There’s a buzz in the cryptosphere today. dominance hasn’t been this low since last August. Google trends show that interest in hasn’t been this low since last April. Are we in the quiet before the storm or status quo?

Dominance is hovering just above 50%. A result of money rapidly flowing into and a relatively stagnant price conspire to lower the actual position of . But not by much. ’s market capitalization can still fit hundreds of other cryptos within it.

This Isn’t 2015 or 2017 – The Market Is Far More Crowded

Some in the space have noted that a lower dominance preceded a major bull run in the past. Others have noted that the rise and fall of very nearly , in which soared to $1,000 and then dumped below $100.

Join CCN for $9.99 per month and get an ad-free version of CCN including discounts for future events and services. Support our journalists today. Click .

One thing left out of that analysis is the petulant effect of Mt. Gox. It’s reasonable to blame the first major crash on the failure of Mt. Gox. Being the major exchange, its collapse scared investors. Subtract that, and it’s unclear whether the crash would have happened at all.

In the last bull run, however, we don’t have things like that. There’s no single catalyst that can be blamed for the sell-offs. Interest began to wane. Double digit percentage drops pushed new investors to dump. There is no data to suggest that such investors will come back.

Where Will The Money Come From This Time?

In one respect, it’s a sign of virtue that scares away those wealth seekers. It’s difficult to stay invested in the space unless you have a philosophical distrust of the fiat system as part of your core principals.

The bull run up to $20,000 was one of the few price movements that got some long-term hodlers to move their funds. Some have reportedly bought back in at lower prices. The average daily price of is largely dictated by less than half of the coin supply.

We can be sure that there’s not going to be a “” in the near future. But a slow death for is less than impossible. Over the past few months, it’s taken a lot of work to make any money on a investment. You have to be very careful and reasonably equipped to time your buys and sells. If you’d had the same money in , you’d be flush right about now.

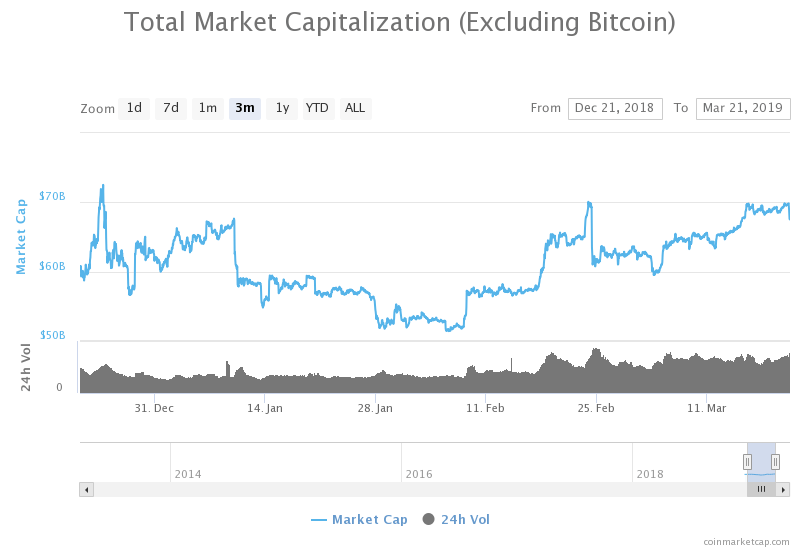

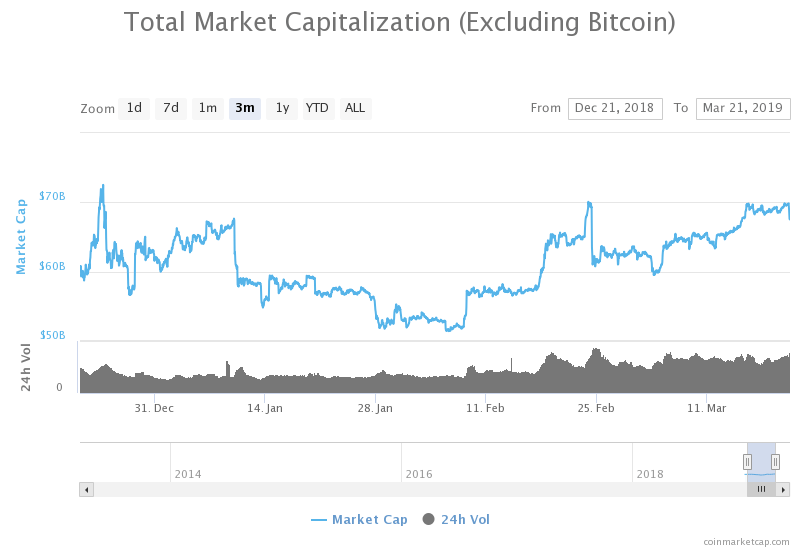

Non- market capitalization is on the rise once again. | Chart from Coinmarketcap.com

The Tokenized Economy Won’t Build on bitcoin

At the same time, smart contract platforms continually gain additional value. Real investment products are popping up all over the place. Did you know, for example, that you can buy and earn interest on it with the ? You don’t even have to lock your Ether up in a CDP, as Dai is currently quite plentiful on regular markets.

The actual value of , if you count everything that runs on it, is higher than $14 billion. 505 have a market capitalization higher than $1 million. Many of these , like and themselves, have been 80 or even 2-500% higher than their current valuations.

New projects launch all the time, and the tokenized economy largely makes its home on . Demand for Ether during the bull run can be largely attributed to people wanting to buy and hold these types of assets. However, ’s long-term dominance as the world’s computer is questionable as well. One can imagine a thriving market with multiple platforms. After all, it’s not what you use, but what you do with it. and are seeing incredible usage, and not for lack of trying on the part of entrepreneurs.

EOS and Tron: Underrated

doesn’t have the market going for it, at least not in the same way.

Speaking of , the majority of its aren’t counted by most metrics at this point. The same goes for . These are traded on decentralized exchanges like TRX.market and Newdex.io. Whatever volume and prices they do have, they’re real.

If the and markets were fully accounted for, the market dominance of would be even lower. Is that a good sign for , too?

New on TRX do volume in the millions of TRX, and the upcoming to the platform means that real liquidity isn’t far off. Users will be one step from getting to fiat cash, or vice versa, as opposed to a few hops. A reasonable assessment assumes that stablecoins will find their way to as well.

The Unpopular View: bitcoin’s Dominance Is Slipping for More Than Financial Reasons

It’s helpful to view the current situation from a historical context. It’s probably popular to assert that we’re on the cusp of a financial epiphany again. However, a historical view has to include all the additional options for new money.

New money going into will be filtered through this lens – people investing in for the first time have a lot of decisions to make. Holding some amount of seems an obvious hedge against the even more extreme volatility of the subsidiary markets, but the levers are a lot bigger on cheaper assets.

And the mentioned platforms aren’t all there is. Several others have emerged as well. , , , – all of these are in the running to consume part of the new capital that will come through any bull run. Each can host assets worth hundreds of millions of dollars, and likely will.

Any analysis of is incomplete if it doesn’t mention that has managed to gain while ’s remained relatively stagnant. was under $30 when began to slide last fall. Now it’s almost twice that price, and its .

So, is going to chart to $50,000 or $100,000? It’s certainly possible.

But the road to get there won’t be anything like it was before. A lot of other assets will rise with it, and their rise will necessarily temper ’s moon aspirations. It’s entirely possible that every time gains 25%, base like Etheruem or will gain more percentage-wise.

From the long view, it’s not even crazy to think that one day might not be number one. This doesn’t mean will have “failed.” It means that others could be in higher demand. ’s many use cases need flexibility to emerge.

Published at Sat, 23 Mar 2019 10:11:19 +0000