The prolonged cryptocurrency market downturn is beginning to manifest in the once white-hot cryptocurrency hedge fund industry.

It seems like only yesterday that these funds — targeted at accredited and institutional investors and devoted exclusively to cryptoassets — were the taking the investment world by storm.

Mesmerized by stories of , traders quit well-paying jobs in finance en masse to seek their fortune in cryptoassets. More than 165 cryptocurrency hedge funds opened in 2017 alone, up from 19 the year prior.

However, new cryptocurrency hedge fund launches have slowed to a crawl in 2018. According to , just 20 funds launched during the first quarter, while nine others have closed amid the downturn — which has seen these funds decline by an average of 23 percent so far this year.

The climate is not just affecting smaller funds. Well-known funds report difficulty attracting new investors, as well as convincing current ones to enlarge their positions.

“New capital has slowed, even for a higher-profile fund like ours,” Kyle Samani, co-founder of Austin, Texas-based Multicoin Capital, told the publication.

Cryptocurrency hedge funds made astronomical returns across the board last year, perhaps making it difficult for investors to evaluate funds. Prospective investors are likely approaching these funds with much more skepticism.

However, there’s at least one other factor at play. The US Securities and Exchange Commission (SEC) — along with securities regulators in other countries — have begun into initial coin offerings (ICOs), one of the primary types of assets these funds hold.

The SEC’s ICO probe recently expanded to as well, perhaps making fund managers hesitant to launch funds until the regulators provide more clarity.

There were many trends which emerged last year with the increase of the inception of cryptocurrency hedge funds being one of them. Last year saw 167 cryptocurrency hedge funds come into existence with the rise of bitcoin’s value that really brought the cryptocurrency world into the mainstream.

It is estimated that at the current state of affairs, barely fifty of the cryptocurrency hedge funds will actually be able to raise enough capital funding to remain a sustainable option for the institutional investors who have staked a claim in them.

Most of the rest are not going to to be able to make it. Those that were cautious about entering the space and exercised caution on the other hand could find themselves looking at “once in a lifetime” entry levels. That is assuming the expert opinion that blockchain technology and digital assets become the next big disruptive technology as expected. But with any market or new technology.. time will tell.

Don’t say that we didn’t mention that during all of the exuberance of 2017.. some of the experts advised caution.Check out the excerpt from our July 2017 Article below:

July 14th 2017:

bitcoin surges to $19,000 on the Coinbase exchange 12:13 PM ET Thu, 7 Dec 2017 | 00:39

rocketed above $19,000 for the first time on Thursday before falling sharply from its record high.

In trading on the Coinbase exchange, the digital currency hit a high of $19,340.

“It goes without saying that prices have reached a level where sentiment is exhibiting short-term euphoria,” said Mark Newton, managing member at , in a note to clients.

“But to think prices are at mania levels where this could suffer a serious crash here… is a bit ridiculous.”

While Newton Advisors, the 100+ Crypto hedge funds that have opened this year and just about everyone you ask says sky’s the limit for bitcoin, other experts have a different opinion.

, professional trader and Founder of isn’t as optimistic. Siebenthal postponed plans to launch a crypto hedge fund- citing a possible correction to 7500 or lower before the cryptocurrency market- led by bitcoin resumes it’s uptrend.

“I’m still bullish on cryptocurrency and a huge believer in the future applications and adoption of blockchain technology. But we’re near all time highs heading into historically the worst performing quarter of the year for bitcoin. I wouldn’t be in any hurry to rush in here.”

, the former macro manager who’s turned into one of the biggest champions of bitcoin, is shelving plans to start his cryptocurrency hedge fund and is predicting that the digital money may extend its plunge to $8,000. Novogratz isn’t giving up on them and said he still believes they’ll be a disruptive force in finance.

William Mougayar, general partner at early stage fund Virtual Capital Ventures and author of who organized , wrote via email:

I don’t want to be in the difficult position of explaining to my limited partners 8–14 months from now why the assets have dropped by 80%.

While so many of the hedge funds that opened doors in the second half of 2017 were crushed, those that exercised caution while many carelessly entered the space may very well present investors with an incredible buying opportunity.

The general consensus from the experts- at least the ones that called the sharp drop in bitcoin prices (and took a lot of flack for suggesting the digital currency could drop 50% or better when it was trading near all time highs) are now calling for the next bull run to resume possibly in the 2nd quarter this year.

Cryptocurrencies could go on a bull run greater than last year and pass the trillion-dollar mark in terms of value,

Nevertheless, while fickle investors and fund managers are mulling heading for the exit, some bulls are doubling down in preparation for the next rally. Morgan Creek Capital Management, for instance, is reportedly seeking to for what would likely be the industry’s largest cryptocurrency hedge fund.

“There is 200 Trillion dollars tied up in stocks, bonds, gold & cash. I am not excited about putting my money into any of those 4 options right now. If 1% of that 200 Trillion finds it’s way into cryptocurrencies over the next 10 years you’d be looking at a 2 Trillion Valuation. 12X what it is today.”

Despite the sell off, Investors are still eager to invest in the next technological revolution.

“bitcoin Will One Day Be Worth 40 Times Price It Is Now.”

Find the

See JP Morgan:

Cryptocurrency and blockchain technology have become incredibly popular amongst individual and institutional investors across the globe. Many have been leaning more towards investing in hedge funds relating to the cryptocurrency industry instead of the individual cryptocurrencies.

Cryptocurrencies were the best-performing currency in 2015 and by far the best performing asset class of 2017. Business Insider, Forbes & CNBC covered some of the outlandish returns in some of the top cryptocurrency hedge funds last year.

And while the market correction has scared skittish investors from entering, many are using this as an opportunity to buy in low ahead of the next bull run.

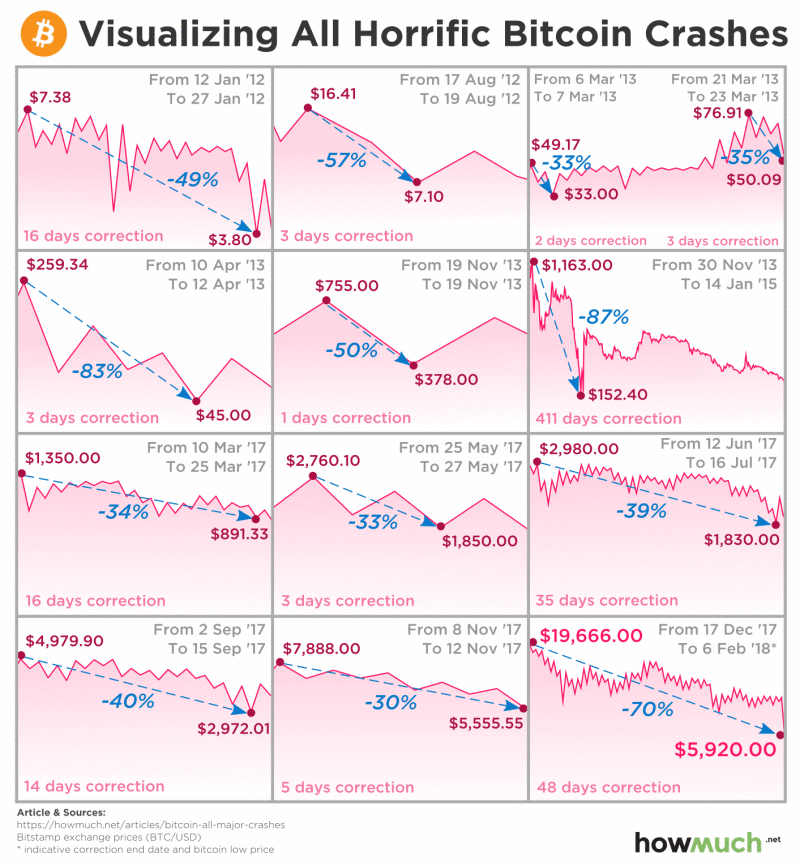

As frightening as a 70% correction has been for crypto newcomers, it’s far from the worst corrections the digital currency has sustained. Nearly all of which happened in the first couple months of the year and all were followed by even bigger rallies.Visualizing the History of bitcoin Crashes: Are Hodlers Prepared for the Next Bull Run?

The latest bitcoin crash has some investors believing the “end of days” are near. Once bullish “hodlers” and committed individuals now voice their concerns and fears that this crash indicates that the cryptocurrency market may be faced with a new normal.

While the latest crash has been painful, it is best to step back and assess the current state of bitcoin relative to its past. bitcoin has “crashed” many times over the past several years, but how does this latest downturn compare to past steep sell offs?

In order to compare the most recent bitcoin crash to other past panics, we decided to create a visual that clearly shows twelve other times that the top cryptocurrency has sold off. Each box represents a specific time period in which the price of bitcoin came under extreme selling pressure.

Using the bitcoin-to-U.S.-Dollar (BTC/USD) pair, our team found the specific highs and lows of the past crashes dating back to January 2012. Utilizing a blue arrow, we highlight the percentage of value lost during each sell off. Lastly, we measured the length of each specific crash period by stating the number of days the correction ultimately lasted.

This Is Not bitcoin’s First Rodeo, Top Crypto Has History Of Surviving Crashes

Despite the steep 70% losses during the latest cryptocurrency sell off, this is not an unusual event for bitcoin. Since January 2012, there have been thirteen major corrections or crashes in bitcoin, including this latest rout. Losses have been as minimal as 30% and as severe as 87% during these bitcoin panics. Compared to its past events, this latest correction was not even as severe or painful as it has been in the past.

The latest correction took place between December 17, 2017 and February 6, 2018, or 48 days, in which 70% of bitcoin value was lost. However, if you look at the period between April 10, 2013 and April 12, 2013, bitcoin lost an astounding 83% of its value over a three-day period. Talk about a panic!

The point is that crashes have become relatively common throughout the cryptocurrency market, which is known for its swift volatility. It is important to turn to data and the facts in times of turmoil, rather than relying on one’s emotions.

Here is a breakdown of the visual, showing each of the corrections in bitcoin by date of occurrence. It will also include the percent of value loss and the length of the correction in number of days:

1. January 12, 2012 — January 27, 2012, -30%, 16 Days

2. August 17, 2012 — August 19, 2012, -57%, 3 Days

3. March 6, 2013 — March 7, 2013, -33%. 2 Days

4. March 21, 2013 — March 23, 2013, -35%, 3 Days

5. April 10, 2013 — April 12, 2013, -83%, 3 Days

6. November 19, 2013 — November 19, 2013, -50%, 1 Day

7. November 30, 2013 — January 14, 2015, -87%, 411 Days

8. March 10, 2017 — March 25, 2017, -34%, 16 Days

9. May 25, 2017 — May 27, 2017, -33%, 3 Day

10. June 12, 2017 — July 16, 2017, -39%, 35 Days

11. September 2, 2017 — September 15, 2017, -40%, 14 Days

12. November 8, 2017 — November 12, 2017, -30%, 5 Days

13. December 17, 2017 — February 6, 2018, -70%, 48 Days

Overall, the latest correction in the price of bitcoin is nothing out of the ordinary. History shows that the top cryptocurrency has sustained much more rapid losses during a shorter period of time over the course of the past several years, yet it has not discouraged long-term investors.

Regulatory crackdown fears seem to be main source of the latest crash, but the recent cryptocurrency regulatory hearing before the struck a much brighter tone than crypto traders had anticipated.

This shows that fears of regulators attempting to shut down the cryptocurrency market are overblown. In the end, cryptocurrency is still a very relatively new concept that will have its highs and lows, but its resilience in the face of uncertainty has been nothing short of incredible.

was originally published in on Medium, where people are continuing the conversation by highlighting and responding to this story.

As innovations are coming in from blockchain industry, it takes a keen observer no time to identify it. This can be said of Ripple. The digital currency and global money transaction firm is investing $25 million into digital and blockchain startups.

Made in , the $25 million investment is to be managed by Blockchain Capital Parallel IV, LP. The angel capital firm is seen as the first fund to accept capital calls in digital assets with concentration on the development of the blockchain space.

What is Obtained in the Ripple Investment?

, Blockchain Capital has approximately $150 million fund under its watch. The investment firm is expected to invest in entrepreneurial teams that are blockchain-focused. Not only that, the investment is expected to provide an opportunity to identify new use cases for the XRP Ledger and , Ripple has said.

According to Bart Stephens, co-founder and managing partner of , the capital firm is a pioneer in the blockchain sector, it has been at the fore and in the trenches with their portfolio companies, like Ripple, which is designing a new crypto ecosystem.

Bart made known that it saw opportunities for distributed ledger technology in healthcare and identity management.

“Whether it’s using XRP, bitcoin or just the underlying blockchain technology, our goal is to find the best projects and give them the resources to be successful companies that deliver value to customers for the long term,” Bart said.

Meanwhile, talking on the latest development with Blockchain Capital, Ripple’s SVP of Strategic Growth, Patrick Griffin, reiterated that “Blockchain Capital is the premiere fund for any project looking to get off the ground in the blockchain space. They have a proven track record for finding and funding the projects that matter.”

“This is the first fund that we’ve contributed to, and it won’t be the last. We plan to be major players in shaping the future generation of blockchain or crypto companies.”

The reason behind this investment, according to Ripple is that the firm believes in supporting the XRP Ledger and Interledger Protocol, at the same time, the cryptocurrency firm is ready to continue to seek opportunities and support entrepreneurs, companies and funds that share this vision.

Blockchain Capital is blockchain-centred venture investor, founded in 2013 to help entrepreneurs invest ideas, build companies, and manage projects on blockchain technology. The San Francisco is flaunted as one of the oldest and most active venture investors in the blockchain technology sector. Since it was created, the venture has financed 72 companies, protocols and tokens.

The post appeared first on .