By : Dave Ramsden, deputy governor for markets and banking at the , said in an interview with CNBC that crypto assets like bitcoin are too volatile to be a store of value and they do not meet the principles of currency.

Citing the research of the Financial Policy Committee (FPC), Ramsden stated that the high volatility and the relatively high costs of crypto transaction settlement make cryptocurrencies less practical as currency.

Volatility Could be an Issue for bitcoin and Crypto but Time Will Fix It

For any new or emerging asset class, volatility could be an issue for investors.

bitcoin, the first crypto asset to be created in 2009, is still about 10 years old and as is the rest of the cryptocurrency market.

Most other major crypto assets in the market in the likes of Ethereum, the second most valuable asset in the global crypto market, actually came after 2014.

As a new asset class, investors expect volatility in crypto assets and generally consider it a risky investment.

, for instance, the CEO of Xapo and a PayPal director, who has been a supporter of bitcoin and the crypto market for many years, wrote in an essay that he puts the chances of bitcoin succeeding at about 50%.

“In my (subjective) opinion those chances of succeeding are at least 50%. If bitcoin does succeed, 1 bitcoin may be worth more than $1 million in seven-to-10 years. That is 250 times what it is worth today (at the time of writing the price of bitcoin is ~ $4,000),” Casares .

Many industry executives and investors in the crypto market are in agreeance that there exists a chance cryptocurrencies may fail over the long run if they fail to garner sufficient adoption and struggle to evolve into practical currencies.

The track record of bitcoin over the past 10 years has led investors to become more confident in the chances of its success as a store of value.

The criticism of the intense volatility of bitcoin and cryptocurrencies, in general, is valid. As an asset class at its infancy, extreme volatility at times is expected.

Bank of England Deputy Governor Dave Ramsden said:

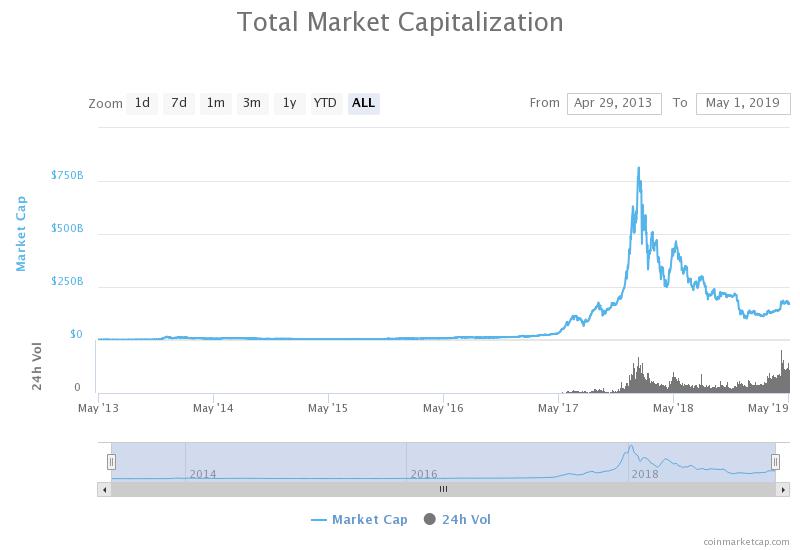

“Just a year ago, the Financial Policy Committee looked at crypto assets in some details supported by the fintech hub. The conclusions of the FPC are that crypto assets are too volatile to be a store of value and we’ve seen that in terms of their subsequent movements through last year. And also, as a medium of exchange, the costs of transactions were very expensive so it didn’t really satisfy those basic principles of being a currency.”

How Volatility Would Settle Down

But, as the structure of custodial services supporting crypto assets improves and both high net worth individuals, as well as institutional investors, feel increasingly comfortable in committing to the asset class, it could allow cryptocurrencies to find stability in the years ahead.

At around $170 billion, the market cap of all cryptocurrencies in the global market combined still remains only a fraction of the market cap of a widely utilized store of value such as gold, which is estimated to have a market valuation of more than $8 trillion.

“Overall, because of the small size of the crypto asset market, the FPC is concluded that they didn’t represent a risk to financial stability but it was very important that we kept monitoring them,” Ramsden added, emphasizing the small market valuation of cryptocurrencies.

The maturation of the industry and leading companies that support it could also result in more stability for crypto assets in the long-term as controversial occurrences such as the Tether-Bitfinex scandal would not have a noticeable increase in the price of cryptocurrencies.

Published at Wed, 01 May 2019 00:00:16 +0000