() is long overdue for one strong move to the upside that can complete the bullish gartley pattern seen on the daily chart for . This move would also position () for a fall on the weekly time frame and thus set the ground for the final corrective wave to the downside. However, before that happens, a move to the upside is mandatory. We have called for this move in most of our previous analyses but the price has been stalling this move so far. We also mentioned that this move will occur around the end of a week because /USD will have to close the weekly candle above $4,000. The price currently holds strong above the 21 day exponential moving average and it is extremely unlikely to slide below it before the bullish gartley comes to fruition this time.

In the recent past, we have seen most outperform () because the space received better than () did. Samsung’s was found to have (ETH) support but not () support. Similarly, a lot of saw very favorable developments like (XLM)’s listing on . So, () has taken a back seat for now and (ETH) seems to be in charge of making most of the moves on a shorter time frame. That being said, might have their last party before /USD comes crashing down again to take with it. The conditions on the weekly time frame show that /USD has not been this overbought since the beginning of the correction. I think it is a very strong indicator of the massive decline that is yet to come.

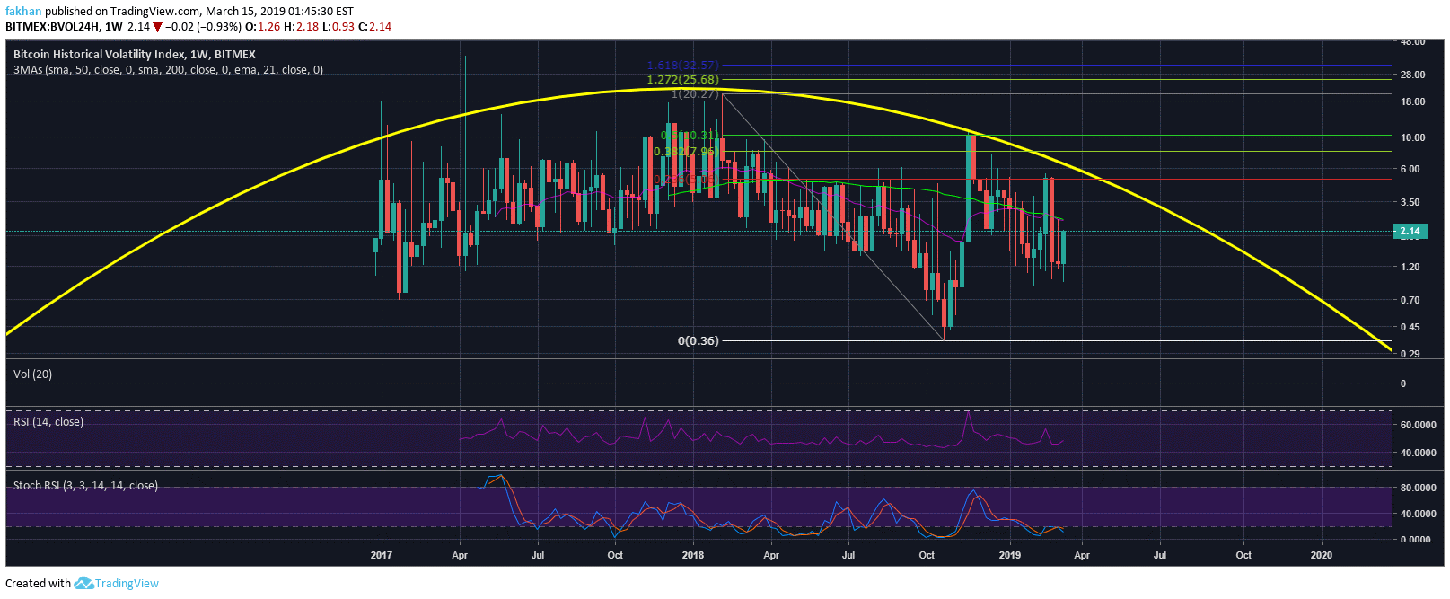

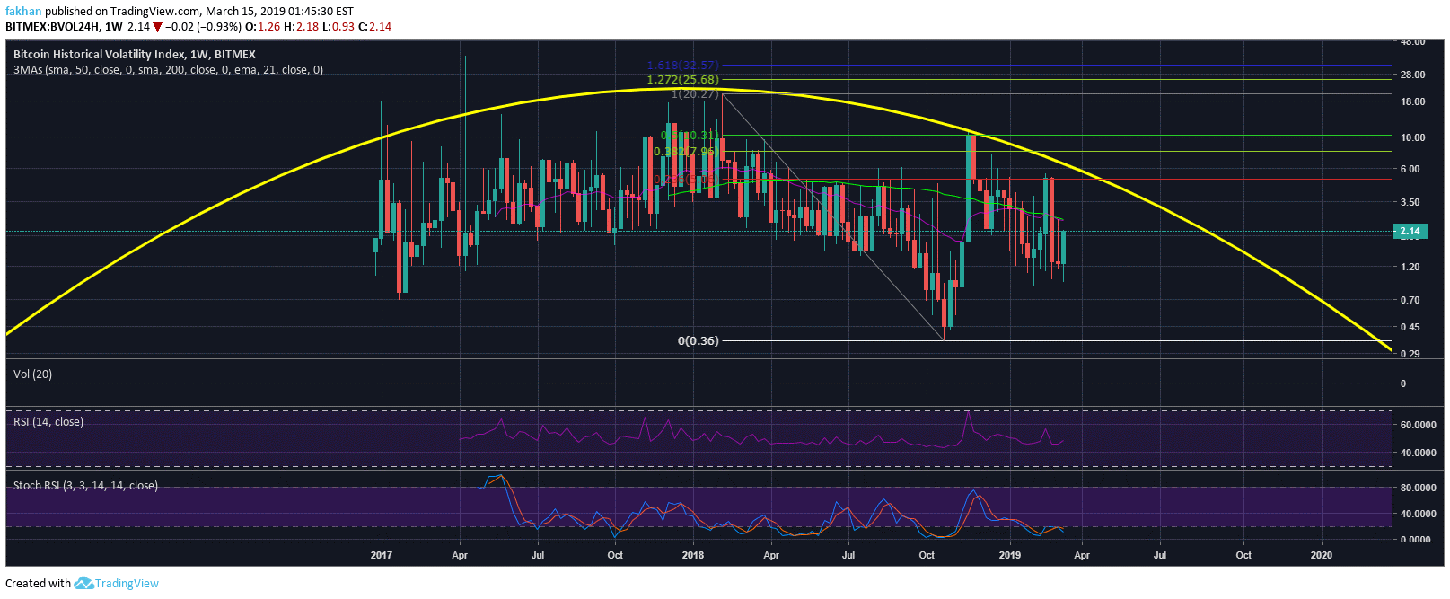

Historical Volatility Index (BVOL24H) shows that the volatility could drop a lot more in the weeks to follow. When falls this time, we expect it to break below the previous low and mark a new all-time low. Before that happens, () does not have a chance at trend reversal. So far, the weekly time frame shows that BVOL24H has been rejected at the 61.8% Fib extension level followed by a rejection at 38.2% and then a rejection at the 23.6% Fib extension level. Therefore, it is now likely to continue the downtrend until it reached a new all-time low.

As ()’s volatility starts to decline, we will see the market make big moves up and down. This already happened around October, 2018 when the index declined significantly as the price declined. The same is expected to happen this time. We believe that BVOL24H will retest the 50 week moving average around the end of the week. If it faces a strong rejection and closes the week before the 50 week moving average, the price of () would decline significantly in the weeks that follow. In fact, this drop might in fact be a lot steeper than the one we saw around the end of 2018.

Published at Fri, 15 Mar 2019 14:13:15 +0000