Replacing Paper Contracts? Photo by on

Replacing Paper Contracts? Photo by on

When we talk about smart contracts, the first thing that comes to our mind would usually be (ETH) — to put it bluntly, the mother of all smart contracts. Well, that statement may be a little misleading, but I would argue that Ethereum was the first project which drew public attention to smart contracts implementation. It was made possible due to the design of a blockchain infrastructure. And just in case you might not know what Ethereum is, it is a decentralised platform for running smart contracts.

A smart contract is a program which contains a set of commitments, including how the contract participants shall fulfil these commitments. It executes across multiple computers so that the computers can have a consensus on the computation which enforces the validity of the contract — and is widely used in Ethereum. Today, mainstream smart contract adoption includes , , and , whereas more widespread applications of smart contracts are still in its early stages of development.

On Ethereum specifically, every smart contract that is deployed runs on every in the Ethereum blockchain. Whenever a user wants to call a smart contract, that smart contract gets activated on each of the full node across the entire Ethereum network. This has resulted in scalability issues, which is somewhat recognised as the key technical challenge that needs to be solved in order for blockchain applications to reach mass adoption. The , while other enterprises / organisations has ventured into creating their own blockchains to try address the scalability issues.

Before we dive into exploring other newer blockchains which feature smart contracts, it is interesting to note that — the term was coined and explored with 10 years before bitcoin’s existence. However, the term and its appliances has only recently been further explored. Ethereum’s platform has allowed developers to build DApps (Decentralised Apps) on its blockchain, that is defined by smart contracts. The immutability and cryptographic security features on the blockchain keeps these contracts secure.

Having a middle ground to store smart contracts removes the need for an intermediary party, as conditions within the contracts can be now developed and enforced on the platform itself. A simple example would be a buy-sell agreement — the moment the buyer makes payment to a seller, the contract enforces the item to be released from the seller to the buyer.The Evolution of Smart Contracts

Since Ethereum, the potentials of implementing smart contracts continues to be explored, as many other communities and enterprises have started looking into various ways in which smart contract can be adopted.

Public Smart Contracts

So far, the use of public smart contracts have seen limited. As mentioned above, token sales, multisig transactions and cryptokitties are the main areas in which we have seen smart contracts being deployed on the public chain. However, problems in regard to these implementations has arisen since. . . . The case of the Cryptokitties itself has made the entire Ethereum blockchain seem unreliable, where scalability issues has been commonly brought up.

Newer (than Ethereum) startups like have since launched into trying to provide a ‘better’ consensus protocol; it boasts that is is able to process thousands of transactions per second, and writing smart contracts in more commonly used programming languages like Golang, Python etc., compared to Ethereum’s Solidity limitations.

(Tendermint itself is another whole virtual realm of services & products that we can discuss in another article)

Enterprise Smart Contracts

Large enterprises like , , , , , and many others that I may have missed have also ventured into providing consultation services and building blockchains in a number of industries (, etc.)to build smart contracts on.

This is with the intention that smart contracts need not necessarily be deployed in an entire public blockchain for the world to see. Participating parties of the smart contract can simply spin off full nodes of the smart contract within a consortium blockchain to enforce these smart contracts — keeping the details of the contract private. Other methods also includes leveraging on to protect details of the smart contract and linking it to the Ethereum (public) blockchain.

Other DApps-chains

Disclaimer: The segment below highlights a few DApps-chains, but the number of existing blockchains which allows decentralised applications to be built are non-exhaustive. Also, in no way am I trying to promote these cryptocurrencies below.

The number of public blockchains which features DApps (decentralised apps) has been surging as well. Relatively newer platforms (or not so new anymore) such as Enigma (ENG), EOS (EOS), ICON (ICX), and NEO (NEO & GAS), have different goals on what they aim to empower the world with.

, where the team is building a blockchain which provides ‘’ — due to the fact that data (inclusive of smart contracts) on the public blockchain is public. Secret contracts deployed on Enigma would remain private.

(aka. Ethereum on Steroids), focuses on Ethereum flaws to build a ‘better blockchain’ as they claim to provide better technical capabilities compared to Ethereum. One of the main technical capabilities being addressed is the number of transactions per second (TPS), which has been a well-known issue both bitcoin and Ethereum has been facing while scaling.

, or the ICON Foundation, which seeks to provide a network (within the ICON Republic) in which multiple independent blockchains can be built on with DApps, and be able to communicate with one another.

, the eldest of the four, has the deepest relations in China, a key player in innovative technology. Its preparing itself for the smart economy, and places huge emphasis on staying regulatory compliant. Here is a list of existing available currently.

The Future?

From this alone, we can clearly see that many groups are figuring out on the best way to leverage on the blockchain infrastructure to shape the next phase of technology. It is clear that smart contract adoption will only continue to grow for now, as more and more parties are seeking on ways in which smart contracts can be better utilised.

We should, however, remain vigilant on the potential . could be very much be one of the first few who have taken a big leap into creating a smart contract security-auditing protocol. Despite that, it is essential to keep in mind that security audits and vulnerability discovery on smart contracts are still in its infant stages.

Foreword

Foreword

Most of us, coming to the crypto-currency market, faced the problem of exchanging fiat funds in crypto currency. Most of the exchangers look unsafe, claim a large commission for their services or don’t have sufficient reserves for exchange. LocalcoinSwap is planning to solve these problem.

What is LocalcoinSwap?

LocalCoinSwap (LCS) is a decentralized market that allows buyers and sellers to trade without intermediaries in any crypto currency, using any form of payment. The platform, using P2p protocol and no any needs to undergo any checks or wait long. The platform uses a secure escrow system that solves existing problems of online P2P trading confidence. In the end, we get a fast, secure exchange without intermediaries, which we lack in the traditional market.

How it works?

Exchange:

A person comes to the platform under his login and password. Finds the way he needs the exchange, transfers the funds and immediately after receiving the funds, the crypto currency is transferred to his account. The Localcoinswap platform guarantees the security of the transaction and acts as a guarantor.

Dividends:

You buy LCS tokens and keep them on your ERC20 wallet. The company works, people make exchanges, the project makes a profit. Every quarter, developers calculate the profit of the project and pay dividends to holders of LCS. The profit is paid in proportion to the number of tokens you have in your wallet. It’s very simple: keep tokens — make a profit.

In the end, we get a platform on which you can make a secure exchange and additionally earn simply by keeping their tokens on your wallet. The launch of the platform is planned in June 2018, and the official launch in August 2018.Roadmap

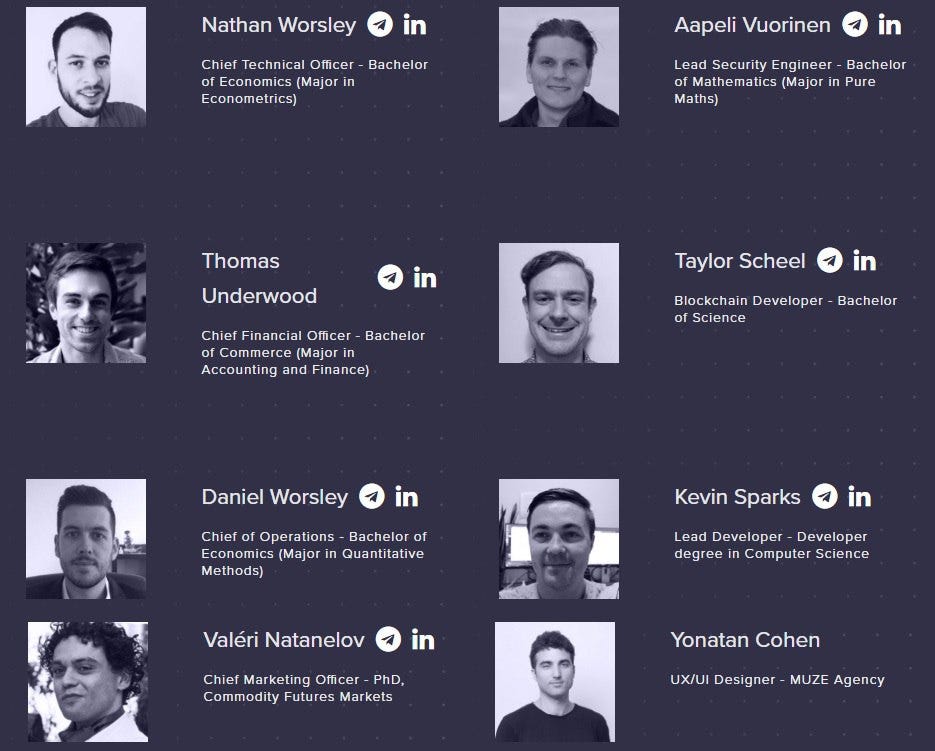

The development team has extensive experience in the field of crypto currency and blocking solutions. Among the team there are people who invested in bitcoins and ethereum in very early stages. Also behind the developers is a lot of successful projects and large, working companies. It is also worth mentioning the impressive list of advisers, among whom there is such a person as George Kimionis, who is the founder of Coinomi Wallet. A full list and description of the team .

Token

LocalCoinSwap issues LCS token. All holders of LCS will receive a part of the profits from the platform and the possibility of reducing commission. Also, all the holders of the tokens will take part in the airdrops of the projects that will be on the platform. And thanks to the blockchain technology, the distribution of profit between the holders of the tokens will be transparent and without the possibility of deception.

ICO

The ICO is scheduled to begin on April 15, 2018

Token Name: LCS

Blockchain: Ethereum

Total tokens: 100,000,000

Price of the token: 1 ETH = 2500 LCS

Accepted are: Ethereum (ETH), bitcoin (BTC), Litecoin (LTC), bitcoin Cash (BCH), Dash (DASH), Ethereum Classic (ETC) and Fiat

Soft cap: $ 500,000

Hard cap: $ 20,000,000

In conclusion

LocalCoinSwap is a very attractive project, and most importantly it is needed by the community. Judging by the team and advisers — ICO will be successful and the product will be implemented within the deadlines set. The only problem of the project is a powerful competitor in the form of Localbitcoin, but I think this market will have enough space for another player.

Idea

Idea

Over the last five years, cryptocurrencies have proven to be the fastest growing financial market in history.

During that time, they have generated significant profits for all the investors who decided to locate their assets in the cryptocurrency market.

Sint

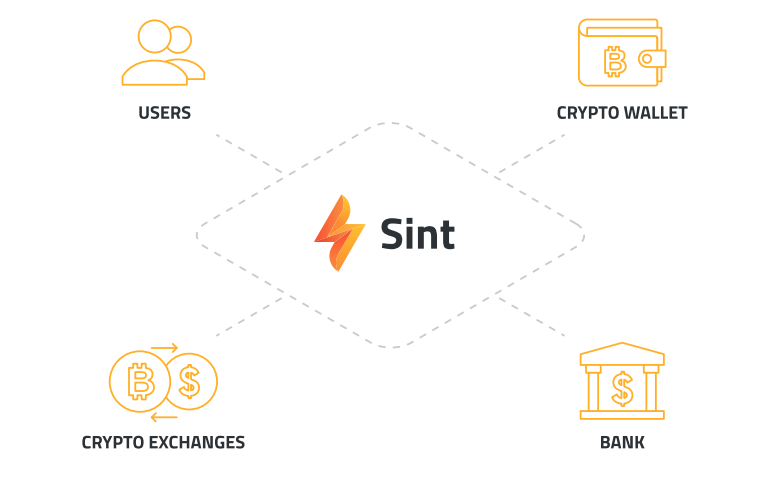

Sint does not function as a cryptocurrency exchange as such.

Its main objective is to be a gateway to the flow of assets between investors and existing exchanges with a wellestablished market position.

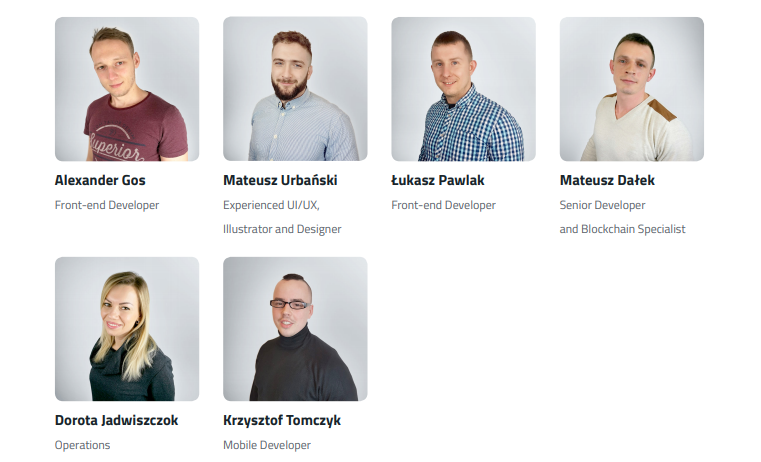

The project is being developed by blockchain enthusiasts and people with experience in the new technologies sector. We believe it is this blend of talent that will help us achieve commercial success.

Sint will provide a comprehensive solution for cryptocurrency users which is clearly lacking in today’s marketplace. It will unify the financial market with the rapidly growing cryptocurrency market and make it more accessible to ordinary people.

Current situation

With the fast and extensive development of Blockchain technology, many opportunities for growing one’s capital have emerged.

The digital currency market is truly international, open 24 hours a day and offers great potential for growth. The rapid increase of interest in cryptocurrencies led to the creation of more than 1,500 new tokens available for daily trading.

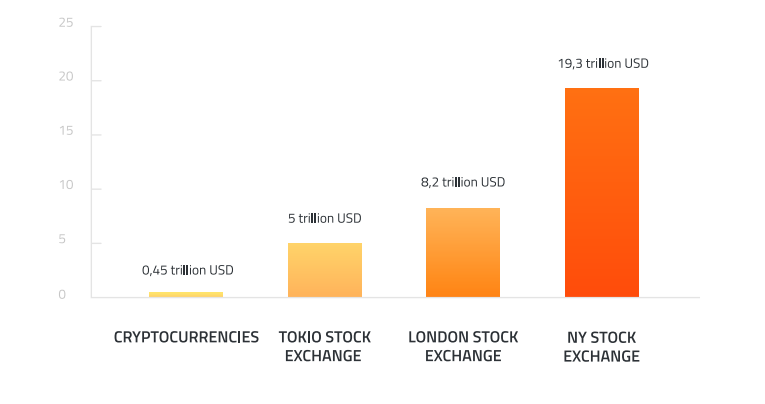

A chart showing the relative positioning of the digital currency market among the world’s largest stock exchanges by capitalisation:

The chart below shows the total capitalisation and increasing market volume over the years:

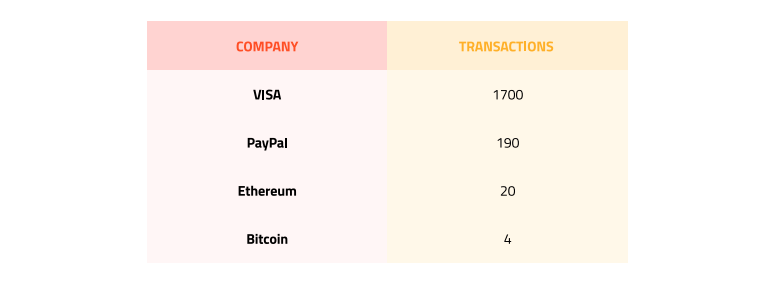

A table showing the positioning of cryptocurrencies compared to the largest global payment service corporations by a number of transactions per second:

Everybody who decides to start investing in digital currencies faces many obstacles on their way.

Trading takes place on many different, unconnected cryptocurrency exchanges. Each of them has different rules, regulations, fees and often complicated and convoluted verification process.

Instant transfers and free availability of funds are crucial for taking full advantage of the opportunities offered by trading digital assets.

Investors can decide whether they want to entrust their assets with large funds or buy cryptocurrencies from private vendors on one of many cryptocurrency exchanges available on the market. The opportunities are enormous.

Definitions

Currency exchange

A platform enabling the immediate exchange of the traditional fiat currencies into digital currencies.

Blockchain

A decentralised and distributed open source database in a peer-to-peer (P2P) network with no central computers and no centralised data storage, for an accounting of individual transactions, payments, etc.

Its main advantages:

The blockchain technology is resistant to cyber-attacks because its security is ensured by cryptography;The blockchain technology, based on a cryptographic encrypted structure, does not need any intermediary institution that verifies transaction data or confirms the identity of its participants, thanks to which the costs of its operation are incomparably lower than those of other systems, and the efficiency is very high;Due to its distributed and decentralised nature, it is resistant to all kinds of IT system failures;The blockchain ledger is open, public, anonymous and not subject to any audits;Security;Decentralisation;Openness;Transparency;Anonymity;Independence;Authentication.

Fiat

Fiat denotes a set of all traditional currencies regulated by governments and banks in individual countries, including USD, EUR, GBP, YEN, etc.

Cryptocurrency

Simply put, it is a distributed accounting system, which is based on cryptography, as the name would suggest. This system stores information regarding holdings in conventional units.

Arbitrage

Rather niche way to invest, usually used only by investment funds or hedge funds. Arbitrage transactions comprise the purchase of goods, securities or other instruments, such as cryptocurrencies in one market while simultaneously selling the purchased goods / securities / other instruments in the same amount in another market where its price is higher.

For the investor

The Sint Platform is a basic tool for newcomers and experienced investors operating on the cryptocurrency market.

It will enable conversion and transfers of funds held in any currency into cryptocurrencies. Thanks to the platform, the transfer of assets to the digital currency market becomes smooth and hassle-free.

Problems and solutions

Problem: Delayed deposits

Crediting your cryptocurrency exchange account with fiat currency takes a long time or is not possible at all. As we know, it is a common practice that many large exchanges do not support fiat deposits at all.

Solution: Instant deposits

Transferring fiat to cryptocurrency is fast, there are no delays related to third-party institutions. The Sint Platform provides free access to your funds without any restrictions and without delay, regardless of time of day or day of the week.

Problem: Delayed withdrawals

Withdrawing money from a cryptocurrency exchange is often impossible or it takes a lot of time. If the exchange offers the possibility to pay out your funds in fiat currencies, in most cases transfers are delayed by multiple days and they are connected with significant fees.

Solution: Instant withdrawals

Money shows up on your account almost right away after making a request. Thanks to the Sint Platform, which integrates quick transfers with the cryptocurrency world, profits can be realised in a very short time.

Problem: High fees

Online money transfer fees start from 2%. The practice of applying such exorbitant commissions, combined with fees charged by cryptocurrency exchanges often completely deprives the investor of profits.

Solution: Low costs

Sint charges a 0.1% commission. This is the lowest possible commission on instant deposit or withdrawal of funds in fiat and cryptocurrencies. When the transaction is made using the SIN token, the commission is 0%.

Problem: Limited access to your funds

The deposit and withdrawal of the money depends on the working hours of the third-party institutions, which limits your access to your funds.

Solution: 24/7 access

Unlimited and smooth access to your fiat and cryptocurrency assets. The Sint Platform allows you to enjoy your funds regardless of the time of day or day of the week.

Problem: Technical instability

The traditional solutions are subject to DDoS attacks, and a failure of one module can render the services impossible to use. This can effectively prevent the transactions from being submitted and cause huge financial losses.

Solution: Stability

The platform based on the Blockchain technology is decentralised, and even in the case of a single-module failure it still works correctly.

Login

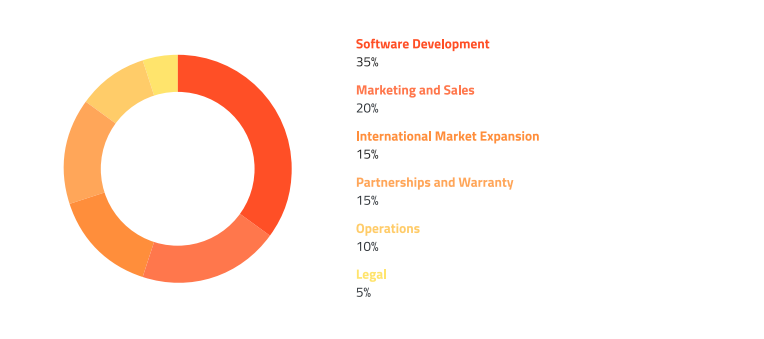

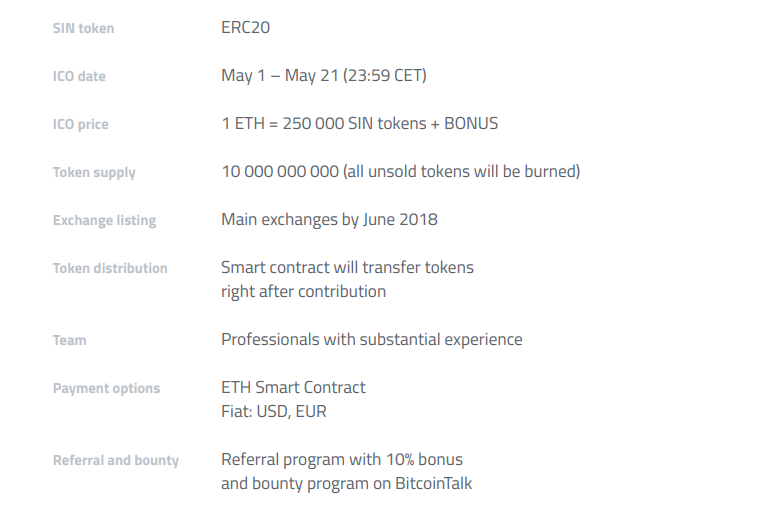

SIN token is our cryptocurrency designed to provide security and unify the market for fiat and cryptocurrency transfers.

REMEMBER: You can only contribute with non-exchange ERC-20 compatibile wallet!

Get to know the team of enthusiasts who are responsible for the project.

Tag Information

Wibsite:

Whitepaper:

Twitter:

Telegram :

My Bitcointalk: