Japan takes another side step with its relationship to cryptocurrency trading as the Central Bank releases a negative Q&A guide for those seeking information about the markets.

BoJ Publishes Negative Q&A for the General Public

The question and answer page translated from Japanese as “Let’s Think About Cryptocurrency” was released on a financial education site run by the Bank of Japan. The page which is aimed at the general public answers broad questions like ‘is cryptocurrency money’, ‘can normal people profit from them’ and the likelihood of having it stolen.

It was that the page appeared after Japan’s financial delegates returned from the Group of 20 nations meeting in Davos, Switzerland last month where the question of whether cryptocurrency could destabilize financial markets was discussed.

The BoJ’s Q&A explains what cryptocurrency is. How coins are bought and sold on exchanges and what the countries regulations are but also explains that there is no central bank for the currency. Eventually, it asks the question,

“Shouldn’t we ban something we don’t really understand?”

The Central Bank answered their own hypothetical here by saying that though cryptocurrencies haven’t yet met the ideals of their creators, the underlying blockchain technology may still have the potential to greatly improve peoples lives.

Japan Struggles with Regulatory Balance

The Q&A comes as Japan’s Financial Services Authority is still struggling to create a balance between regulation and consumer freedom in the cryptocurrency market.

Japan was one of the first countries to create a legal framework for cryptocurrency trading platforms and has enjoyed a booming financial success in the industry but recently has gone through a period of regulatory growing pains.

Following the second largest hack in cryptocurrency history when $500 million in digital assets were stolen from the Coincheck exchange the has created new regulatory guidelines, sent out a round of official warning to exchanges and even suspended a few from doing business.

Japan was also home to the now infamous , the largest cryptocurrency hack which occurred in 2014 but remains both unsolved and unresolved legally.

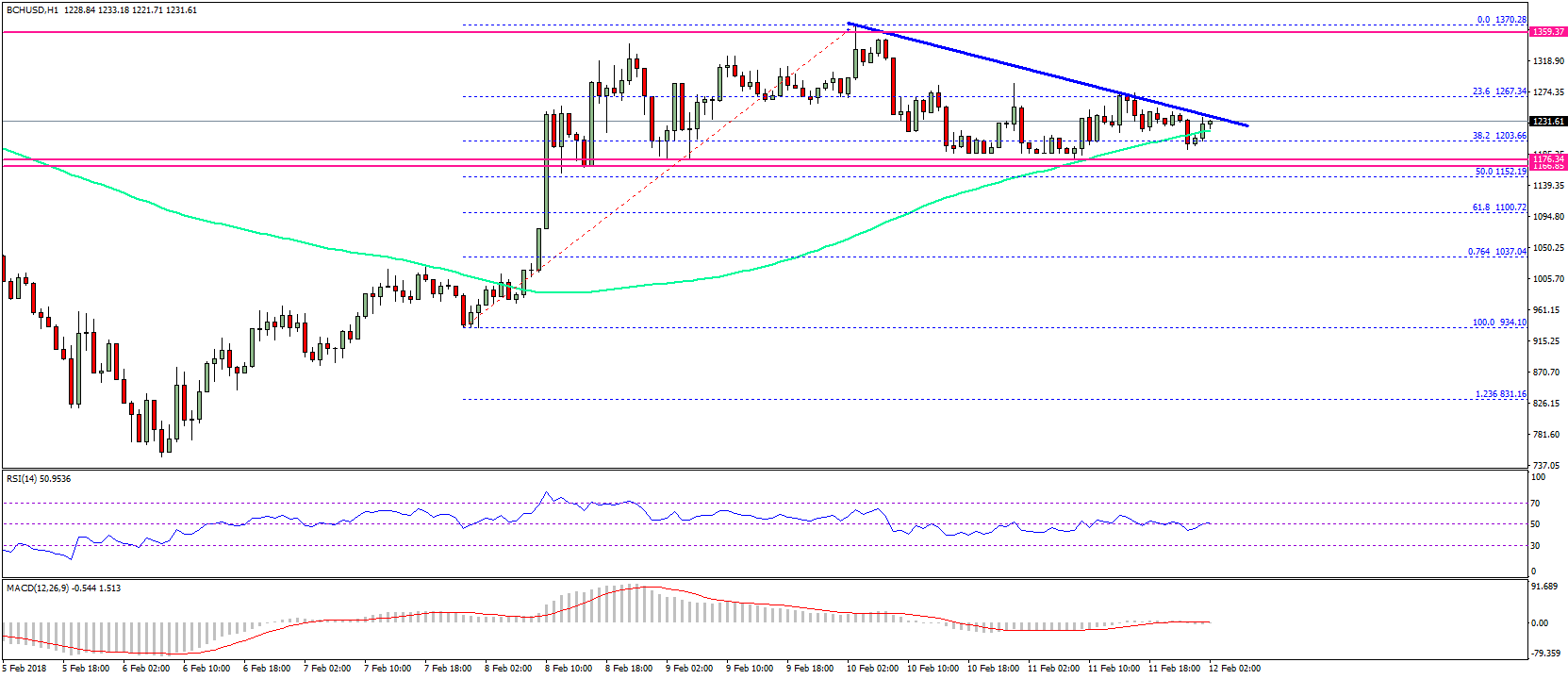

The BoJ’s question and answer sheet could have been bad news for the overall cryptomarket as it took on a rather negative point of view of the entire cryptocurrency ecosystem but early trading in Asia on Tuesday showed a slight rebound in prices with bitcoin trading up over 6% and all other top digital currencies in the green as of the time of writing.

Published at Tue, 03 Apr 2018 07:04:23 +0000

Industry