In December last year, the Federal Reserve forecasted four more rate hikes by the end of 2020, but now that it has seen the effect that announcement had on the markets, it has taken a more dovish approach. The Fed has now forecasted one more rate hike by the end of 2020. However, that is not going to be much help which is why investors as well as President Donald are calling for QE4. This time, it is not as easy as it used to be because the Fed has its own problems. First of all, the Federal Reserve wants to shrink its balance sheet to $3.5 trillion by September, 2019. So long as the Fed keeps doing that, there is no QE4 which means the stock market as well as emerging markets like are very likely to experience maximum .

The inverted yield curve that we have seen for the first time since the last financial crisis is a strong indicator that investors are worried short term. Unlike retail investors, professional investors look at the intent behind every move. When they see the Fed backing down on its aggressive quantitative tightening policy just three months after, they sense that something is wrong. This is why the demand for long term bonds has risen which has led to yields of long term bonds decrease in comparison to that of short term bonds, hence the inverted yield curve. The inverted yield curve has historically been a very good indicator of an upcoming recession. As the Fed keeps unwinding its balance sheet, the is going to experience more . The weekly chart for S&P 500 (SPX) shows that the index is overbought and is due for a sharp decline that might last till September, 2019.

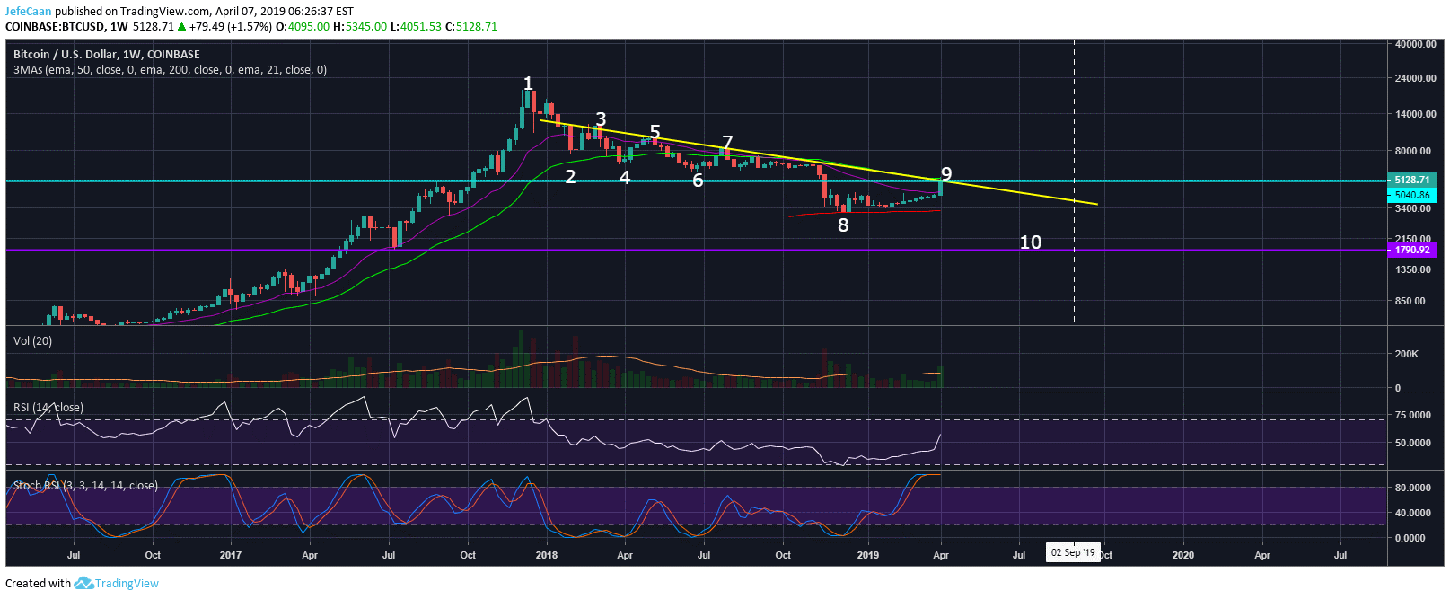

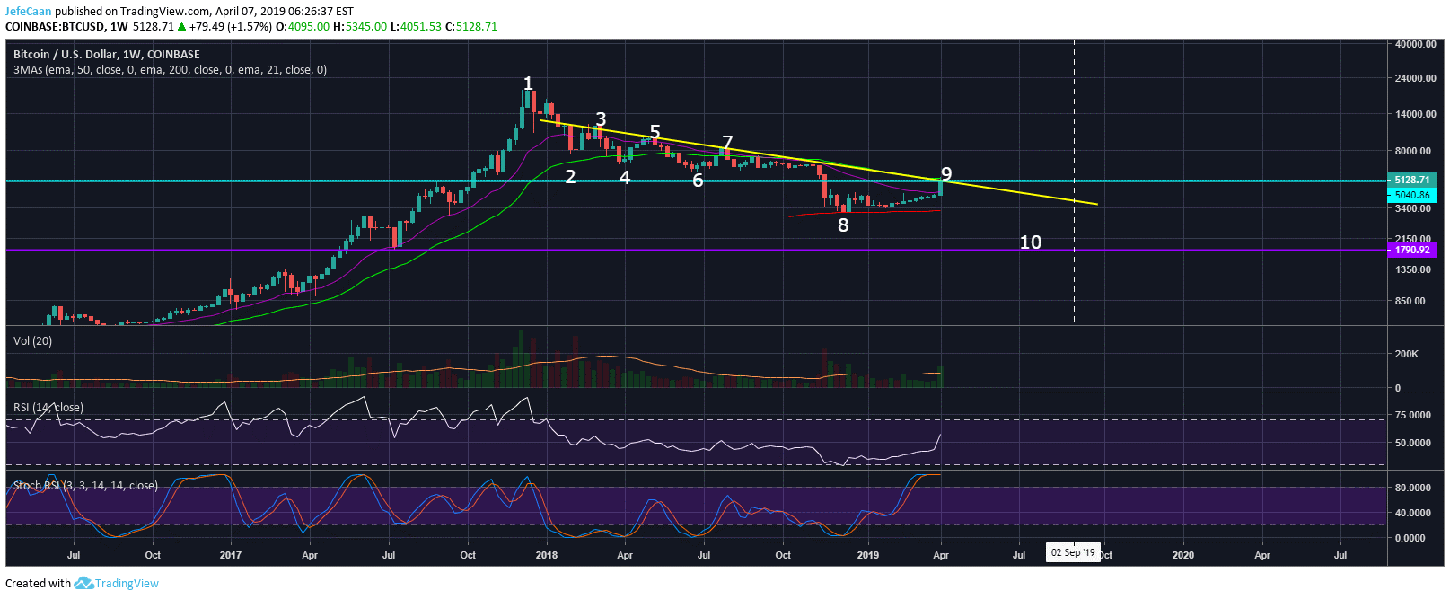

() and other are still highly speculative assets. It would be unreasonable to compare () to digital gold at this point when it has a market cap of less than $100 billion and has been seen massive pumps and dumps. The weekly chart for shows that () is heavily overbought and is due for a sharp decline if it closes the week below the 50 week exponential moving average. () also has a strong correlation with the S&P (500) as we have noted many a time in some of our analyses. The last time the S&P 500 (SPX) started to decline was in September, 2018. If we look at the /USD chart around that time, it was also preparing for a decline. When the S&P 500 (SPX) crashed after that, so did /USD until the price declined to its 200 Week EMA and closed above it.

The next few months are going to be golden for Gold but not for () because it is not Gold, at least not yet. Moreover, as we have seen in the past, () has had a negative correlation with Gold. The price of Gold rallied during October to December last year when () as well as the S&P 500 (SPX) declined. Some things in the market have not changed despite the and suffering of the ongoing bear market. Retail investors still have no problem buying under overbought conditions and they keep on expecting a bull run every single time. For the to see a trend reversal, the market has to inflict maximum . So far, that has not happened.

Published at Sun, 07 Apr 2019 14:08:35 +0000