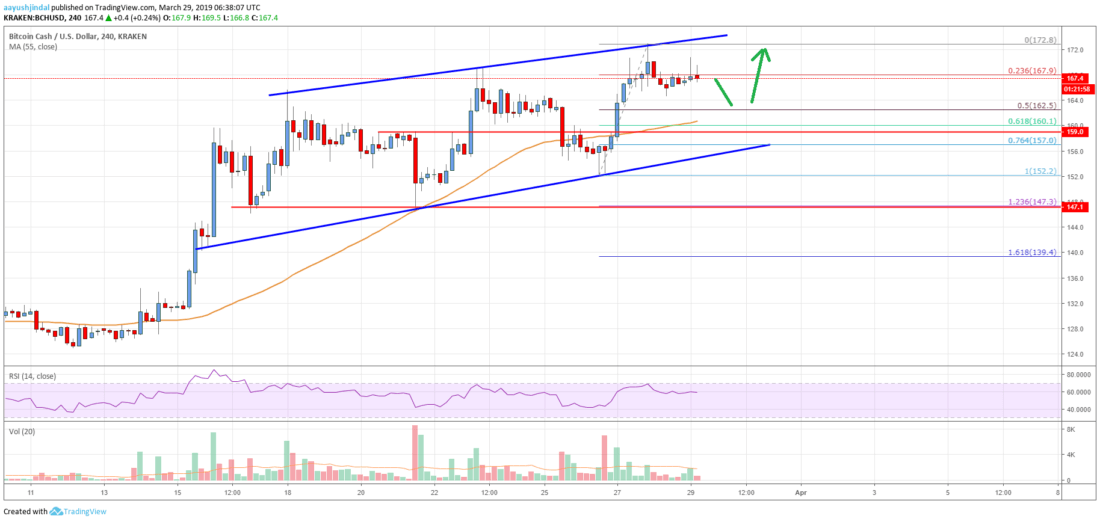

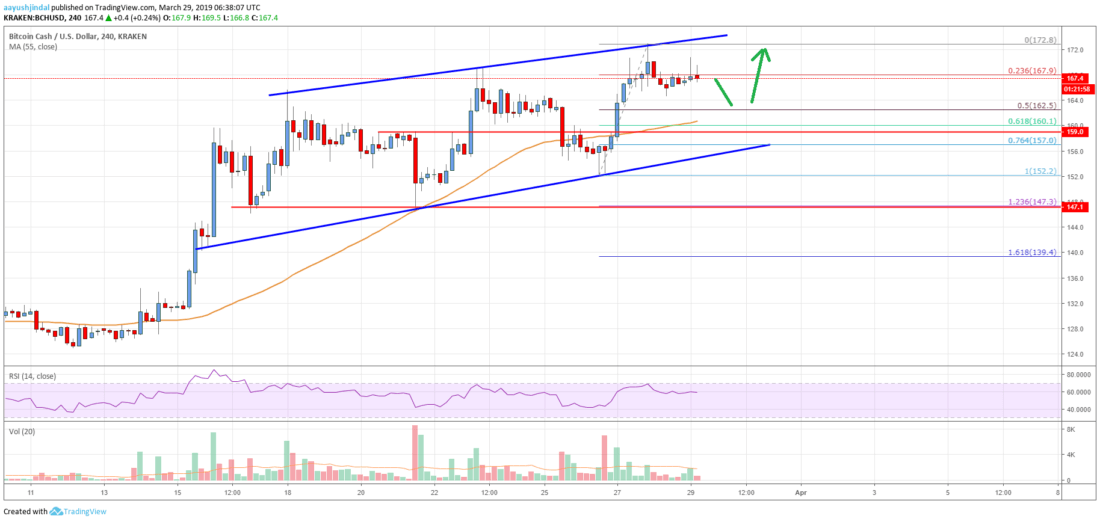

- bitcoin cash price gained traction recently and broke the $164 resistance area against the US Dollar.

- The price traded to a new monthly high at $172.8 before correcting lower.

- There is a crucial ascending channel formed with support at $157 on the 4-hours chart of the BCH/USD pair (data feed from Kraken).

- The pair is currently correcting lower, but dips remain supported near $162.5 and $157.0.

bitcoin cash price remained in a strong uptrend above the $160 level against the US Dollar. BCH even broke the $170 level and it is currently correcting lower towards key supports.

bitcoin Cash Price Analysis

Buyers remained in action this week, with positive moves in , , , and bitcoin cash against the US Dollar. Earlier, the BCH/USD pair corrected lower from the $168 resistance level. It broke the $160 and $155 support levels. However, losses were limited and later the price bounced back from the $152 support. There was a strong upward move above the $154 and $155 resistance levels. Finally, there was a close above $164 and the 55 simple moving average (4-hours).

A new monthly high was formed near the $172 level and recently the price corrected lower. The price declined below the $170 level and the 23.6% Fib retracement level of the last wave from the $152 swing low to $172 high. The current price action suggests more range moves below the $170 and $172 resistances. On the downside, an immediate support is near the $162.5 level. It represents the 50% Fib retracement level of the last wave from the $152 swing low to $172 high.

There is also a crucial ascending channel formed with support at $157 on the 4-hours chart of the BCH/USD pair. The main support is near the $160 pivot level. Besides, the 61.8% Fib retracement level of the last wave from the $152 swing low to $172 high is also near $160. Finally, the is also near the $160 level. Therefore, if there is a downside correction, the price may find bids near $162.5 or $160.0.

Looking at the , bitcoin cash price is placed nicely in a significant uptrend above the $160 support area. In the short term, there could be a downside correction towards $165 or $162. However, buyers are likely to remain in action as long as the price is above $160. On the upside, the main hurdles are $170, $172 and $180.

Technical indicators

4 hours MACD – The MACD for BCH/USD is currently placed in the bullish zone.

4 hours RSI (Relative Strength Index) – The RSI for BCH/USD is currently well above the 55 level, with a flat bias.

Key Support Levels – $165 and $160.

Key Resistance Levels – $172 and $180.

Published at Fri, 29 Mar 2019 08:08:34 +0000