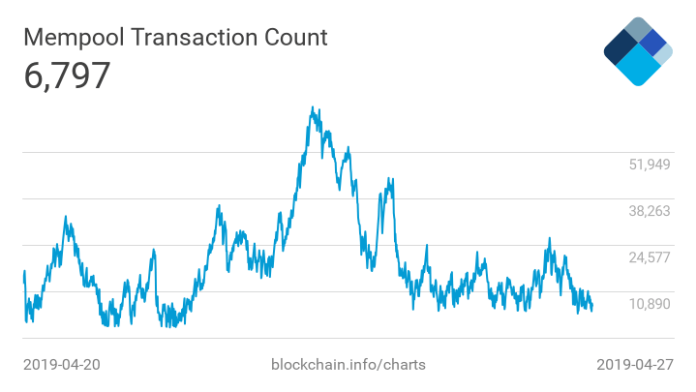

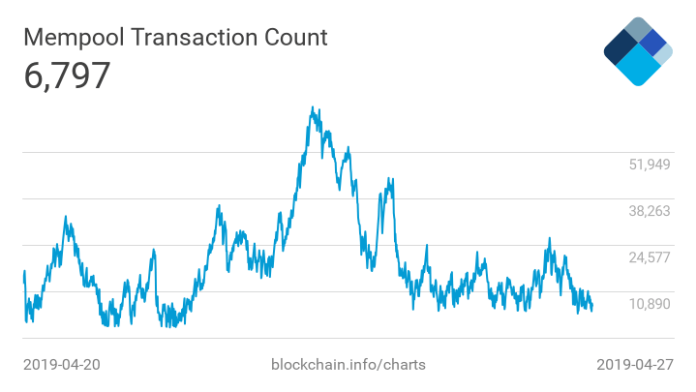

On April 26, 2019, ’s number of transactions reached a large number and it could be connected to the New York AG’s lawsuit against Bitfinex and Tether. In addition, the total number of confirmed transactions reached a relatively higher point as well.

Although the Tether and Bitfinex effect will not matter in the long run, ’s unconfirmed transactions reached a maximum of 26,373 on April 26, 2019.

Source:

Tether and Bitfinex’s influence on the crypto-community is huge enough that it won’t go unnoticed, hence, there will be a wide range of implications once the lawsuit proceeds. However, the first effect of the lawsuit was seen on the price of , as it collapsed by 9%, which had a domino effect on the prices of as they dropped even lower.

Source:

The number of unconfirmed transactions, however, reduced; at press time, there were approximately 2,000 unconfirmed transactions.

In addition, the total number of confirmed transactions per day reached a peak of 404,279, which, according to a Twitter user @kerooke has happened only six times in the history of and this was the seventh.

404,116 transactions were confirmed yesterday.

Only 7 days in history have seen more transactions in a single day.

— Kevin Rooke (@kerooke)

The crypto-community was slowly turning bullish on after weathering the crypto winter, but the recent pullback of ’s prices to $4,900 has turned the sentiment bearish. and other cryptos are bound to feel the effects of the as it uncovers the truth about Bitfinex and Tether: if the 2017 rally was really caused by pumping Tether into the market, whether all of the USDT in circulation is actually backed by the US Dollar and more.

A Twitter user @nondualrandy tweeted:

“13,000 unconfirmed $ transactions and growing fast”

@johneakin84, another Twitter user commented:

“However all those previous times didnt have 30% of the transactions caused by Veriblock spam, but on the flipside a lot of lightning transactions now would have been seperate onchain transaction in the past”

@ninjascalp, a Twitter user replied to Kevin Rooke:

“Nothing much here. Just people that got liquidated coming back into the market.”

The post appeared first on .

Published at Sun, 28 Apr 2019 11:58:43 +0000