Every year on April 1 – April Fool’s Day – members of the crypto sphere try to outdo each other with nerdier and nerdier inside jokes and pranks, and this year has not proven to be any different.

Over the course of the day, we will be adding new April Fool’s stories that are still coming up. Do you want to share a find with us? Send it to us on .

Subreddit /r/bitcoin in 2015 about a return of all (BTC) stolen from now-defunct crypto exchange by a former DEA agent seeking a plea deal. In 2017, (ETH) co-founder wrote a claiming that ETH would change from its (PoW) algorithm to the Proof of Authority (PoA) in 2018.

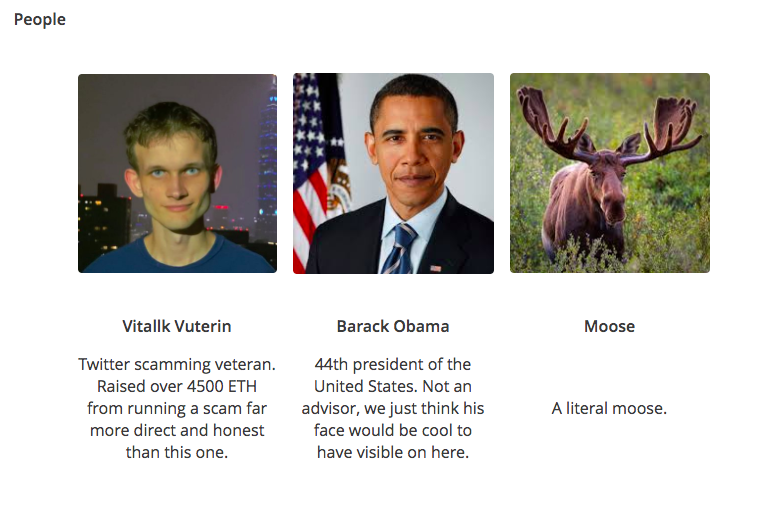

This year, Buterin posted another announcing the launch of an Ethereum “stablecoin” called the World Trade Franc (WTF). The WTF, which Buterin refers to as “combin[ing] all benefits of capitalism and socialism with none of the downsides of either,” is currently being marketed to “sketchy Pacific island nations national governments.” Below is a screenshot of WTF’s “people:”

Jesus Coin, described on Twitter as “THE currency of God’s Son,” tweeted today in another apparent Buterin-related prank about the new addition of Ethereum’s co-founder to their management team:

I have great news Vitaly Buterin has joined us. Retweet , get another 10,000 JC and let’s pass moon and get straight to heaven!

— Jesus Coin (@Jesuscoinico)

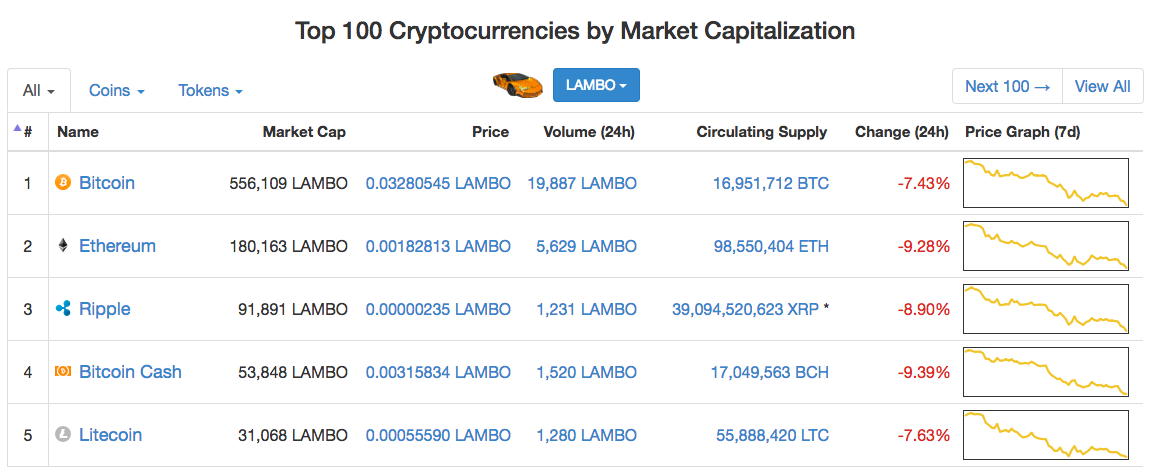

, a popular cryptocurrency market cap ranking resource, added a “Lambo” currency reference for its listed assets, showing how many “Lambos” each currency is roughly worth. As bitcoin is currently trading for around $6,561, one Coinmarketcap’s “Lambo” is equal to exactly $200,000.

user drowssap5 has also gotten into the April Fool’s spirit, that had finally released their , with the following caveat:

“Just kidding. They wouldn’t do that.

Happy April Fools day!”

, a service for adding money to prepaid phones with bitcoin, posted on both Twitter and their blog today that they are changing their name to “S**trefill,” even going as far as to change their to mimic their “.”

“S**trefill’s” writes that due to a decrease in demand for spending bitcoin, they are switching their focus over to “s**tcoins,” or coins that “are not perceived as having such a “high long-term value.” The launch of S**trefill’s new token, S**tCoinCash, will support a equivalent called the Crackening Network, according to the Medium post.

Financial news site Finance Magnates posted a legitimate looking “” on launching its own cryptocurrency with a “massive” (ICO) that would rival both. The fake “Facebook Coin” would require “data such as name, address, phone number, mother’s maiden name and name of first pet,” and would advertise itself on the site, in spite of Facebook’s .

A slew of prank cryptocurrency launch announcements have also come out today, with blogging site Tumblr’s , design site Houzz’s , and grocery store chain Sam’s Club’s .

Meanwhile, crypto commenter @WhalePanda tweeted earlier today that the real April Fool’s joke is :

The real joke today is the price.

— WhalePanda (@WhalePanda)

In a similar fashion to Finance Magnates’ fake Facebook ICO story, Blockchain Center has jokingly reported on “.” The search engine’s coin, called Googol (GG) according to the prank article, is not powered by Blockchain – instead, all transactions are to be recorded in a “brilliant” SQL database “distributed all over the world.”

Published at Sun, 01 Apr 2018 15:14:35 +0000