() bulls have finally stepped up to give the market direction. Until recently, both the bulls and bears were confused as to who is really in control. The bears expect the price to come down but they expect a rally past $4,000 first. As for the bulls, the majority is confident that /USD has already bottomed and the price is only going to rise from current levels. The daily chart for shows that the number of margined shorts has once again declined to a critical support. If this support is broken, it is likely that the next support will be broken as well and BTCUSDShorts will decline all the way towards its support at 8,777. This fall in the number of shorts will be quick and so will be the corresponding rally in /USD.

The bulls have been too afraid to step up as we have seen the past few weeks. When /USD experienced a flash crash last week that scared the majority of () bulls which is why the price has been sideways for so long. A lot of () bulls believe the price has already bottomed but yet they are not prepared to step in until they see a strong rally to the upside. We expect that the next rally past $4,000 will be the signal that the bulls need to get onboard. The majority will take it as a signal of bullish reversal when it would most likely be a fake out and will lead to major liquidations in the days ahead that will lead to another flash crash soon afterwards.

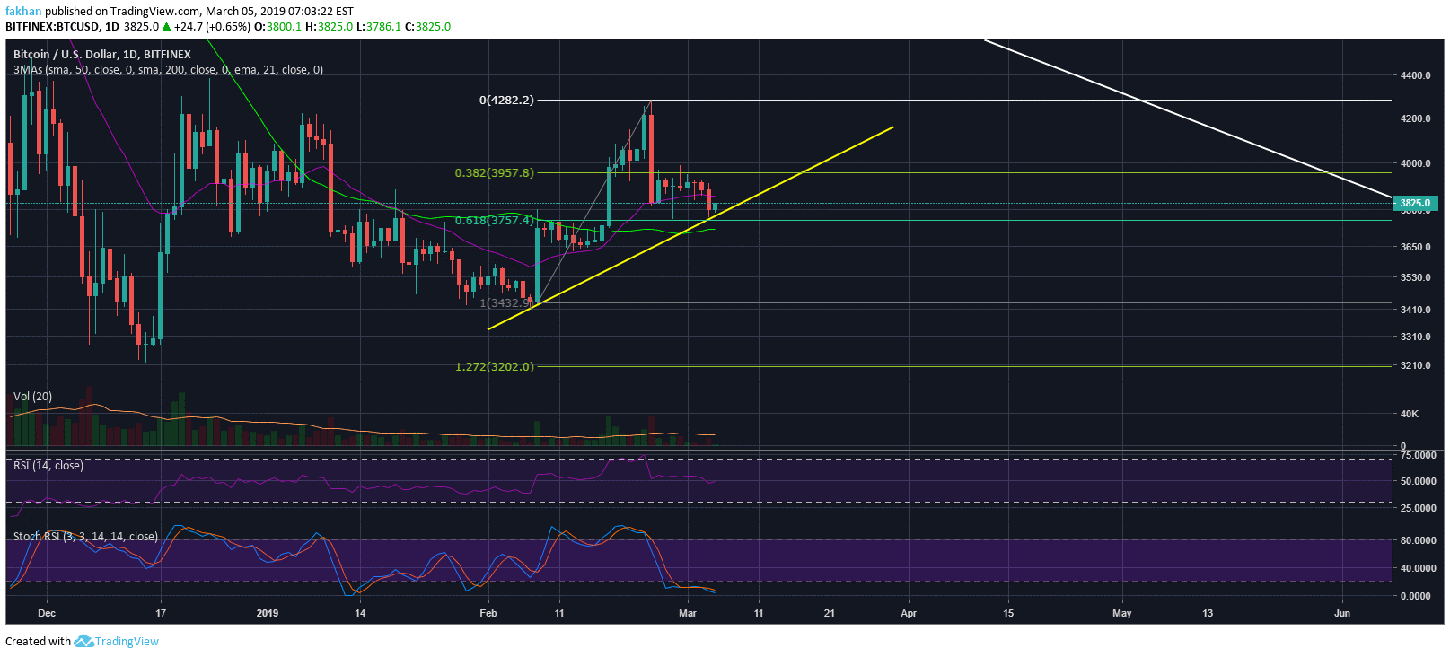

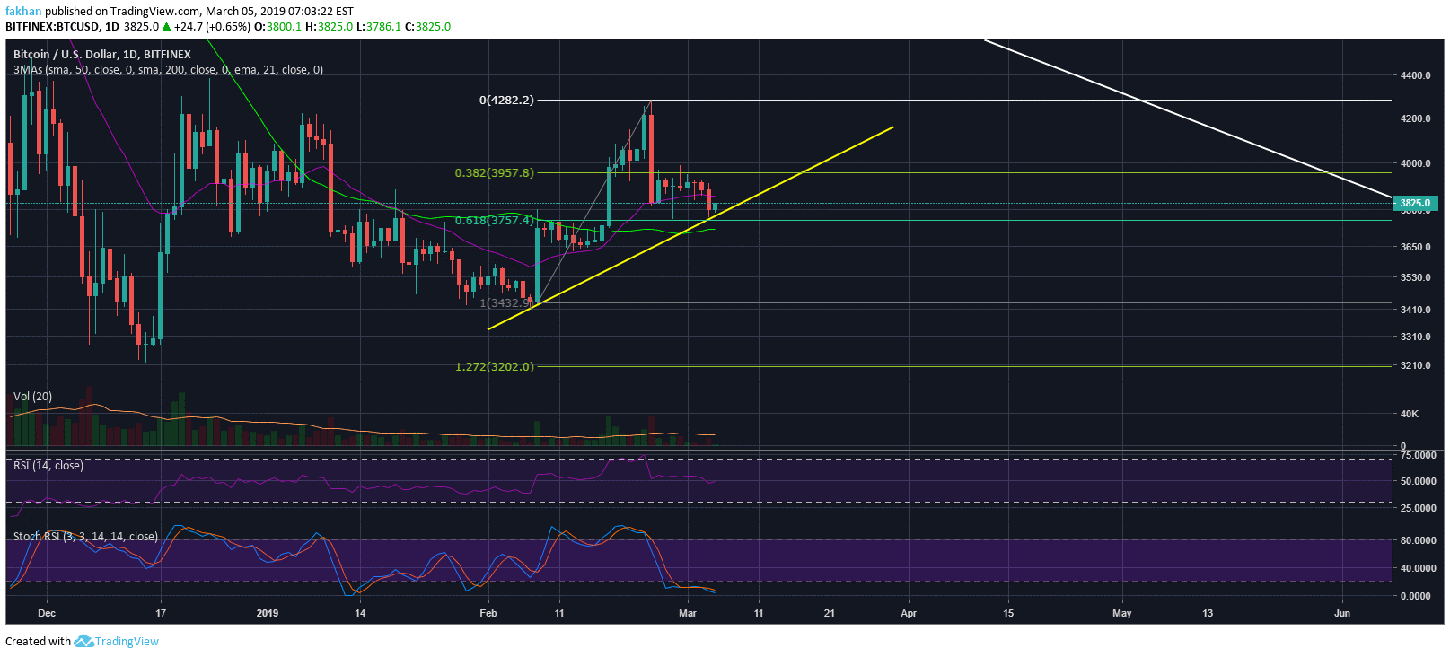

The reason we believe /USD will fall sharply after the quick rally past $4,000 is because the price is already under overbought conditions on the weekly time frame. The daily chart for shows that the price is currently resting atop the 61.8% Fib extension level and is prepared for a rally towards $4,200 which could extend towards $4,500. The dilemma that () traders face here is that the price is under oversold conditions on the daily time frame but overbought on the weekly time frame. This means that the price will have to rally soon without any further delays. This is why we expect a strong rally in /USD towards the end of the week.

The daily volume is also in a steady decline which means any move to the upside or downside is going to be abrupt. When the volume is this low we can expect the price to trade sideways for a long time but make quick sudden moves every now and then. This rally to the upside is going to be no different than the crash we saw last week. In other words those that think they can wait to catch it might find it difficult to do so. For the same reason, it would also not be reasonable to enter leveraged positions at this point.

Published at Tue, 05 Mar 2019 15:07:38 +0000