The global crypto market cap lost another $2 billion since the beginning of the week and now stands at $111.5 billion to CoinMarketCap. and were mostly within standard ranges.

BTC/USD

bitcoin opened the new week with a drop below $3,500 on February 4, 2019. It made a slight movement downwards to $3,490, still ranging in the $3,600 and 3,400 price corridor. The trading pair is in a low volatility state since January 27 when it broke below the $3,600 support and 61.80 percent Fibonacci level.

The pair increased in value on February 5, when it moved north to $3,512, but almost immediately corrected its movement by dropping below $3,450 in the early hours on February 6.

On February 4, the San Francisco-based cryptocurrency exchange Kraken the acquisition of crypto derivatives trading platform and index provider Crypto Facilities in a nine-figure deal. is a UK-based crypto futures trading company, authorized and regulated by the Financial Conduct Authority (). By acquiring the platform, Kraken aims to meet client demand for more innovative products and trading instruments and will now offer both spot and futures markets on its platform. According to the “eligible Kraken clients will gain access to futures on six cryptocurrency pairs, providing a highly efficient way to trade and hedge cryptocurrency in any market environment.”

Rumor has it that Facebook has made its first blockchain-related as well. to the outlet Cheddar, the social media giant has hired the core team of a startup called . The company was founded by researchers at the University College London and is developing system used to facilitate payments and other services through blockchain technology. Facebook has been looking for a way to enter the crypto industry since last December when different sources reported it was to launch a stablecoin to target India’s $69 billion remittance market.

The U.S.-based crypto exchange Coinbase it is expanding its support for PayPal withdrawals to all E.U. and European Free Trade Association countries. The company introduced the service in December 2018 when it was piloted for U.S. citizens only.

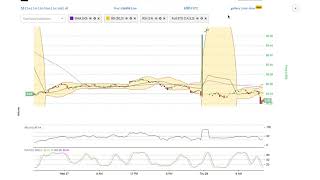

ETH/USD

has been in a downtrend since January 6 when it last peaked at $161. On January 27, however, it entered in a low volatility range trading state, hovering between $103 and $113.

The pair was trading in the $110 to $106 zones during day trading on February 4 before closing the session at $108. On February 5, it made no significant changes in price staying around the $108 level.

The Ethereum client company, Parity a bug in its node/ software on February 3. According to the official the company “received several reports that an attacker could send a specially-crafted RPC request to a public Parity Ethereum node” that could eventually make it crash. This means that all nodes operating with a version before 2.2.9-stable and pre 2.3.2-beta could become targets of the attack. Multiple Ethereum nodes that serve JSONRPC including , , , and other publically-accessible services supported by Parity were among the potential victims.

As per the official website, is a core blockchain infrastructure company handling over $50 billion in assets and underpinning some of the most ambitious projects in the blockchain space.

Like BTCMANAGER? Send us a tip!

Our Address: 3AbQrAyRsdM5NX5BQh8qWYePEpGjCYLCy4

Published at Wed, 06 Feb 2019 10:10:13 +0000