network. As the protocol is open and peer-to-peer, users can validate transactions and custody their own funds without relying on banks or intermediaries - a model that shifts authority from institutions to individuals. This architecture is public and permissionless, meaning anyone can participate and verify the rules that govern the ledger .

Practical empowerment comes from a small set of capabilities that users gain when they choose personal custody:

- Full control of spending via private keys

- Direct, permissionless transfers across borders

- Censorship resistance for value transfers

- Programmable, auditable transactions

These features reduce dependency on third parties, but they also place clear obligations on individuals to manage keys, secure backups, and follow good operational security-responsibility that traditional banking externalizes to institutions.

Adopting this model typically involves simple tools and layered security: software wallets for everyday use, hardware devices for long-term storage, and multisignature setups for shared or high-value protection. Users must weigh trade-offs between convenience and control (such as, custodial services versus self-custody) and design backup and recovery procedures that match their risk tolerance. The underlying open-source, peer-to-peer design continues to enable these choices by keeping the monetary protocol transparent and accessible to all .

Key Principles of Self Custody and Why Private Keys Matter

At the heart of personal financial sovereignty is the private key: a cryptographic secret that grants exclusive control over funds. Whoever holds the private key controls the bitcoin, not an exchange, bank, or third party. That reality shifts responsibility from institutions to individuals and makes practices like secure backup, verified recovery, and prudent key distribution essential. Core actions include:

- Back up seed phrases to multiple geographically separated locations

- Use hardware wallets or air-gapped devices for key storage

- Never share private keys or type them into untrusted devices

These measures reduce single points of failure and preserve the property rights that bitcoin enables.

Security for self-custody is both simple in principle and demanding in practise: private keys are irreversible and portable, so loss or theft is permanent. Consider a speedy comparison for decision-making:

| Custodial | Self-Custody |

|---|---|

| Convenience | Full control |

| Counterparty risk | Key-management risk |

| Recovery via company | Recovery via backups/multisig |

Advanced defenses like multisignature setups, deterministic backups, and regularly tested recovery procedures transform a fragile secret into a resilient asset.

Building good key hygiene starts with threat modeling and ends with routine verification: think like an adversary and practice like a custodian. Recommended steps include:

- Use hardware wallets for day-to-day signing and cold storage for large holdings

- Implement multisig to distribute risk across trusted devices or people

- Perform periodic restore drills on alternate devices to confirm backups

Bold safeguards-firmware updates, passphrase additions, and tested recovery plans-turn the abstract concept of ownership into a practical, defendable position, allowing individuals to truly act as their own bank.

Comparing Custodial Services and Personal Wallets to Evaluate Risk

When weighing custody models for bitcoin, the distinction is simple: custodial services hold private keys and manage access on behalf of users, while personal wallets give the individual exclusive control of those keys. This is consistent with standard definitions of ”custodial” as relating to the legal right to care for or provide custody-applied here to digital assets-and with usage that emphasizes supervision and guarding of property by a third party .

Risk trade-offs center on control versus convenience. Consider these practical differences:

- Control: Personal wallets – full key control, no counterparty risk.

- Convenience: Custodial services – easier recovery, integrated services, but dependency on provider security and solvency.

- Regulatory exposure: Custodians may be subject to compliance and seizure risk; personal wallets are more resistant to third‑party intervention.

These trade-offs mean users must judge whether operational ease and custodial insurance (if any) justify giving up direct key custody.

| Risk Factor | Custodial Service | Personal Wallet |

|---|---|---|

| Counterparty risk | High | Low |

| Key control | Provider | User |

| Recovery options | Provider-assisted | User-managed |

| Regulatory/Seizure risk | Higher | Lower |

Choosing between the two approaches is ultimately an exercise in risk allocation: keep full custody to maximize sovereignty and minimize third‑party dependency, or delegate custody to gain operational simplicity and potential institutional protections-each approach aligns with different threat models and user capabilities, as reflected in authoritative usage of the term ”custodial.”

Choosing the right Wallet technology and Hardware for Long Term Security

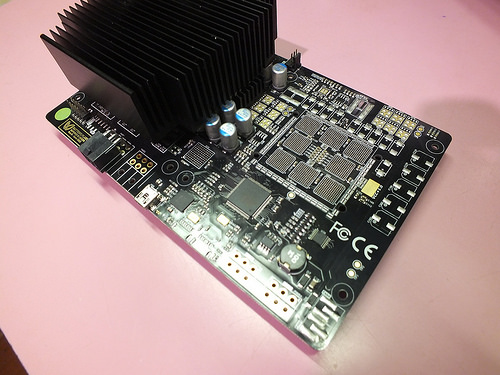

Balance permanence with accessibility: Long‑term custody demands a clear threat model - are you protecting against casual theft,device failure,or state‑level seizure? Software wallets that prioritize convenience and integration can be useful for everyday transactions and credential management,but they trade off exposure to online risks; examples of these consumer‑focused digital wallets emphasize ease of use and multi‑purpose integration rather than cold storage design , . For funds you plan to hold for years, prioritize architectures that minimize persistent online key exposure and allow you to implement layered defenses such as offline signing and hardware isolation.

Prefer proven hardware features and verifiable provenance: When selecting a hardware device, choose units with a secure element or air‑gapped signing capability, an audited firmware update process, open or well‑documented seed derivation, and a clear supply‑chain story so you can verify authenticity. The following quick comparison can help frame the tradeoffs:

| Type | Storage | Connectivity | Best for |

|---|---|---|---|

| Hardware (cold) | Private key offline | USB / QR (limited) | Long‑term holdings |

| Software (hot) | Encrypted device storage | Internet | Daily spending |

| Custodial | Third‑party servers | Internet | Convenience / fiat on‑ramp |

Physical backups should be stored in durable, fire‑ and water‑resistant media rather than a casual pocket wallet – think metal plates or secure safes rather than a consumer leather wallet .

Operational best practices: Combine device quality with disciplined procedures: keep firmware current, verify device authenticity before first use, encrypt and distribute backups across geographically separated, secure locations, and document a recovery and inheritance plan. Key practices include:

- Test your recovery on a new device before decommissioning the original.

- Use a passphrase in addition to your seed for plausible deniability and layered security.

- Consider multisig for high balances to avoid single‑point compromise.

- Maintain provenance – buy hardware from trusted channels and preserve purchase records.

- Plan for heirs with clear, secure instructions stored separately from seeds.

Implementing Backup, Redundancy, and Recovery Plans to Protect Your Funds

Protecting bitcoin begins with protecting the private keys: treat them as the only authority over your funds and plan for their longevity. Use hardware wallets for routine custody, store mnemonic seeds only in encrypted, durable media (metal plates are recommended for fire and water resistance), and consider multisignature setups to distribute risk across devices or trusted parties. bitcoin’s open, peer-to-peer design underscores the need for personal responsibility in custody choices - always obtain wallet software and firmware from official sources to avoid compromise .

Operational redundancy reduces single-point failures. Adopt a layered approach: primary secure device, secondary cold backup, and an offsite encrypted copy. Implement the following practical steps:

- Generate and verify backups in multiple formats (seed phrase + encrypted file).

- Encrypt every digital backup with a strong passphrase and store passphrase separately from the backup.

- Rotate and re-test backups quarterly; perform a full test restore on a spare device to confirm recoverability.

- Store copies in geographically separate, secure locations (home safe, bank safe deposit, trusted custodian).

When choosing wallet software or reference clients, download only from official distribution channels to minimize supply-chain risk .

A formal recovery plan reduces uncertainty after loss or disaster: document recovery steps, assign roles for emergency access (without revealing secrets publicly), and record expiration or audit dates for each backup. Use a simple recovery matrix to clarify responsibility and cadence:

| Backup Location | Frequency | Encryption |

|---|---|---|

| Hardware wallet (device) | Continuous | Device PIN |

| Metal seed plate (offsite) | On change | Physical security |

| Encrypted backup (cloud or vault) | Weekly | AES-256 passphrase |

Stay engaged with the community for evolving best practices and threat intelligence, and periodically review forum guidance and developer recommendations to keep recovery procedures current .

Best Practices for Secure Transaction Signing and Minimizing Exposure

Keep keys and signing devices isolated. Use purpose-built hardware wallets or an air-gapped device for any private-key operations; avoid entering seed material on internet-connected machines. Employ multisignature setups to spread custody and reduce single-point failure, and prefer deterministic backups that can be verified without revealing secrets.

- Hardware wallet for routine spending

- air-gapped signer for high-value transactions

- Multisig for shared custody and redundancy

The objective is to make signing an intentional, auditable action rather than an ad-hoc event-aligning with common definitions of being secure: free from exposure and able to achieve protection through deliberate measures .

Minimize exposure during the signing workflow. Prepare unsigned transactions on a watch-only or online wallet, transfer only the unsigned payload to the air-gapped signer via QR or SD card, sign offline, then broadcast from a separate online node or service. Keep firmware and signing software current and verified; validate PSBT (Partially Signed bitcoin Transaction) contents on the signer before approving.

- Prepare offline – construct but don’t sign on hot devices

- Verify – confirm amounts and destinations on the signer

- Broadcast separately – signed tx goes out from a different system

Design workflows that reduce the blast radius of a compromised machine-concepts of “secure by design” used in other civic programs emphasize making safer choices repeatable and accessible .

Harden operational security and plan for human error. Store seed material with physical, geographic, and redundancy separation; consider metal backups and secret sharing schemes. Train on recovery drills, record provenance of backups, and limit routine exposures-use dedicated devices for routine checks and keep high-value keys offline except when required.

- Backup diversity - multiple media and locations

- Passphrase layering – add Salt to your seed for extra protection

- Rehearse recovery - verify backups by restoring to a clean device

| Signing Habitat | Typical Exposure |

|---|---|

| Air-gapped signer | Very low |

| Hardware wallet (USB) | low |

| Mobile/desktop wallet | High |

Following these practical controls reduces the likelihood of unintended key disclosure while preserving the autonomy that self-custody affords.

Maintaining Privacy and Operational Security While Managing Your bitcoin

Managing your own funds requires combining technical controls with disciplined habits. At its core, bitcoin is a peer-to-peer electronic payment system that lets individuals verify and control value without intermediaries (), but that control brings responsibility: run a full node when possible, keep private keys offline in a hardware wallet or cold storage, and separate spending addresses from long‑term holdings. Never re‑use addresses and treat public on‑chain history as permanent - plan transactions assuming anyone can view them.

Operational security is about reducing linkability and single points of failure. Use simple, repeatable mitigations:

- Tor or VPN for network privacy

- Coin control to avoid accidental coin‑mixing

- Multisig to split custody and limit compromise

| Practice | Risk Mitigated |

|---|---|

| Address rotation | Linkability |

| Hardware wallet | Key theft |

| Multisig | Single‑point compromise |

Software hygiene and community verification complete the picture: obtain wallets and node software from trusted sources and verify signatures before installing – official downloads and community resources can help (, ). Maintain encrypted backups of seed phrases, keep systems patched, and practice recovery drills so you can restore funds if a device fails. quick checklist:

- Verify binaries and signatures

- Encrypt backups and store backups offline

- Practice recovery on a spare device

Legal, Tax, and Compliance Considerations When Managing Personal bitcoin Holdings

Individuals holding bitcoin should be mindful that legal treatment varies by jurisdiction: some governments treat crypto as property, others impose money‑transmission or licensing requirements when activity crosses into providing services. While simple personal custody rarely triggers the full suite of regulatory obligations,offering exchange,custodial,or automated teller services invokes strict AML/KYC and written compliance program requirements-examples of these standards are documented for operators such as bitcoin ATM providers and blockchain platforms,which must implement formal AML controls and monitoring.

Tax authorities commonly treat bitcoin as taxable property, meaning each disposal (sale, trade, or use to purchase goods/services) can generate a reportable gain or loss; thus accurate records of acquisition dates, amounts, and fiat equivalents are essential. For reliable reporting, maintain exports of wallet transaction histories, receipts for purchases and sales, and records of transfers between personal wallets (to avoid double‑counting). Practical steps include:

- Track cost basis: preserve timestamps and fiat values at acquisition.

- Document receipts: invoices, exchange confirmations and wallet export files.

- Reconcile transfers: label self‑to‑self moves to prevent incorrect tax events.

Guidance on recordkeeping and protecting holdings-covering scams and loss prevention-can help complement tax documentation practices.

Adopt baseline compliance and security practices even as an individual: use hardware wallets or well‑audited software with strong backups, maintain clear chains of custody for funds, and keep organized, retrievable records for at least the period required by your tax authority. If your activities scale (e.g., converting into a business, operating BTMs, or providing custodial services) prepare to implement a formal AML program, KYC processes, transaction monitoring, and suspicious activity reporting as required by regulators-many BTM/platform operators rely on dedicated compliance solutions and officer oversight to meet these obligations.

| Action | Why it matters | Priority |

|---|---|---|

| Secure keys & backups | Prevents irreversible loss | High |

| Export & archive tx history | Supports tax & audit needs | High |

| Monitor regulatory changes | Avoids unexpected compliance risk | Medium |

Building a Long Term Strategy for Inheritance, Governance, and Multisignature Controls

Design a durable plan that links on-chain controls to off-chain legal instruments so bitcoin can pass to heirs smoothly. Documented access instructions, clear beneficiary designations, and a trusted executor or trustee bridge the technical custody with estate law; this reduces friction during probate and aligns crypto assets with traditional inheritance processes . Use written, legally recognized directives that reference where keys or multisig policies are stored, and ensure those directives are periodically reviewed to reflect life changes and evolving regulation.

Operationalize governance using threshold multisignature schemes and role-based responsibilities so no single point of failure exists. Practical elements include:

- Key distribution: split keys across trusted parties and geographic locations.

- Recovery workflow: define a timed, verifiable process for heirs to claim funds (e.g., notarized death certificate + executor authorization).

- Least-privilege: assign signing rights aligned to roles (co-signers, emergency signer, cold storage custodian).

These steps create an auditable governance trail while preserving the self-custodial ethos of bitcoin.

| Role | Responsibility | Example |

|---|---|---|

| Executor | Coordinate legal claim and evidence | Submit probate + verify documents |

| Co-signer | Participate in multisig signatures | Holds one key share in safe deposit |

| Custodian | Maintain hardware and backups | Rotates firmware and tests recovery |

Maintain the plan with scheduled audits, education for successors, and accounting for taxes and outstanding liabilities so transfers are practical and compliant; estate assets and debt obligations still affect net inheritance and should be anticipated in documentation . Test recovery procedures with low-value transactions or simulated signings, refresh seed protections, and keep a concise, legally endorsed inventory of custody arrangements accessible to appointed fiduciaries.

Q&A

Q: What does the phrase “bitcoin enables individuals to act as their own bank” mean?

A: It means that with bitcoin an individual can hold, send, and receive their own funds without relying on a traditional bank or central intermediary. Control is achieved through ownership of private keys and use of wallets, enabling peer-to-peer transfers and custody outside the traditional banking system .

Q: How does bitcoin allow self-custody of funds?

A: Self-custody requires a wallet that holds cryptographic private keys; whoever controls the private keys controls the bitcoins. Users can choose software wallets, hardware wallets, or multisignature setups to secure keys and manage access without a third-party bank or custodian .Q: What are private keys and why are they important?

A: A private key is a secret number that authorizes spending of the corresponding bitcoins. If you lose the private key or the seed that derives it, you typically lose access to the funds permanently; if someone else obtains it, they can spend your funds. Proper generation, storage, and backup of keys are therefore critical .Q: Do users still need banks to use bitcoin?

A: No-bitcoin’s peer-to-peer protocol lets users transact directly with each other without a bank as an intermediary. However, some people use exchanges, custodial services, or payment processors for convenience, fiat on/off ramps, or regulatory reasons .

Q: How is the bitcoin network secured if there’s no bank?

A: The network is secured by a distributed set of miners and nodes that validate and record transactions on the blockchain through consensus mechanisms. This decentralized validation replaces trust in a single institution with cryptographic proof and distributed agreement among participants .

Q: What are the main benefits of acting as your own bank with bitcoin?

A: Benefits include direct control of funds, censorship resistance (fewer intermediaries that can block transactions), global peer-to-peer transfers, and the ability to hold value without relying on banking infrastructure or local monetary policy .

Q: What are the main risks and downsides?

A: Risks include total loss of funds from lost or stolen private keys, user error, phishing and malware, and limited recourse compared with regulated bank accounts. Self-custody also requires users to learn security best practices and may expose them to price volatility and regulatory uncertainty .

Q: How can individuals reduce the security risks of self-custody?

A: Best practices include using reputable hardware wallets, creating secure offline backups of seed phrases, employing multisignature arrangements for higher-value holdings, keeping software up to date, and using tested procedures for key generation and recovery .Q: When might someone prefer a custodial service instead of self-custody?

A: People who lack technical expertise, prioritize convenience, want integrated fiat services, or prefer regulated consumer protections may choose custodial services or exchanges. Custody trades some control and privacy for convenience, customer support, and frequently enough insurance or compliance features .

Q: Is bitcoin legally recognized as a form of banking or money in all countries?

A: No. Legal status and regulatory treatment of bitcoin vary widely by jurisdiction-some treat it as a commodity, others as currency, and some restrict or ban its use. Users should check local laws and compliance requirements before transacting at scale .

Q: Can businesses use bitcoin to operate without traditional banking?

A: Yes, businesses can accept, hold, and pay in bitcoin, enabling new business models and cross-border commerce without banks. Many businesses still use banking services for fiat operations, payroll, and compliance, so the practical mix depends on their needs and local regulations .

Q: Where can readers learn more about bitcoin development, wallets, and best practices?

A: Technical documentation, developer guides, and community forums explain bitcoin fundamentals, wallet implementations, and mining/validation concepts. Official and community resources, including development pages and mining forums, are useful starting points for deeper study .

To Wrap It Up

bitcoin’s architecture and open‑source design make it possible for individuals to hold and transfer value without relying on banks or central authorities, functioning instead as a peer‑to‑peer electronic payment system where control of funds can reside with the user rather than an intermediary . This model shifts custody and responsibility to the individual, enabling self‑custody, increased financial autonomy, and access to a global payment network that operates by consensus across participants rather than through centralized control .

At the same time, acting as your own bank requires technical understanding and disciplined security practices-private key management, backup strategies, and cautious operational habits are essential because transactions are final and there is no central entity to reverse errors or recover lost keys. The wider bitcoin community, including developer and user forums, provides resources and ongoing discussion to help users learn best practices and keep pace with evolving tools and threats .

Ultimately, bitcoin’s peer‑to‑peer, open‑source framework offers a practical path for individuals to assume direct control over their money, but that empowerment comes with personal responsibility and the need for informed use. As the ecosystem and its supporting community continue to mature, users who combine sound security practices with an understanding of the system’s trade‑offs are best positioned to realize the benefits of being their own bank .