An approach to pre-sale network valuation.

This article aims to give a brief overview on assessing ICOs using their social media profiles as an aspect of fundamental analysis. In simple terms value can be measured according to what people believe something is worth. This is related to subjective theories of value where value is not inherently intrinsic or based on the labour needed to produce something, but rather determined by the importance an individual places on an item or service. For example most people agree that pricing a Modernist painting is more qualitative than quantitative. Similarly tokens released during an ICO have limited utility as a store of value or medium of exchange, so adoption is mainly about acquiring an asset based on the company's perceived value proposition and future potential. One popular quantitative method for determining value in this class is Metcalfe’s law. The law was put forward in the 1980s by Robert Metcalfe, who proposed;

The value of a network is proportional to the square of the number of users on the network (n²).

Since then it has become an important formula for valuing social media networks like Facebook and Tencent and studying various connected technologies. Recent studies have also shown it is an accurate measure when deriving formulas for valuing large caps like bitcoin, Ethereum and Dash, giving accurate predictions on price correlation against network usage. For ICOs, however, we have limited data about transaction activity or number of active participants, so we have to speculate based on comparable projects and other indicators. A good way to do this is by looking at social media presence. From looking at social media we can hope to get an idea on the amount of potential business partnerships and merchants, the engagement of the developer community and the breadth of the prospective user base. It can also provide insights into the health of a company by visualising exposure to market sentiment during volatility. Once tokens have been released, however, a more accurate method should be based on gathering data from sources like , or .

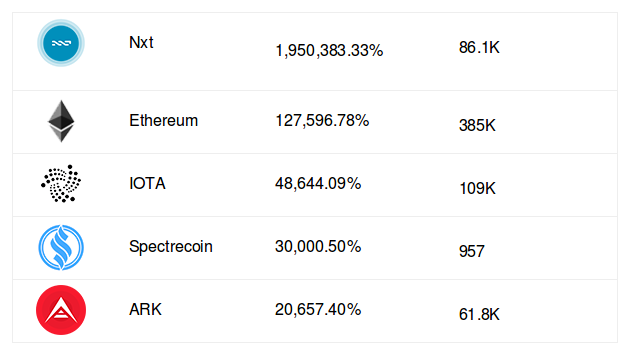

To begin with, the number of followers on social media does not correlate with ROI, although having a large presence makes adoption more likely. The above table shows top performing ICOs with their ROI and Twitter follower count (note Spectrecoin). Secondly, engagement on a network is not a guarantee of future growth or company value, with competition and fungibility making loyalty almost obsolete.

For a specific example we’ll look at Mainframe as an upcoming ICO with a successful social media campaign, but at risk of over-reaching. Mainframe describes itself as the web3 communications layer, using a decentralised network for censorship-resistant message routing. It currently has 5,800 followers on twitter and around 23,870 members on it’s community Telegram channel. The company is in the middle of a public marketing campaign aimed at building it’s core base by giving away $3M of tokens. While this type of promotion is important, it is possible that they’re over exposing the company to market sentiment. In a bear market this can mean attracting too many unsophisticated investors, making it more susceptible to cascading effects.

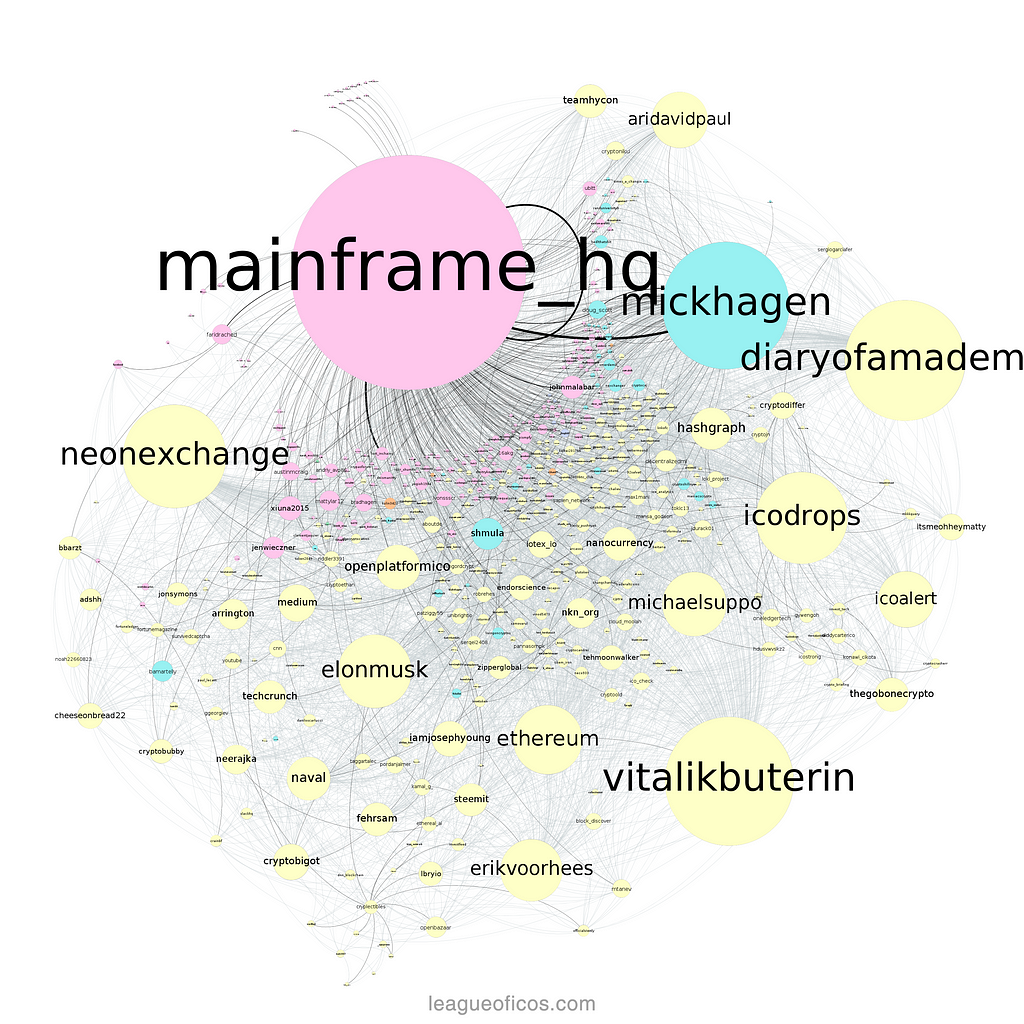

Above is a directed graph from a Twitter search network of ‘’. Immediately visible are a number of well known influencers such as Ian Balina, Michael Suppo, ICO Drops, ICO Alert, Vitalik Buterin, Elon Musk, etc. There are also a number of upcoming ICOs such as NEX, Open Platform, Hashgraph, Hycon, IoTeX. While these connections may not represent definitive partnerships or close associations, they position the project in a public space for them to sculpt a narrative about their company. CEO Mick Hagen also appears to have a strong social media presence, which indicates a company very aware of optics.

Followerwork gives them a social authority score of 54% from 5,387 followers over 4.90 years. The top bio word cloud of Mainframe_HQ’s followers is: crypto, investor, enthusiast, blockchain, tech, entrepreneur, founder, cryptocurrency, #blockchain, #crypto, business, #bitcoin.

Here a picture starts to emerge about a company very focused on business development and acquiring funds. A concern is that efforts to engage the developer community have been sidelined for promotional gain. This is significant because fungibility makes it important to focus on tangible assets such as hardware, or building a codebase that continues to attract developers.

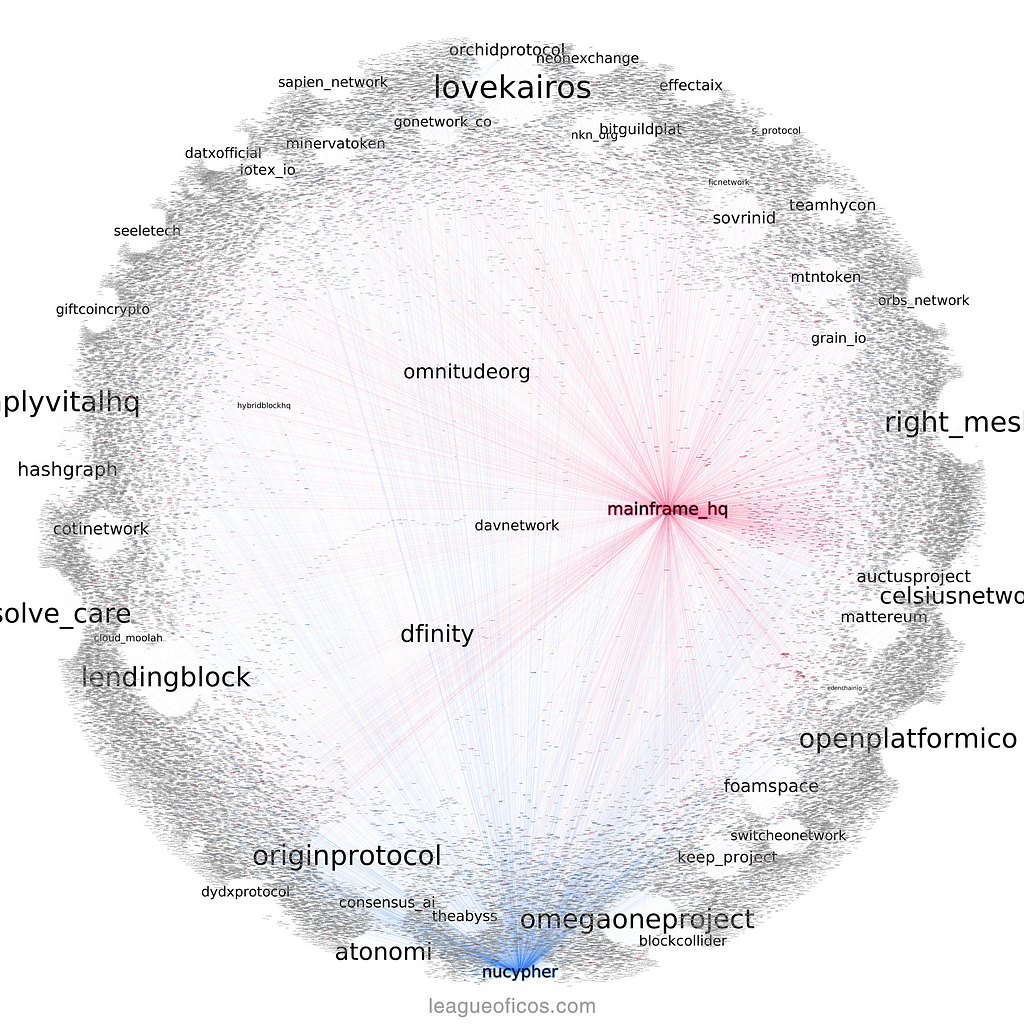

To put this in perspective we can analyse a similar project with a fairly different media strategy. NuCypher is a company building proxy re-encryption for distributed systems, and has roughly the same social following as Mainframe with 4,700 followers on Twitter and 23,860 members on their Telegram channel. Above is a Twitter follower graph of the top 50 upcoming ICOs with highlighted edges for both Mainframe and NuCypher. Again Mainframe has a high degree of centrality meaning their profile is connected to a very broad and general community. NuCypher however, is associated to a more fringe community which may be align with their branding strategy.

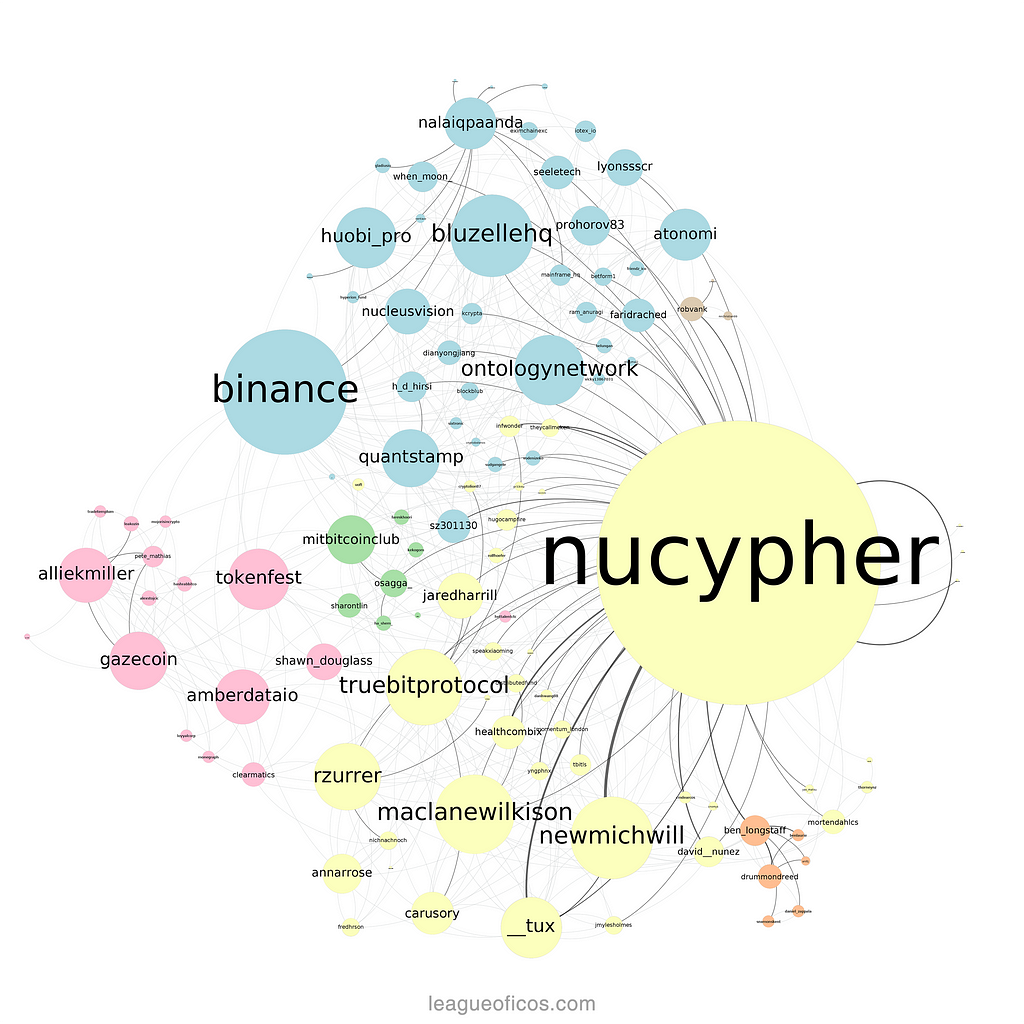

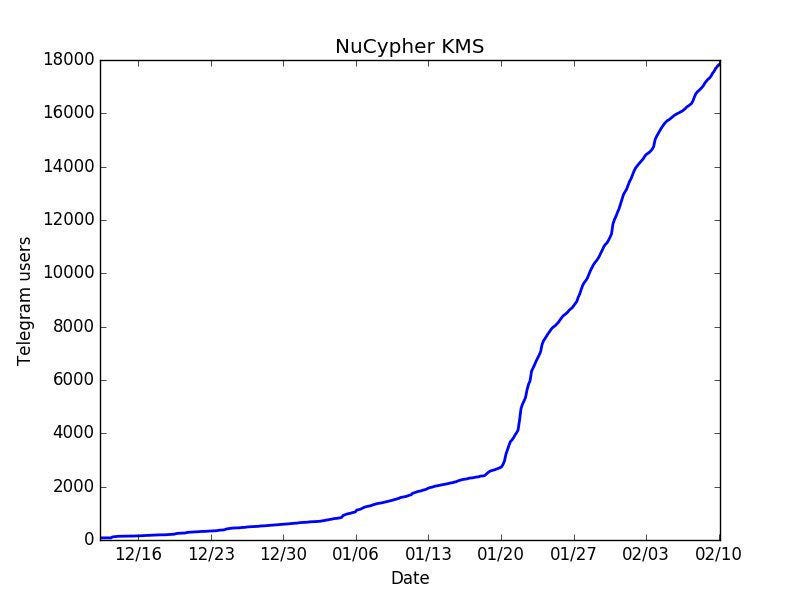

Above is a directed graph from a Twitter search network on ‘’. Visible are some prominent companies already listed with considerable ROI; Ontology Network, Bluzelle, Binance, Nucleus Vision, Huobi, Quantstamp. This tells us the company is already connected to some established players and may be fairly ahead on their road-map. Although NuCypher have finished their pre-sale, no details have been given about the crowd-sale which may indicate they’re satisfied with their current funding arrangements. Focus appears to be more concerned with technical and engineering areas which will help build the core dev base. They also provide a chart showing progress of their Telegram channel (below) which displays an initial exponential growth stage. Estimating a point of critical mass where the network reaches saturation is more related to the the widespread applicability of the service and adoption of the blockchain ecosystem in general. However the chart shows considerable growth in relation to current market sentiment.

To summerise we can value a blockchain or dapp company using Metcalfe’s law based on network usage. Social media can be a useful tool for estimating adoption rates by visualising network interactions while identifying potential partnerships and user engagement/retention. As new protocols develop and gain significant network traffic, users will become more vested in their chosen blockchain ecosystems. However competition and fungibility make it important for a company to build robust connections with a core base of users and developers. In the end social media can be an important indicator of future network growth but ultimately network valuation will be based on active monthly users and unique transaction addresses on the specific blockchain or application.

League of ICOs offer a range of advisory services, strategic relationships and manage a large network of cryptocurrency investors. More specifically, if you are interested in pre-sale network valuation please contact us at admin@leagueoficos.com.

Social

Telegram:

Twitter:

Website:

Donations address

ETH: 0x6A3fE4917Fb8443478D5E50D990A8Db29f18791E

NEO/GAS: ARUqyyB1VEMLmxQhtqWuheZAx98ntag5MK

LOI community

We want to thank our community for the way in which you have fostered collaboration and shared your insights. I believe this remains the core of our continued success.

LOI is an ICO research and development group who offer private pools for highly anticipated projects. We aim to create a community that enables members to grow and develop through informed research and analysis while providing opportunities for pre-sale inclusion.

The inventor of Ethereum has very positive thoughts about the blockchain technology. He stated that the blockchain technology has solved the problem of manipulation. He added that when he spoke about blockchain in the western world, the people replied that they trust Facebook, Google, and their banks more than blockchain. But the rest of the world doesn’t trust organizations and corporations that much.

Countries like Africa, Europe, Russia are not the places where the people are rich. And blockchain technology has the opportunities for these countries where the people have not reached the highest level yet.

The blockchain is just a kid and there are many things that the blockchain is going to change. It is possible that the technology can truly disrupt the multiple industries and make them secure, transparent, efficient and democratic. The technology acts as an unassailable intelligent creation as it is the product of a person or group of people who are known to each other and only known by their groups.

So, let’s get roll into some of the key features of this latest technology.

1. Decentralized technology

With the help of decentralized technology, we can store our assets over the internet. these assets can be anything from tokens to contracts or even registry of property documents. With the help fo decentralized technology, the owner has direct control over their property and their private key which is directly linked to their assets. Not only this, the owner can also transfer the asset whenever he wants to and to anyone he wants.

In the recent times, the blockchain technology is being viewed as a powerful technology to decentralize the web. It has the potential to prove itself by bringing a massive change in the existing industrial sectors like finance and banking. As the technology hit the digital world, the individuals will have the direct control on their assets.

The blockchain technology also eliminates the need for the third party in the middle of which is taking the huge fee in terms of transaction charges. The individual can directly indulge in the transaction giving minimal fee. Besides, this also helps the financial organizations to get ready for the upcoming crisis and they have already started working on their services.

There is a powerful idea behind blockchain which is not to trust any entity like the bank, or government or any organization. The entire network of blockchain is based on decentralization. The blockchain enthusiasts can buy assets like identity information, financial assets, contracts, evidence documents and many others.

The Internet is also having a huge role of decentralization by accessing and flowing of information. The next step of blockchain has started and the Internet has helped it a lot. With the help of the Internet, the blockchain technology can greatly influence industries and make any process more transparent, secure and efficient. Still, the potential implications of the technology to our society are far-reaching.

2. A distributed ledger

The blockchain is nothing, but a distributed ledger which contains all the types of information about the participants in a digital way. Whenever a digital transaction is executed it gets stored in the chain linking with the previous and next transaction. Thus, it set out a chain of a transaction which can be stored and can be audited in near future. And once they are completed they go into the blockchain. The blocks are added in a sequential manner when a new block generated the previous one solidifies in a hash manner and get blocked in the database.

Recommended: .

Blockchain technology has recorded each transaction and shares it across the network. The users in the network can verify and validate the transactions and also has an identical copy of that ledger. In the ledger, the encrypted transactions can be added and all the modifications can be added in the copies in minutes or seconds. The participants can use their private keys in order to access their assets and to maintain them cryptographically. It serves an online ledger keeping the record of transactions that just cannot be altered. The distributed ledger can be used for a wide variety of applications including digital assets, financial services, voting rights, tracking ownership, physical assets.

3. Leading to a safer and secure ecosystem by providing the tamper-free environment

Don and Alex Tapscott the authors of Blockchain Revolution stated that “The blockchain is an incorruptible digital ledger of economic transactions that can be programmed to record not just financial transactions but virtually everything of value.” From the above two features, it can be easily seen how the technology is impacting a tamper-free environment for the participants as well as for the businesses. It automatically checks updates in very few minutes. It helps in providing a self-reviewing system which is very robust.

All the aspects of blockchain technology have created a very powerful network as every node can act as an administrator of the technology and can join the network. Besides, every node in the network has an incentive for participating the network. It is essential to complete the nodes in order to have the chance of winning the digital currencies. The specific nodes are said to mine the recent blocks which contain the entire details of the recent transaction.

4. Hash — Providing authenticity

In various cases, the authenticities of the data as well as the documents are very important. Besides, there are many organizations that have sensitive documents, contracts, assets that need to be protected. Whenever a data, file or document is created or stored in the file, a hash is created. A hash is like a fingerprint that uses an algorithm and turns the data into an output of fixed length. This is considered as the unique identifier for every single transaction.

On the other note, every block can be divided into two parts namely the header and the transaction part. The header contains the previous block’s hash and the previous hash it is building upon. The second part of the block contains the hash of the current transaction which is created to be connected to the next block when added. In this way, the blockchain is distributed and updated with the new block. This also makes the blockchain immutable. Thus, by comparing the hash of any transaction, the participants can verify its authenticity which helps them in achieving the independent verifiable system.

5. Minting

There are many ways from which the participants can mint the coins. The most ordinary method is mining, but there are also other methods which are coming into the limelight. Although the miners earn the monetary reward by earning bitcoins, they have to spend money in order to buy power and equipment which help them to operate their mining process. There are another processes which help them to remove the external step of having all the real power and real hardware. Besides, it would also help to lower the cost of minting.

Conclusion

Cryptocurrencies are proving themselves the very best interest other spheres by providing a transparent system decreasing risks of deals and eliminating third parties. Blockchain drives an important disruptive in many industrial sectors. You can see how intermediaries decrease after the adoption of this technology.

Also Read:

Stay up to date with . for the safe and improved trading. Chat with us to discuss your queries and doubts. To stay updated on latest news, follow us on , , and .